Greetings,

Administrative Update

1. Please note that The Daily Shot will not be published on Friday, September 3rd and Monday, September 6th.

2. If you post our charts on social media, we ask that you please credit “The Daily Shot” (@SoberLook or @TheDailyShot on Twitter).

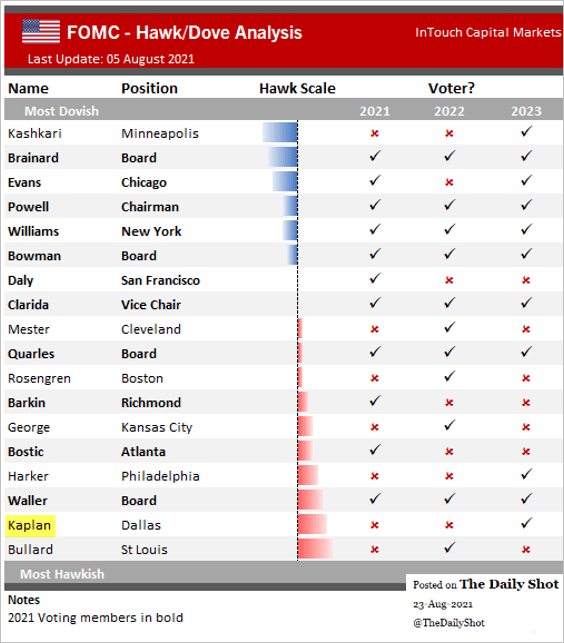

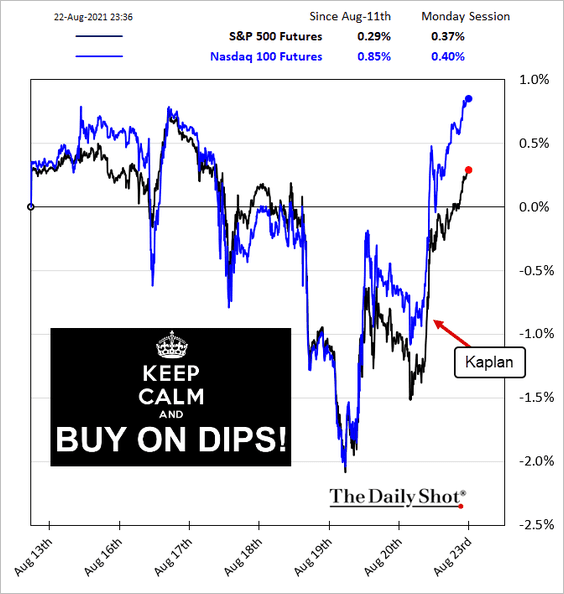

United States: Robert Kaplan, one of the more hawkish Fed officials, suggested that he may rethink the timing of taper as the pandemic situation worsens (data below).

That message was a signal for the stock market to rip higher. The “buy-the-dip” crowd is proven right once again.

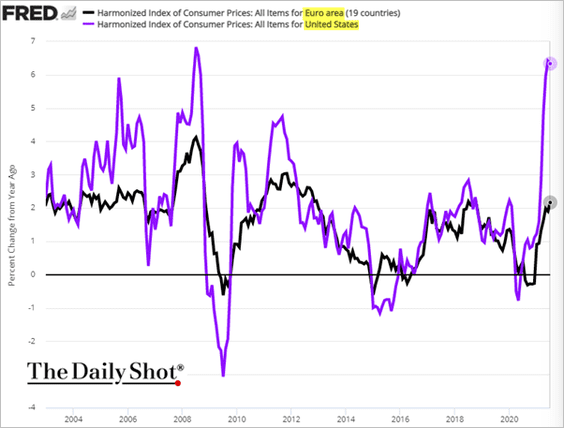

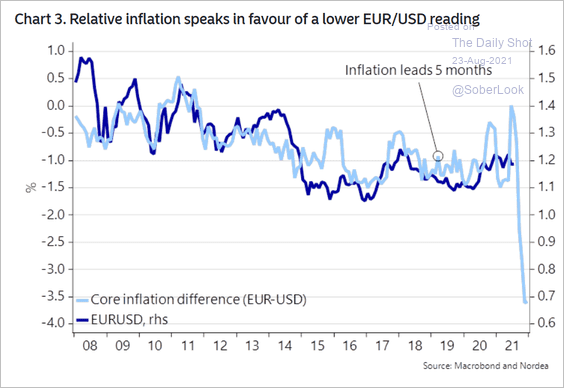

Eurozone: Inflation differentials between the Eurozone and the US …

… point to a weaker euro (stronger dollar) ahead.

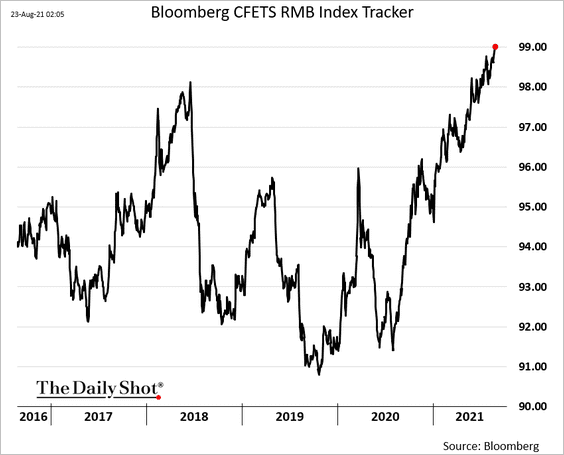

China: The renminbi continues to strengthen against other currencies.

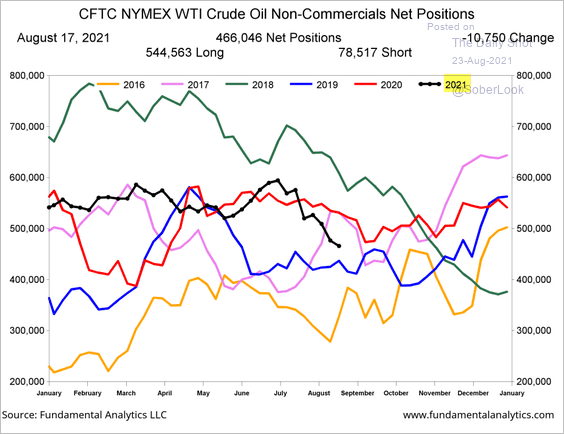

Energy: Speculative accounts have been cutting their bets on WTI crude.

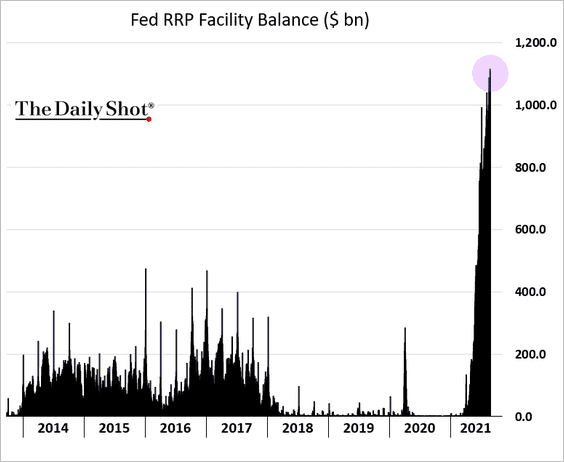

Rates: The Fed’s RRP balances continue to climb (banks and money market funds depositing cash at the Fed).

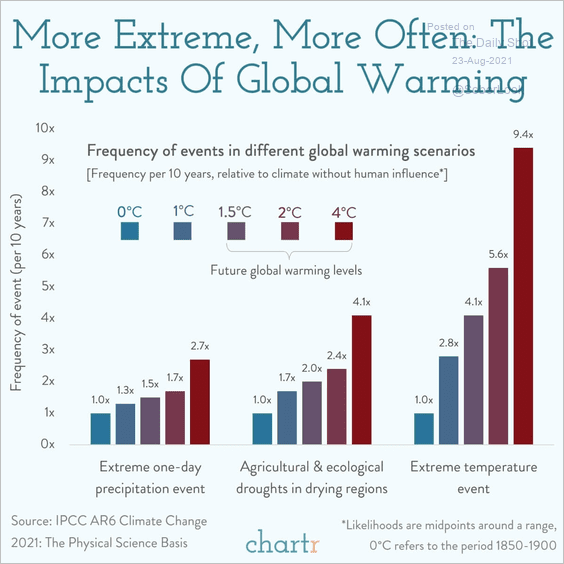

Food for Thought: The global impact of climate change:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com