Greetings,

Before we begin, we wanted to alert you to one of our favorite weekend reads: the Weekly S&P500 ChartStorm by Callum Thomas — it features 10 handpicked charts covering macro, technicals, valuations, and more — it’s a quick and effective way to stay on top of the market outlook.

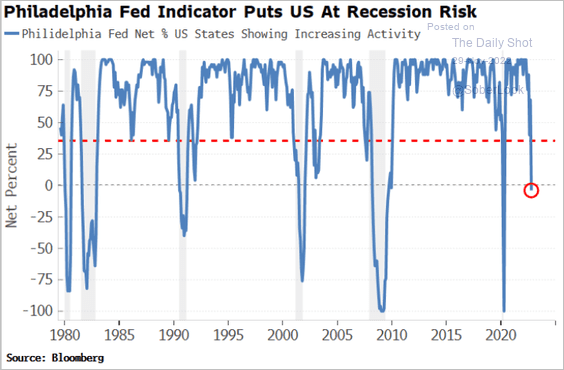

The United States: More states are reporting declining economic activity, which typically occurs around recessions.

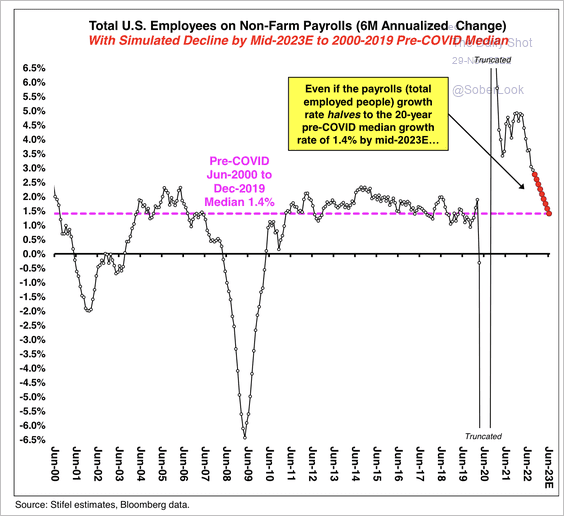

Stifel expects payroll growth to cool toward the 20-year pre-COVID median, which would resemble a soft economic landing.

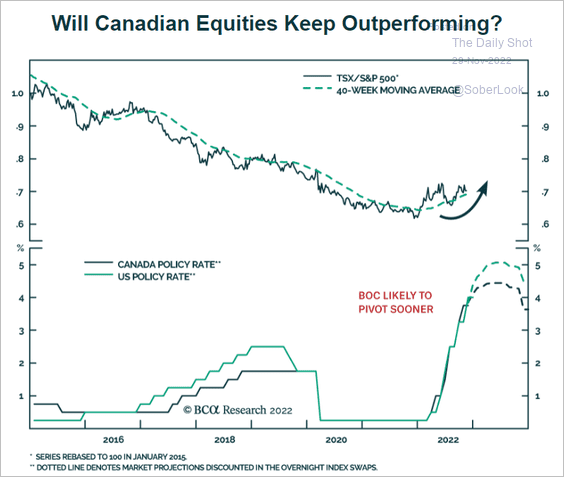

Canada: Will Canada’s stocks keep outperforming the US?

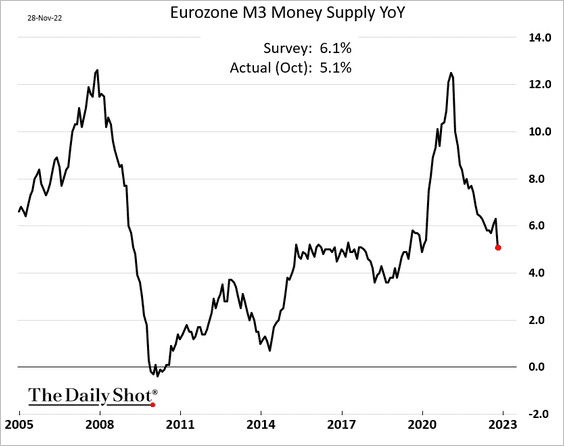

The Eurozone: Eurozone money supply growth is slowing rapidly even as loan growth has remained relatively robust.

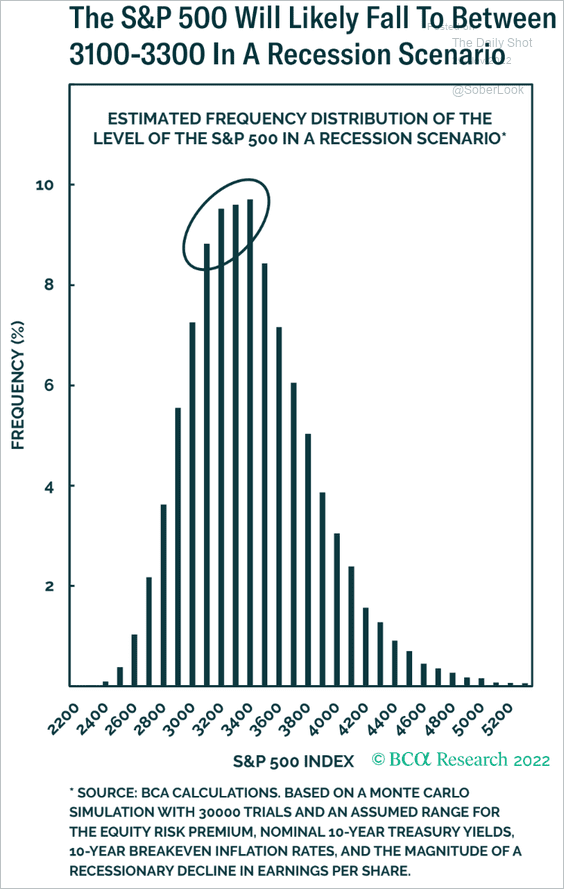

Equities: A recession will send US shares to new lows.

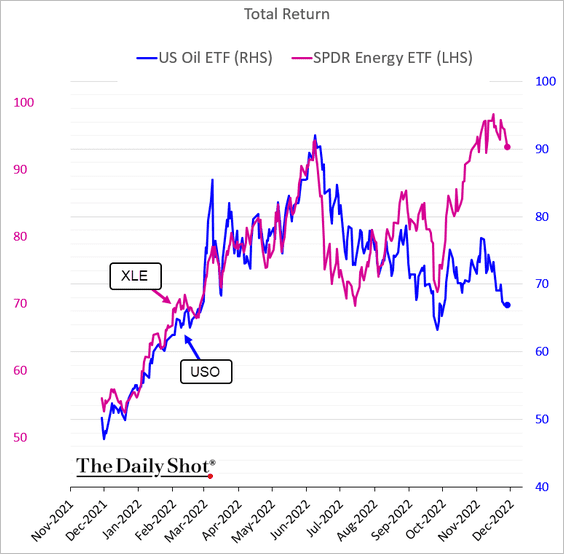

Energy: Energy shares have diverged from oil prices. Is the stock market expecting higher crude prices ahead?

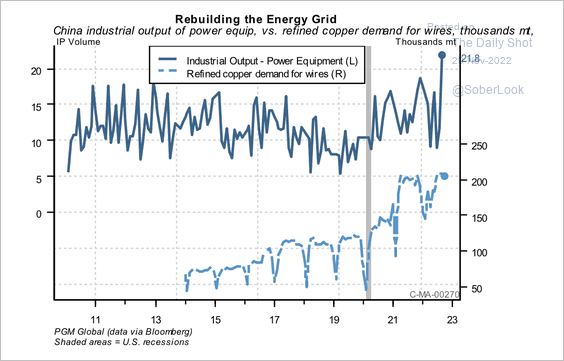

China: China is rebuilding its energy grid as part of its five-year plan to generate more renewable energy, according to PGM Global. That could fuel greater demand for copper.

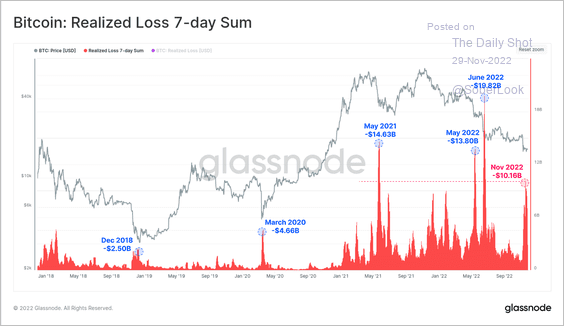

Cryptocurrency: This month has marked the fourth largest realized loss event for BTC holders on record.

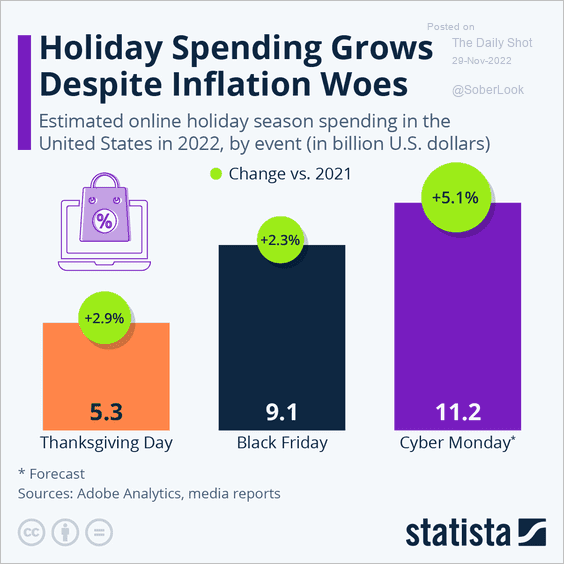

Food for Thought: Lastly, holiday spending grew despite the economic backdrop:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com