Greetings,

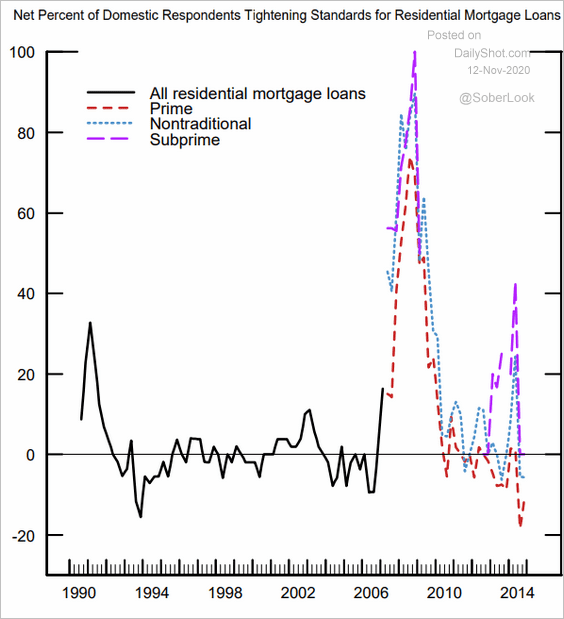

Credit: Let’s begin with the Fed’s Senior Loan Officer Opinion Survey. Given the strength in the housing market, banks have been easing lending standards on mortgages.

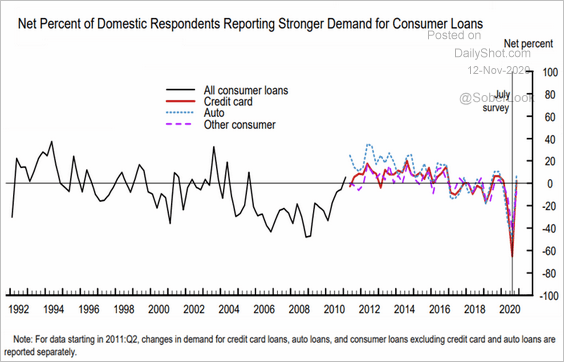

Consumer credit demand (credit cards, auto loans, etc.) has rebounded.

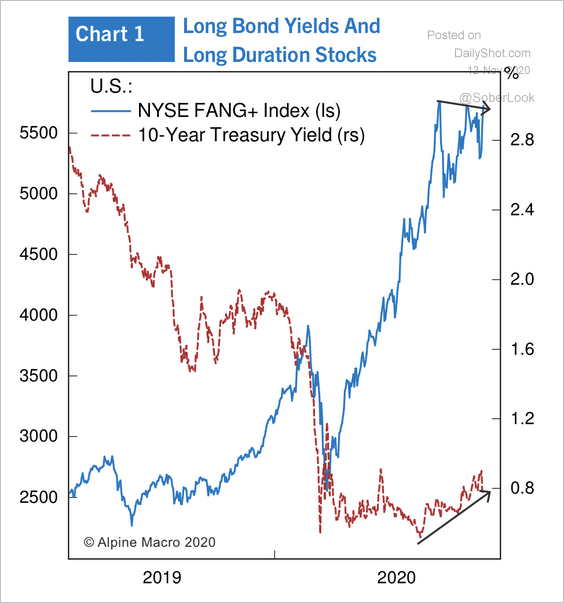

Equities: A substantial increase in Treasury yields could pose a risk for growth stocks, especially the tech mega-caps. A successful vaccine rollout, for example, could be a catalyst for higher rates.

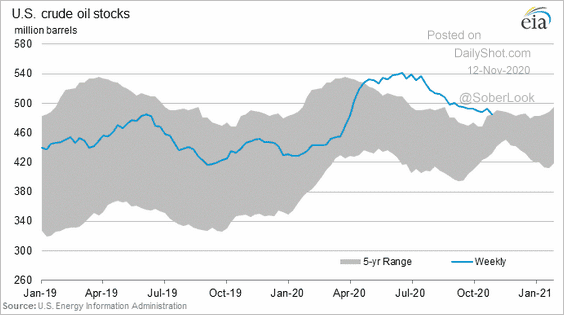

Europe: US crude oil inventories (absolute level) are back at the 5-year range.

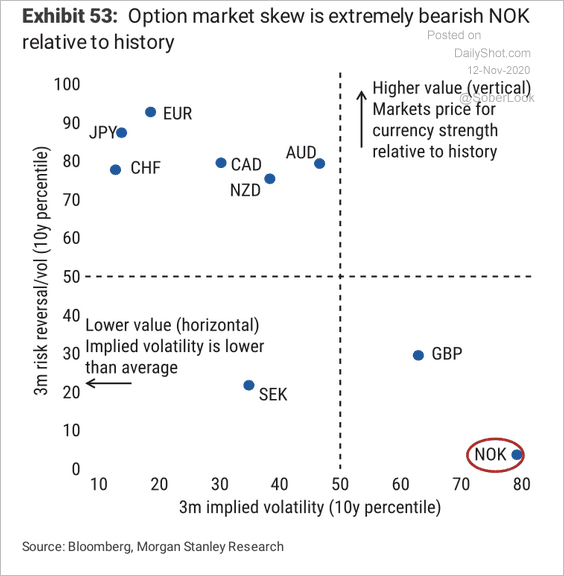

Europe: The options market remains extremely bearish on the Norwegian Krone relative to history.

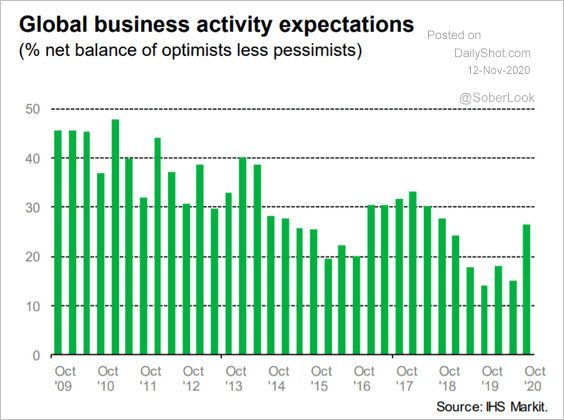

Global Developments: Global business activity expectations have improved.

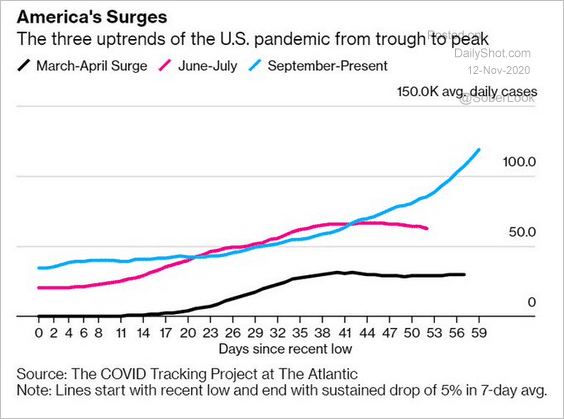

Food For Thought: The latest pandemic uptrend:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

Dear Friends,

The full-length Daily Shot® is now an independent ad-free publication (see TheDailyShot.com). Here is a sample newsletter.

Daily Shot Brief subscribers are eligible to receive the full-length Daily Shot for $115/year (a $20 discount).

To subscribe with this discount, you must register here (NOTE: The regular subscription page will not acknowledge this coupon). The coupon number is DSB329075 (please click the “apply” button for the discount to take effect).

A monthly subscription is also available (here).

The Food for Thought section is available as a separate newsletter. You can sign up here.

Please note that The Daily Shot is not an investment newsletter and is not intended for broad distribution.

If you have any questions, please contact Lev.Borodovsky@TheDailyShot.com.

Sincerely,

Lev Borodovsky

Editor, The Daily Shot