Greetings,

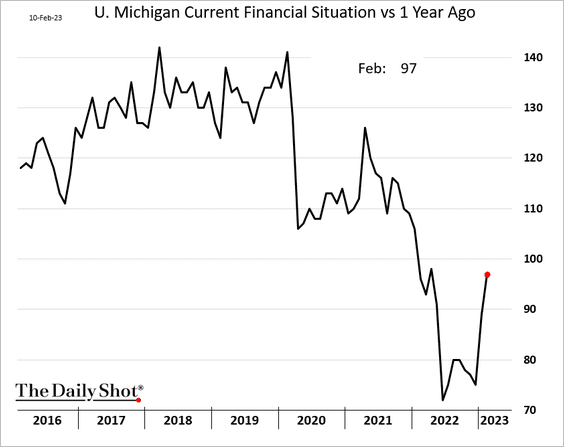

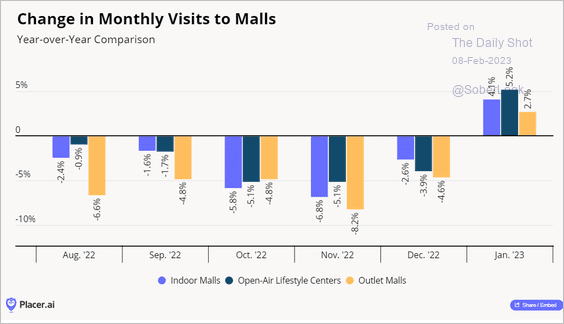

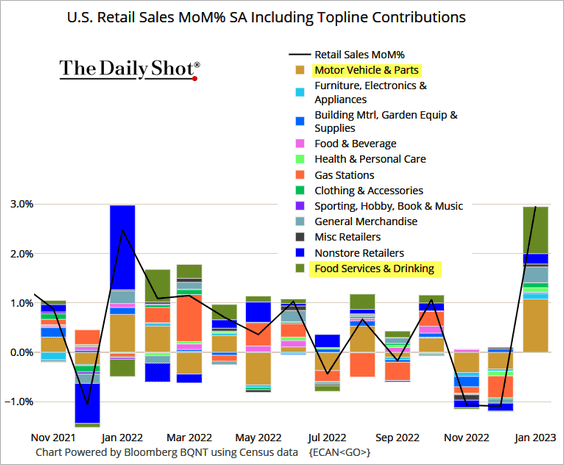

The United States: US retail sales topped expectations as warm weather boosted spending after weak activity in December. Here is a breakdown:

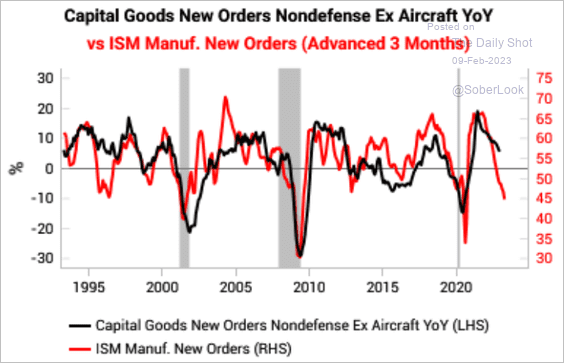

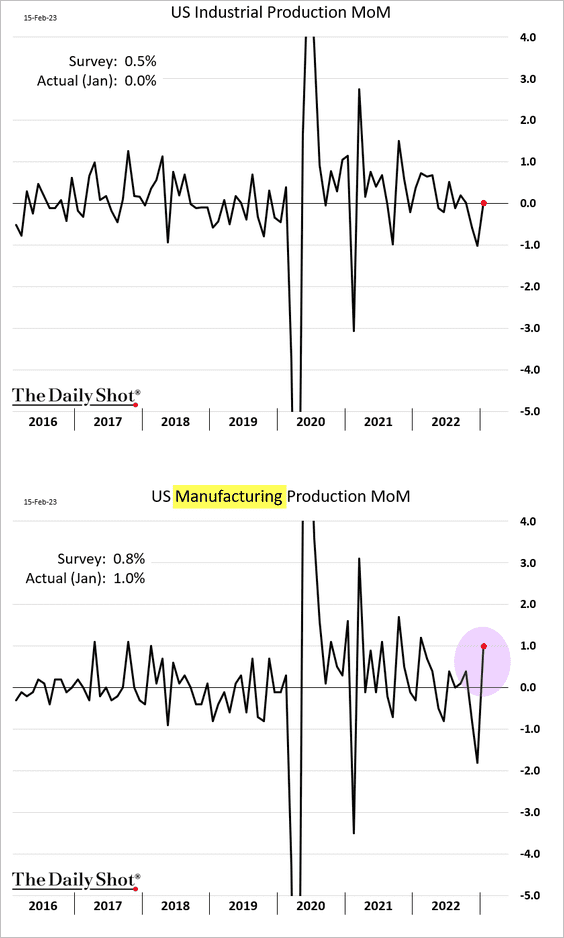

Industrial production was flat last month, but manufacturing output jumped.

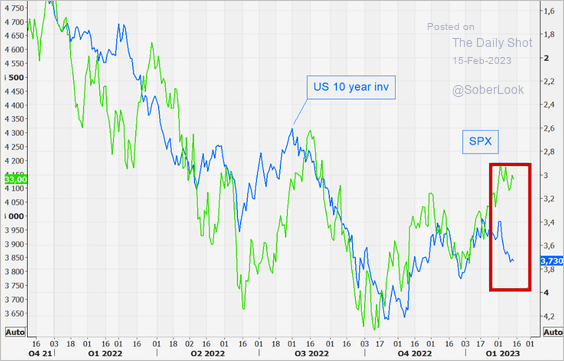

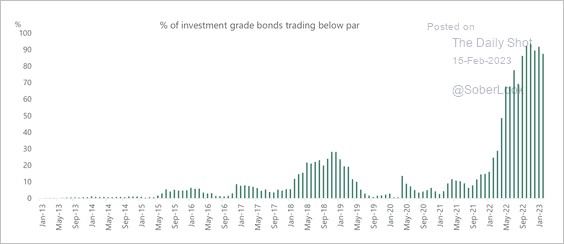

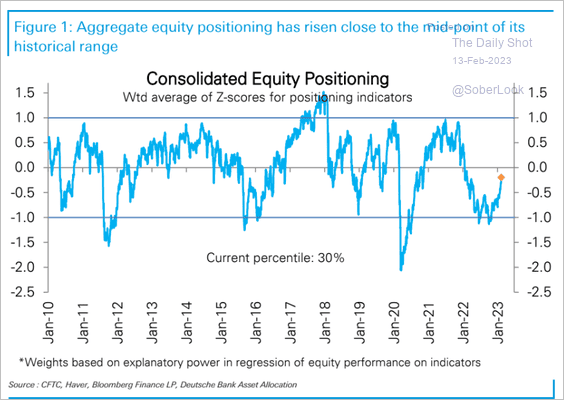

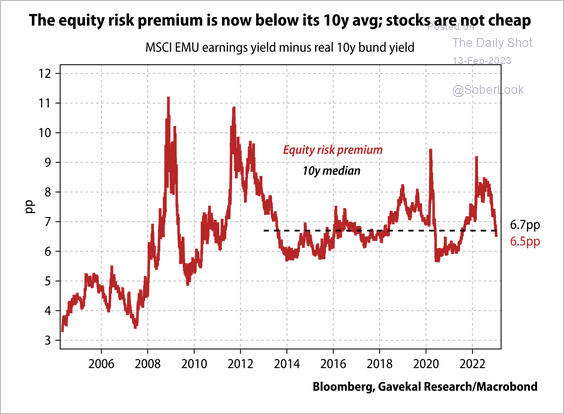

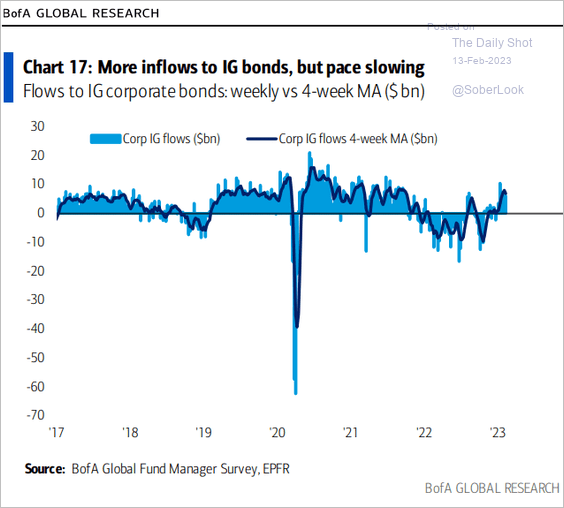

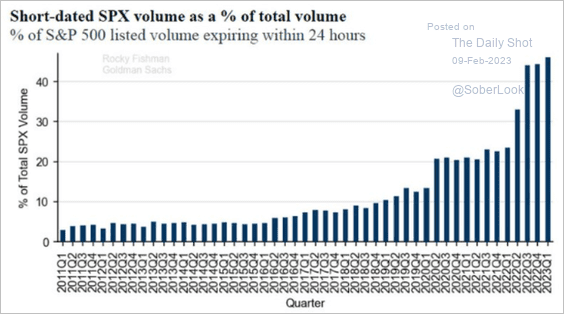

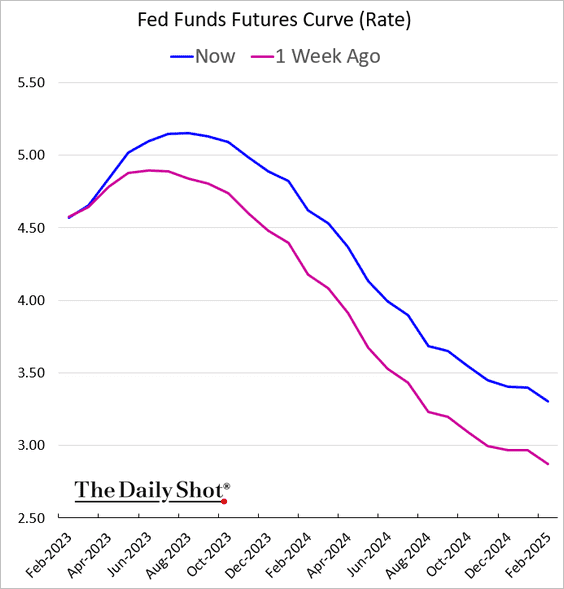

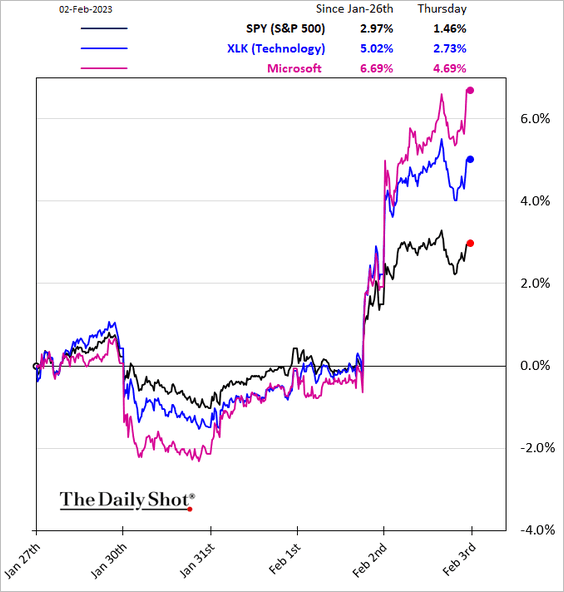

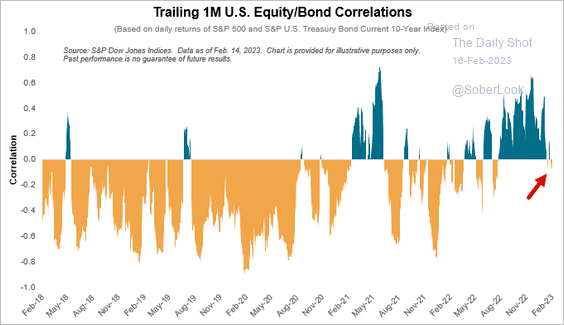

Equities: The stock/bond correlation is negative again.

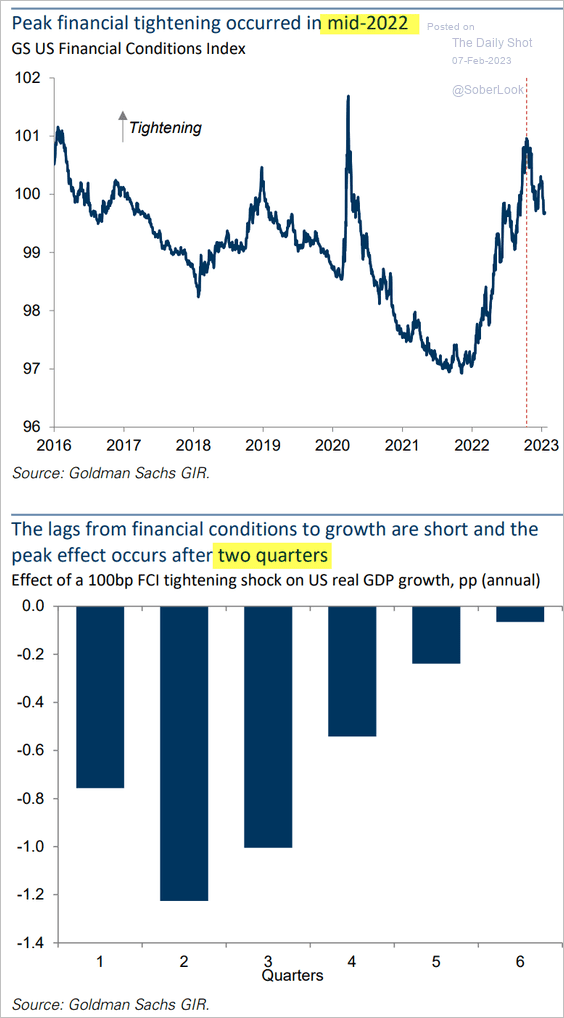

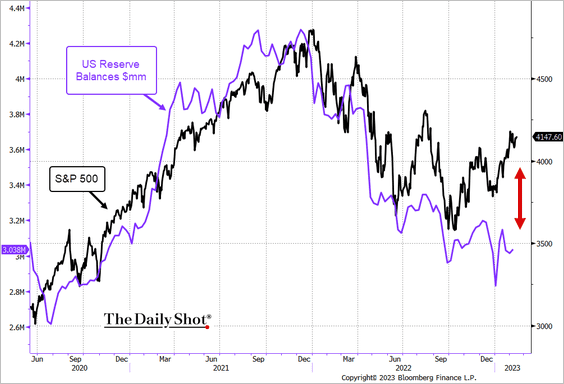

Should stock investors be concerned about the Fed draining liquidity from the banking system? Stocks have diverged from Fed reserve balances.

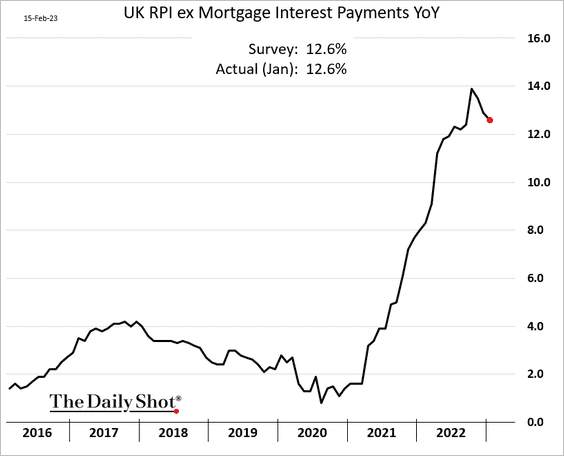

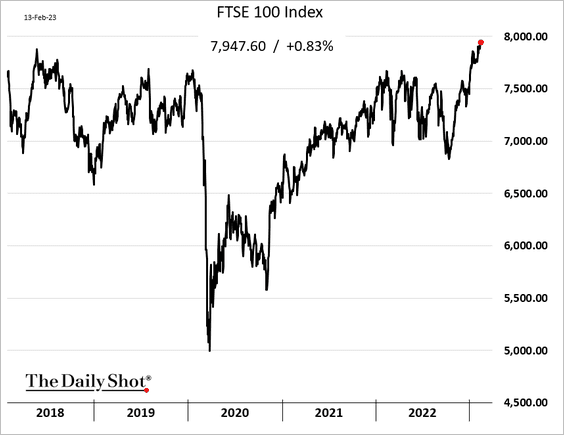

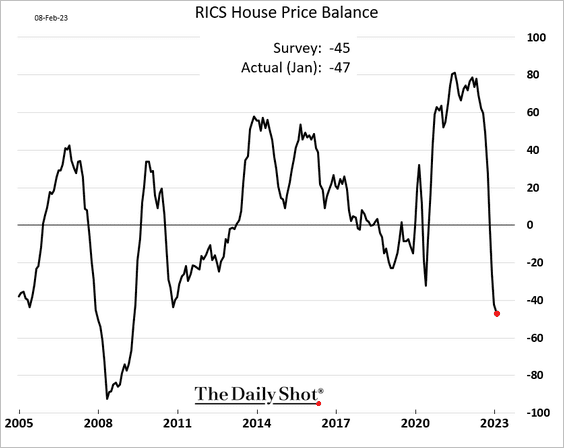

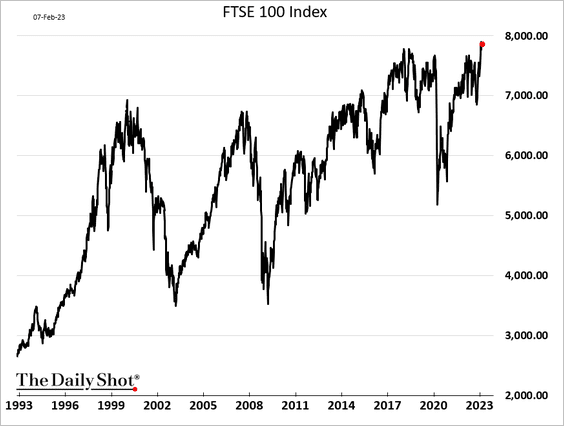

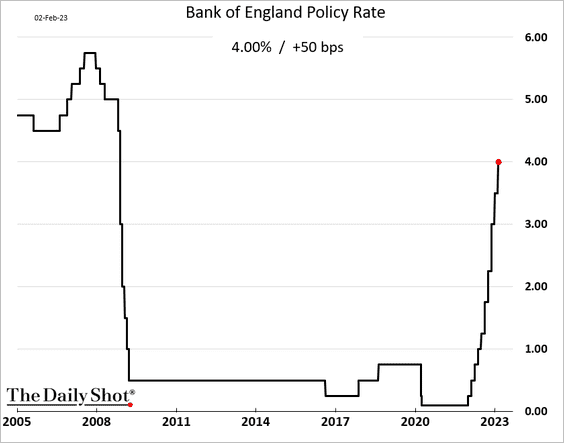

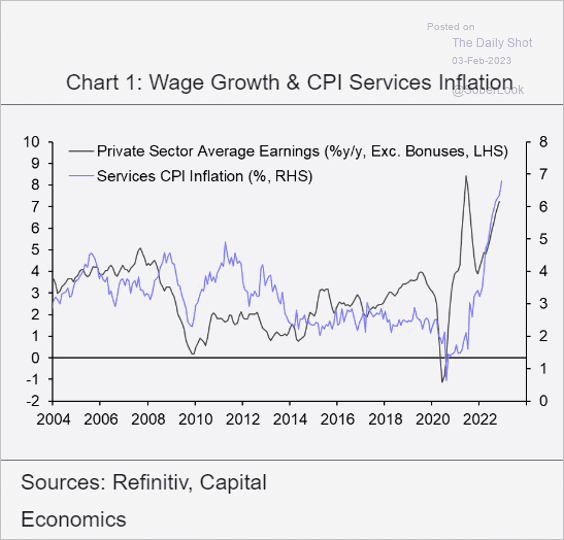

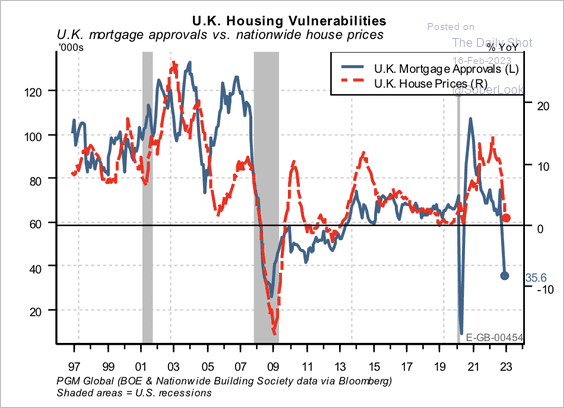

The United Kingdom: Sharp declines in mortgage approvals suggest that additional house price weakness is likely to follow. According to PGM Global, roughly 42% of UK mortgages are at variable rates or fixed rates that expire or reset within 24 months.

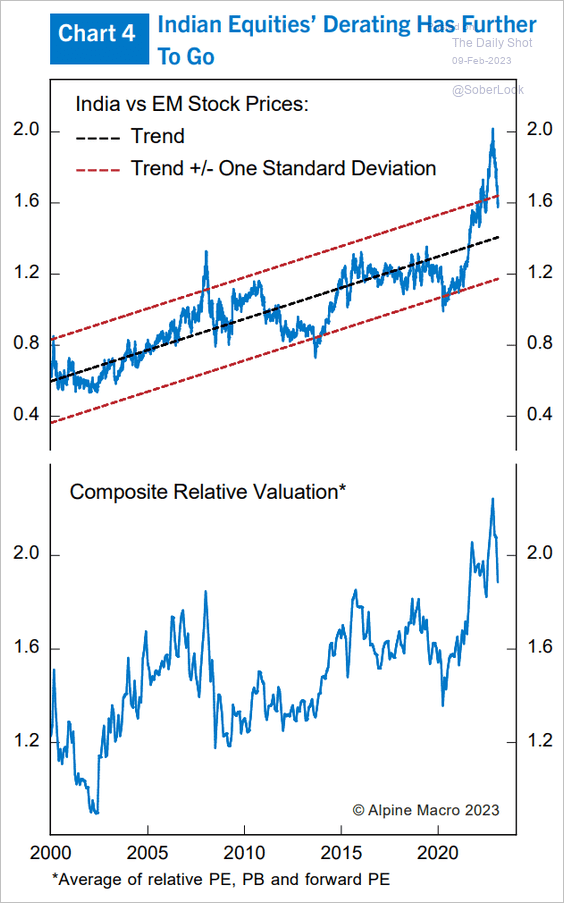

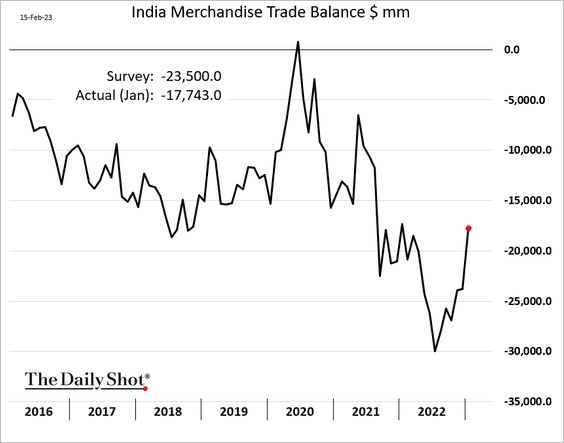

Emerging Markets: India’s trade deficit narrowed more than expected last month.

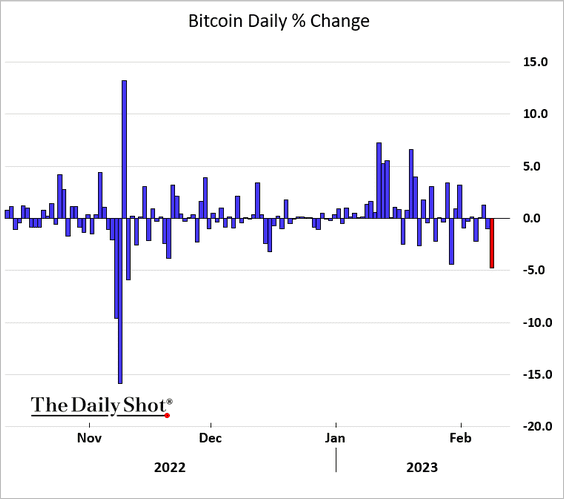

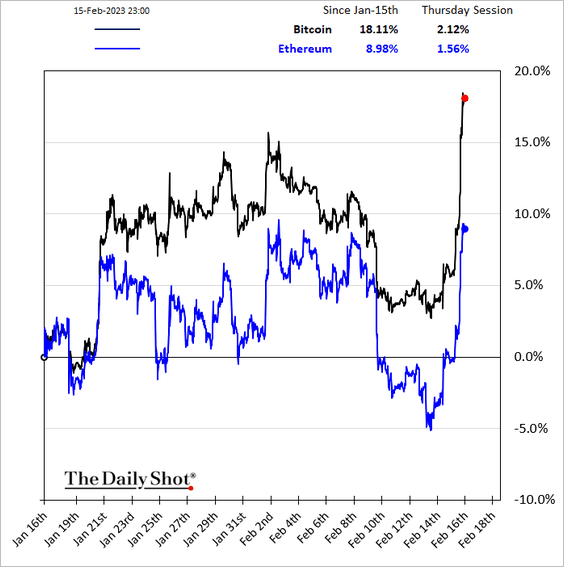

Cryptocurrency: Cryptos surged this week.

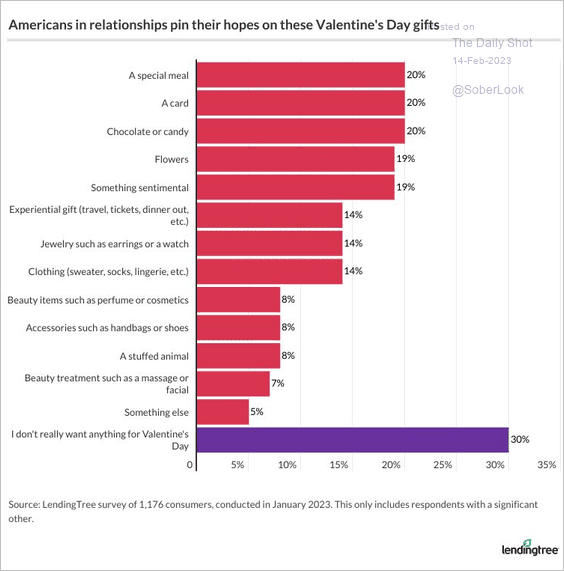

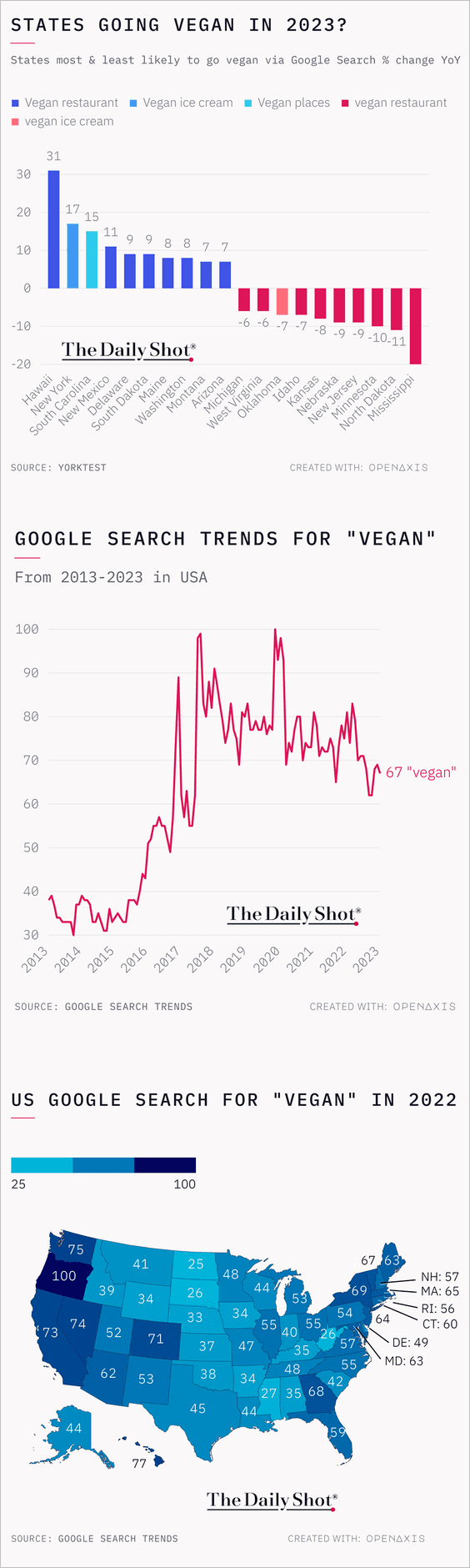

Food for Thought: Lastly, here is vegan-related online search activity:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com