Greetings,

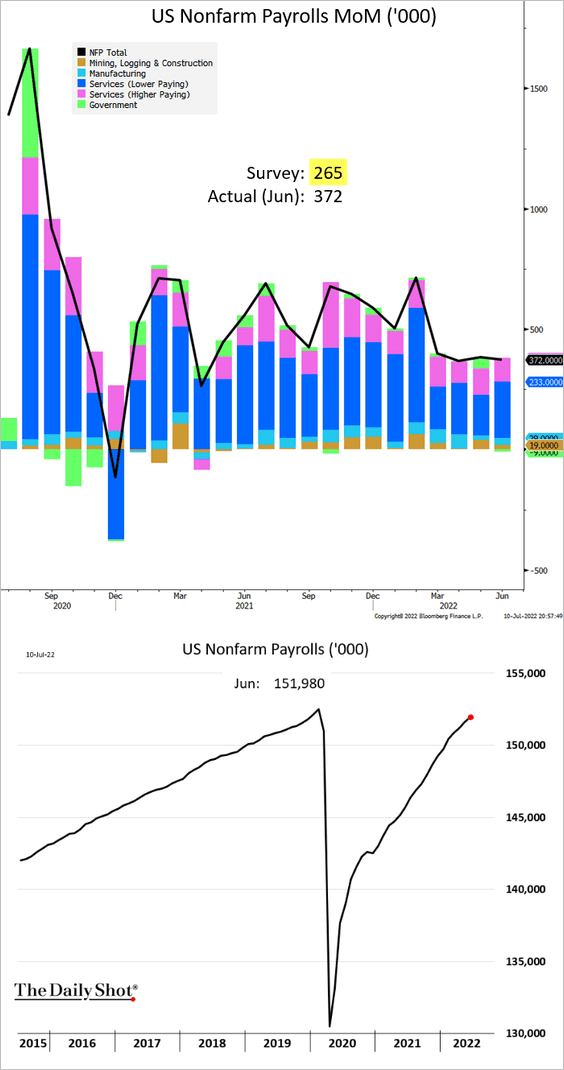

The United States: The June payrolls report surprised to the upside, nearing full recovery.

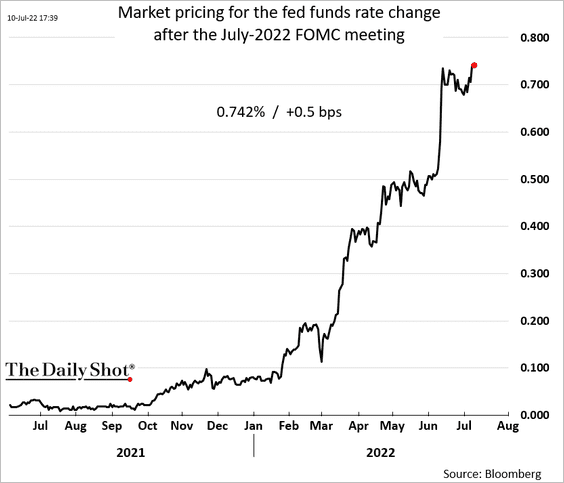

This jobs report sealed a 75 bps Fed rate hike this month.

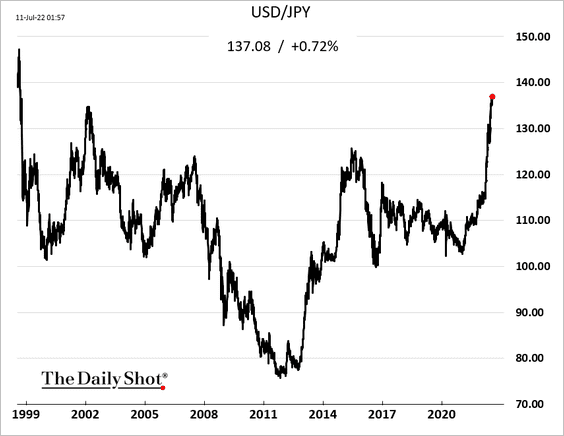

Japan: The yen hit a 24-year low vs. USD. The ruling coalition’s election gains suggest that the accommodative monetary policy is here to stay.

China: The stock market rally has stalled amid new COVID flareups and more anti-tech regulatory action.

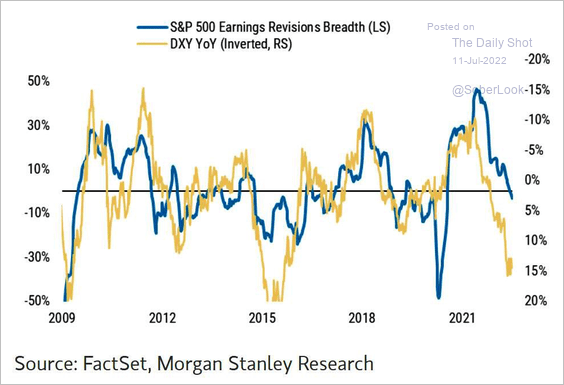

Equities: A stronger US dollar means softer corporate earnings ahead.

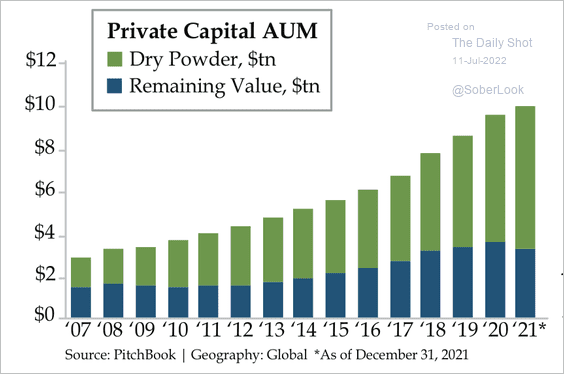

Alternatives: There is still a large amount of dry powder in private markets. “Dry powder” is cash that’s been committed by investors but has yet to be allocated to a specific investment.

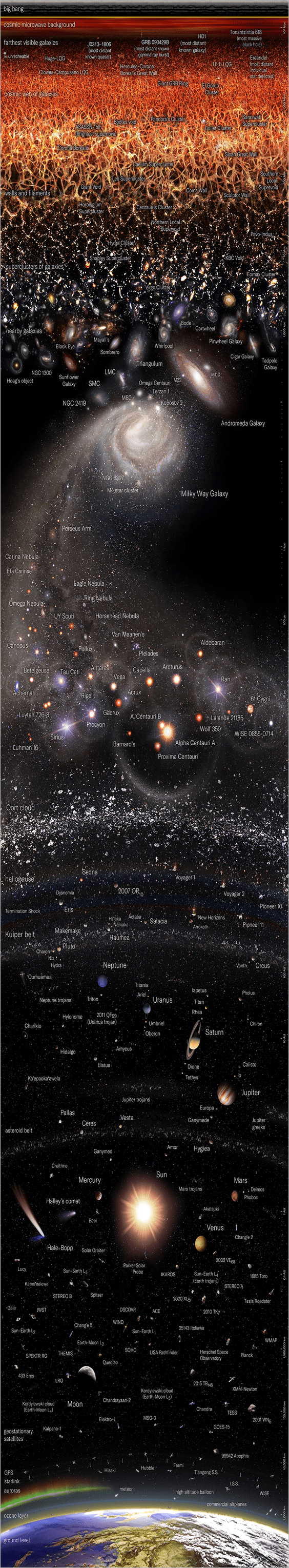

Food for Thought: Lastly, let’s take a look at a map of the observable universe.

Edited by Alexander Bowers

Contact the Daily Shot Editor: Brief@DailyShotResearch.com