Greetings,

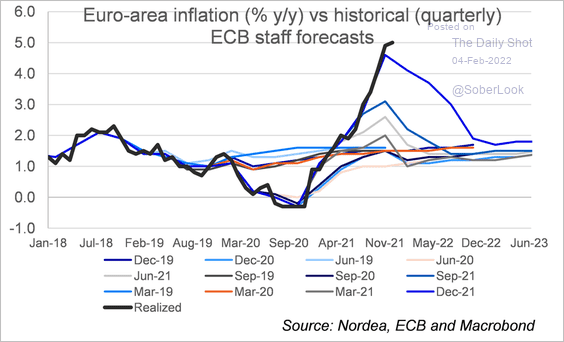

Eurozone: Faced with an unprecedented surge in prices, the ECB is changing direction. Christine Lagarde acknowledged that “inflation is likely to remain elevated for longer than previously expected …”

For months now, the central bank has been surprised by the strength of euro-area inflation reports.

“Compared with our expectations in December, risks to the inflation outlook are tilted to the upside, particularly in the near term … The situation has indeed changed.”

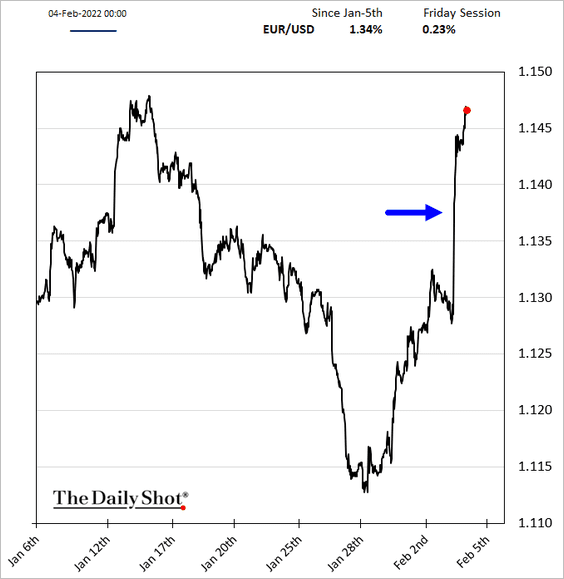

These comments open the door for rate hikes later this year. The euro rose sharply in response.

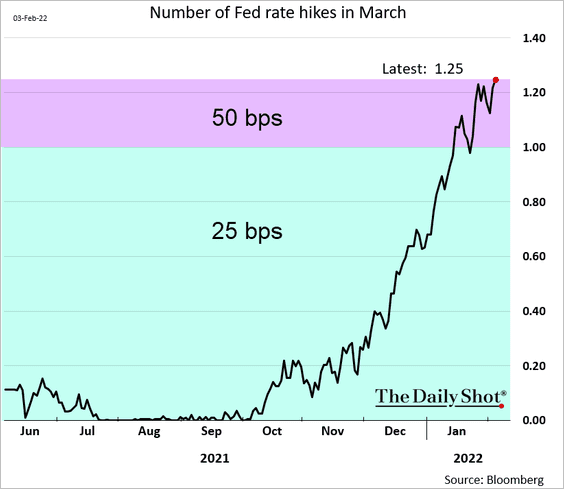

United States: With the BoE raising rates and the ECB snapping out of its dovish mode, traders are betting that the Fed will be aggressive in fighting inflation. The market is now pricing one-in-four odds of a 50 bps rate hike in March rather than 25 bps.

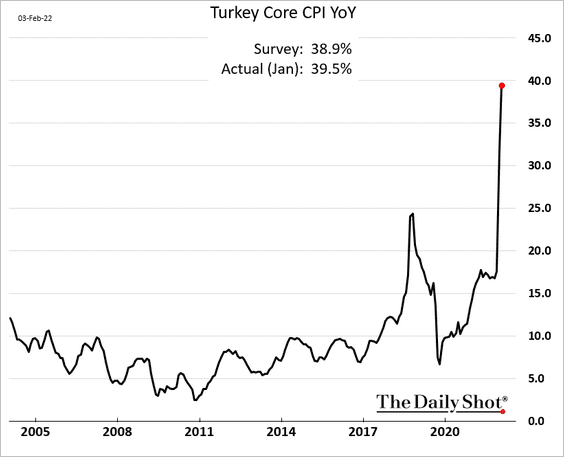

Emerging Markets: Turkey’s core CPI is nearing 40%. Let’s cut rates some more and see what happens.

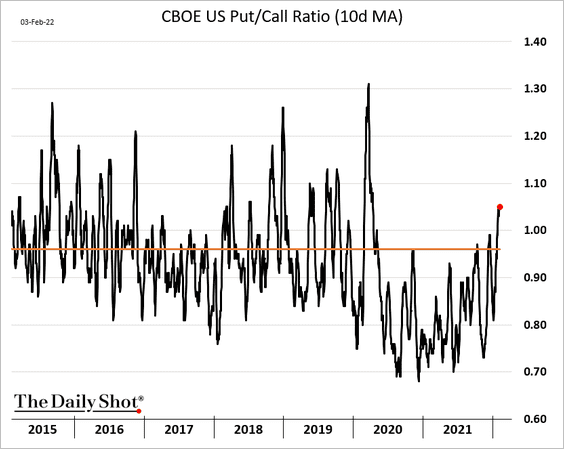

Equities: The options market continues to show caution, with the put/call ratio grinding higher.

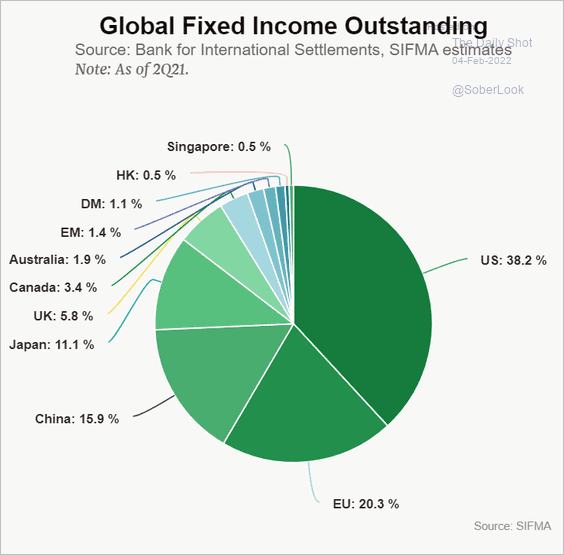

Global Developments: This chart shows the distribution of global fixed income markets.

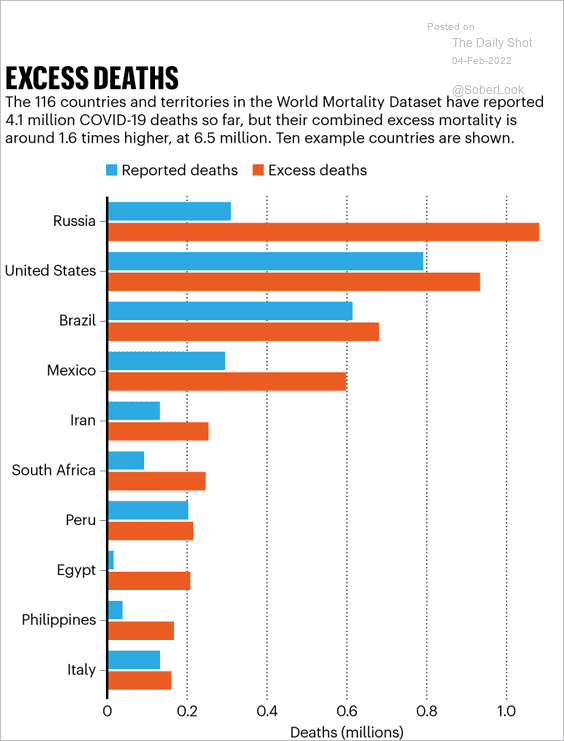

Food for Thought: Reported vs. estimated COVID deaths:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com