Greetings,

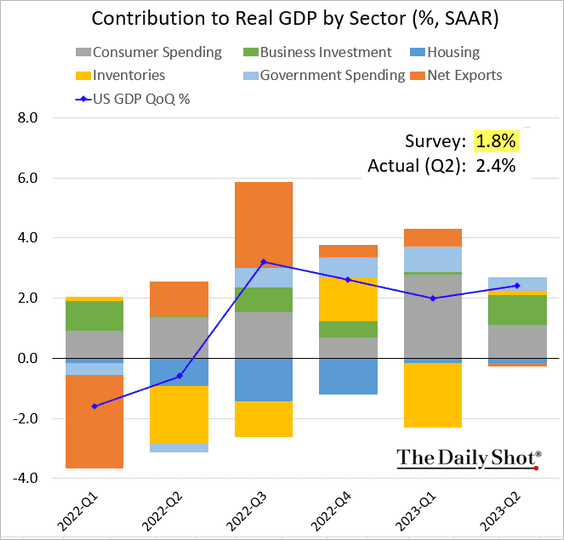

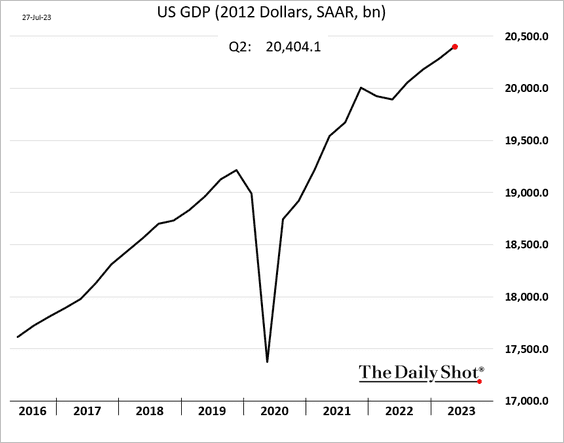

The United States: The GDP report topped expectations, signaling robust economic growth. The Atlanta Fed’s GDPNow model was much closer to the Q2 figure than the consensus forecast (see chart).

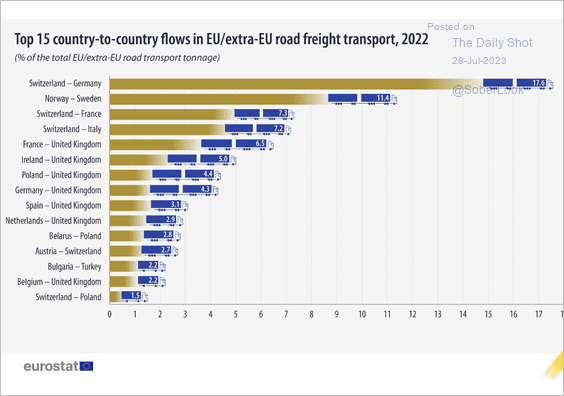

Europe: This chart shows road freight transport between EU and non-EU countries.

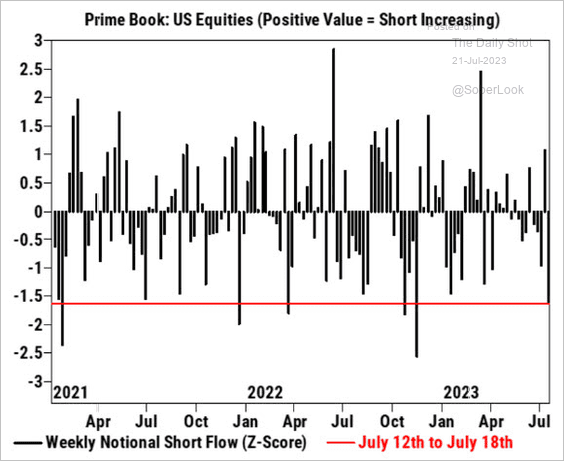

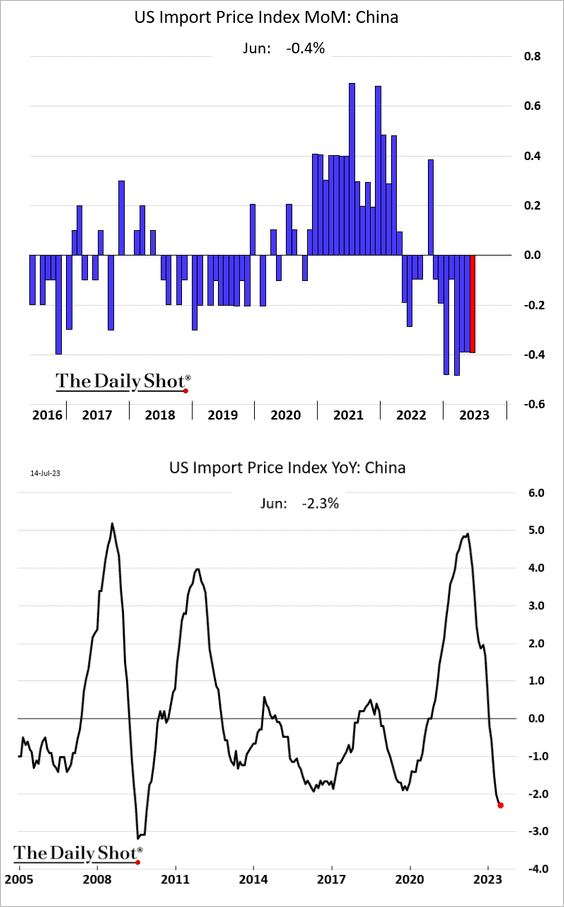

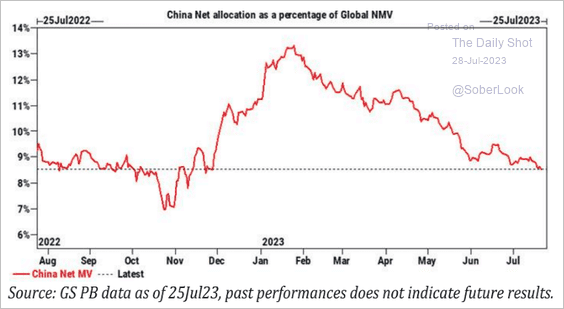

China: Hedge funds have been cutting their exposure.

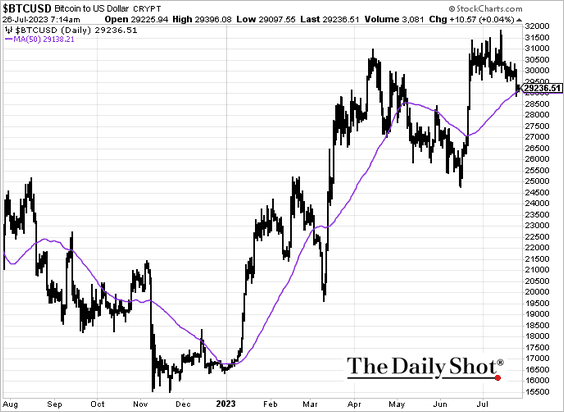

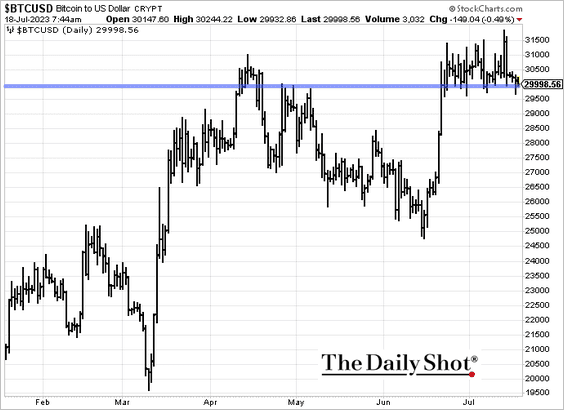

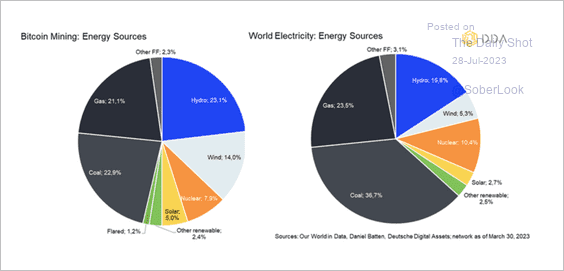

Cryptocurrency: Here is a look at Bitcoin mining energy sources versus global electricity.

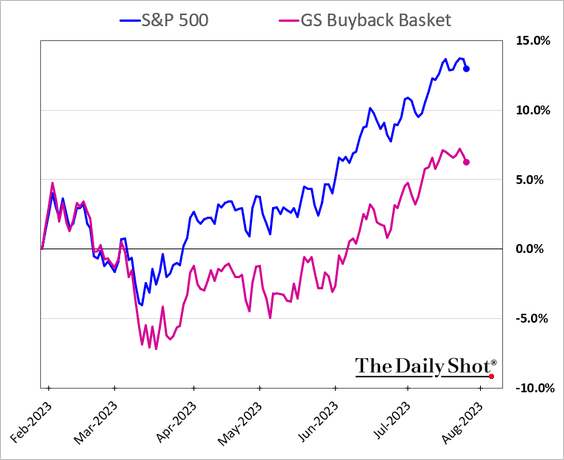

Equities: Firms recognized for their frequent share buy-back initiatives have been underperforming.

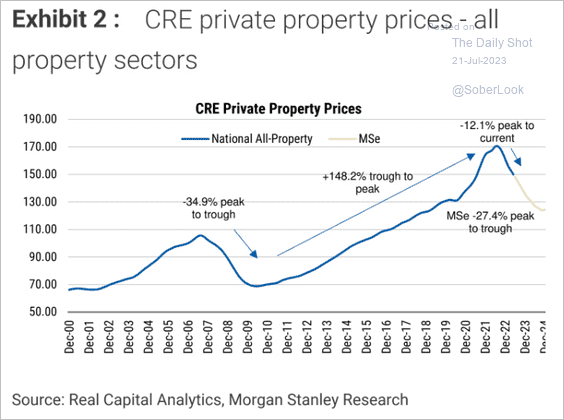

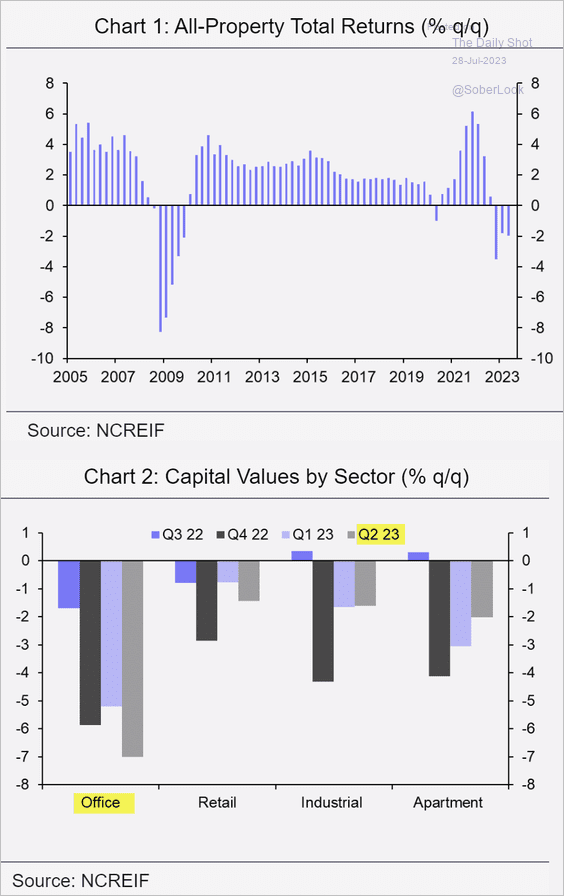

Credit: US commercial property prices continue to decline, with office properties bearing the brunt of this downward trend.

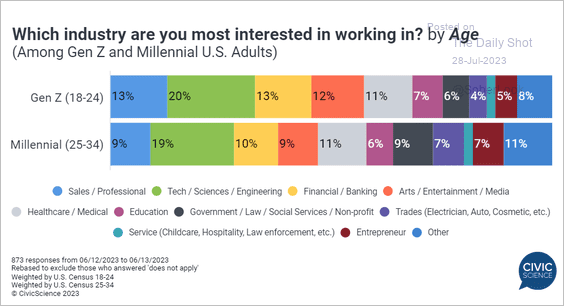

Food for Thought: Gen-Z’s and Millennials’ industry preferences:

Edited by Josh Oldmixon

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily ShotAverage hourly wages for US teens: Brief