Greetings,

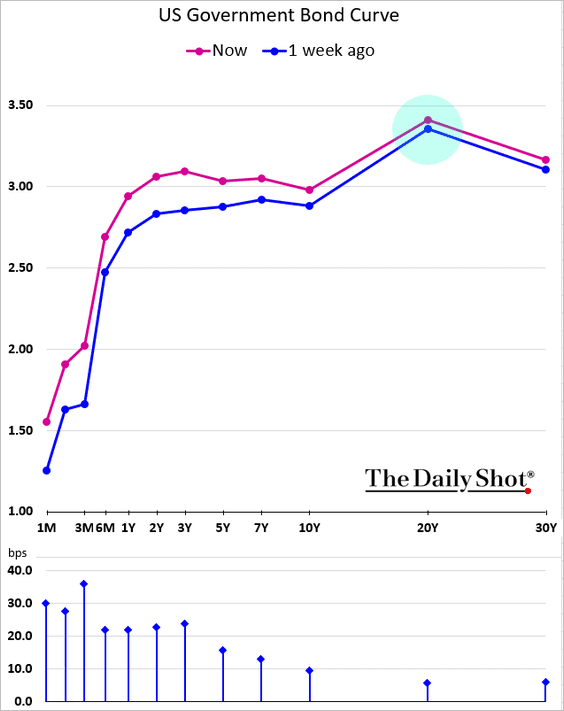

The United States: First, the yield curve inversion hit the worst level since 2006.

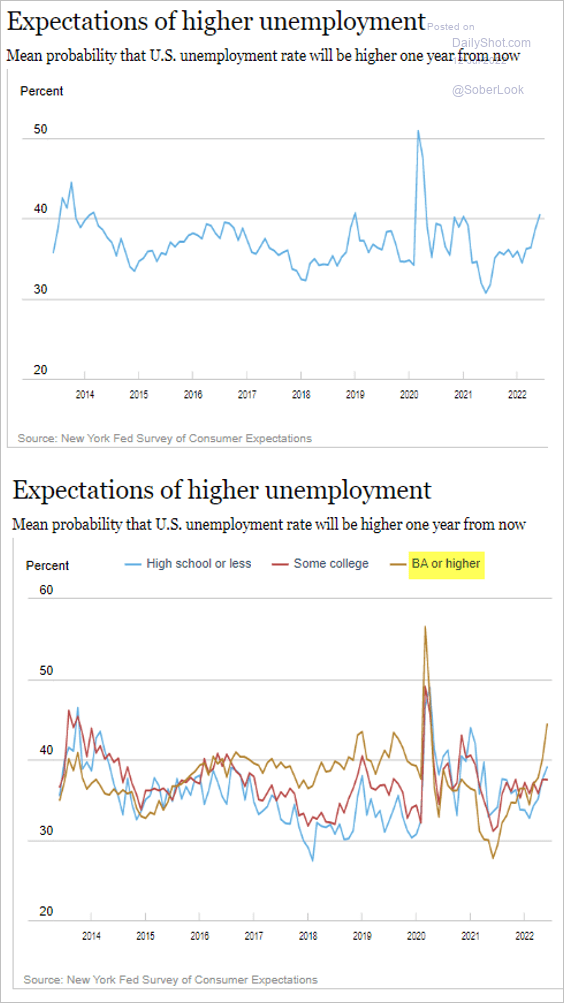

Looking at the labor market, the NY Fed’s national survey signals increasing concerns about employment, especially among Americans with a college degree.

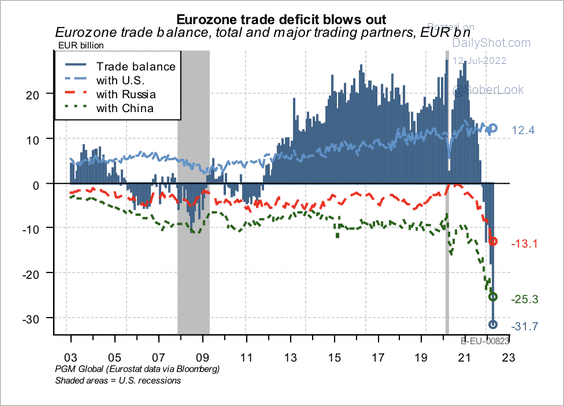

The Eurozone: Chinese demand for Eurozone goods has waned at the same time Eurozone import prices for Russian energy have surged (boosting trade deficit).

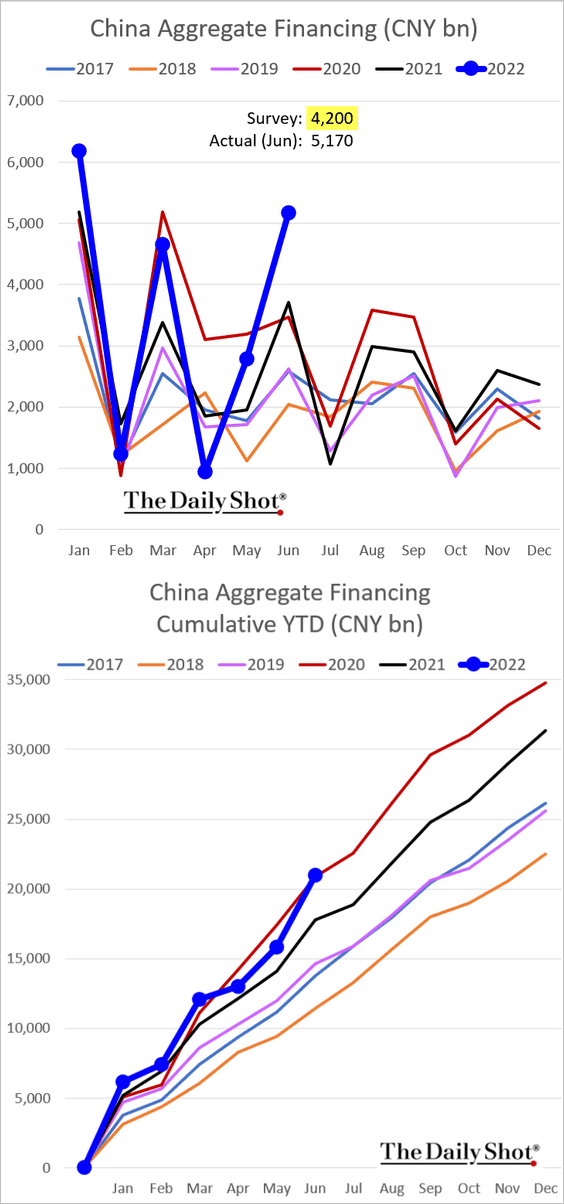

China: Aggregate financing was well above forecasts as Beijing tries to accelerate economic growth after the lockdowns.

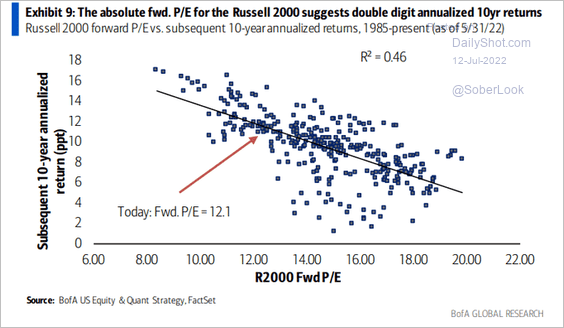

Equities: At current valuations, small-cap returns could be attractive over the next decade.

Rates: The 20yr Treasury yield is dislocated (investors looking for liquidity prefer the 10yr or the long bond).

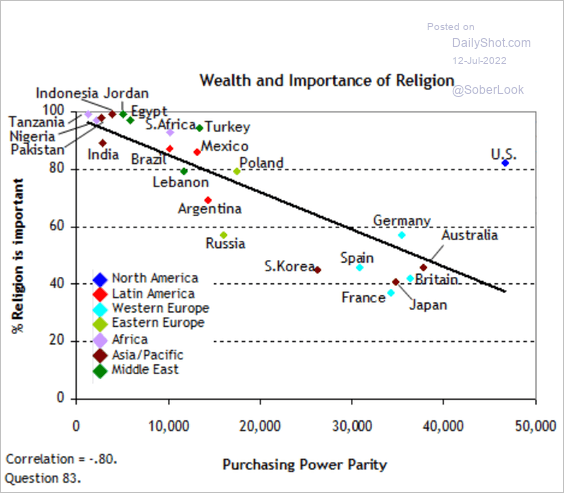

Food for Thought: Lastly, here are countries’ wealth and importance of religion:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com