Greetings,

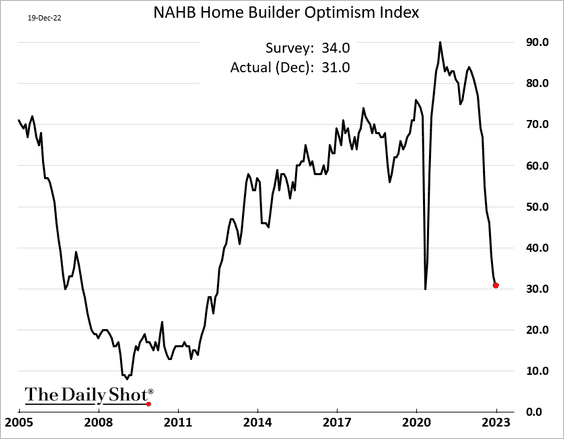

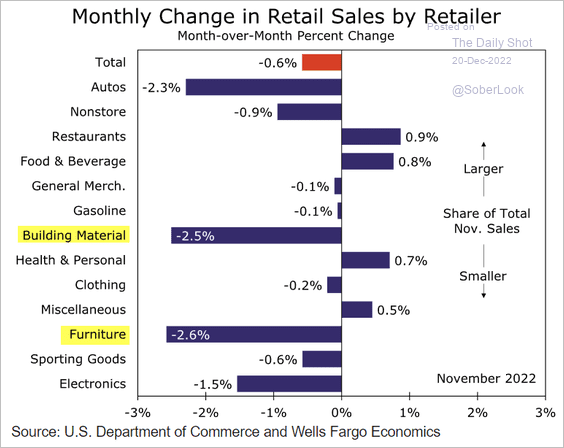

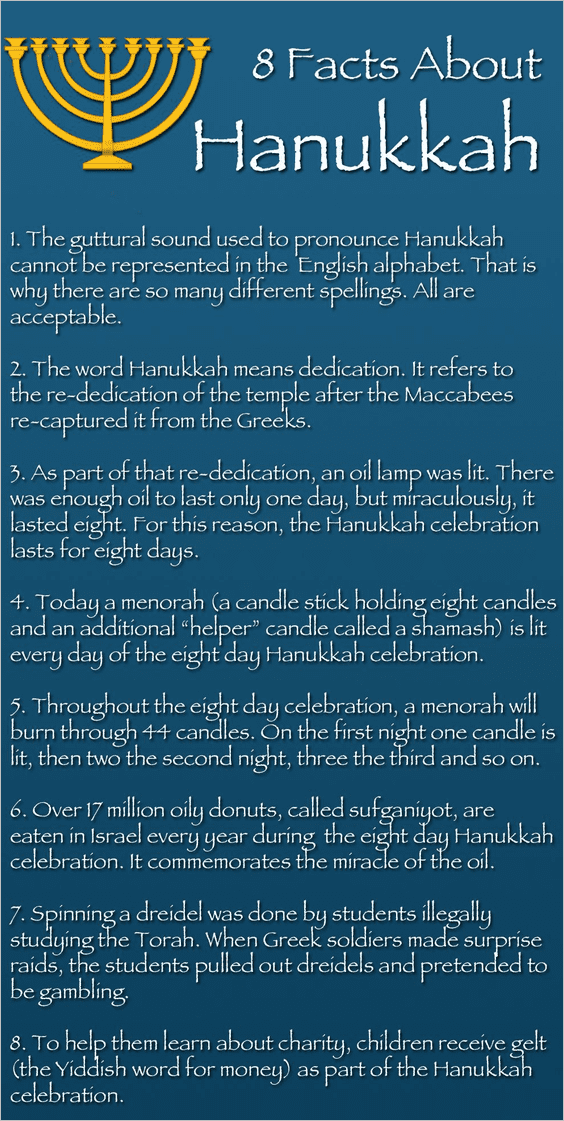

The United States: Real consumer spending on services keeps climbing.

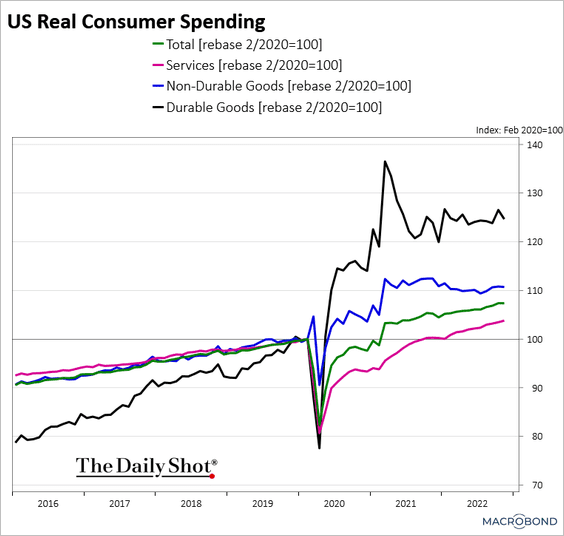

But excess savings continue to dwindle, pointing to softer consumption ahead.

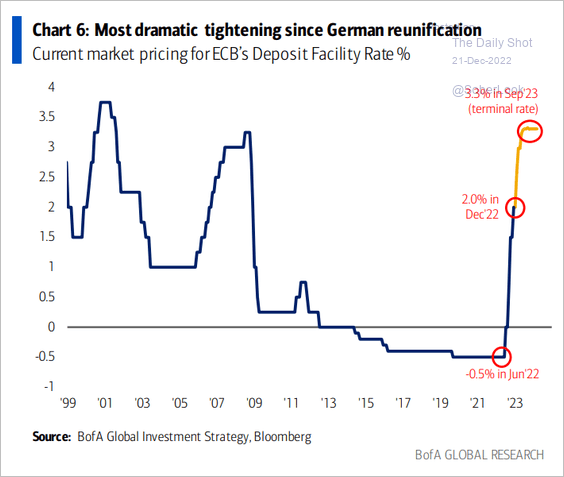

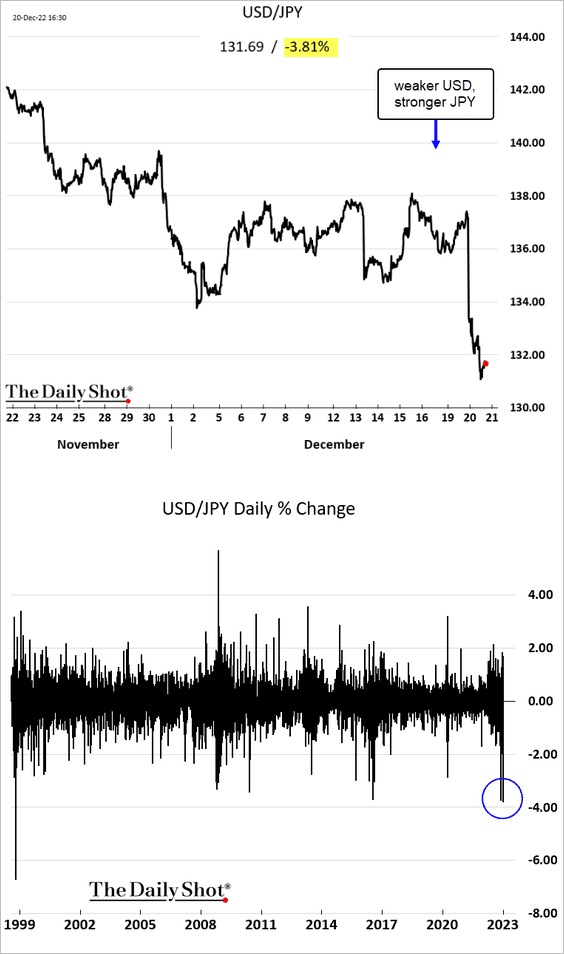

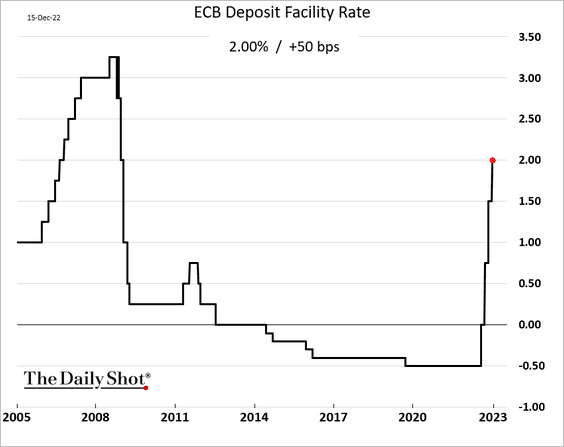

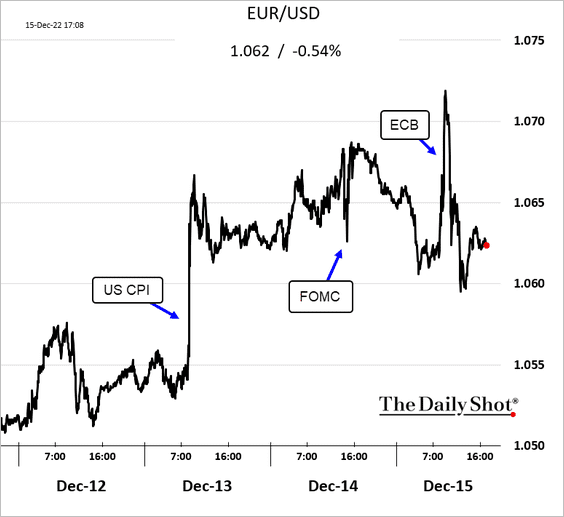

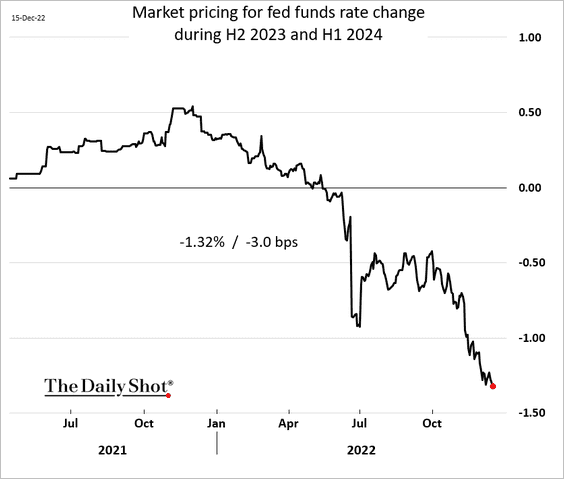

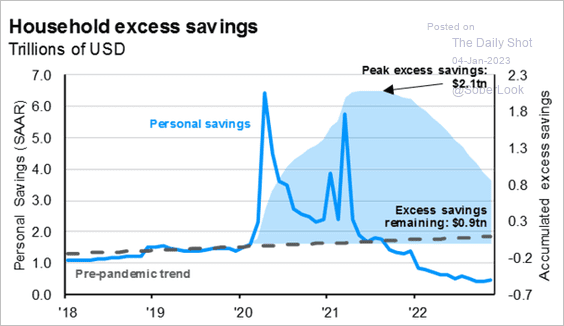

The Eurozone: Despite a weak start of the year for the euro, the currency has entered a golden cross. A golden cross is a technical chart pattern indicating the potential for a major rally. The golden cross appears on a chart when a stock’s short-term moving average crosses above its long-term moving average.

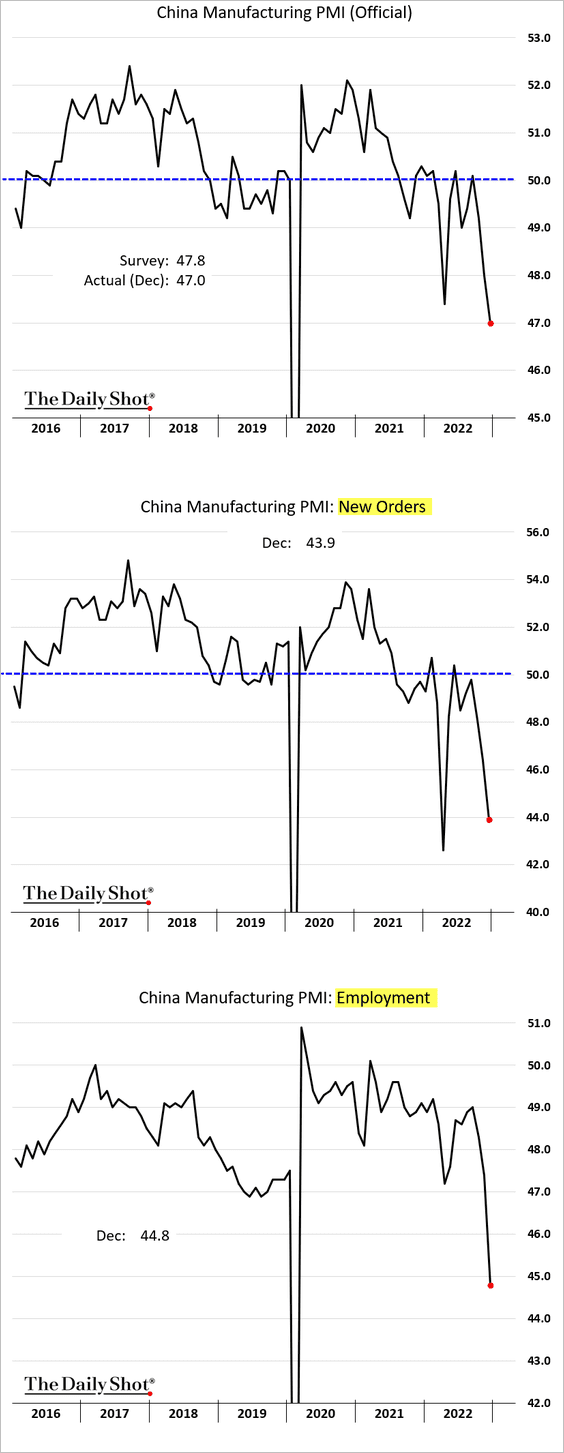

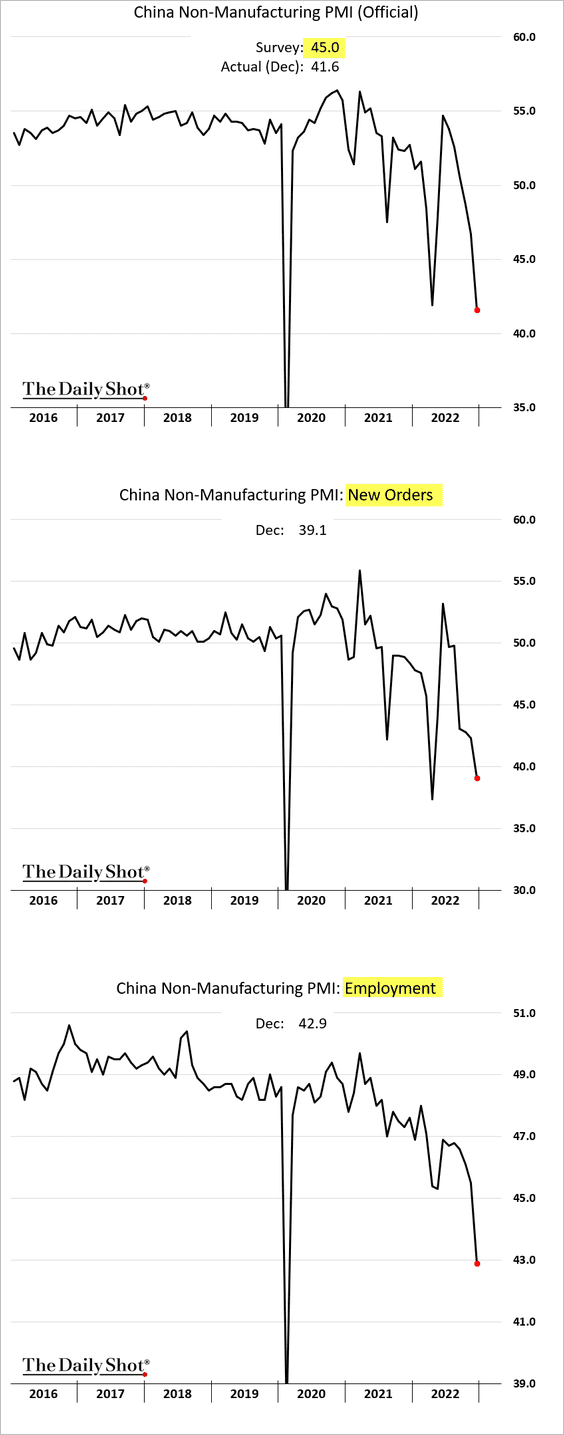

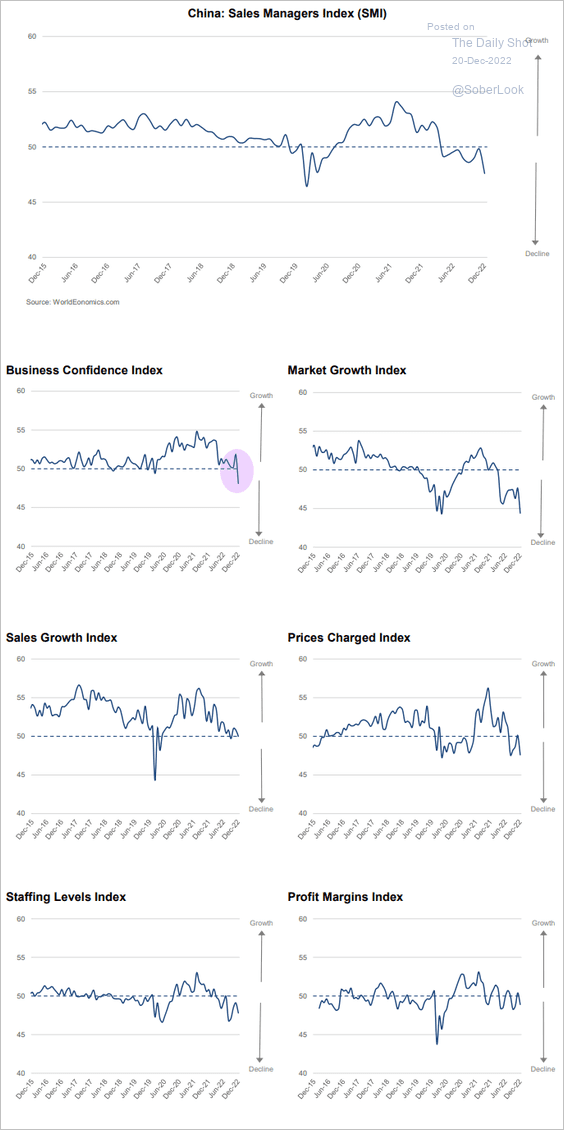

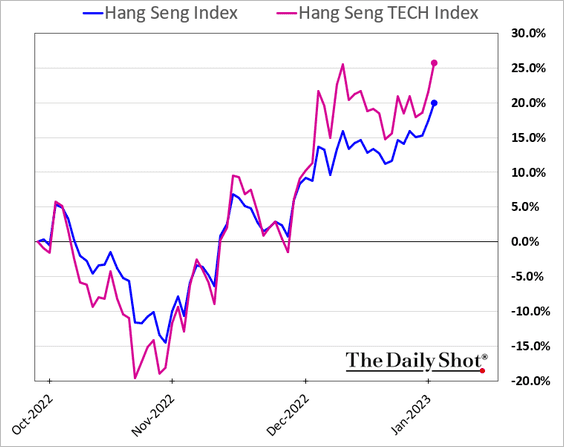

China: Stocks are surging in Hong Kong.

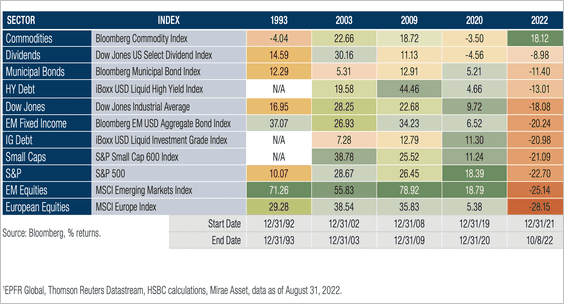

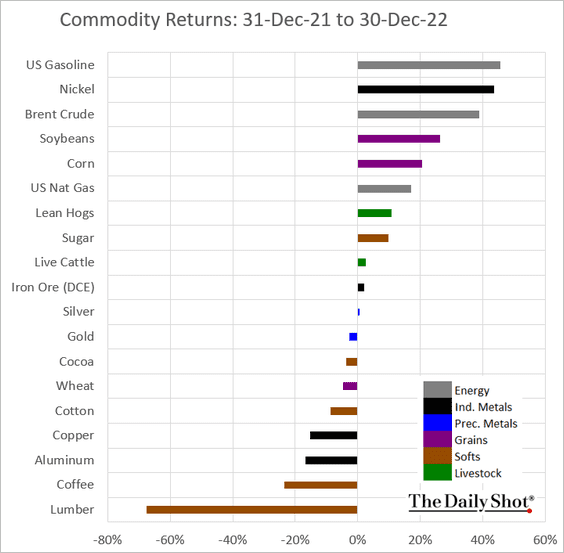

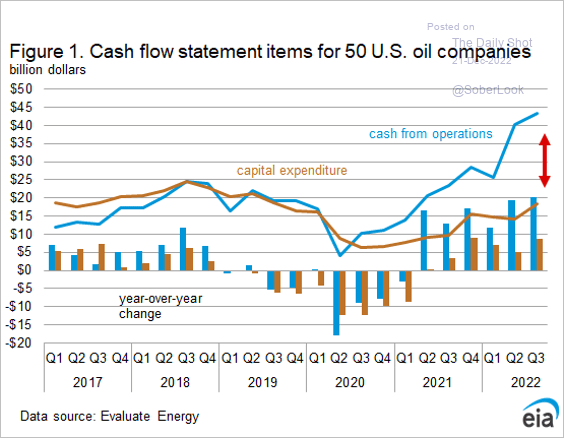

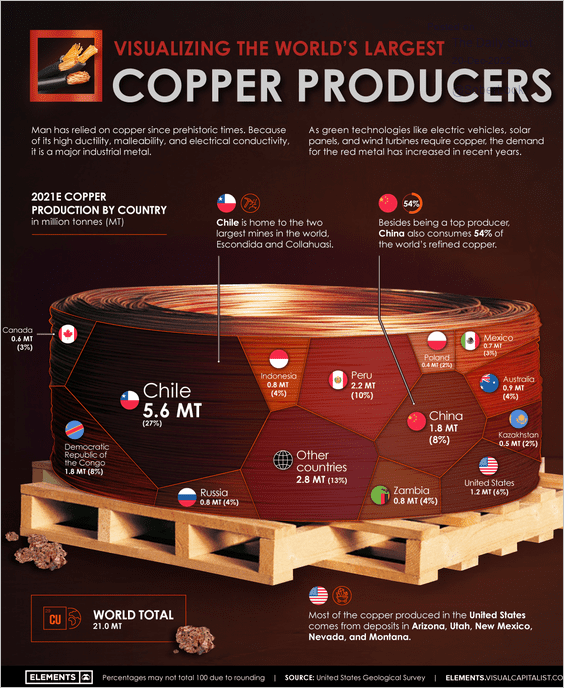

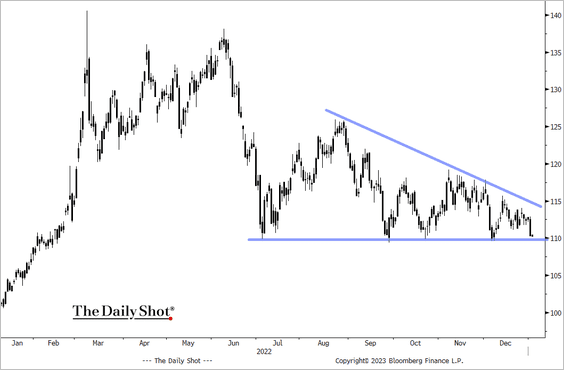

Commodities: Bloomberg’s broad commodity index is at support.

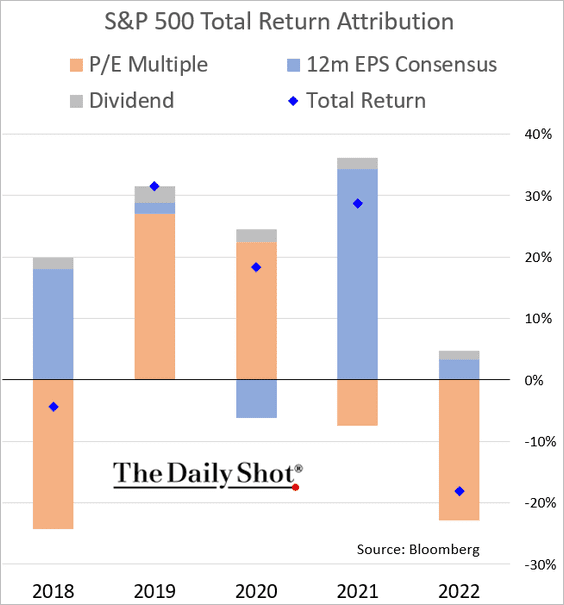

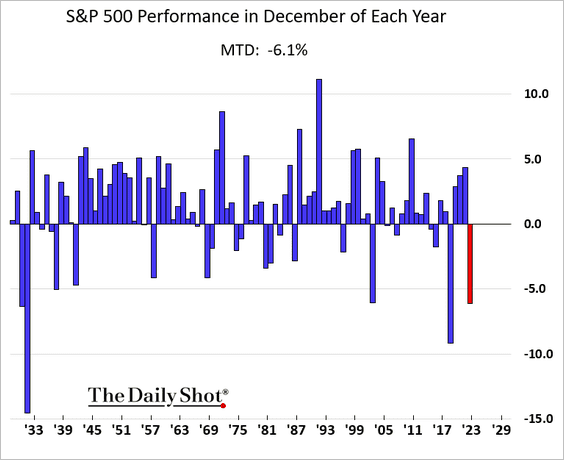

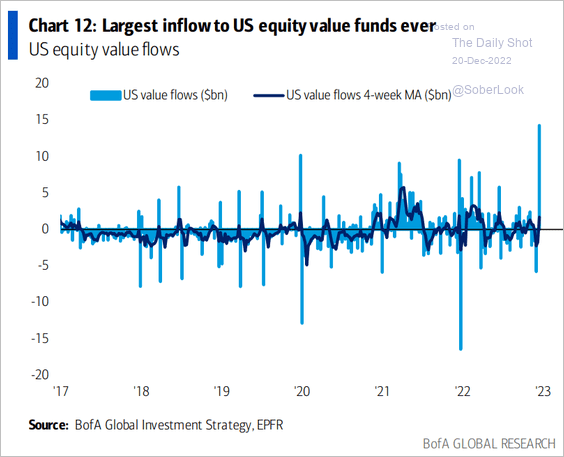

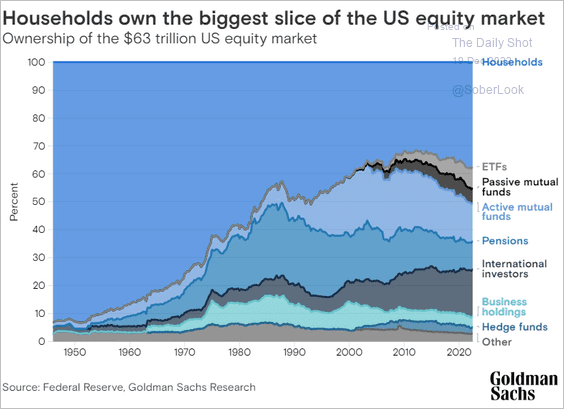

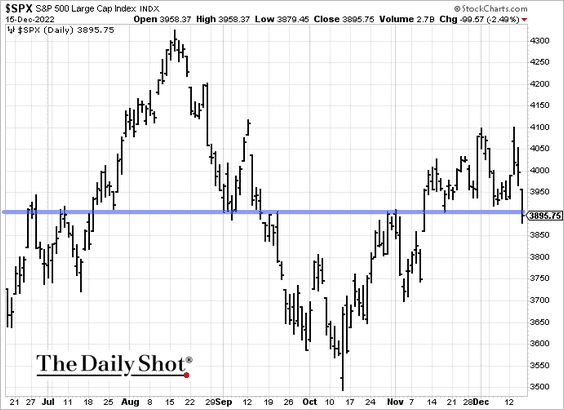

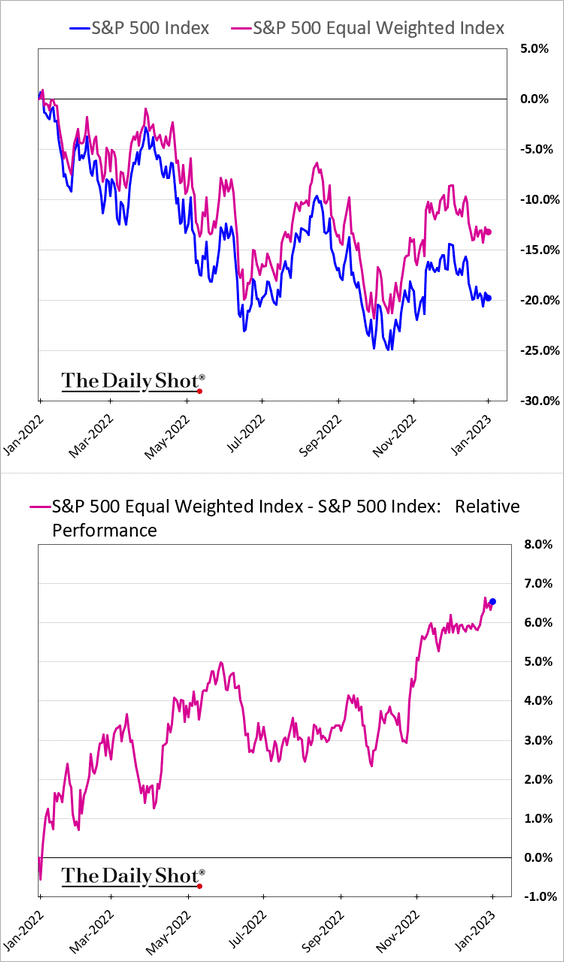

Equities: The S&P equal-weight index has been outperforming due to lower exposure to mega-caps and higher exposure to value.

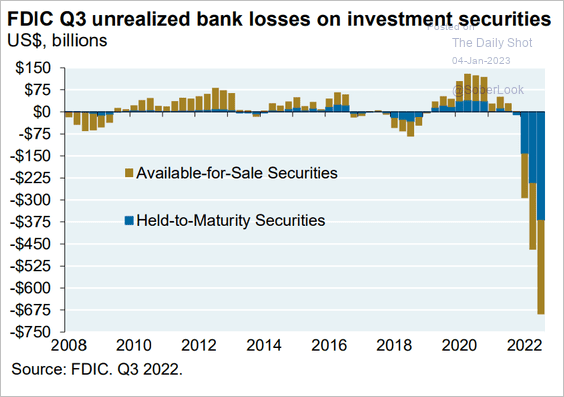

Credit: Banks are sitting on substantial unrealized losses.

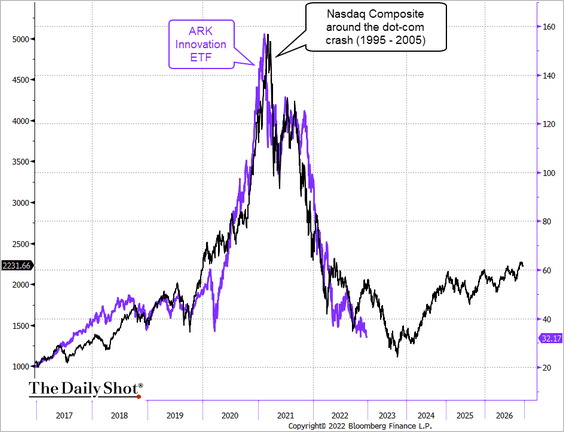

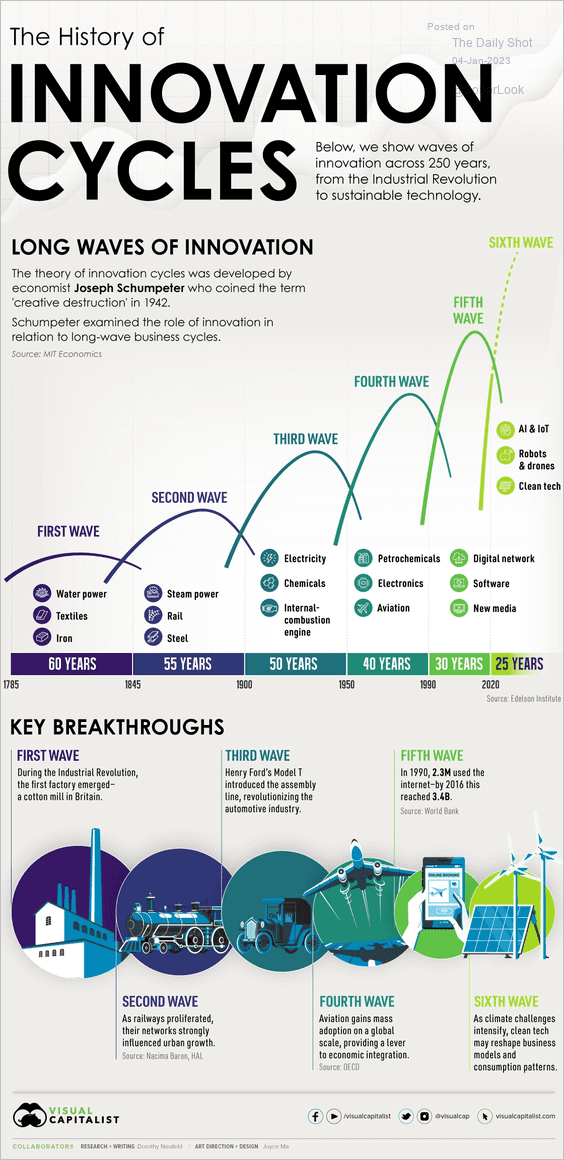

Food for Thought: Lastly, here’s a look at the history of innovation cycles.

Edited by Alexander Bowers

Contact the Daily Shot Editor: Brief@DailyShotResearch.com