Greetings,

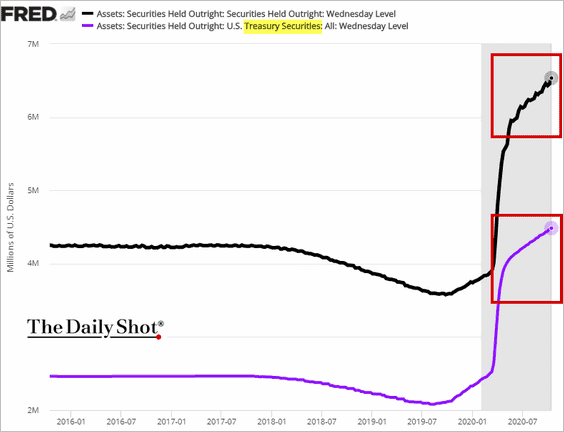

Rates: Markets are preparing for another massive US stimulus bill and the Treasury debt issuance spike that will follow. The Fed has been steadily buying Treasuries and MBS bonds, but that’s not enough to absorb all the new supply.

Is there sufficient appetite at the FOMC to repeat the April buying blitz?

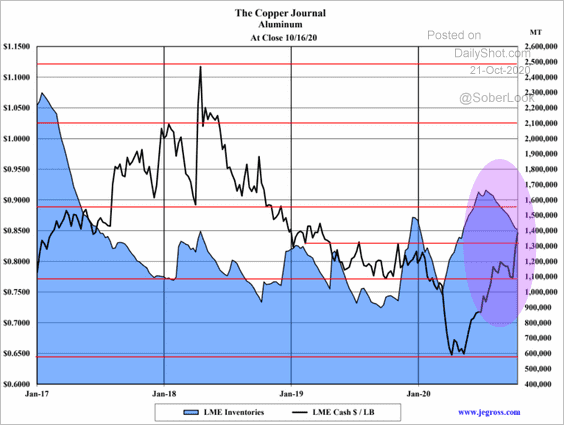

Commodities: Aluminum prices have been surging on demand from China as inventories shrink.

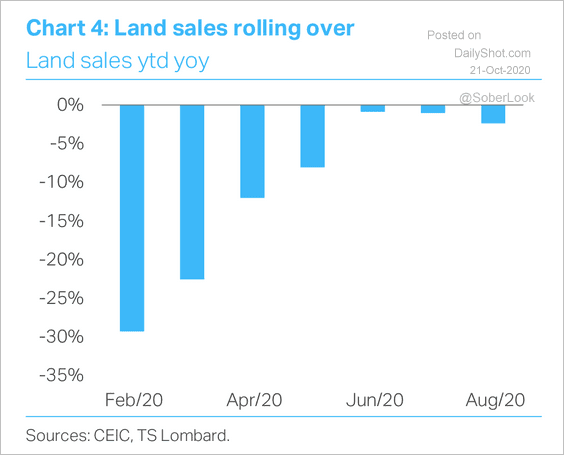

China: Land sales are starting to roll over, which typically leads fixed asset investment by five months, according to TS Lombard. Will the government inject capital to delay an investment slowdown?

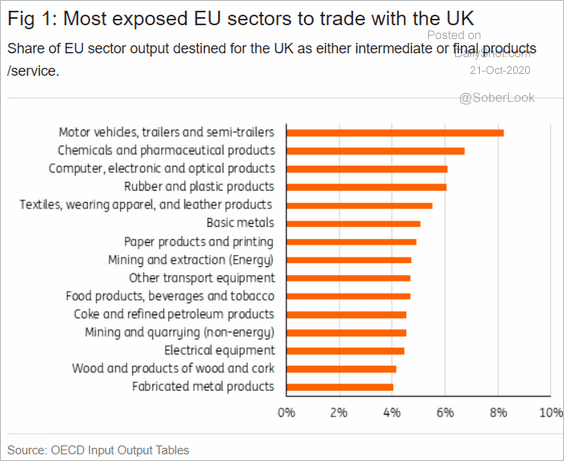

Europe: Which EU sectors are most exposed to Brexit?

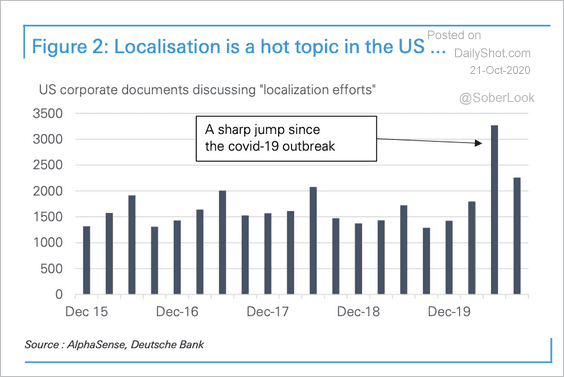

United States: Companies are increasingly discussing localization efforts – a shift from globalization.

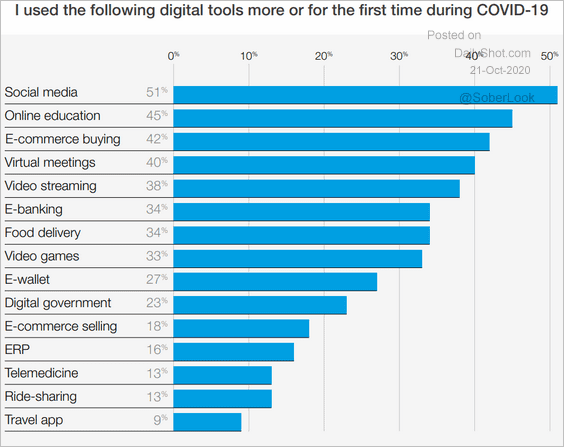

Food For Thought: The increase in digital tool usage during COVID:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

Dear Friends,

The full-length Daily Shot® is now an independent ad-free publication (see TheDailyShot.com). Here is a sample newsletter.

Daily Shot Brief subscribers are eligible to receive the full-length Daily Shot for $115/year (a $20 discount).

To subscribe with this discount, you must register here (NOTE: The regular subscription page will not acknowledge this coupon). The coupon number is DSB329075 (please click the “apply” button for the discount to take effect).

A monthly subscription is also available (here).

The Food for Thought section is available as a separate newsletter. You can sign up here.

Please note that The Daily Shot is not an investment newsletter and is not intended for broad distribution.

If you have any questions, please contact Lev.Borodovsky@TheDailyShot.com.

Sincerely,

Lev Borodovsky

Editor, The Daily Shot