Greetings,

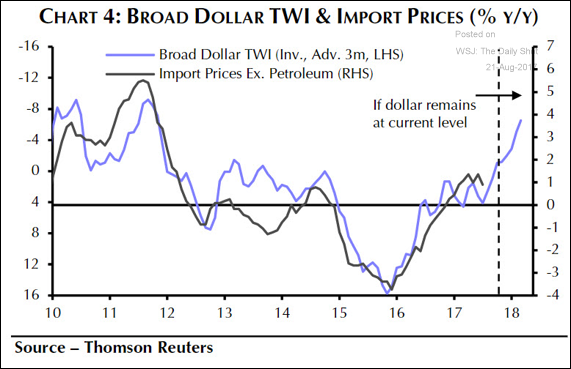

The United States: As discussed previously, the recent dollar weakness will result in higher import prices.

In particular, prices of industrial supplies and materials are expected to rise.

On the other hand, the dollar’s weakness should help boost US exports.

Bitcoin: Bitcoin’s global trading volume has been climbing rapidly. It’s now comparable to some liquid ETFs.

Equity Markets: At this point, the possibility of a comprehensive corporate tax reform has been priced out of the market. This chart shows companies who will benefit the most from lower taxes trading at a discount to the broader market.

But has the market been too pessimistic on tax legislation? After all, US companies are still hopeful.

Even without a comprehensive reform, a one-time repatriation of capital seems likely. What will corporations do with that cash once they bring it to the US? Here are the results of the Merrill Lynch Risk Management Survey. Many of the actions below could give stocks a boost.

The Eurozone: Financial conditions in the Eurozone remain easy despite the recent euro rally.

Emerging Markets: The Capital Economics investment flows tracker suggests massive portfolio inflows into EM Asia (and to a lesser extent Lat Am).

Global Developments: This chart shows the widening gap between the overnight rates implied by the Taylor Rule and the actual central bank policy rates. The central banks are not tightening policy in tandem with the economic improvements.

Food for Thought: Confederate monuments map.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com