Greetings,

The United States: Here are the market-implied rate changes in the months ahead.

Treasury yields and the dollar declined on the back of the soft CPI report but bounced after the Fed’s dot plot showed only one rate reduction this year.

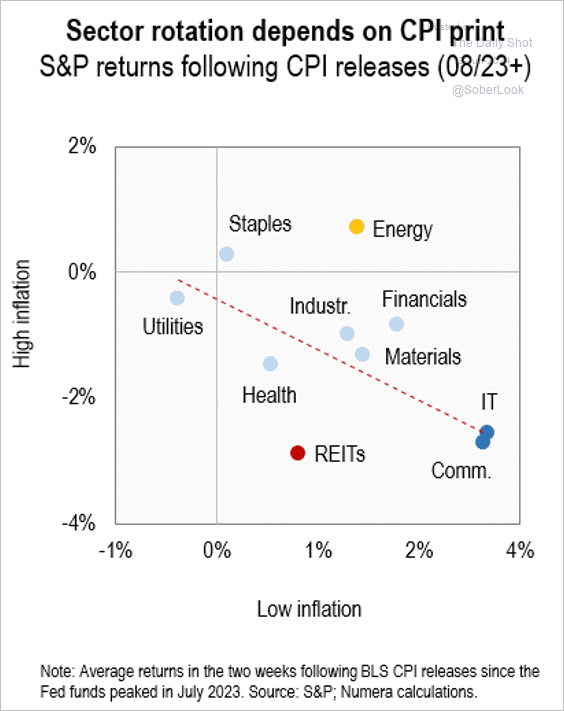

Equities: This scatterplot shows average returns by S&P 500 sectors in the two weeks following the CPI release.

The Eurozone: The euro bounced following the subdued US CPI report.

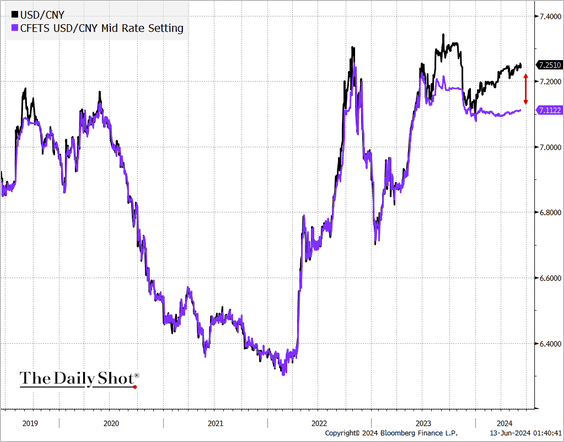

China: The renminbi continues to trade weaker than the PBoC’s midpoint setting.

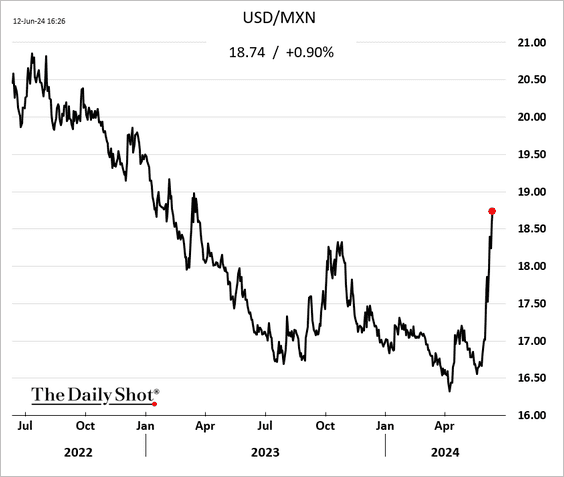

Emerging Markets: The Mexican peso has been facing downward pressure.

Credit: Banks’ exposure to property loans:

Food for Thought: Homeownership rate changes by state since 2014:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily Shot Brief