Greetings,

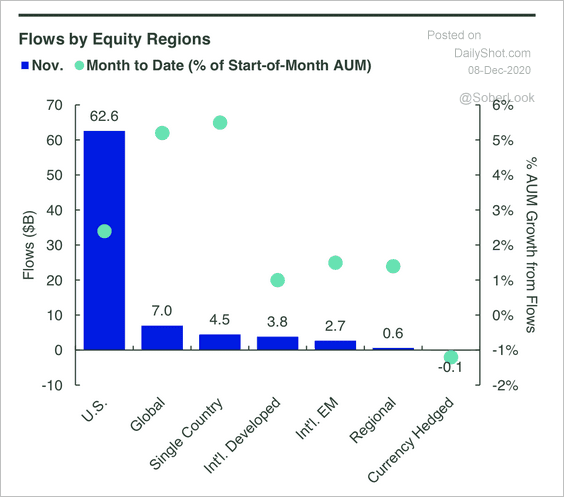

Equities: US-focused ETFs took in $62 billion of inflows in November – the highest monthly inflow in history, according to State Street.

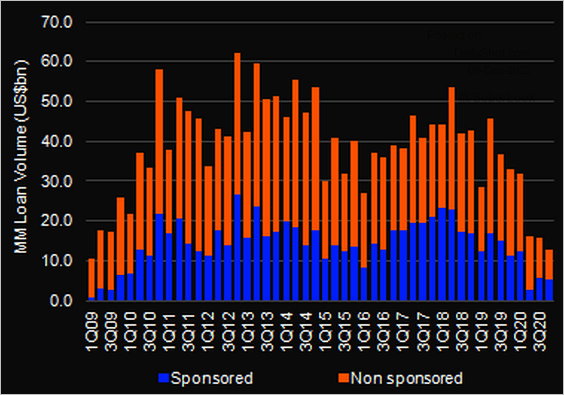

Credit: The US middle-market loan volume is at multi-year lows.

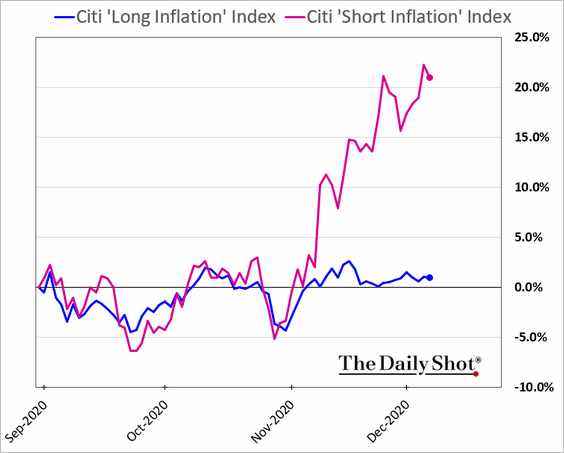

Rates: The markets are signaling higher inflation ahead.

• Stocks that benefit from higher inflation are outperforming.

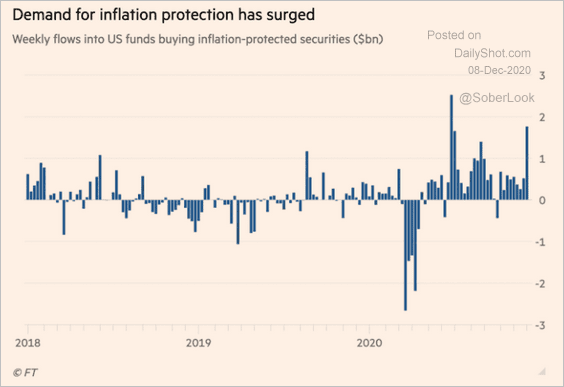

• Demand for inflation-protected securities (TIPS) remains elevated

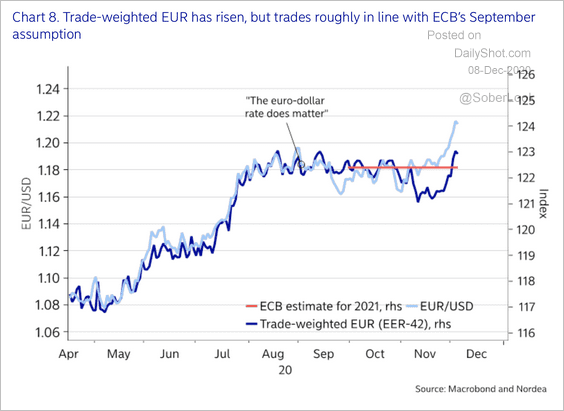

Eurozone: Will the ECB talk down the strengthening euro?

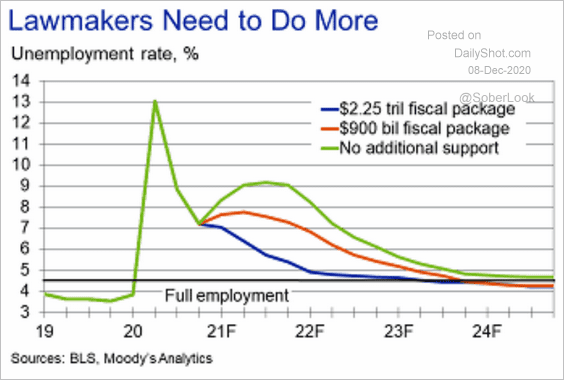

United States: Here is how different fiscal stimulus scenarios may impact the unemployment rate.

Food For Thought: Layoffs and working from home prompted many Americans to start a business.

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com

Dear Friends,

The full-length Daily Shot® is now an independent ad-free publication (see TheDailyShot.com). Here is a sample newsletter.

Daily Shot Brief subscribers are eligible to receive the full-length Daily Shot for $115/year (a $20 discount).

To subscribe with this discount, you must register here (NOTE: The regular subscription page will not acknowledge this coupon). The coupon number is DSB329075 (please click the “apply” button for the discount to take effect).

A monthly subscription is also available (here).

The Food for Thought section is available as a separate newsletter. You can sign up here.

Please note that The Daily Shot is not an investment newsletter and is not intended for broad distribution.

If you have any questions, please contact Lev.Borodovsky@TheDailyShot.com.

Sincerely,

Lev Borodovsky

Editor, The Daily Shot