Greetings,

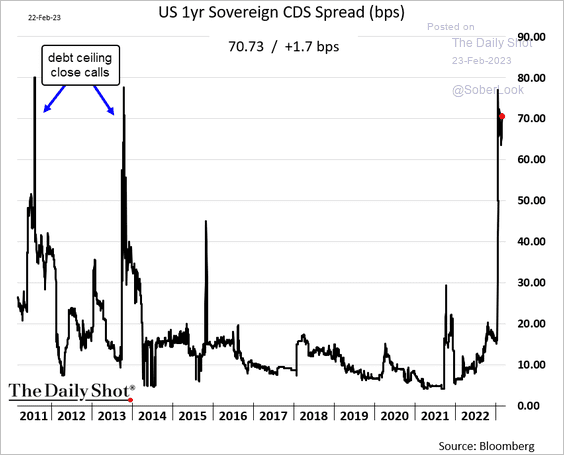

The United States: Market jitters around US debt default risks persist as the x-date approaches. The Treasury is expected to run out of emergency funds in late summer. Here is the US one-year sovereign CDS spread.

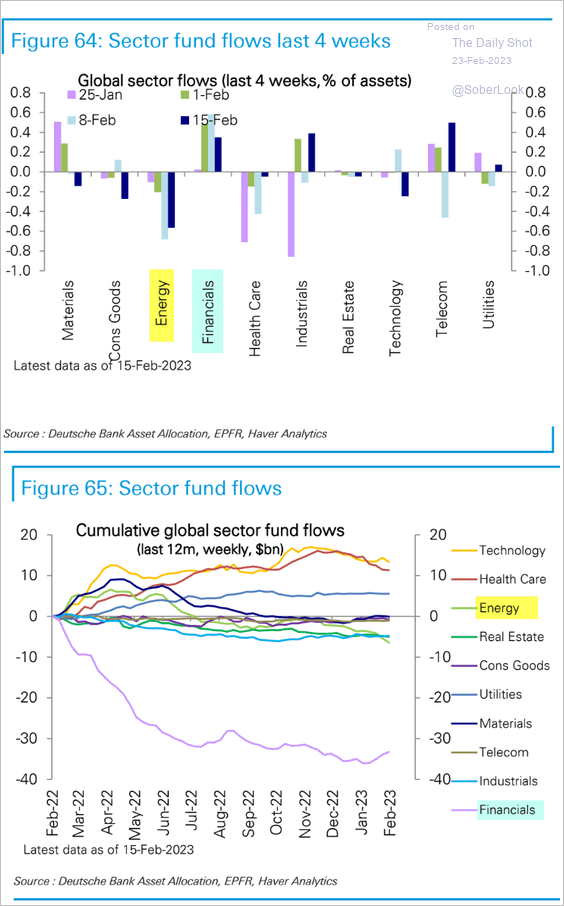

Equities: Fund flows into financials are recovering after massive withdrawals last year. Energy-sector funds are seeing outflows.

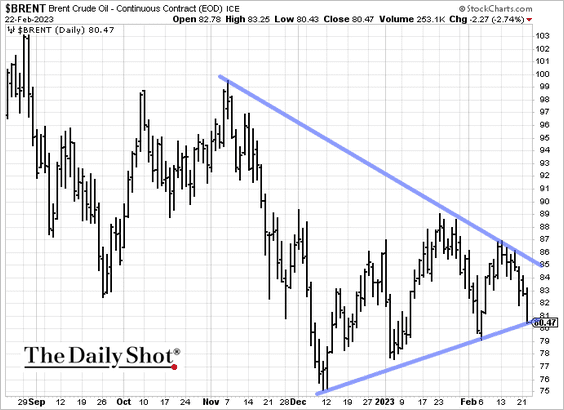

Energy: Crude oil has been under pressure this week amid demand concerns.

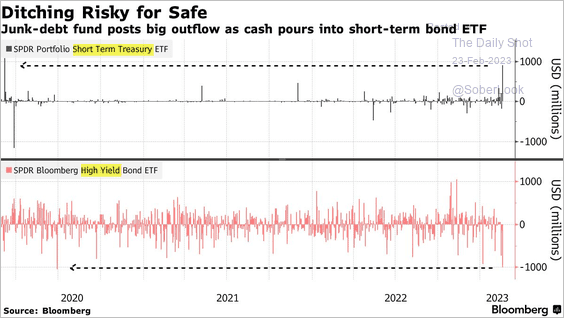

Credit: ETF investors have been dumping HY bonds and moving into cash.

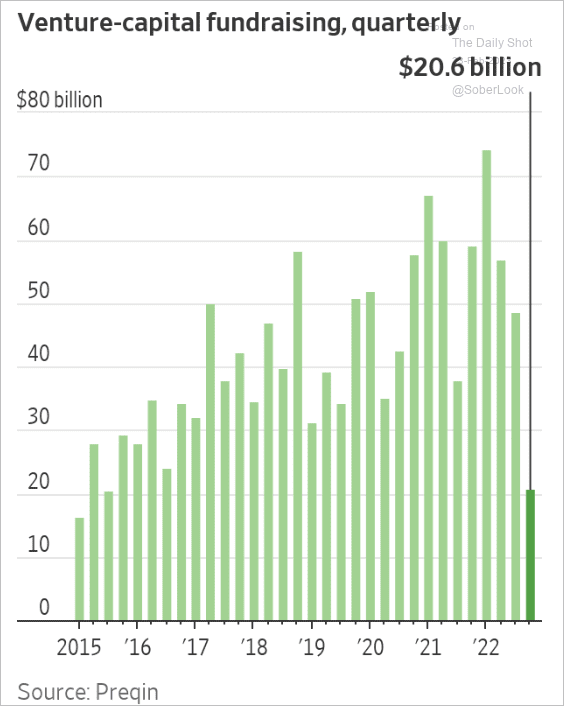

Alternatives: VC fundraising hit a nine-year low.

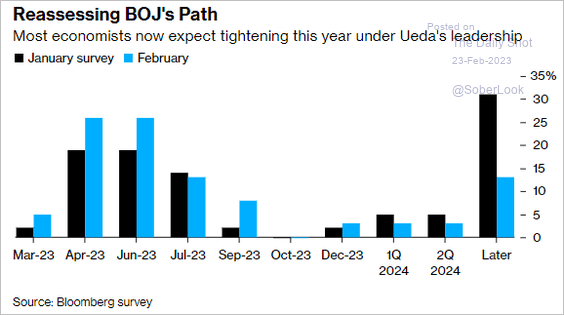

Asia – Pacific: Economists expect the BoJ to tighten policy this year under new leadership.

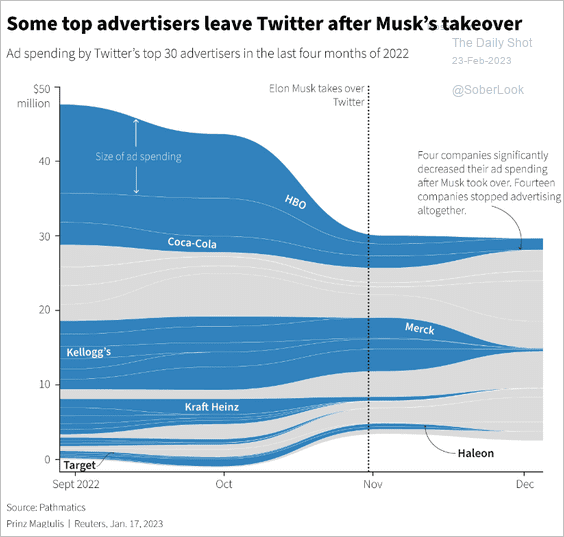

Food for Thought: To conclude, here are Twitter’s advertising revenue losses:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com