Greetings,

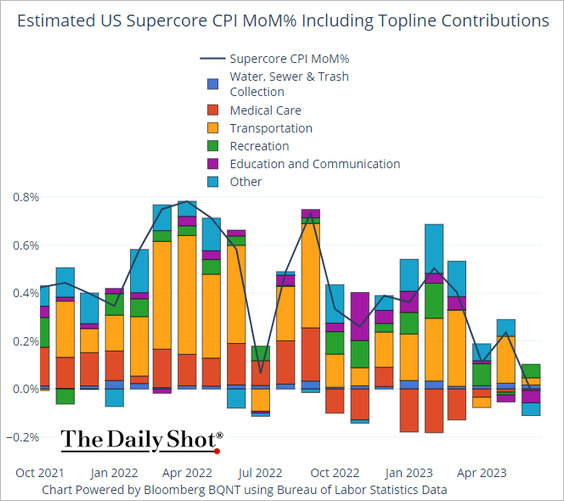

The United States: The supercore CPI (services less housing) was flat on the month, a welcome development for the Fed.

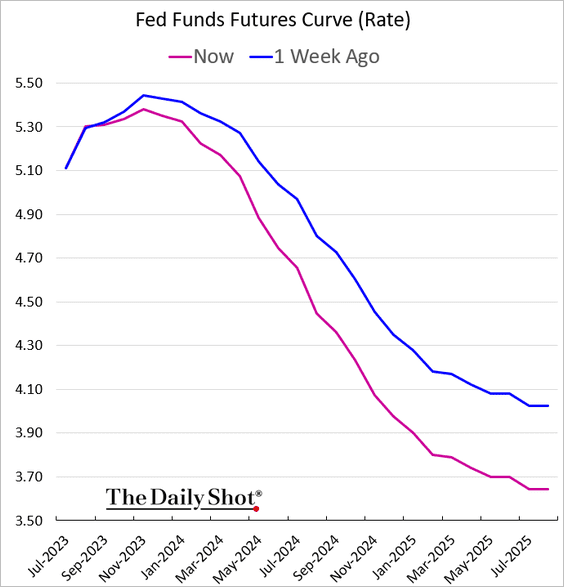

Despite the positive inflation news, the market still expects the Fed to raise rates this month. But the July hike could mark the end of the hiking cycle.

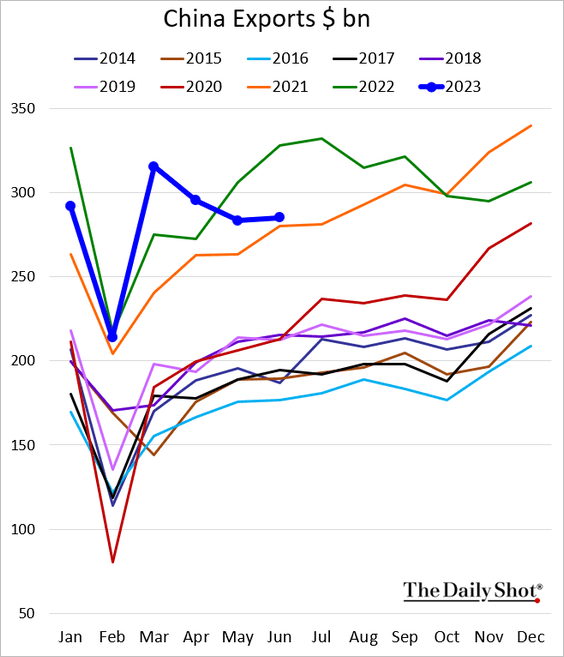

China: Exports were lower than expected last month (well below 2022 levels).

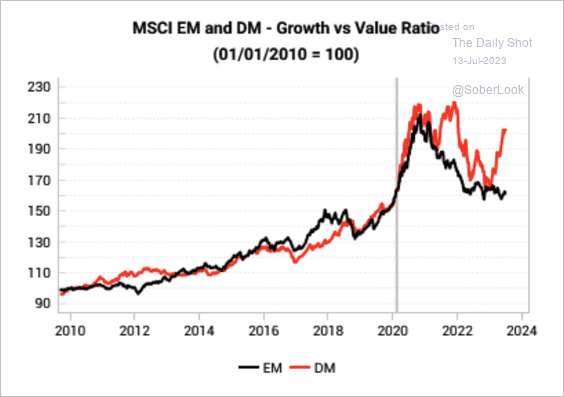

Emerging Markets: EM’s growth/value ratio has significantly underperformed DM’s this year.

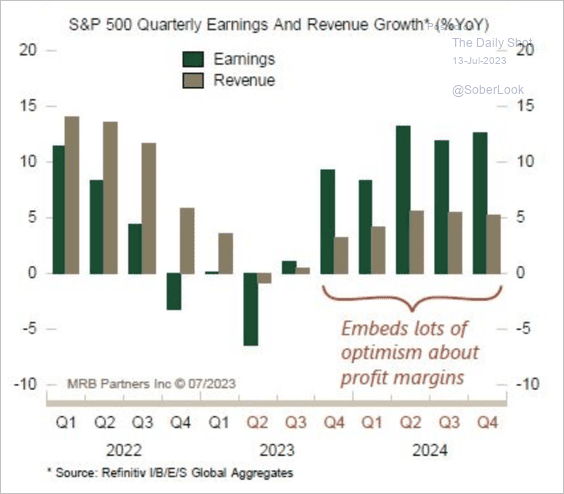

Equities: Analysts expect earnings growth to reaccelerate.

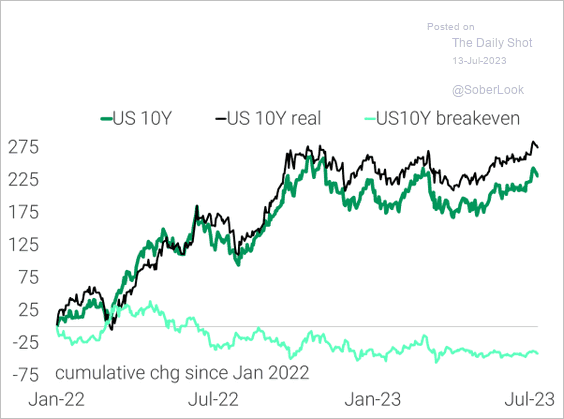

Rates: Real rate increases have outpaced nominal rates, lowering inflation expectations.

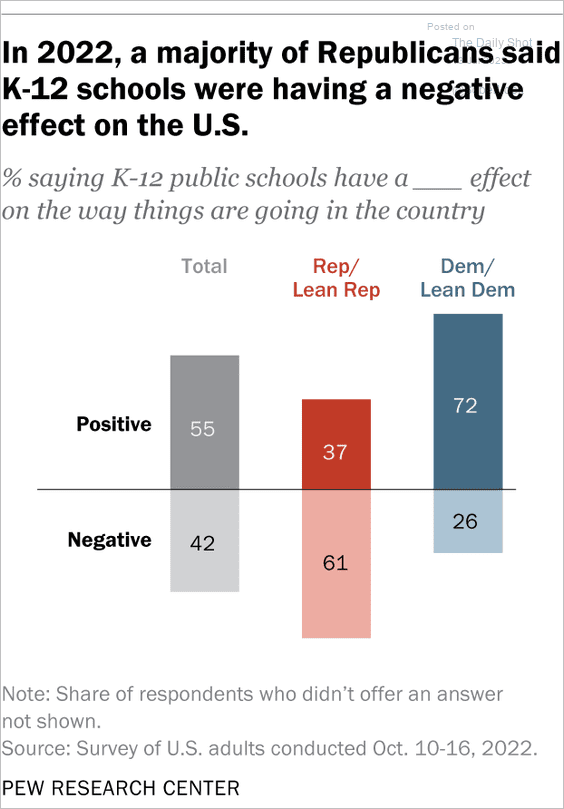

Food for Thought: Here are views on the impact of K-12 schools on the US:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily ShotAverage hourly wages for US teens: Brief