Greetings,

Before we begin, we wanted to alert you to one of our favorite weekend reads: the Weekly S&P500 ChartStorm by Callum Thomas — it features 10 handpicked charts on the US stock market covering macro, technicals, valuations, and more — it’s a quick and effective way to stay on top of the market outlook.

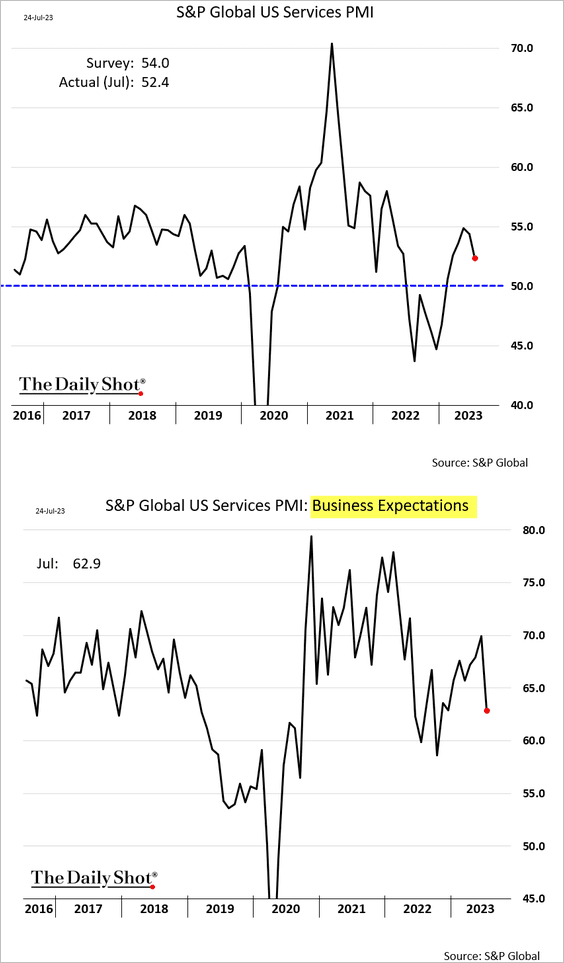

The United States: The services PMI index from S&P Global declined in July but remained in growth territory (PMI > 50). Business outlook and hiring softened.

Labor market imbalances continue to ease as job openings moderate.

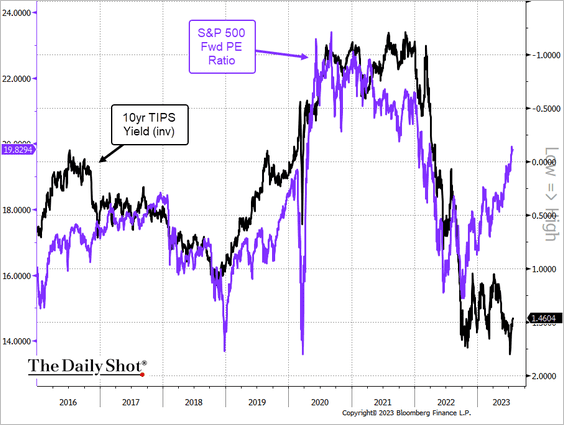

Equities: The S&P 500 PE ratio has diverged from real yields.

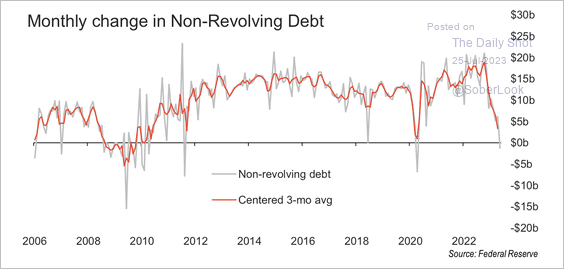

This is the first US non-revolving debt contraction in 12 years, underpinned by tighter lending standards.

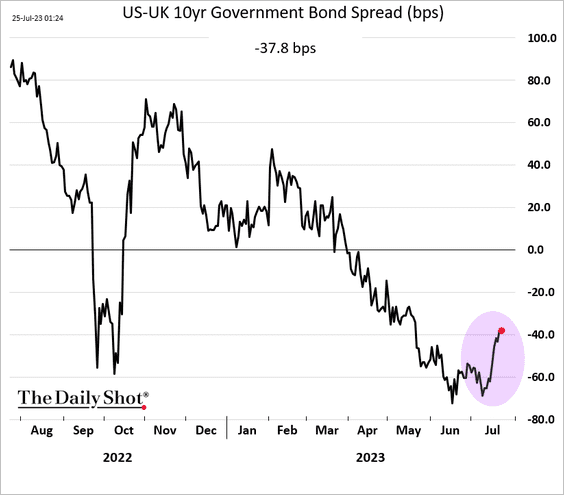

The United Kingdom: The US-UK 10-year spread is tightening.

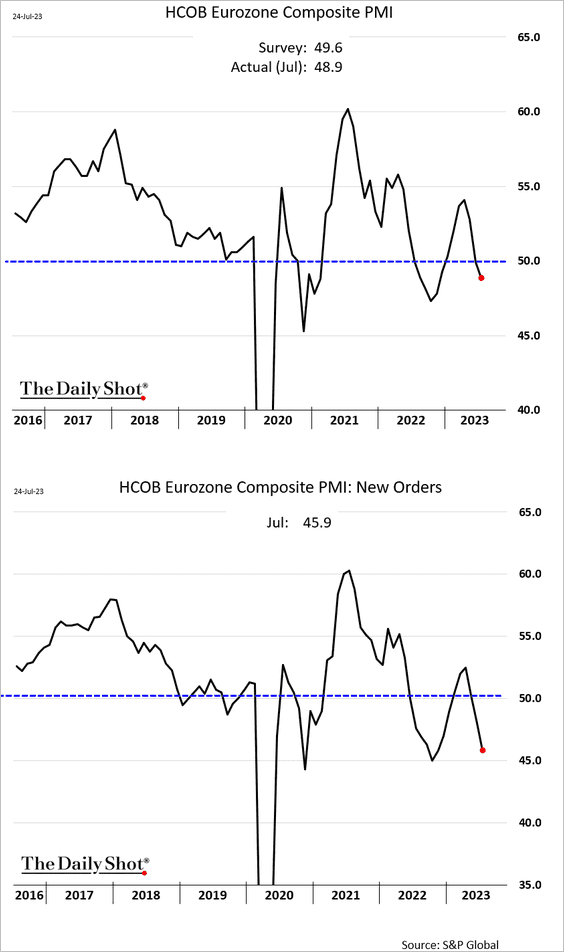

The Eurozone: The euro-area composite PMI shows shrinking business activity.

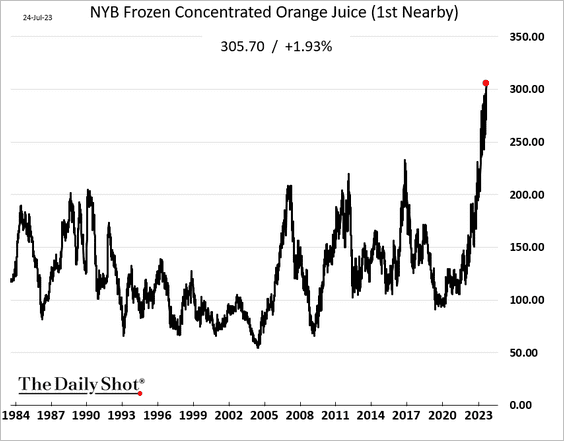

Commodities: Orange juice futures hit a record high.

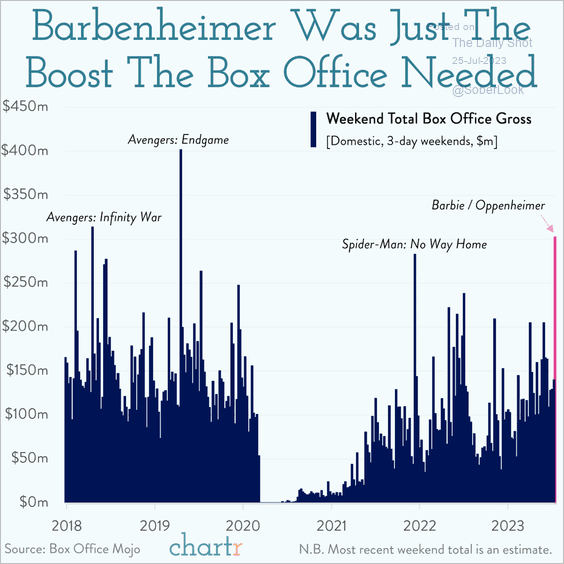

Food for Thought: Here are weekend box office gross proceeds:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily ShotAverage hourly wages for US teens: Brief