Greetings,

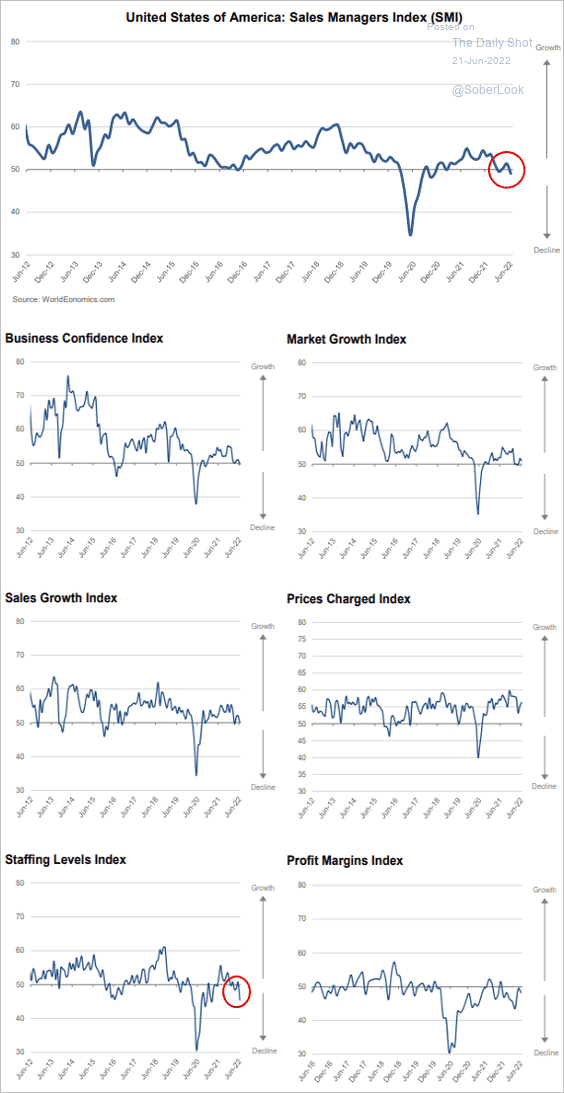

The United States: To begin, the World Economics SMI report indicates that US business activity is already in contraction mode (SMI < 50). It appears that companies are now shedding jobs (lower left panel).

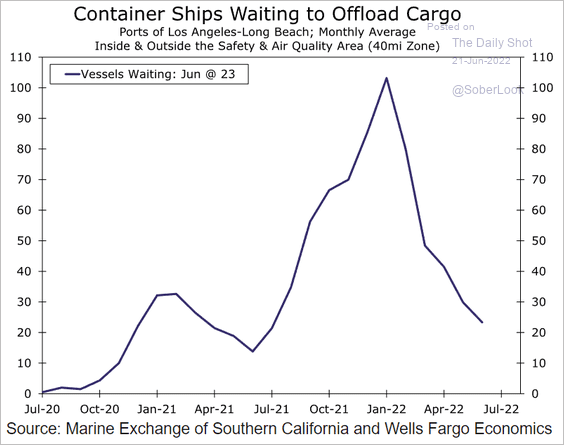

West Coast port delays continue to ease as inventories surge from slowing demand.

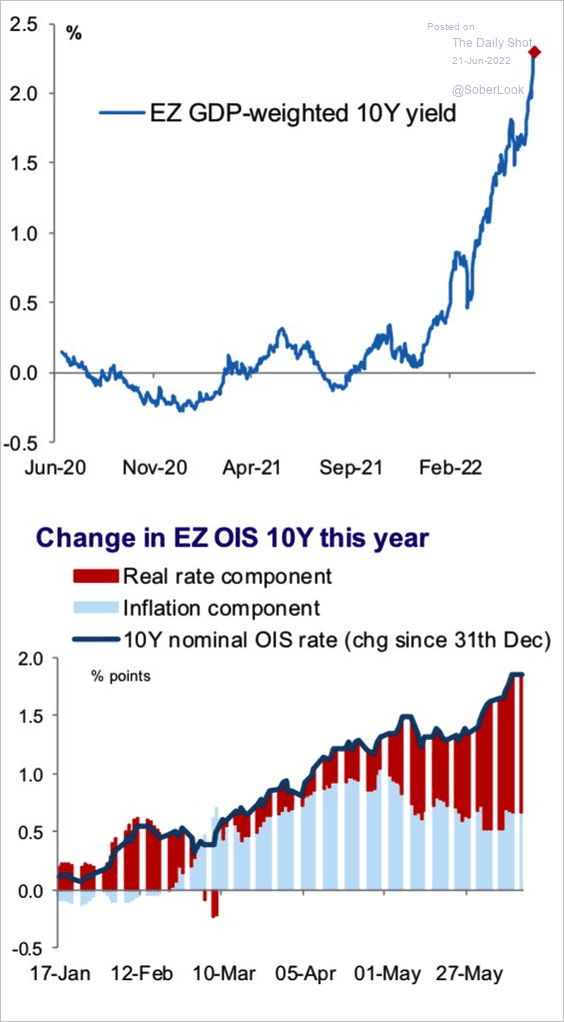

The Eurozone: The recent euro-area yield surge has been driven by real rates rather than inflation expectations.

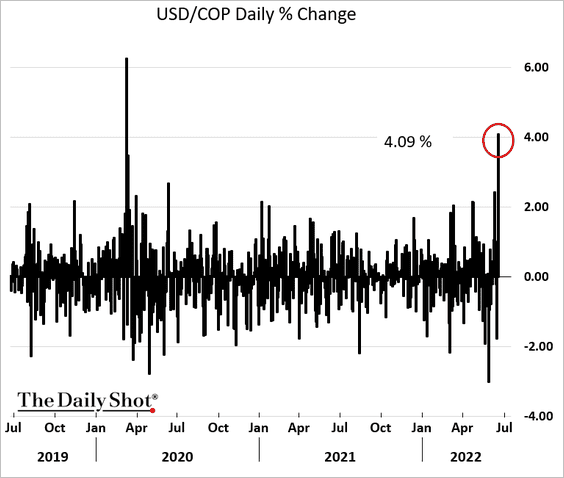

Emerging Markets: The Colombian peso tanked in response to the election outcome (chart shows the US dollar surging against the peso).

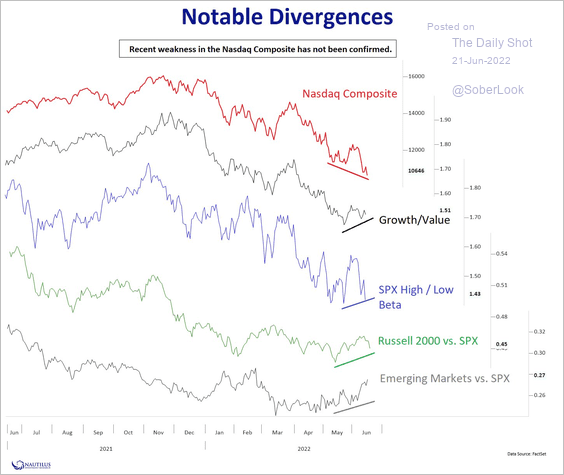

Equities: There has been a pickup in risk-on areas of the market lately.

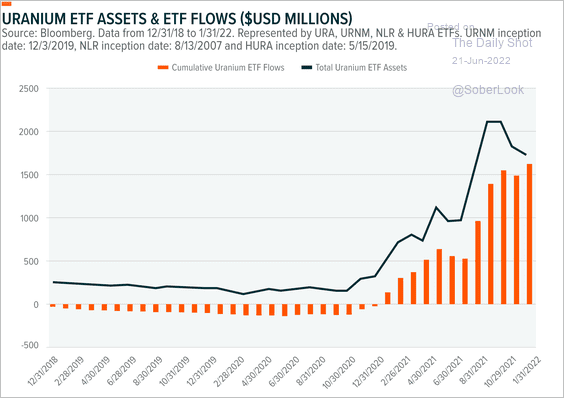

Energy: Uranium ETF assets and flows have surged over the past year.

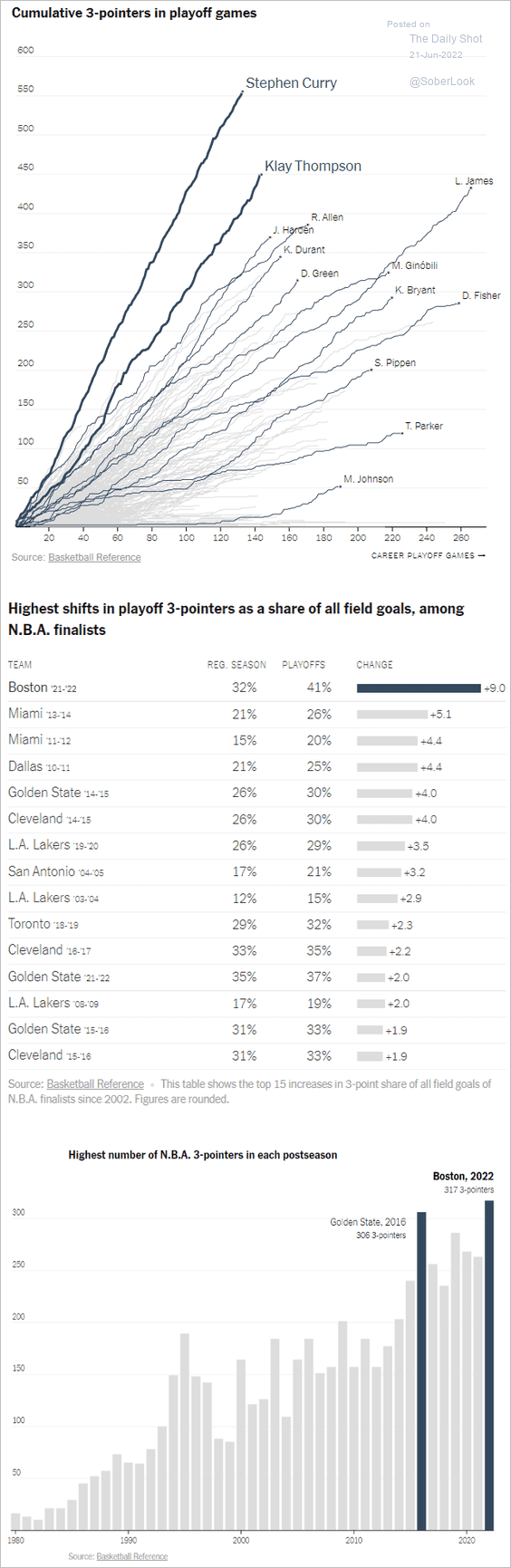

Food for Thought: NBA 3-pointers:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com