Greetings,

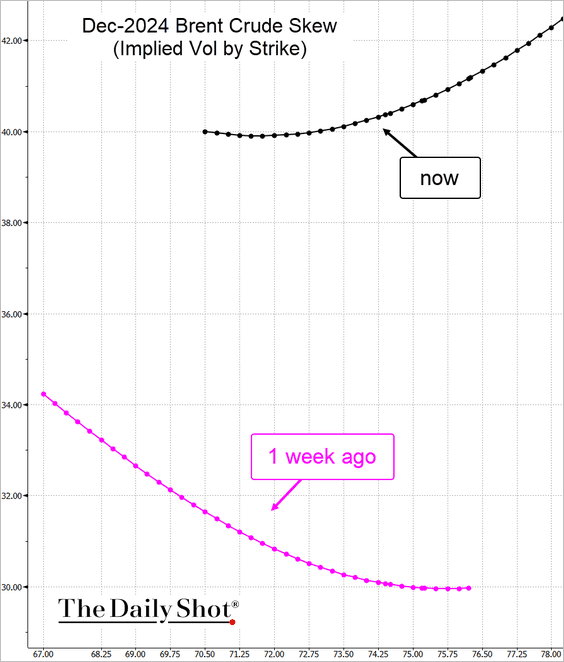

Energy: Options traders see crude oil risks skewed to the upside. Here is the Dec 2024 volatility smile.

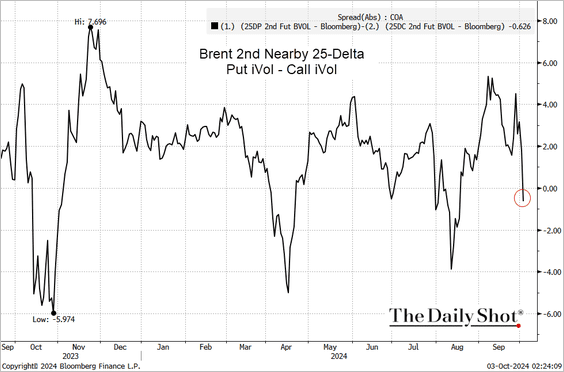

Here is the 25-delta put/call skew.

Equities: Market breadth has improved dramatically over the past couple of months.

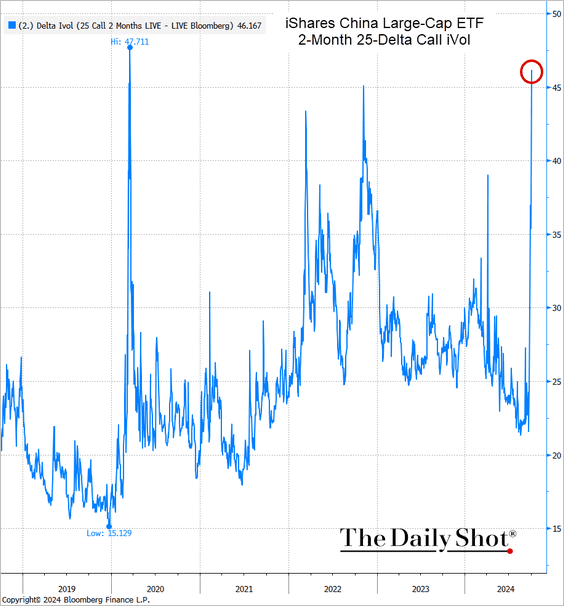

China: Demand for call options on China-focused equity ETFs (FXI shown below) has been surging.

The United Kingdom: The pound has been gaining against the euro due to faster ECB rate cut expectations.

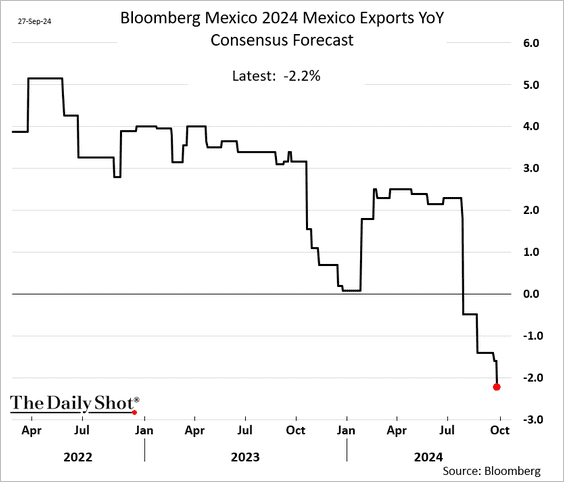

Emerging Markets: Economists have been downgrading their forecasts for Mexico’s GDP growth this year as exports soften.

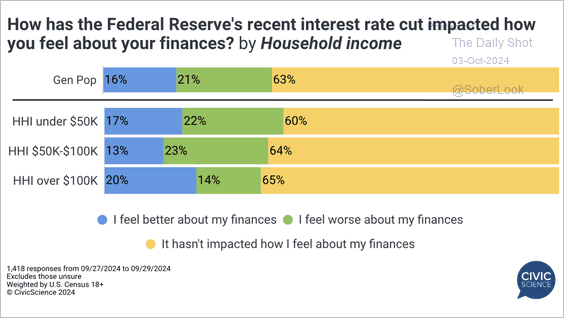

Food for Thought: Impact of the Federal Reserve’s recent interest rate cut on financial sentiment by household income:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily Shot Brief