Greetings,

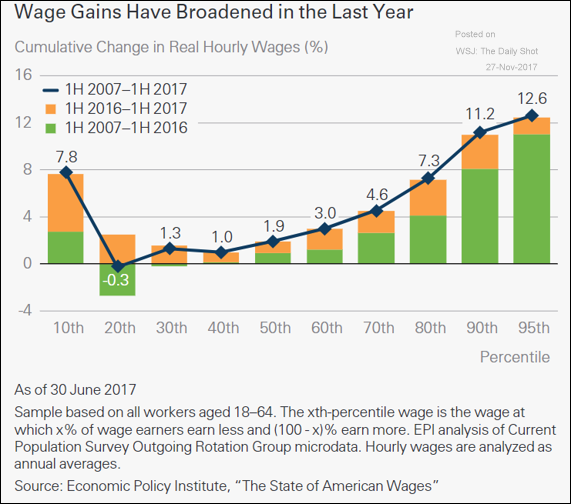

The United States: Wage growth in the US has broadened across income categories over the past year.

Here is a comment from Ronald Temple, Head of US Equities and Co-Head of Multi-Asset Investing at Lazard Asset Management:

“After stagnating for the prior nine years for most workers, real wages increased across the income spectrum starting in 2016. I believe that the middle-class consumer will drive the next leg of growth for the US as higher wages lead to higher consumer confidence and increased spending.”

Europe: While most indicators point to the housing inflation in the UK stabilizing (see example), some analysts see home price increases moderating further.

Credit: The riskiest leveraged loans dominate the market.

Equity Markets: Here is the trend for corporate and ETF listings.

Stocks are no longer the most actively-traded securities. Note that two of the top ten most active publicly listed securities are volatility products.

Emerging Markets: Here is a forecast for inflation rates and the GDP growth across Latin America.

China: Higher rates are expected to pressure the nation’s property markets.

Food for Thought: Student debt vs. future earnings (by college).

Edited by Joseph N Cohen

To receive the Daily Shot Premium, you need to be a subscriber to The Wall Street Journal. The Daily Shot readers qualify for a special membership offer of $1 for 2 months and can join simply by clicking here.

If you are already a WSJ member, you can sign up for The Daily Shot at our Email Center by clicking here.

The Daily Shot Premium is also available online at DailyShotWSJ.com

If you have any issues at all, please contact a Customer Service representative by calling 1-800-JOURNAL (1-800-568-7625) or sending an email to support@wsj.com.

Thanks to Josh Marte (@joshdigga), Matt Garrett (@MattGarrett3), Joseph Cohen (@josephncohen), Ycharts.com, S&P Global, and Moody’s Investors Service for helping with the research for the Daily Shot.

We would also like to thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. http://research.stlouisfed.org/fred2/

Contact the Daily Shot Editor: Editor@DailyShotLetter.com