Greetings,

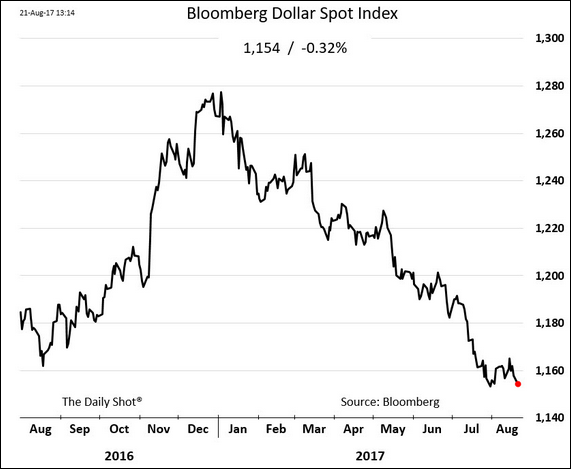

The United States: The dollar is drifting lower again, which should help with exports and may further ease financial conditions. This trend is also one of the reasons some analysts suggest that we will see another rate increase in December (markets are pricing in one-in-three odds of a December hike).

But has shorting the dollar become a crowded trade?

Credit: Moody’s Liquidity Stress Index is declining rapidly as the Oil & Gas sector stabilizes.

Equity Markets: Here are some highlights from the Merrill Lynch Fund Manager Survey.

Managers trimmed their exposure to health-care stocks over the past month.

North Korea showed up as one of the biggest tail risks.

Energy Markets: Here is the impact of Monday’s solar eclipse on California’s solar power output.

The Eurozone: More fund managers now view the euro as overvalued.

Emerging Markets: The recent EM recovery has been more synchronized (a lower growth dispersion).

Global Developments: A number of indicators point to continuing economic strength around the world.

In order: BMI GDP Forecasts, Pew Research survey, Merrill Lynch Fund Manager Survey.

Food for Thought: The range of North Korea’s artillery.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com