Greetings,

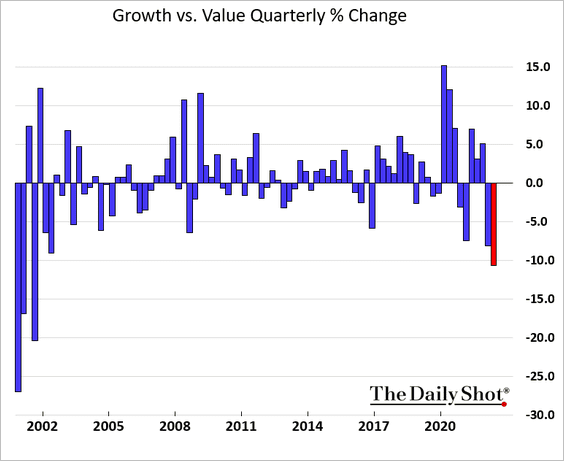

Equities: To begin, the current quarter’s underperformance of growth vs. value stocks is the worst since the dot-com bubble.

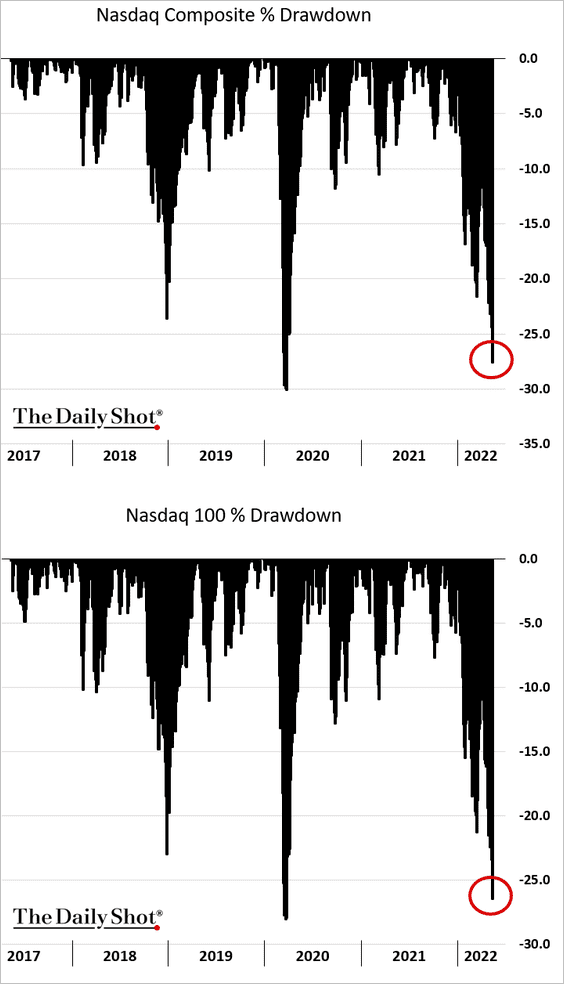

This is illustrated in the current drawdown in the Nasdaq Composite and Nasdaq 100 indices, which is approaching the 2020 level.

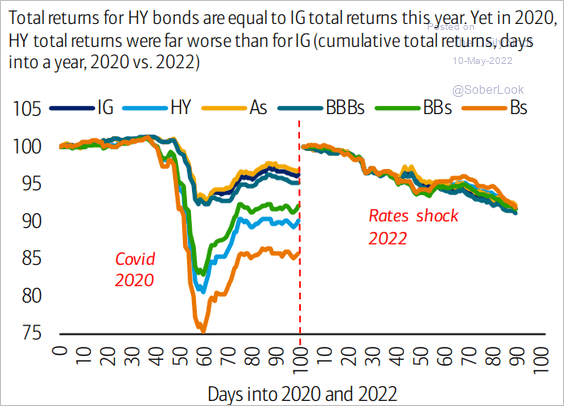

Credit: In credit markets, the current selloff doesn’t discriminate, unlike the COVID shock.

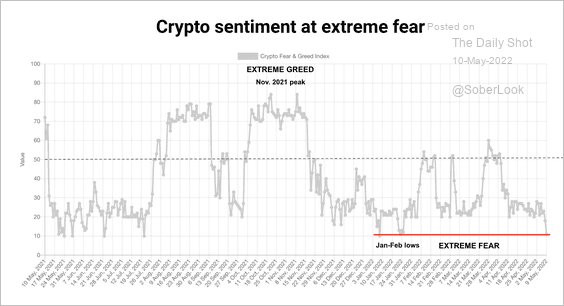

Cryptocurrency: In the crypto-sphere, Bitcoin’s Fear & Greed Index entered “extreme fear” territory.

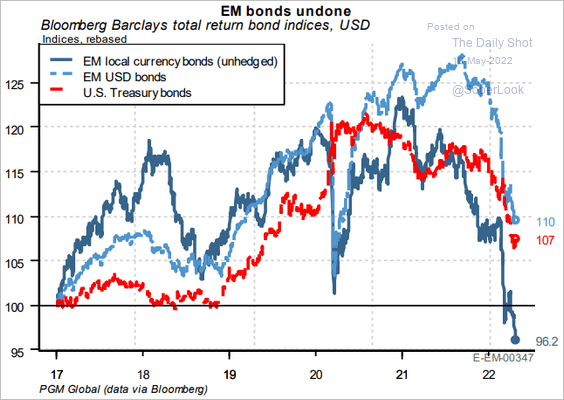

Emerging Markets: With the recent explosion in the US dollar, EM local currency bonds are exhibiting their worst returns since the Global Financial Crisis.

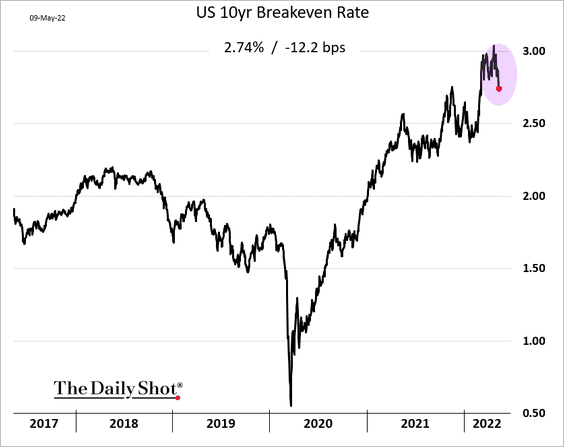

The United States: Market-based inflation expectations moved lower on Monday.

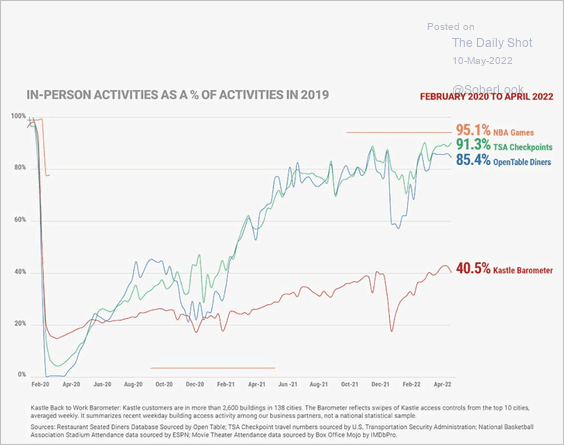

Food for Thought: Lastly, let’s take a look at how the return to normal activity compares with the return to the office:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com