Greetings,

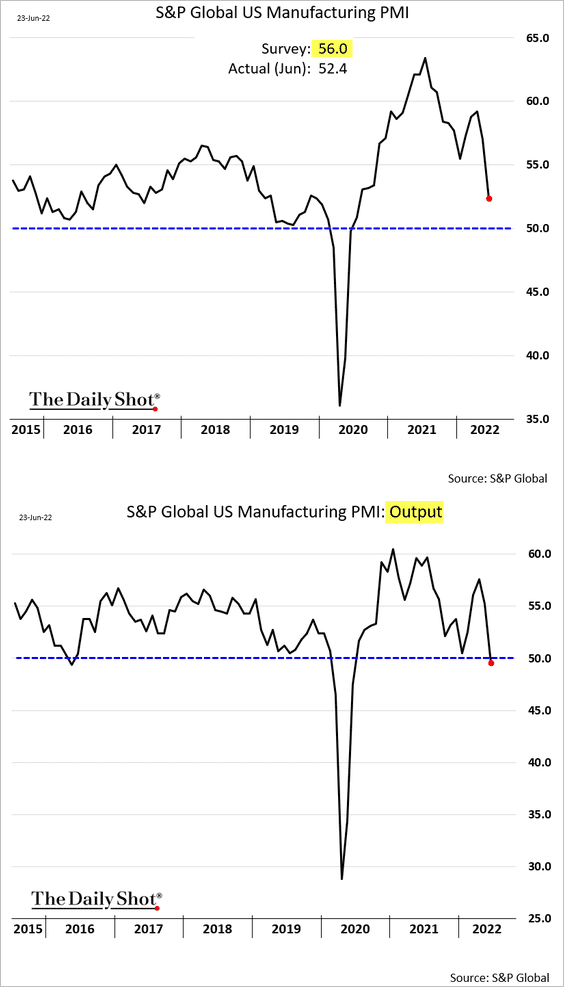

The United States: First, the S&P Global PMI report showed a marked deceleration in business activity this month, with headline figures coming in well below forecasts. Here is manufacturing output:

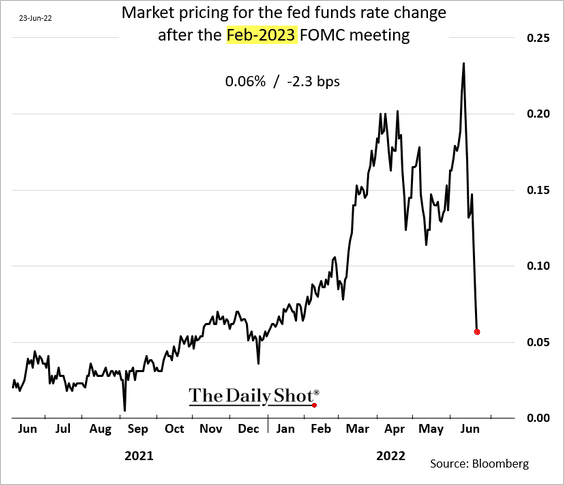

The terminal rate is now just above 3.5%, as the market expects the FED to begin cutting rates as soon as the first half of next year. The probability of a rate hike in February of next year has collapsed.

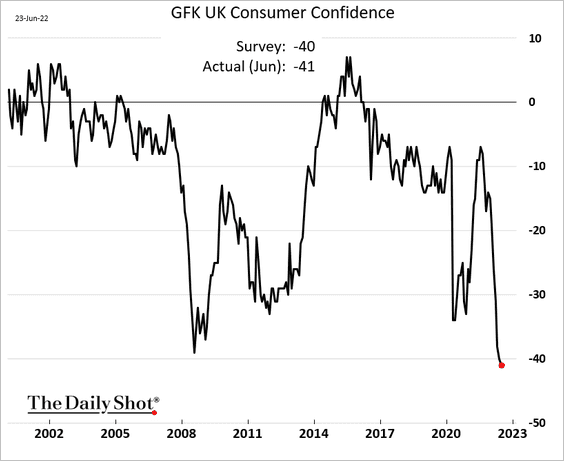

The United Kingdom: The GFK Consumer Confidence index hit a new low.

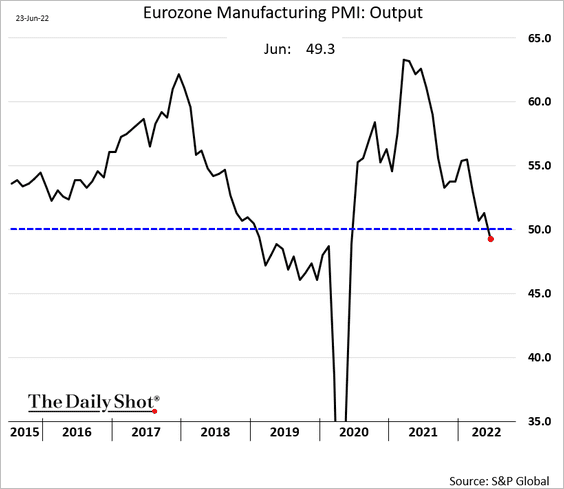

The Eurozone: Manufacturing output is contracting for the first time since the initial COVID shock in 2020.

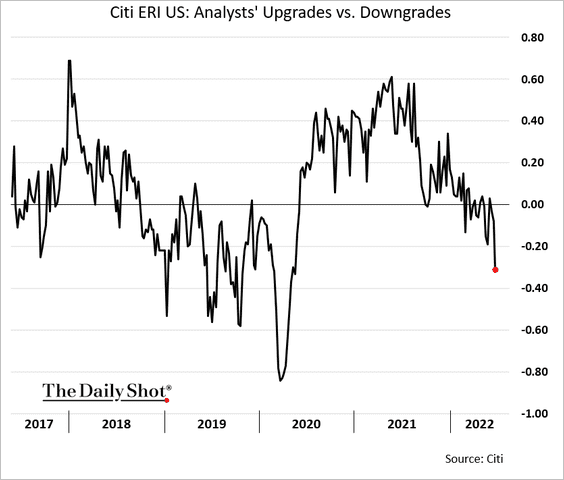

Equities: Analysts are now chipping away at earnings forecasts, with downgrades exceeding upgrades.

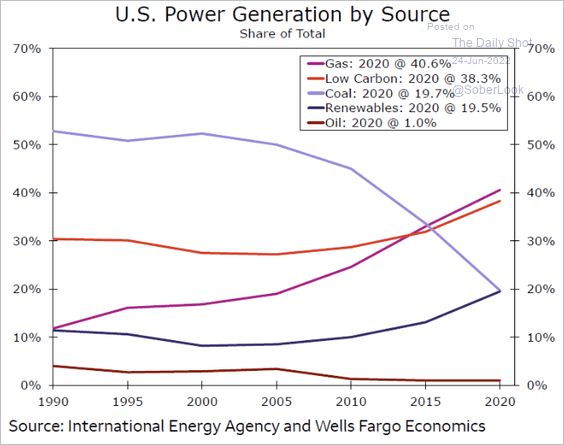

Energy: About 20% of the energy generated in the United States came from renewables in 2020, up from 10% a decade ago.

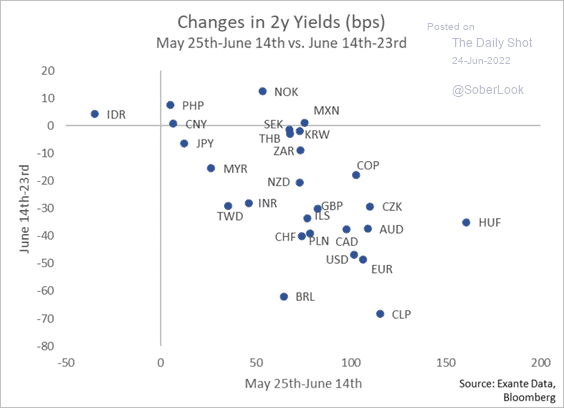

Rates: Bond yields have moved lower globally.

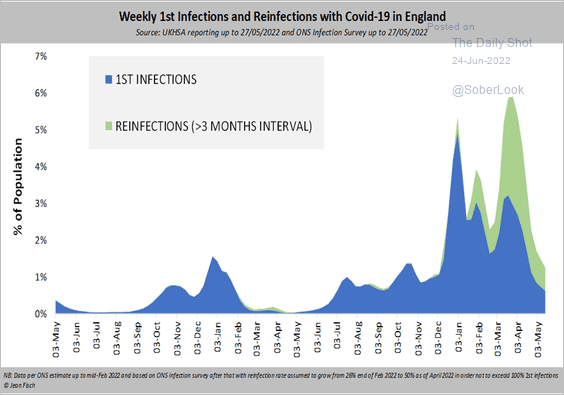

Food for Thought: Lastly, here are COVID reinfections in England:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com