Greetings,

The United States: The number of states with negative growth is now at the level that signals a recession.

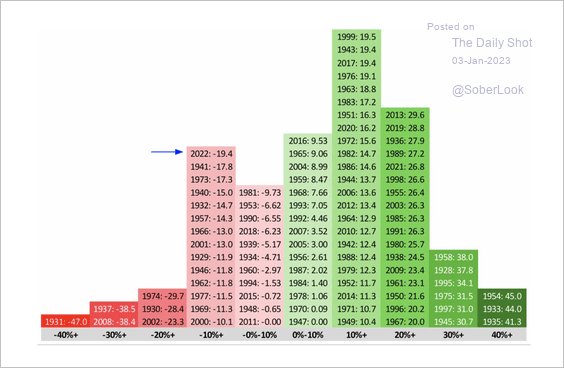

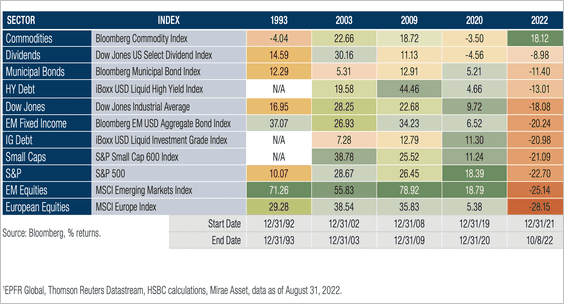

Equities: 2022 saw the largest annual decline for the S&P 500 since 2008.

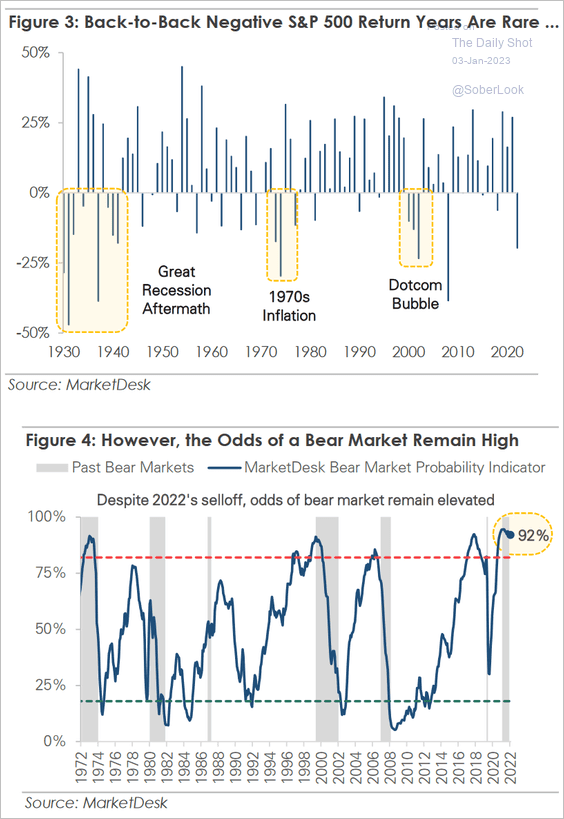

Back-to-back annual losses are rare, but the odds of the bear market continuing remain elevated, according to MarketDesk Research.

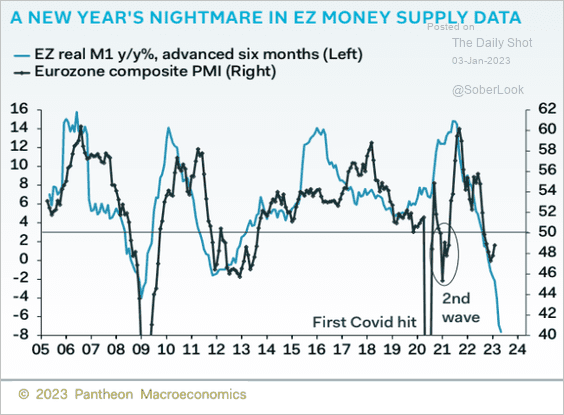

The Eurozone: The sharp decline in the M1 (narrow) money supply growth points to downside risks for business activity.

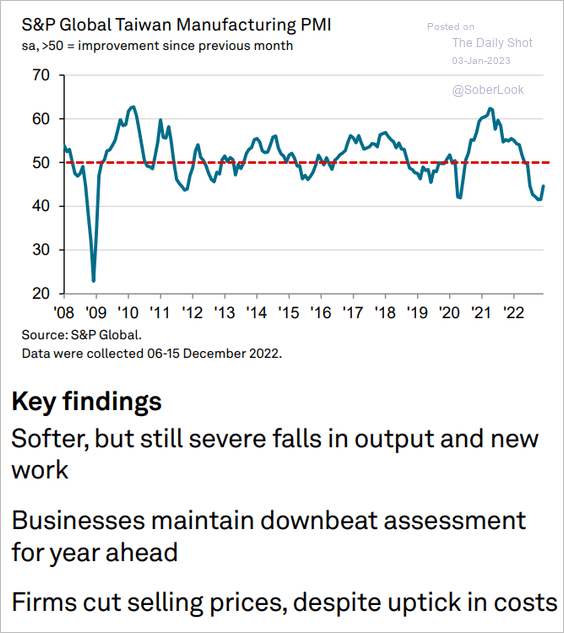

Asia – Pacific: The pace of Taiwan’s manufacturing sector contraction has softened.

Emerging Markets: EM previously led global equity rallies after recessions.

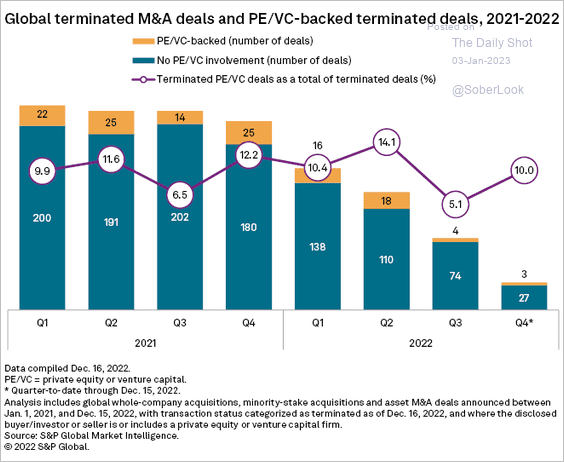

Global Developments: M&A activity slowed sharply as 2022 progressed.

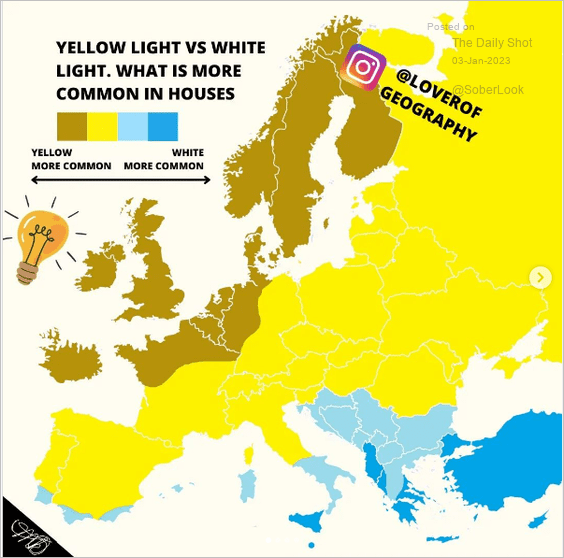

Food for Thought: To conclude, here is a map showing where yellow or white light is more commonly used:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com