Greetings,

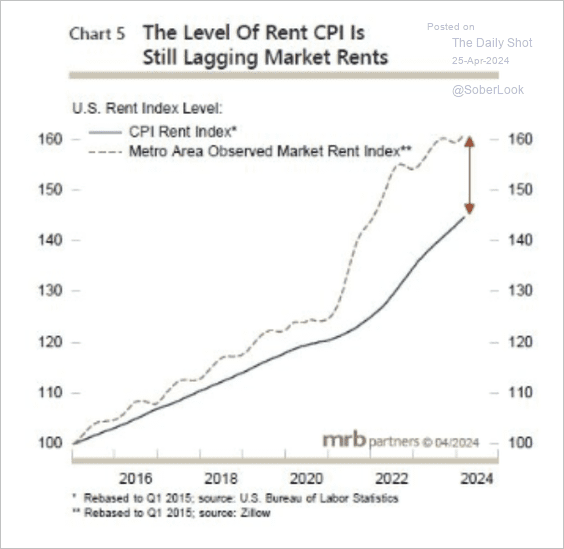

The United States: Market rent levels have been outpacing the rent CPI.

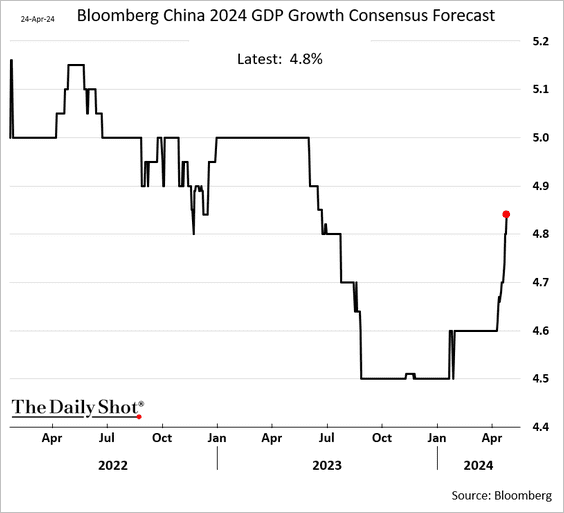

China: Economists have been raising their GDP projections for 2024.

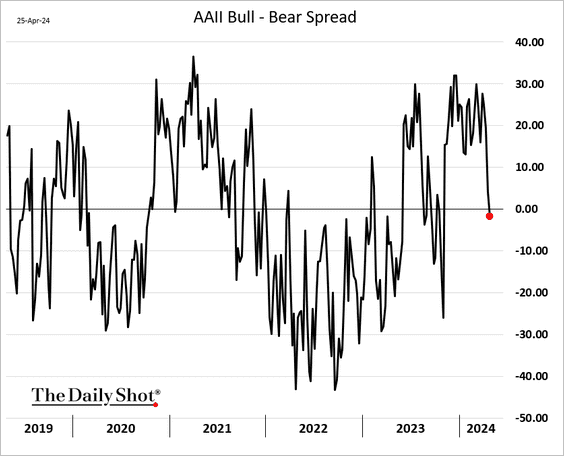

Equities: Retail investors are turning bearish, with the AAII bull-bear spread dipping into negative territory for the first time this year.

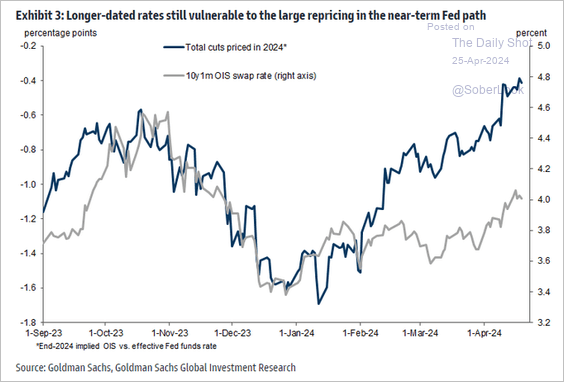

Rates: Longer-term rates are vulnerable to the Fed’s “higher for longer” policy.

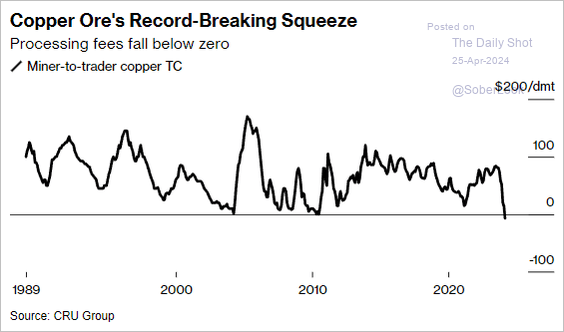

Commodities: The market for semi-processed copper ore is currently facing exceptional scarcity, as traders and smelters are paying prices for copper ore that nearly match its processed value, suggesting a lack of readily available supplies

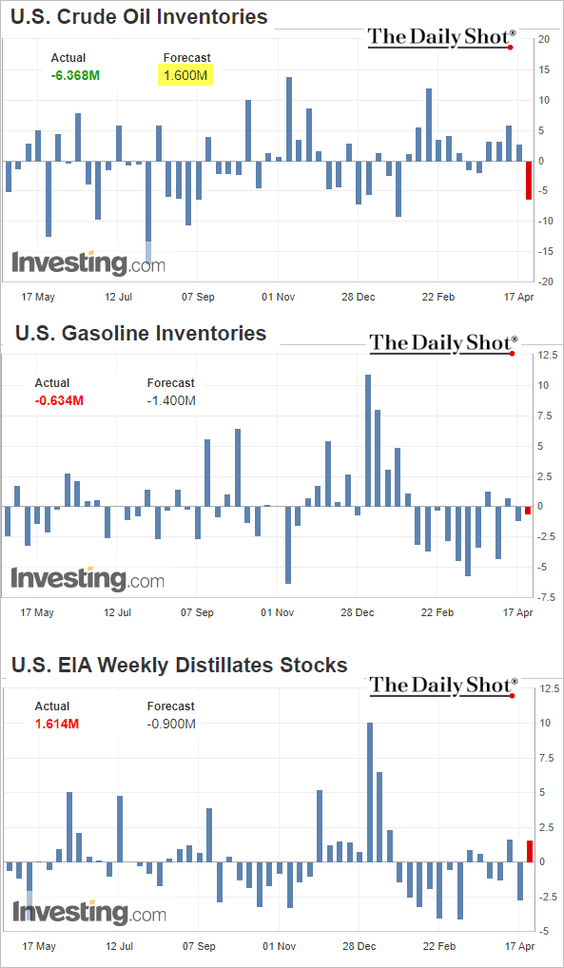

Energy: US crude oil stockpiles declined sharply last week (the market expected an increase). Inventory data for refined products was less bullish. Below are weekly changes.

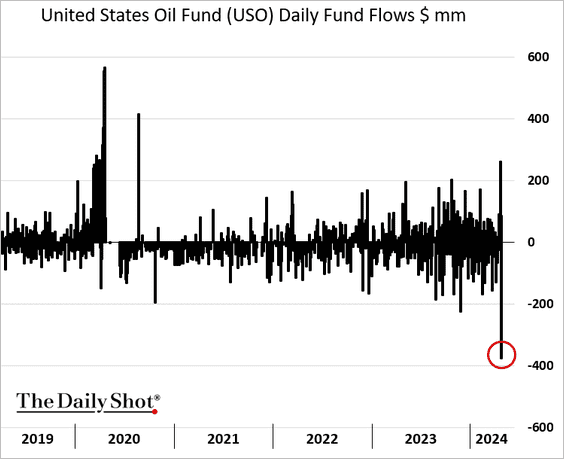

The largest oil ETF saw record outflows this week.

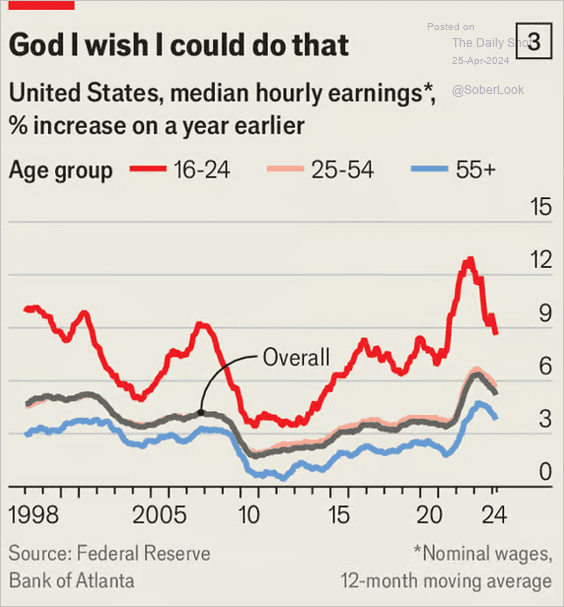

Food for Thought: Wage growth by age:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily Shot Brief