Greetings,

Before we begin, we wanted to alert you to one of our favorite weekend reads: the Weekly S&P500 ChartStorm by Callum Thomas — it features 10 handpicked charts on the US stock market covering macro, technicals, valuations, and more — it’s a quick and effective way to stay on top of the market outlook.

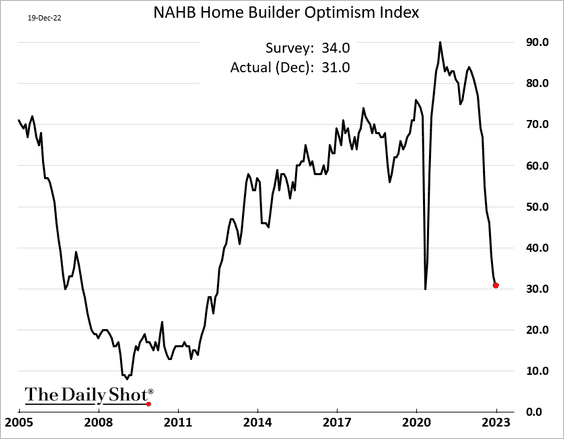

The United States: Homebuilder sentiment came close to the COVID-shock lows this month.

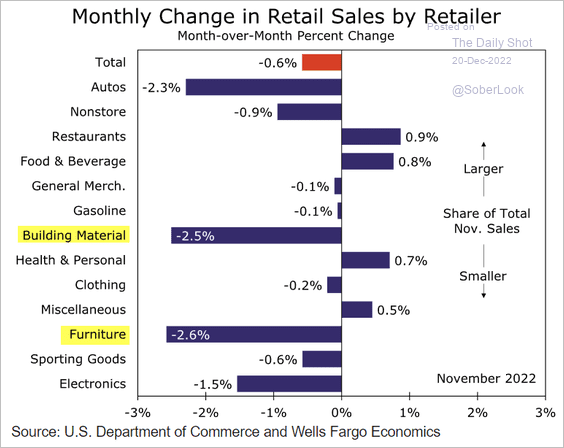

Housing market pain was visible in last month’s retail sales.

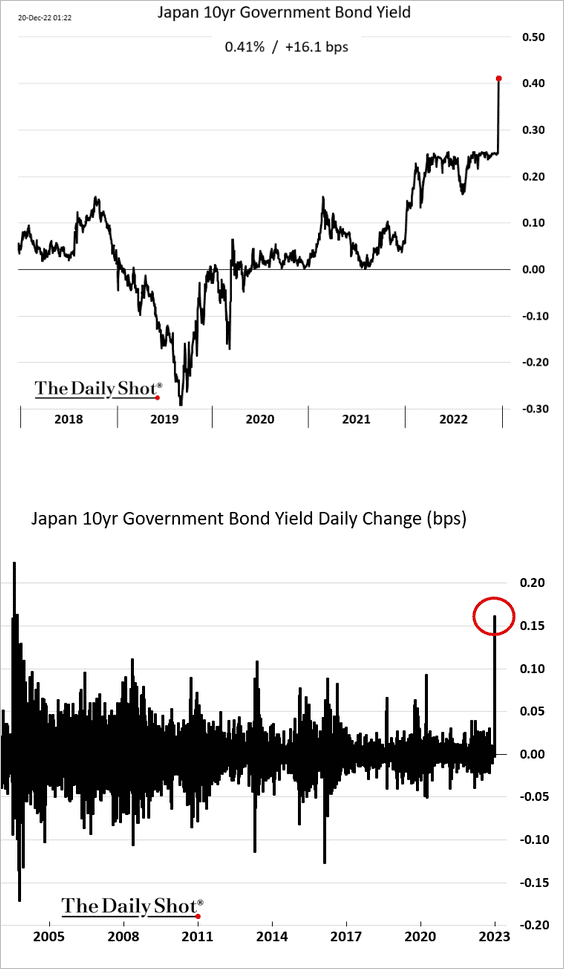

Japan: The BoJ shocked the markets by widening the 10-year JGB yield band to 50 bps from 25 bps. The 10yr JGB yield jumped by most in nearly two decades following the monetary tightening.

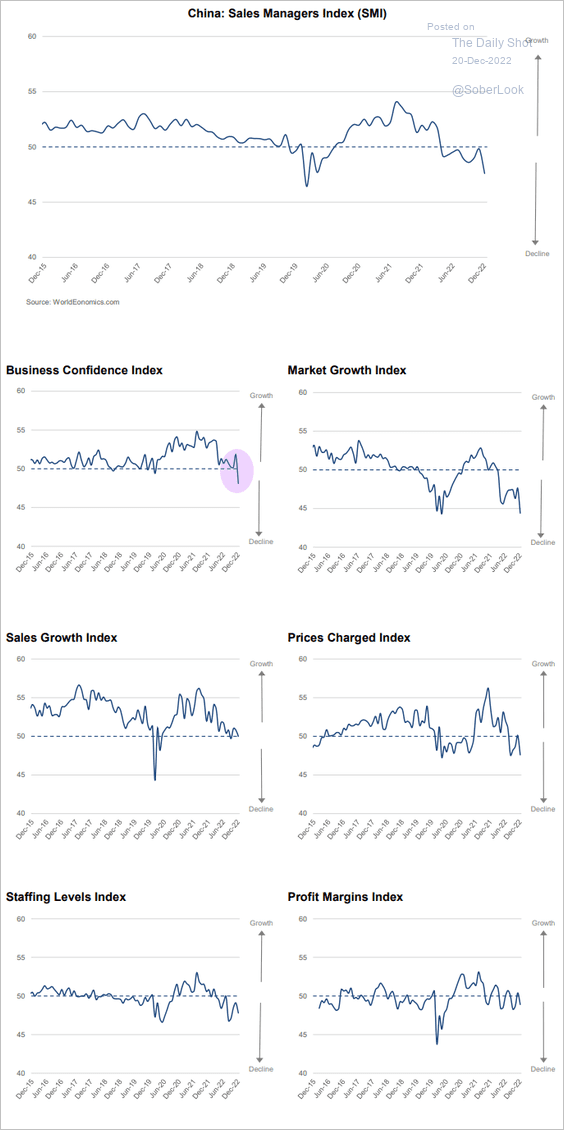

China: The World Economics SMI report showed an accelerating contraction in China’s business activity this month as confidence slumps.

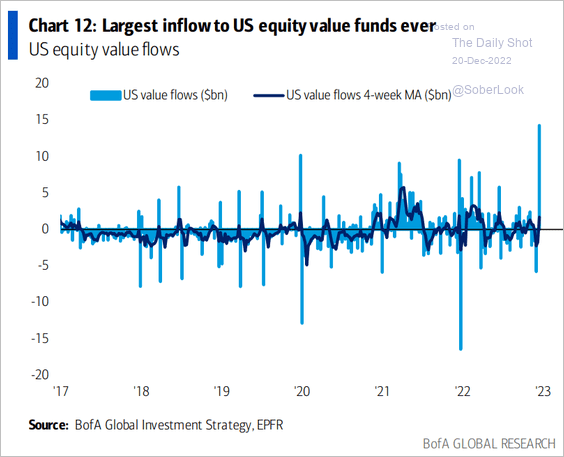

Equities: Value funds saw substantial inflows last week.

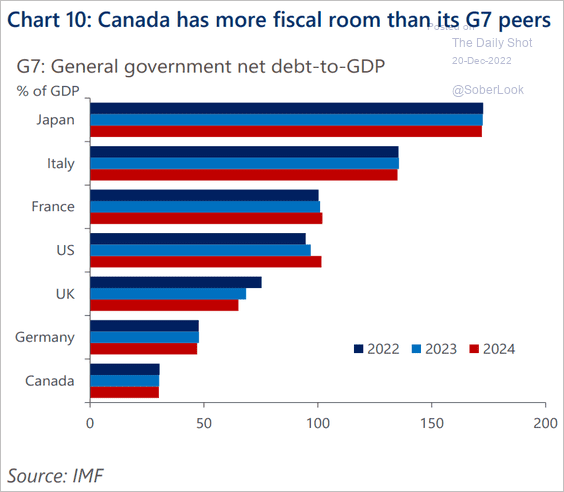

Canada: Canada has more fiscal room than other advanced economies.

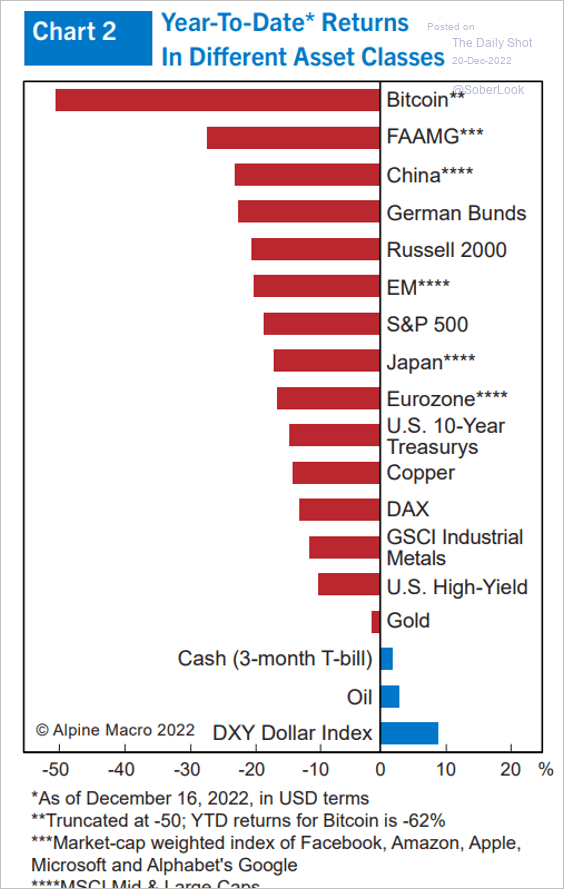

Global Developments: Here are year-to-date returns across select asset classes.

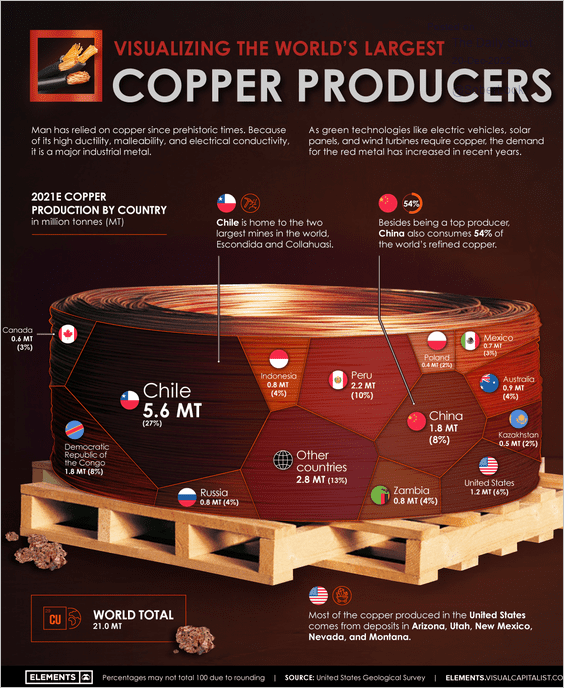

Food for Thought: Here are the largest copper producers:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com