Greetings,

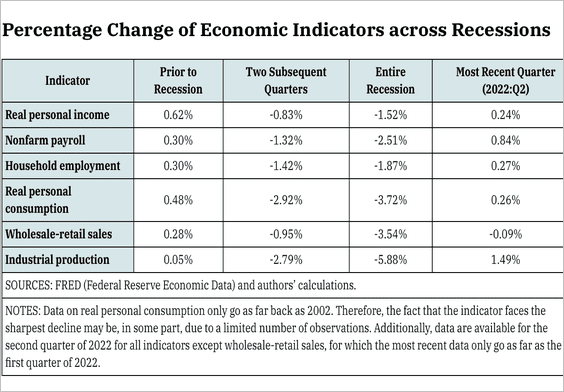

The United States: First, most economic indicators experience varying degrees of positive growth during the two quarters prior to a recession. However, immediately following the onset of a recession, all indicators simultaneously decline.

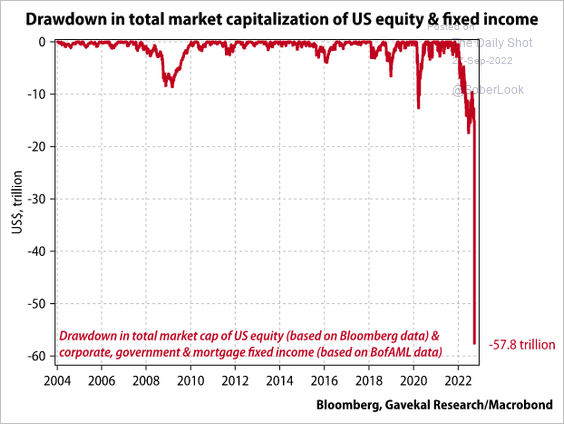

The drawdown in US equity and fixed income markets has been extreme.

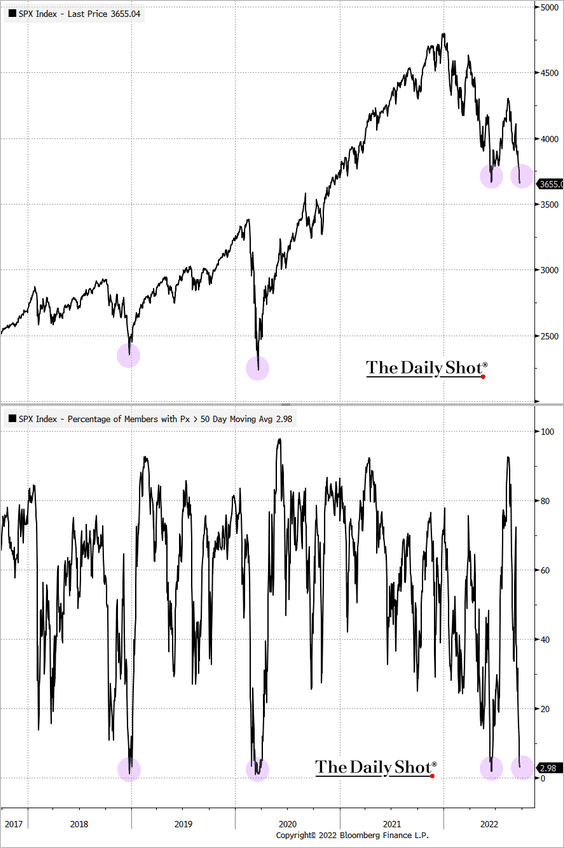

Equities: The percentage of S&P 500 names trading above their 50-day moving average is at extreme lows (typically pointing to a market bounce).

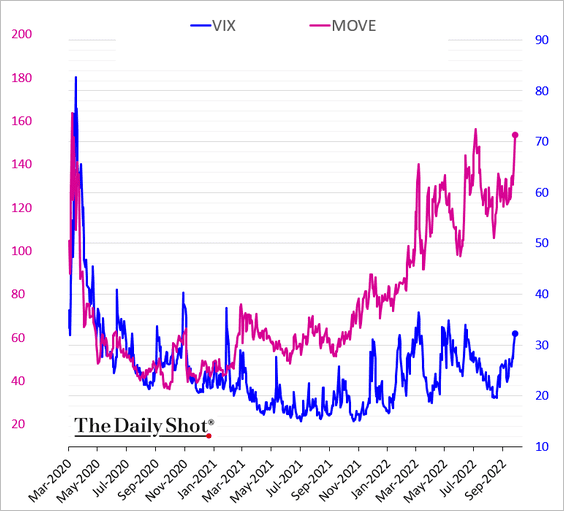

Rates: Treasury market implied volatility (MOVE) continues to outpace the equities vol (VIX).

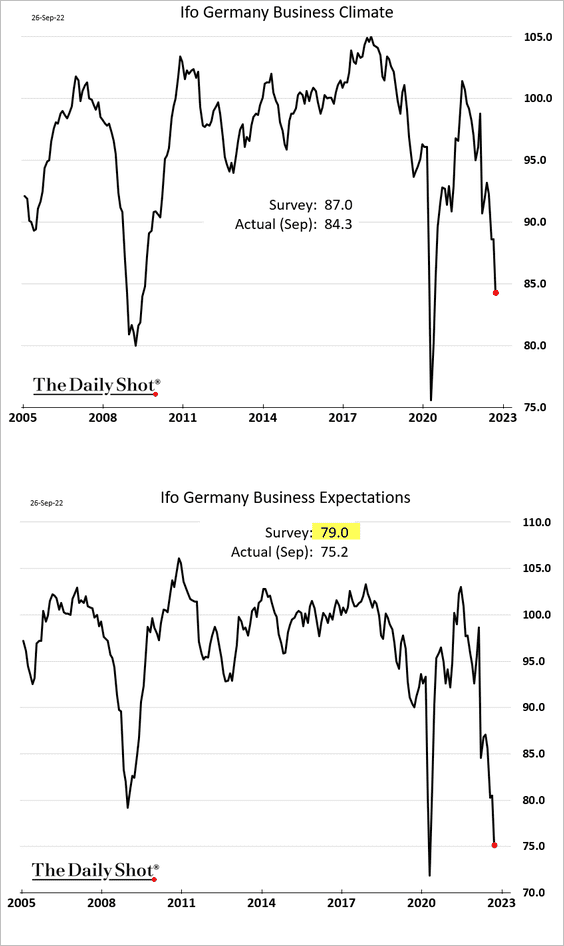

The Eurozone: The Ifo report showed Germany’s business expectations hitting extreme lows.

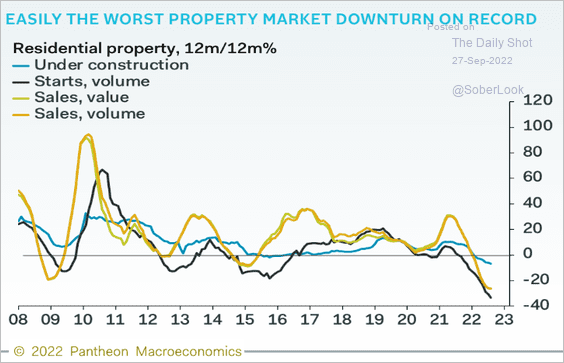

China: The current property market downturn in China has been the worst on record.

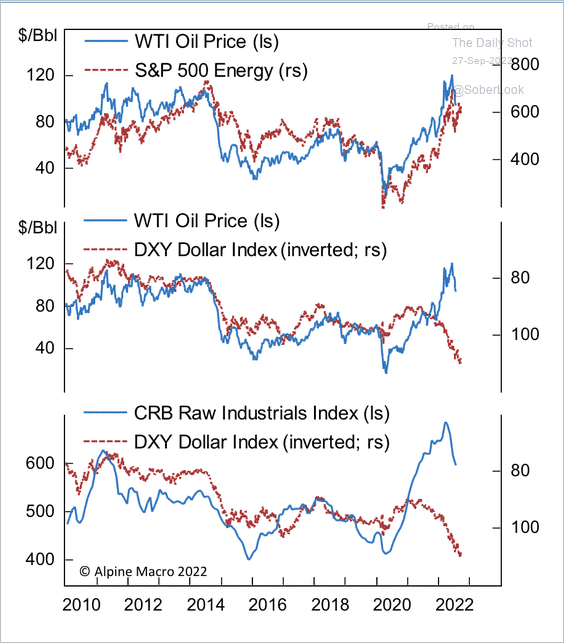

Commodities: The strong dollar and weaker economic growth have triggered a cyclical decline in commodity prices.

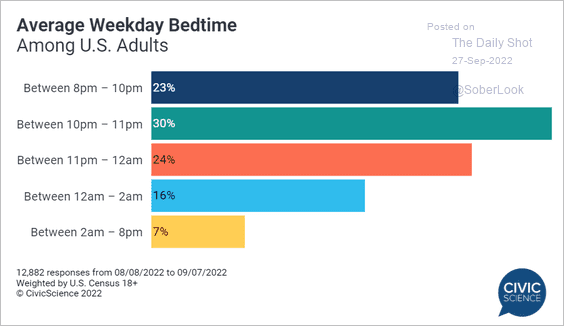

Food for Thought: Lastly, here is weekday bedtime among US adults:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com