Greetings,

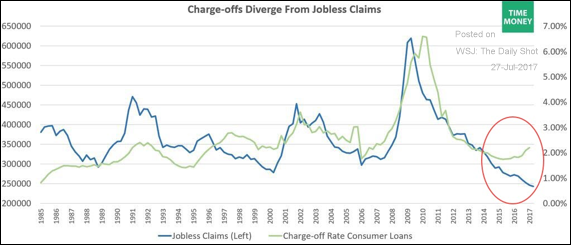

The United States: Consumer loan charge-offs have been on the rise recently despite a strong labor market.

China: This chart shows the growth of shadow banking assets in China. There are indications that the PBoC’s tightening has moderated this expansion in recent months.

Here is the composition of China’s shadow banking.

Rates: Here is the latest projection of the Fed’s balance sheet.

Equity Markets: Some analysts remain convinced that the stock rally has been tightly linked to the total central bank stimulus. That doesn’t bode well for the market over the next couple of years.

Emerging Markets: Rodrigo Duterte knows how to kill drug dealers (and users), but managing the nation’s economy is another story. The Philippines trade deficit continues to worsen.

The Eurozone: The euro blasted past 1.17 after the FOMC statement.

The United Kingdom: Here is the UK’s overall economic update since the EU Referendum vote.

Energy Markets: Despite more cars on the road each year, US gasoline demand is projected to plateau over the next half a decade.

Food for Thought: An internet minute.

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com