Greetings,

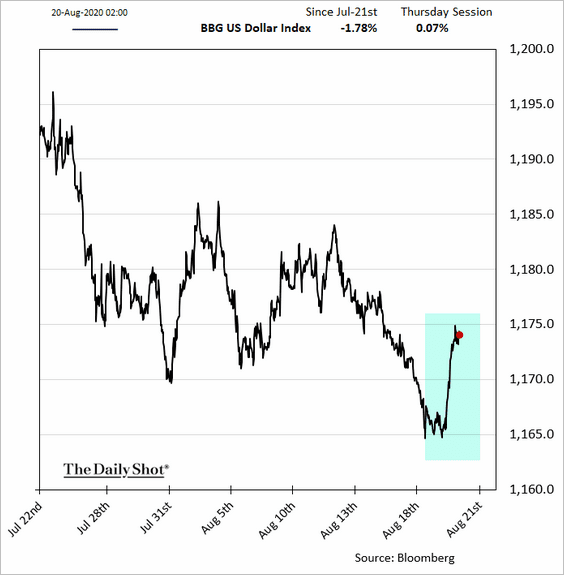

United States: The US dollar bounced from the lows after the Fed minutes were released. Some have suggested that the market response was due to the Fed’s rejection of yield-curve control as a policy tool. It is used by several central banks, notably the BoJ.

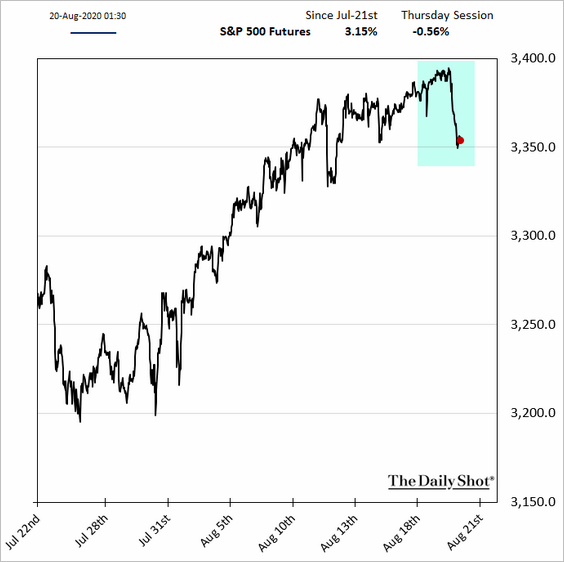

Here is how stock futures reacted to a stronger dollar.

The dollar weakness has provided support for US stocks this year, and investors a jittery about this trend reversing.

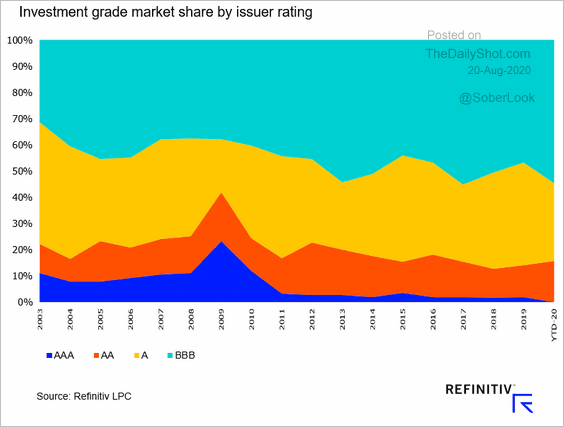

Credit: The corporate investment-grade (IG) bond market looks increasingly risky. The concentration of BBB names keeps climbing.

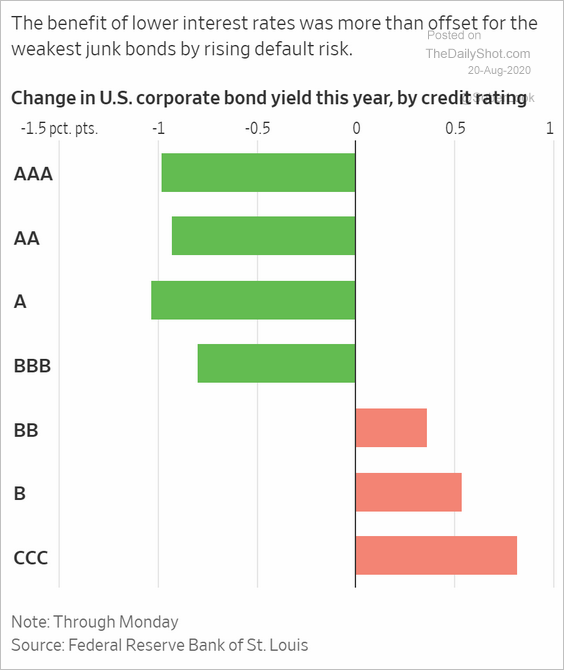

This chart shows this year’s US corporate bond yield changes, by rating.

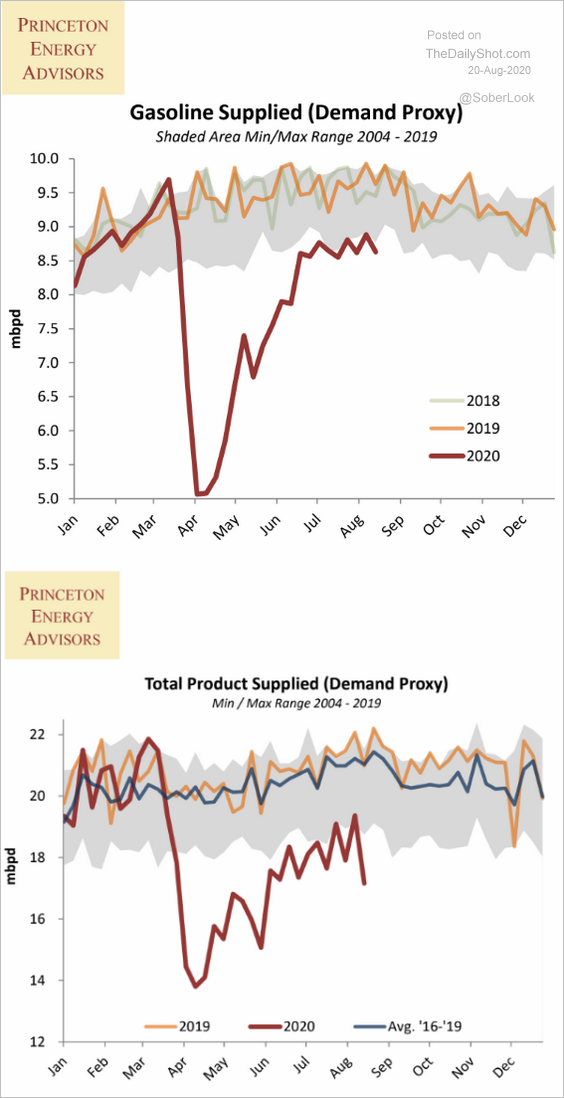

Energy: The recovery in US refined product demand has paused.

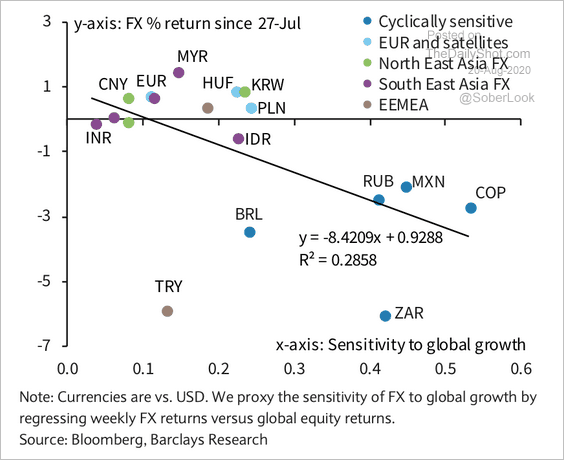

Emerging Markets: Cyclically sensitive EM currencies have underperformed despite broad dollar weakness.

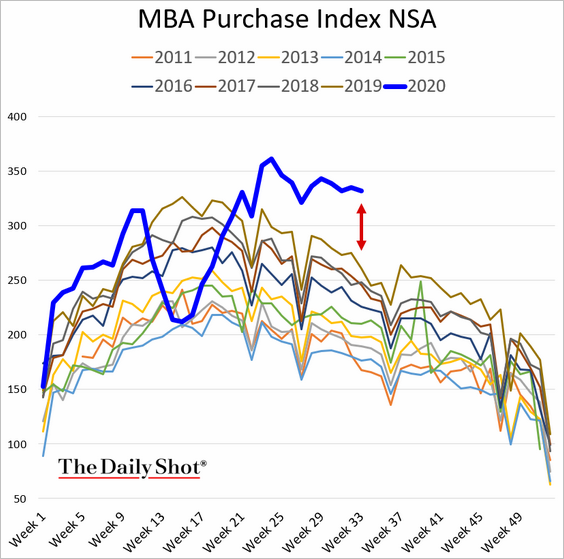

United States: Home purchase mortgage activity is holding at multi-year highs.

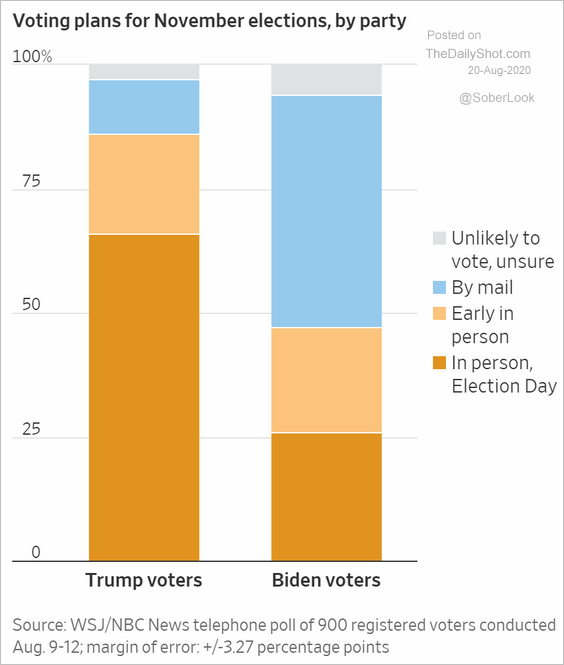

Food For Thought: Voting by mail:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

Subscribe to the Daily Shot Brief