Greetings,

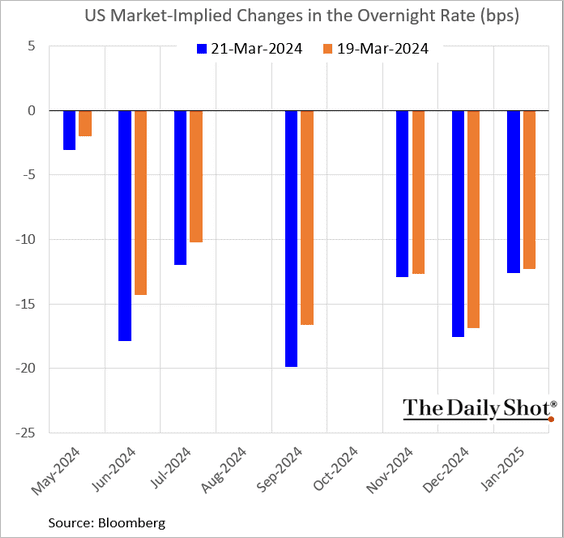

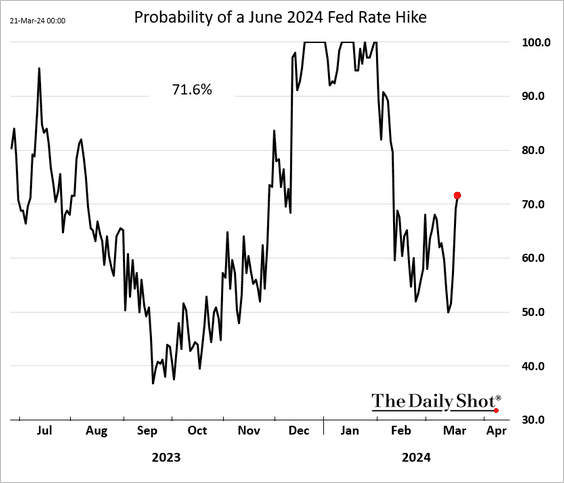

The United States: Markets are now viewing a rate cut in June as more likely.

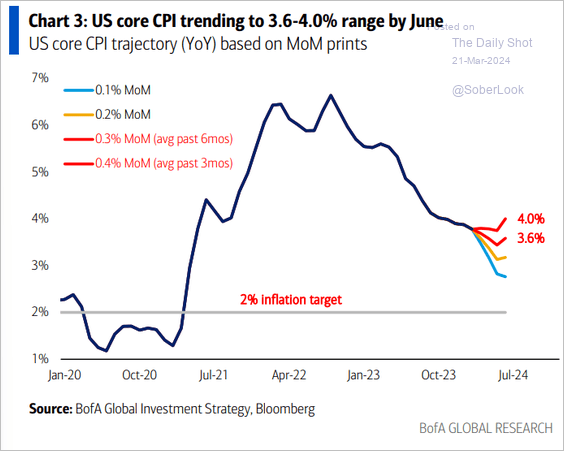

Is there a risk that core inflation could remain persistently above 2%?

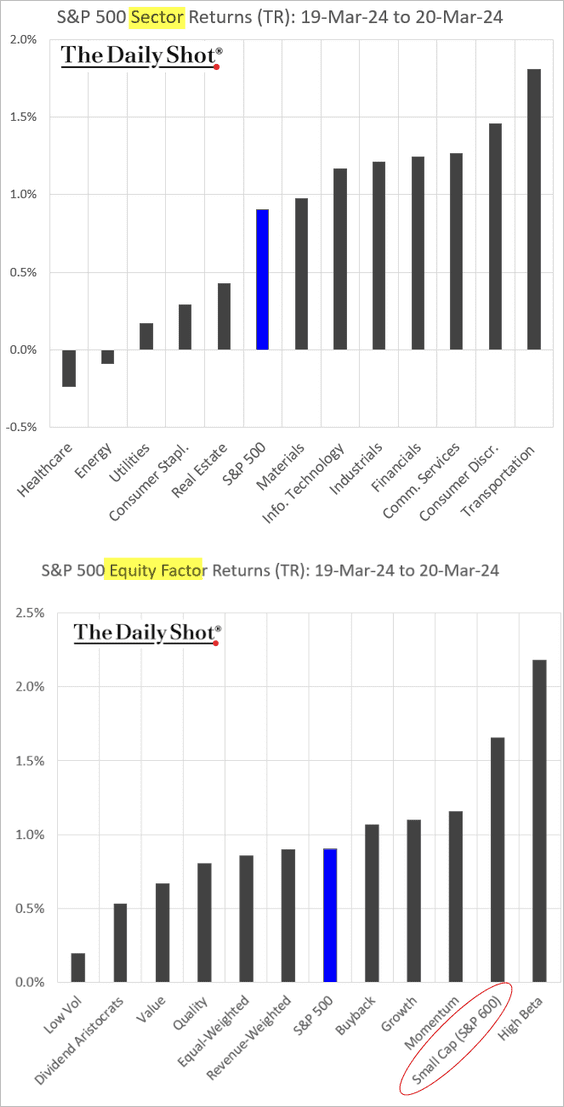

Equities: How did various sectors and equity factors react to the FOMC maintaining its forecast for three rate cuts? Highly correlated to Treasury prices, small caps had a good day.

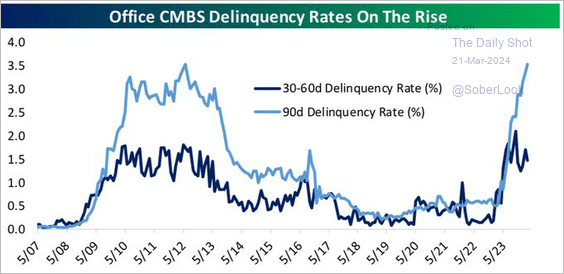

Credit: CMBS portfolios (commercial real estate debt) are experiencing higher delinquency rates.

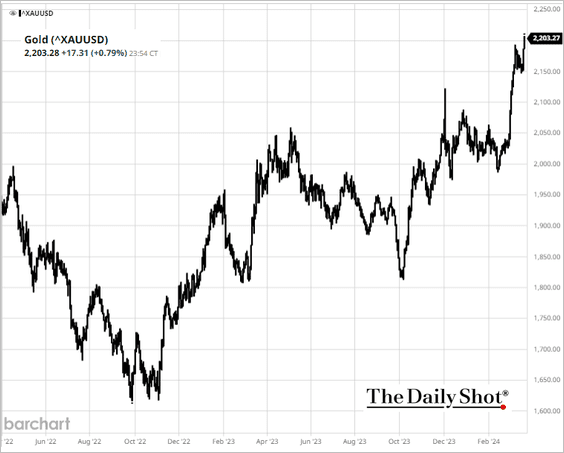

Commodities: Gold hit a record high.

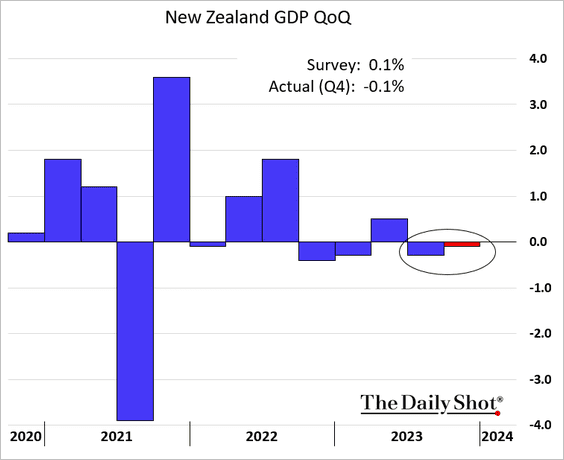

Asia – Pacific: New Zealand unexpectedly reported another technical recession.

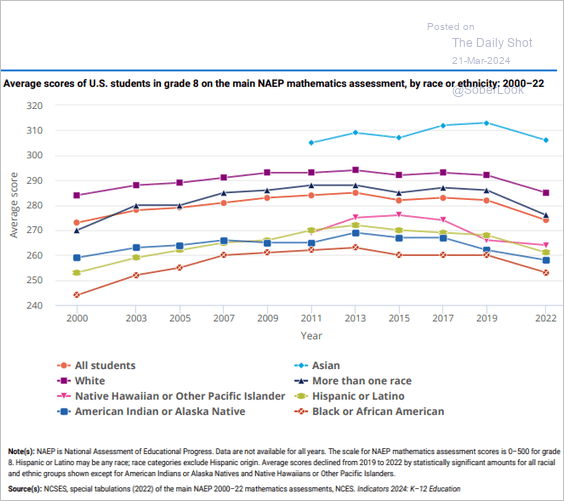

Food for Thought: Math assessment scores by race and ethnicity for US 8th-grade students:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com