Greetings,

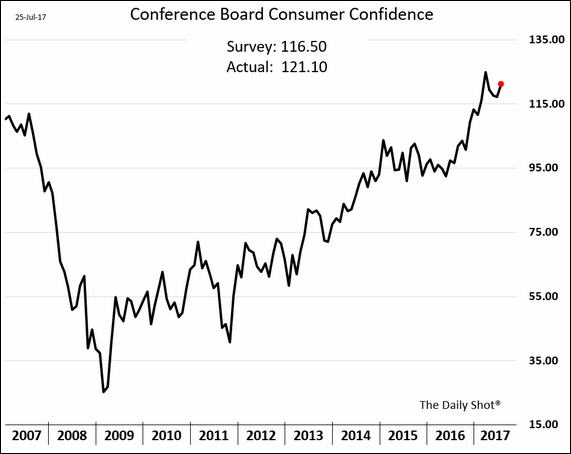

The United States: According to the Conference Board, consumer confidence in the US remains elevated, beating economists’ expectations.

The “present situation” component of the Conference Board’s report has been exceptionally strong. Will we see this trend translate into higher consumer spending?

Global Developments: Is the recent growth in world trade about to slow?

Credit: The percentage of covenant-lite leveraged loans in Europe has exceeded that of the US.

Equity Markets: The charts below show the percentage of companies beating earnings and sales estimates, broken out by company size.

Emerging Markets: Argentina’s economic activity is improving.

The Eurozone: The Ifo business sentiment index for Germany hit a multi-year high, beating expectations. The second chart below shows the breakdown by sector. Note the increasing divergence between the current situation and the expectations index.

Alternatives: Private equity (PE) buyout multiples look stretched. The investment justification is often based on frothy public benchmarks. It’s hard to see the recent PE vintages ending up with decent returns.

Food for Thought: The introduction of a new OxyContin formulation which makes it hard to break down the pill for use in injections and snorting reduced the rates of abuse. However, heroin use rose sharply (as opioid addicts switched over).

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com