Greetings,

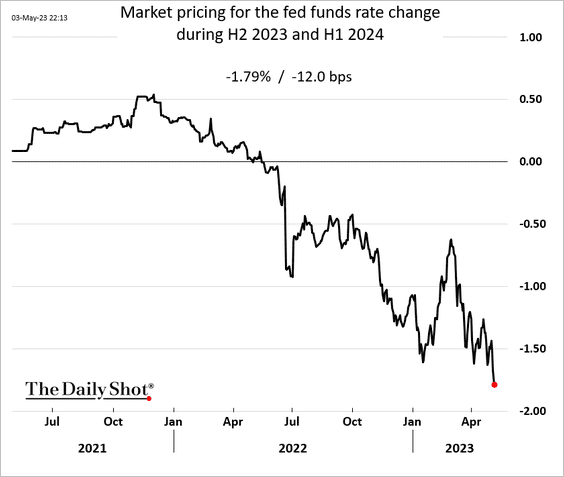

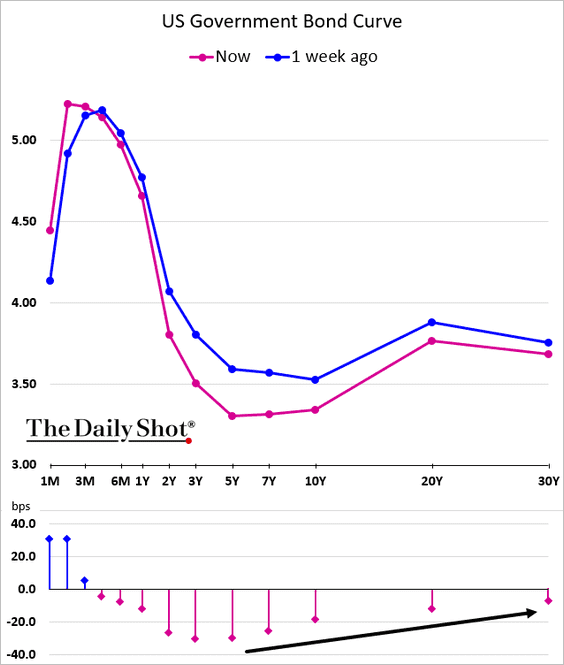

The United States: The market is anticipating approximately 180 bps of rate reductions from the Federal Reserve in the second half of this year and the first half of next year.

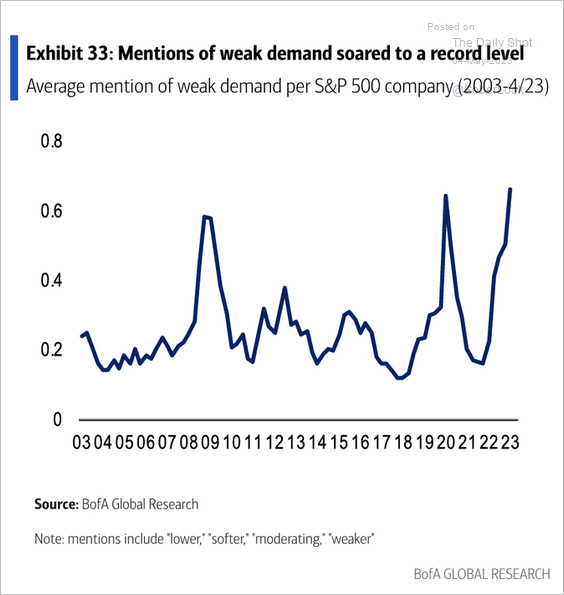

Companies increasingly mention weak demand on earnings calls.

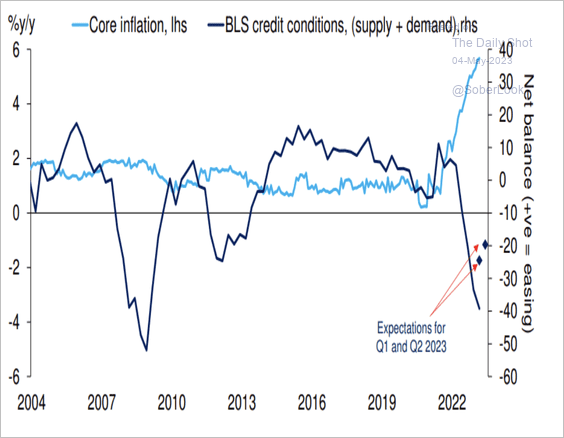

The Eurozone: The ECB faces the dilemma of credit conditions tightening while core inflation remains well above target.

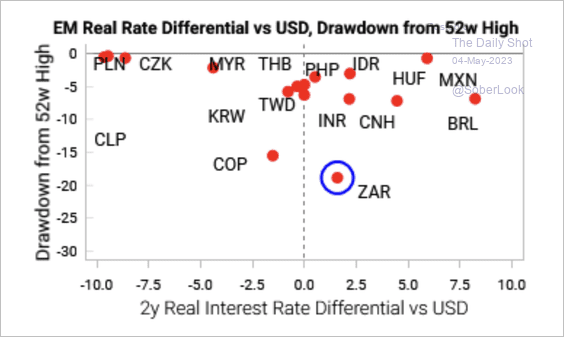

Emerging Markets: ZAR/USD (South African rand) experienced a deep drawdown despite its decent real carry versus the dollar.

Rates: The Treasury curve is steepening at the long end (bull steepener).

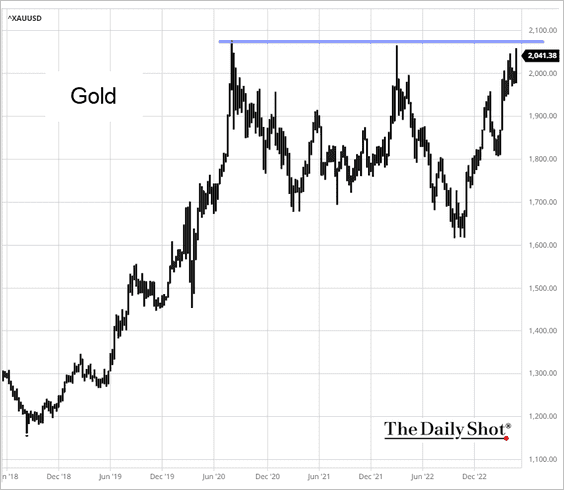

Commodities: Gold jumped on Wednesday, nearing the high reached in 2020, as the Fed signaled a pause and the US dollar moved lower. Persistent turbulence in the US baking sector and the debt ceiling concerns are also driving prices higher.

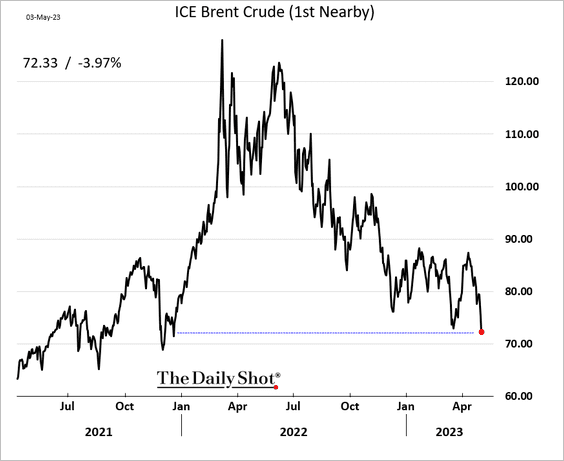

Energy: Crude oil has been under pressure amid demand concerns.

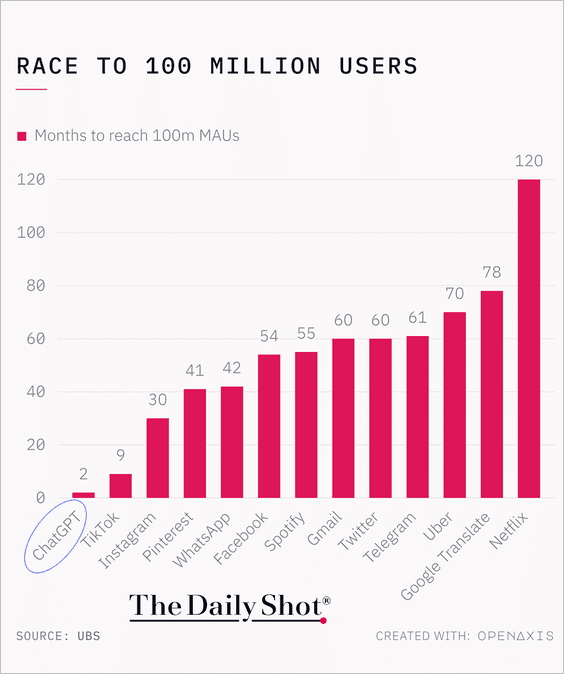

Food for Thought: Here are the months it took apps to reach 100 million users:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com