Greetings,

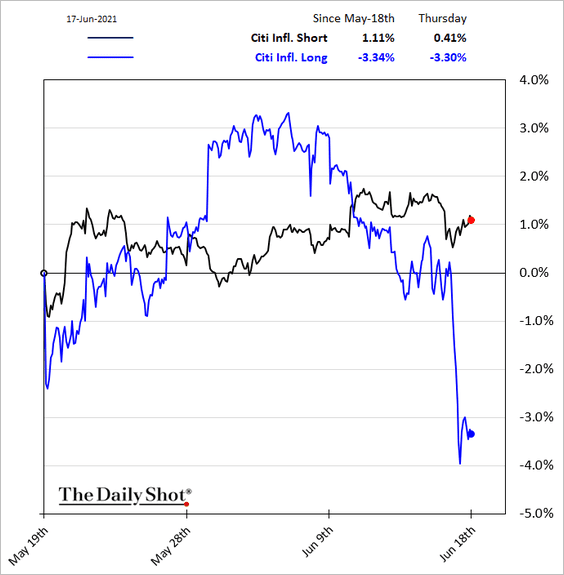

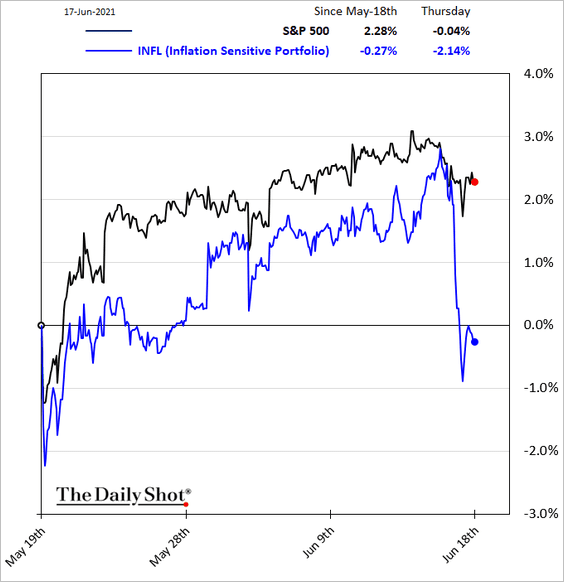

Rates: Investors’ response to the Fed’s hawkish dot-plot was to unwind some of the reflation trades, which have become crowded recently. In the equity markets, inflation-sensitive shares took a hit (2 charts).

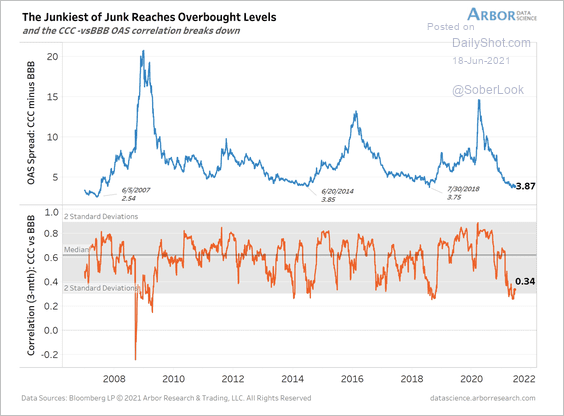

Credit: The correlation between CCC and BBB-rated US corporate bond spreads has dropped in recent months, which typically precedes periods of credit stress.

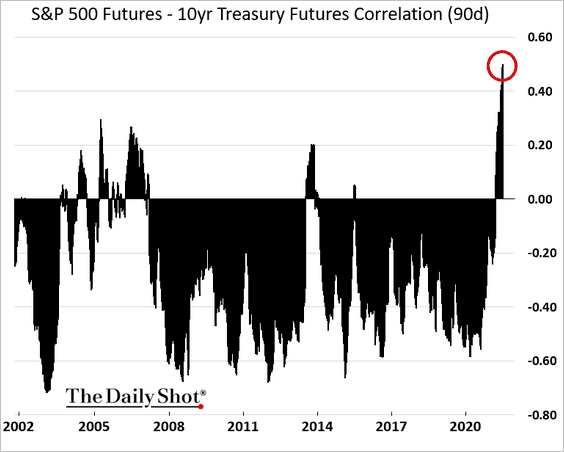

Equities: The stock-bond correlation continues to climb.

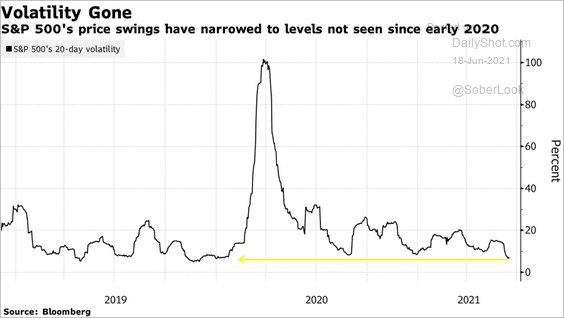

Stock volatility has been subdued.

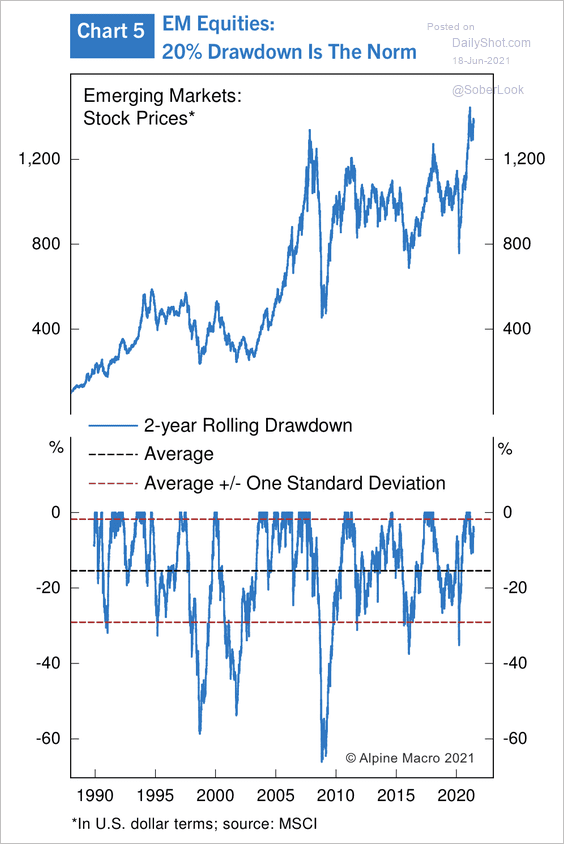

Emerging Markets: In the past 30 years, there has never been a rolling two-year period without a near 20% decline in EM stocks, according to Alpine Macro.

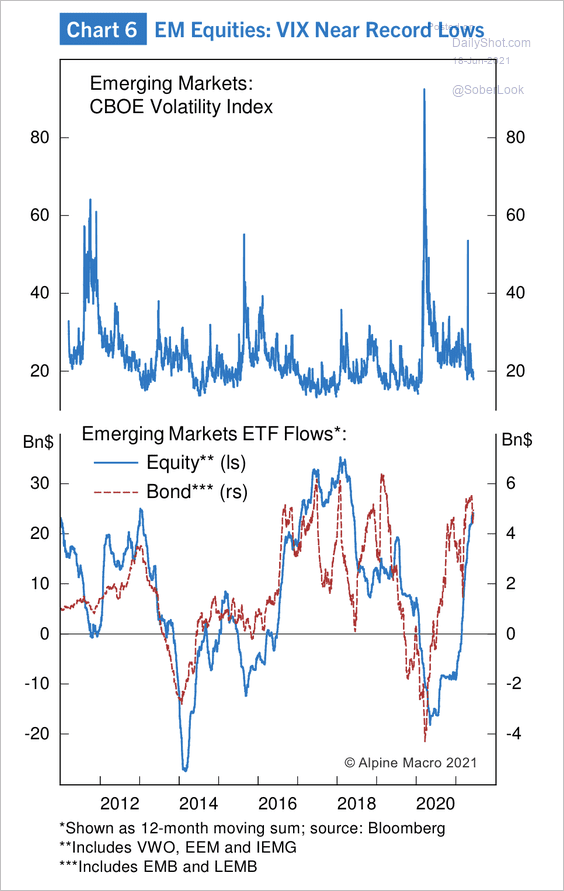

EM equity volatility is at relatively low levels as ETF flows improve.

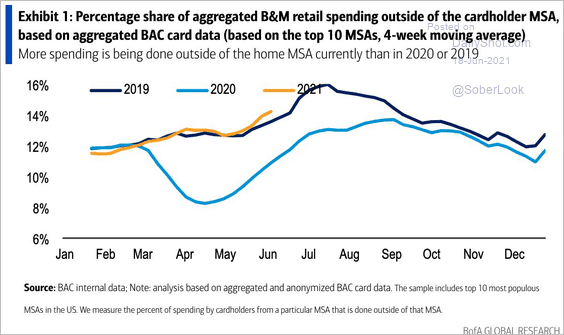

United States: Based on BofA’s card data, consumers are increasingly spending outside of home.

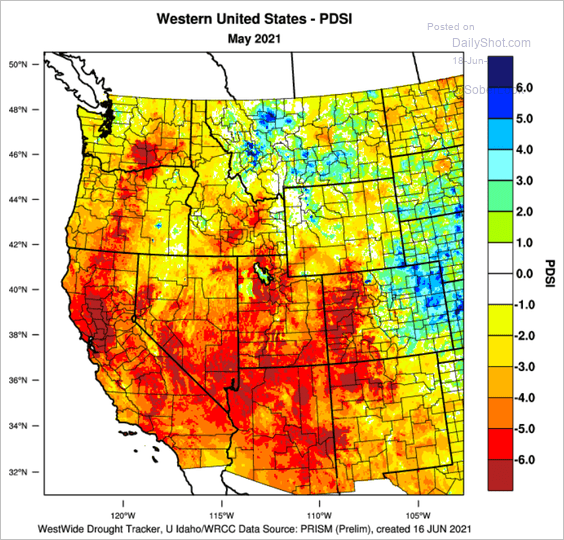

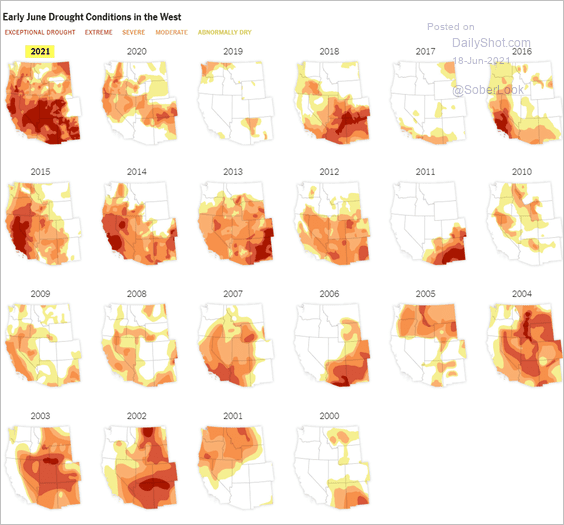

Food for Thought: Western US drought conditions:

Edited by Richard Holmes

Contact the Daily Shot Editor: Editor@DailyShotLetter.com