Greetings,

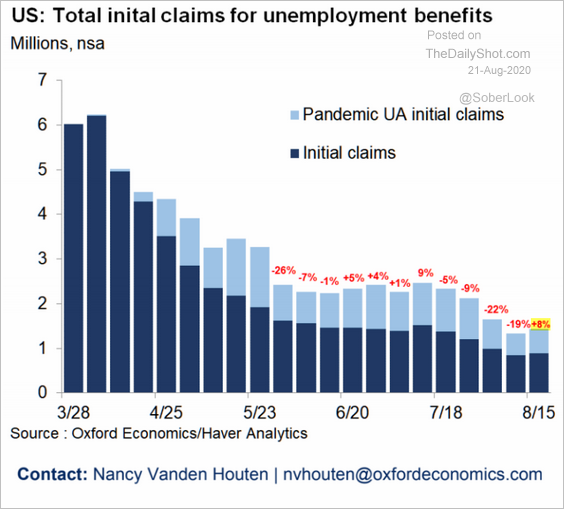

United States: After four weeks of declines, initial unemployment claims rose last week.

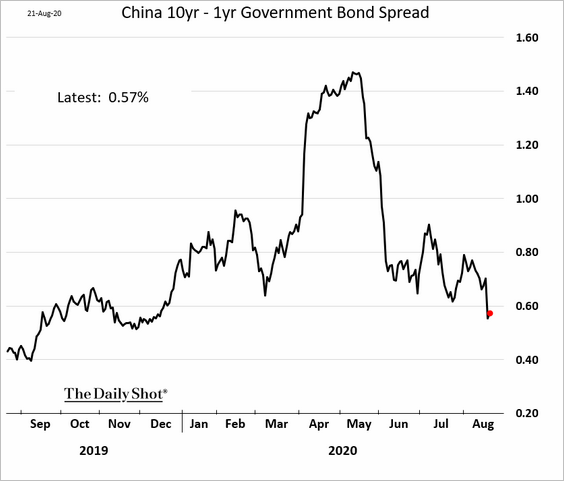

China: The yield curve has flattened considerably since May.

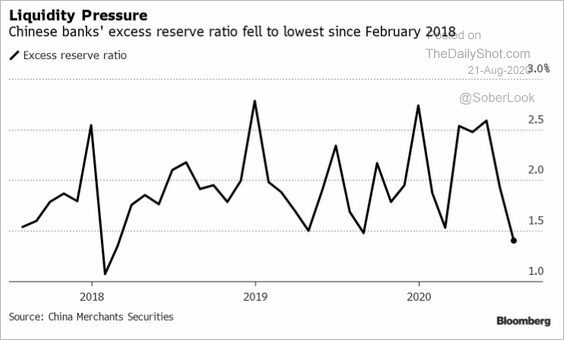

The PBoC has kept liquidity relatively tight and resisted lowering short-term rates.

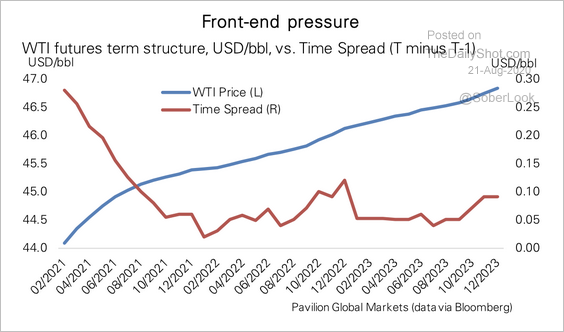

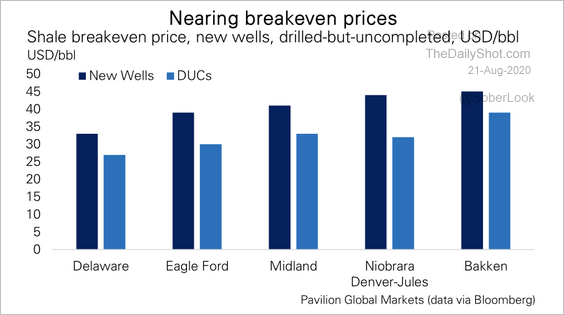

Energy: The US oil futures curve is in contango. And the time spread (price between contracts) should remain wide at the front-end of the curve amid elevated inventories and high storage costs, according to Pavilion Global Markets.

Oil prices are nearing breakeven levels for core US shale plays.

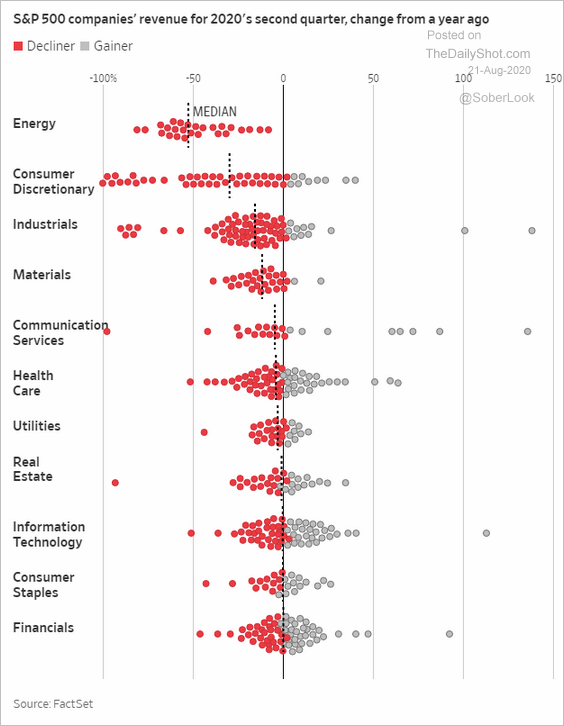

Equitiees: This chart shows the Q2 revenue distribution for S&P 500 companies (by sector).

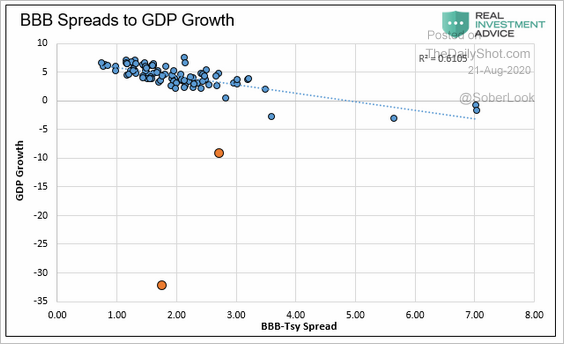

Credit: This scatterplot shows the GDP growth vs. BBB bond spreads. Can you spot the Fed’s intervention?

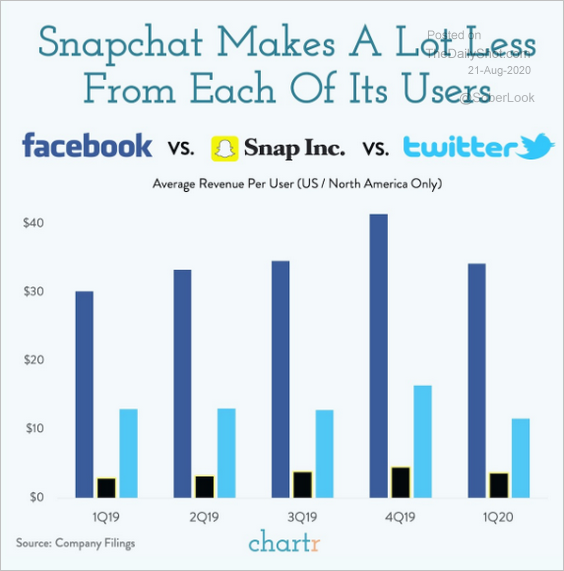

Food For Thought: Social media revenue per user:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

Subscribe to the Daily Shot Brief