Greetings,

Before we begin, we wanted to alert you to one of our favorite weekend reads: the Weekly S&P500 ChartStorm by Callum Thomas — it features 10 handpicked charts on the US stock market covering macro, technicals, valuations, and more — it’s a quick and effective way to stay on top of the market outlook.

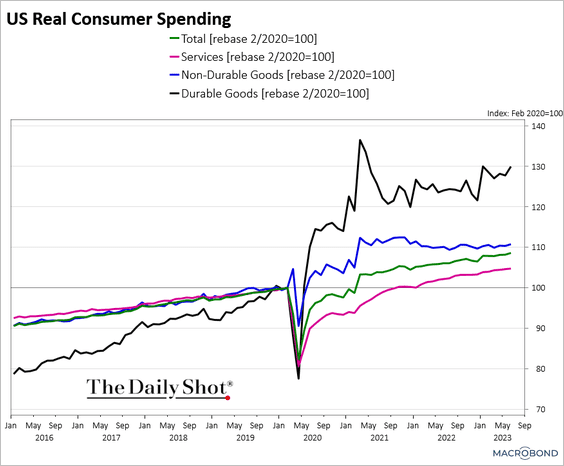

The United States: Consumer spending increased in June, with gains across goods and services.

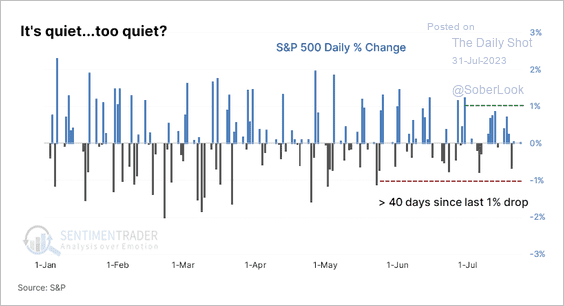

Equities: It has been a while since the S&P 500 experienced a 1%+ drop. According to SentimenTrader, this type of dynamic is almost exclusively witnessed during bull markets.

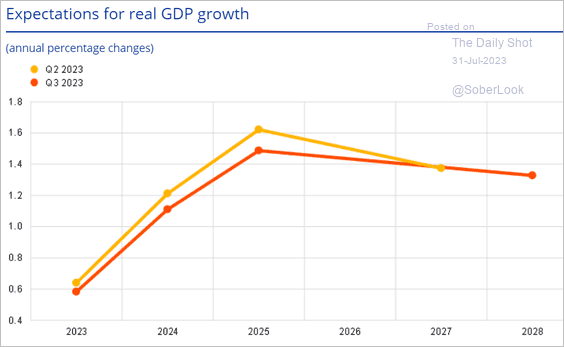

The Eurozone: Forecasters (ECB’s Survey of Professional Forecasters) downgraded their estimates for the euro-area GDP growth over the next few years.

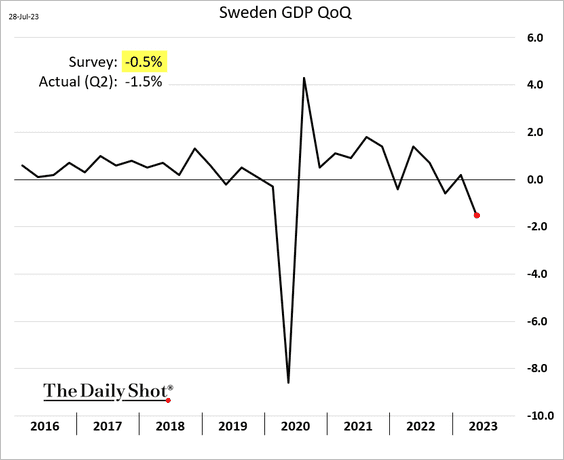

Europe: Sweden’s economy contracted sharply last quarter.

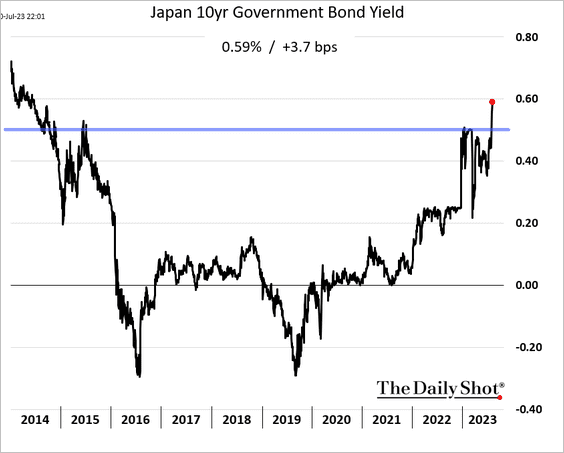

Japan: JGB yields surged to multi-year highs as the BoJ adjusts the yield control policy.

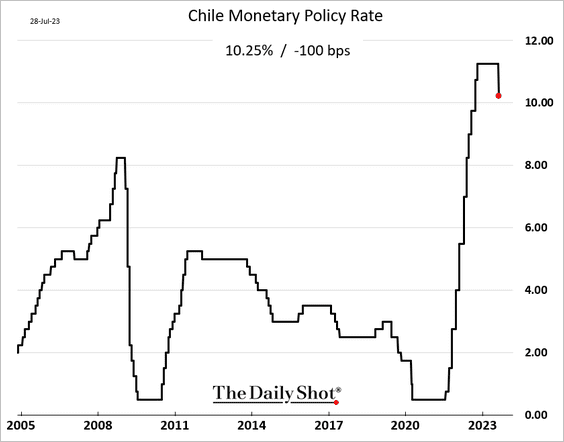

Emerging Markets: LatAm rate cuts have started, with Chile reducing rates by 100 bps (the market expected 75 bps).

Cryptocurrency: Curve Finance, a major stablecoin exchange, fell victim to an exploit.

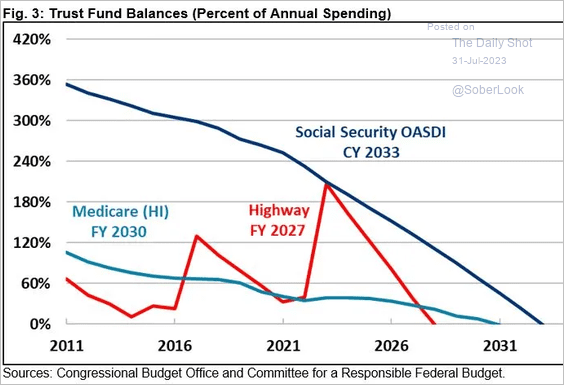

Food for Thought: US trust funds are headed toward insolvency:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily ShotAverage hourly wages for US teens: Brief