Greetings,

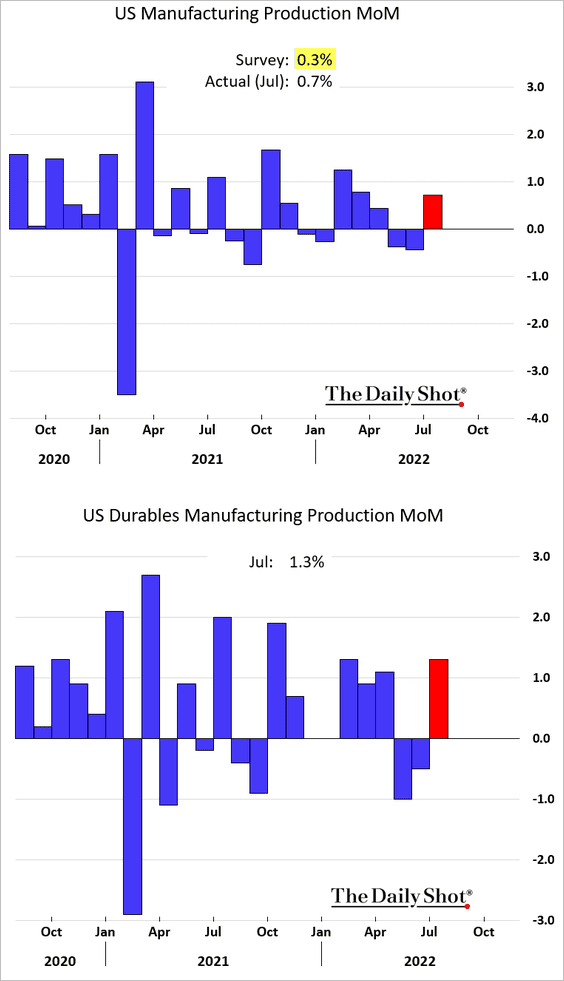

The United States: July manufacturing output surprised to the upside, diverging from much weaker survey-based data. We see a similar trend in Europe.

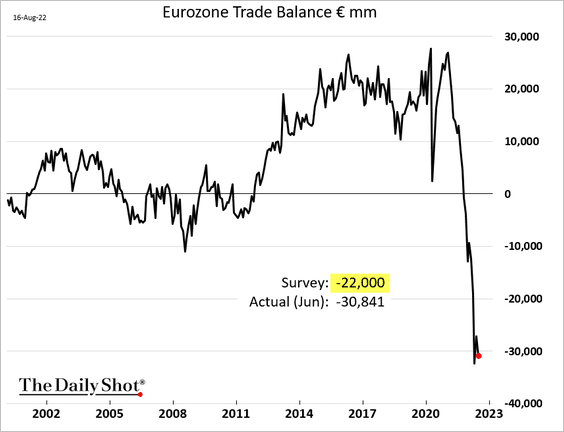

The Eurozone: The trade deficit widened more than expected in June as surging energy imports take a toll.

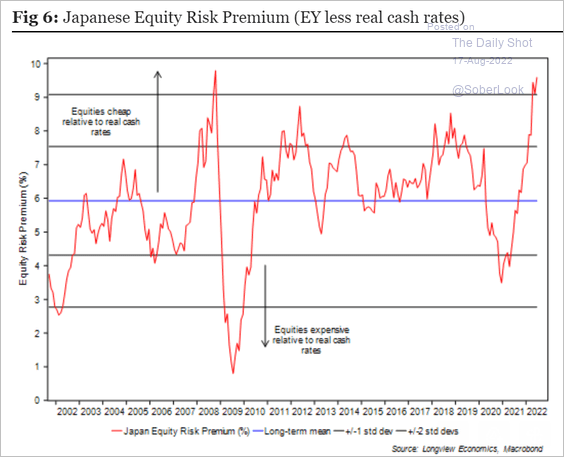

Japan: Japan’s equity risk premium is the highest its been since the financial crisis, meaning that equity investors expect a much higher return above the risk-free rate.

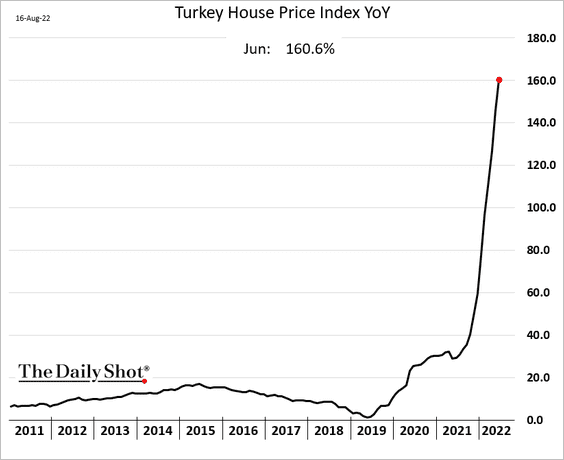

Emerging Markets: Housing becomes more attractive when a currency is massively devalued, and hyperinflation takes over.

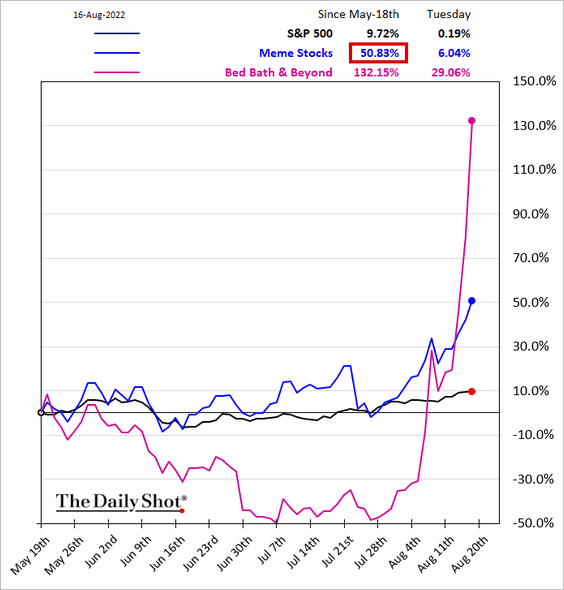

Equities: A basket of meme stocks is up some 50% this month. Risk appetite is back.

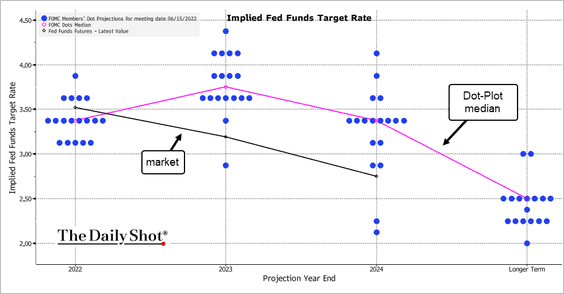

Rates: The market continues to bet against the Fed’s dot plot.

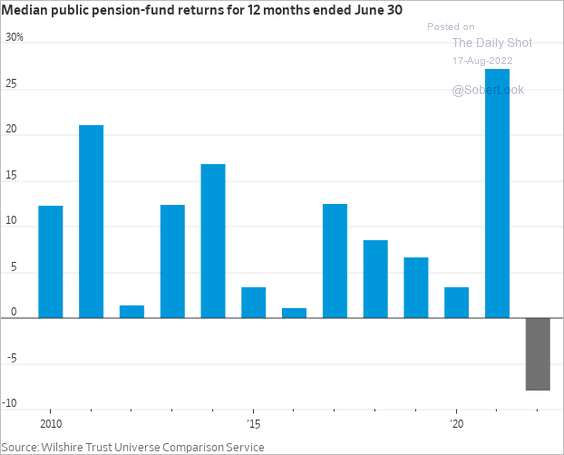

Food for Thought: Lastly, here’s a look at public pension-fund returns.

Edited by Alexander Bowers

Contact the Daily Shot Editor: Brief@DailyShotResearch.com