Greetings,

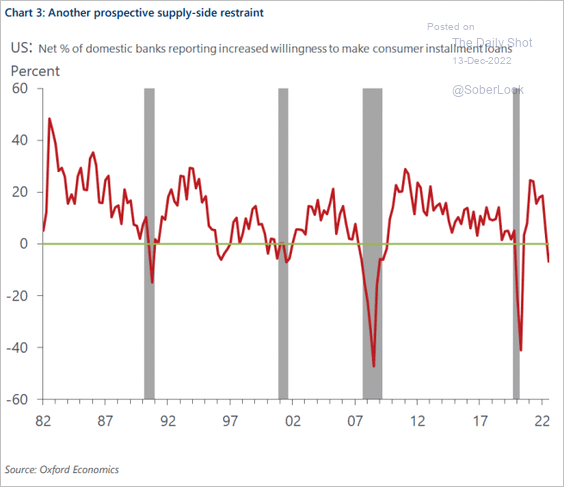

The United States: Credit growth has been robust, but banks appear to be curbing lending amid recession concerns.

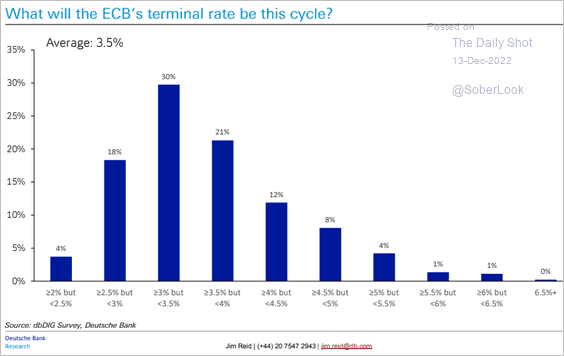

The Eurozone: Here are anticipated ECB terminal rates from a recent survey by Deutsche Bank.

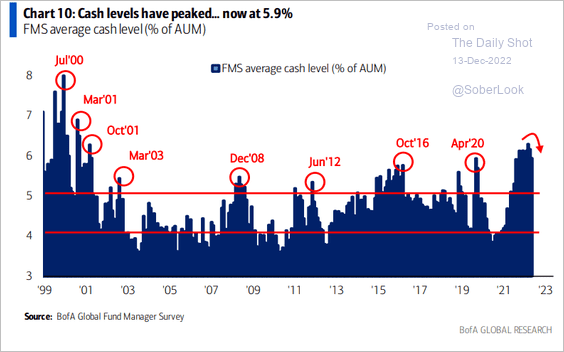

Equities: BofA’s fund manager survey shows cash levels peaking.

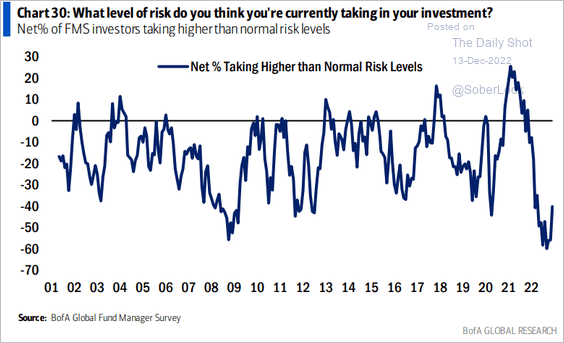

Risk appetite is starting to recover.

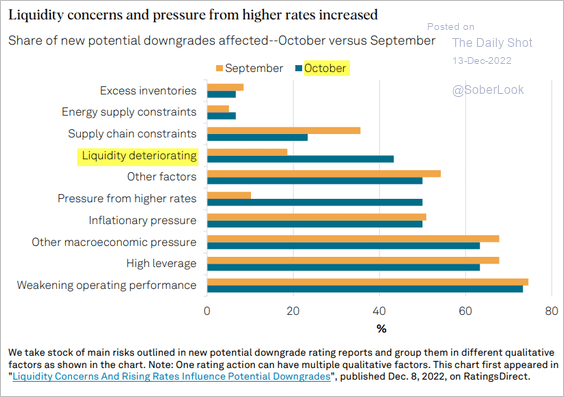

Credit: Here are the drivers of recent rating downgrades.

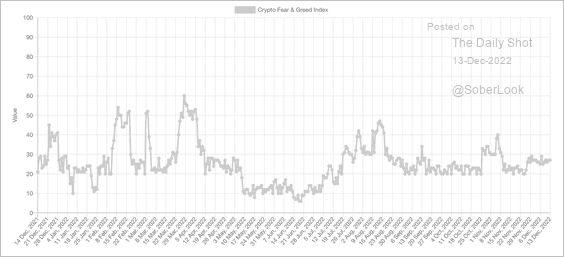

Cryptocurrency: The crypto Fear & Greed Index has shifted between “extreme fear” and “fear” over the past few months.

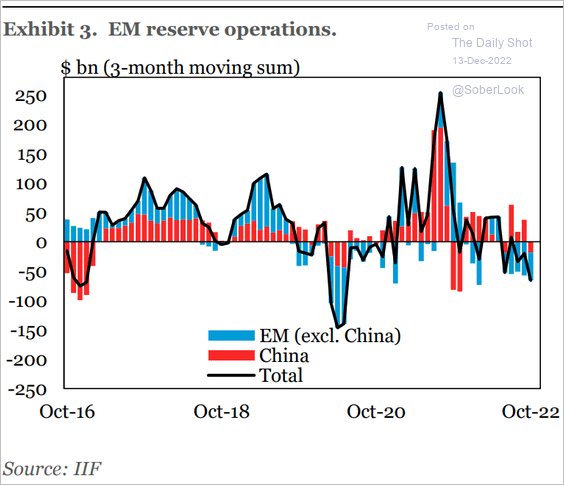

Emerging Markets: EM reserves declined in recent months.

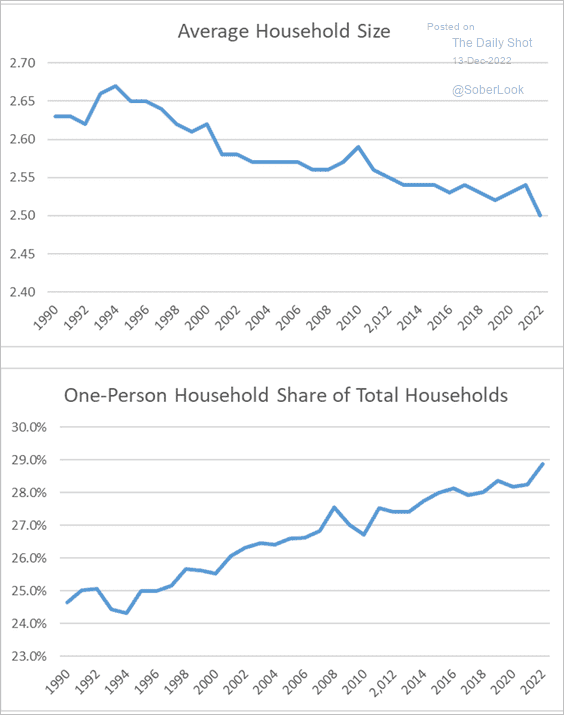

Food for Thought: Lastly, here is the change in US household size over time:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com