Greetings,

The United States: The Conference Board’s consumer confidence indicator edged lower this month.

Europe: Economists now expect only one Norges Bank rate cut before the end of the year (from 4.5%).

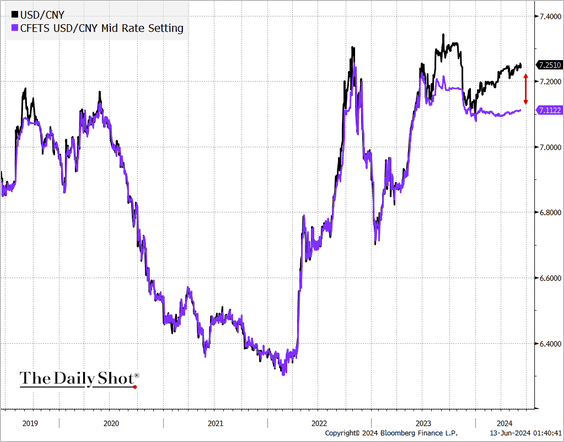

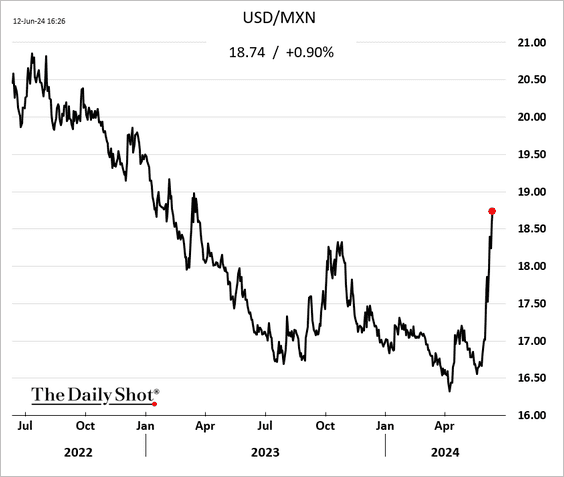

Emerging Markets: Which currencies are most vulnerable to US dollar strength?

Energy: The US and Qatar are driving growth in global LNG supply.

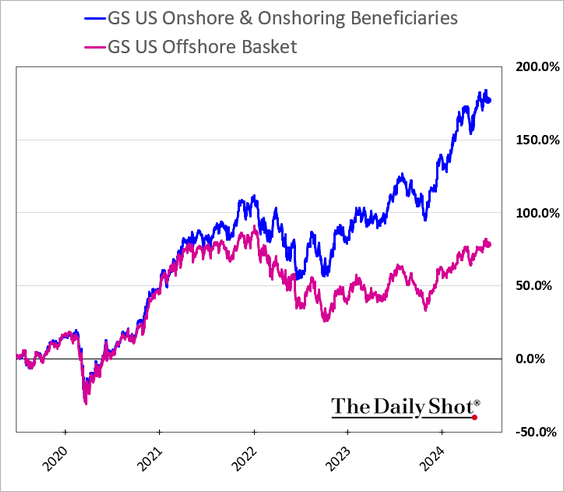

Equities: US companies that focus on onshoring or primarily depend on domestic production have significantly outperformed those that rely on international supply chains or have a substantial international manufacturing footprint.

Food for Thought: Share of renters spending over 40 percent of disposable income on rent in selected countries:

Edited by Josh Oldmixon

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily Shot Brief