Greetings,

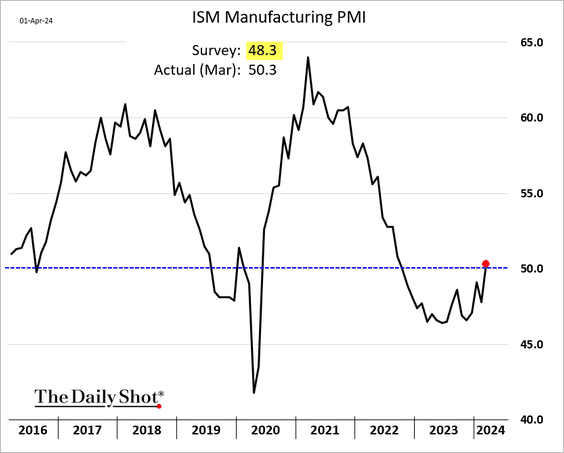

The United States: The ISM Manufacturing PMI finally returned to growth in March, topping expectations.

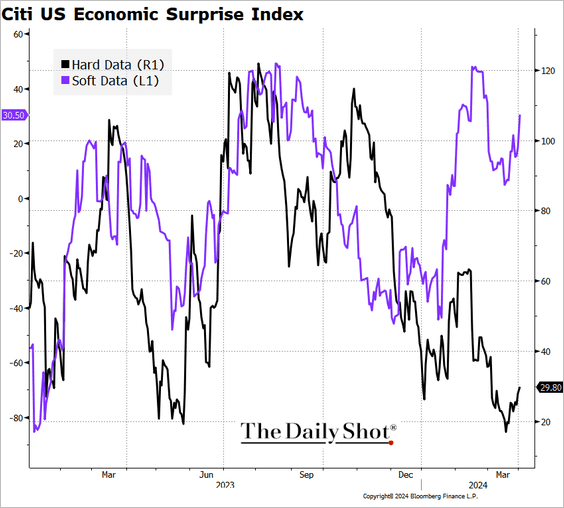

This year’s gains in the Citi Economic Surprise Index have been driven by soft data (surveys).

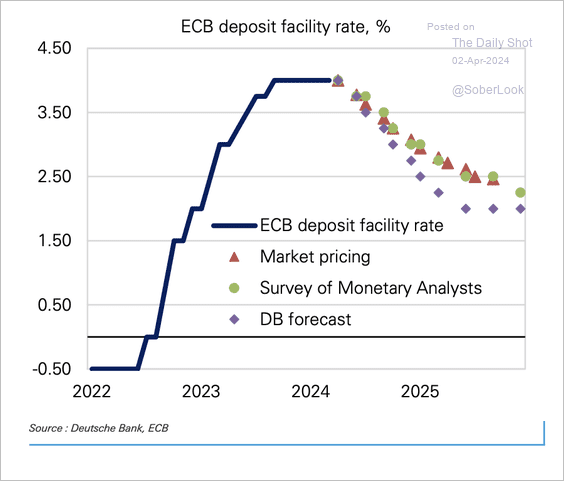

The Eurozone: Deutsche Bank expects the ECB policy rate to drop to 2% by mid-2025.

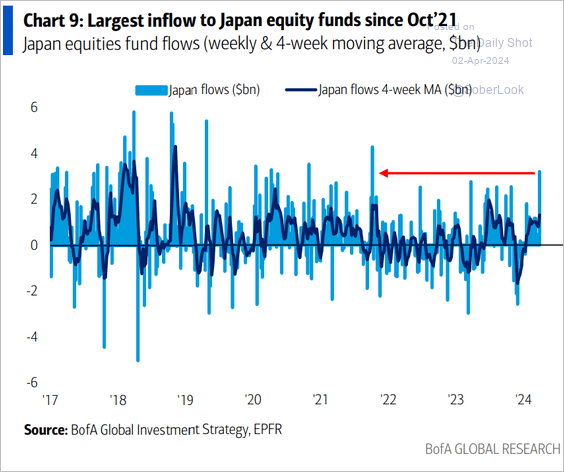

Japan: Investors continue channeling capital into Japan-focused equity funds.

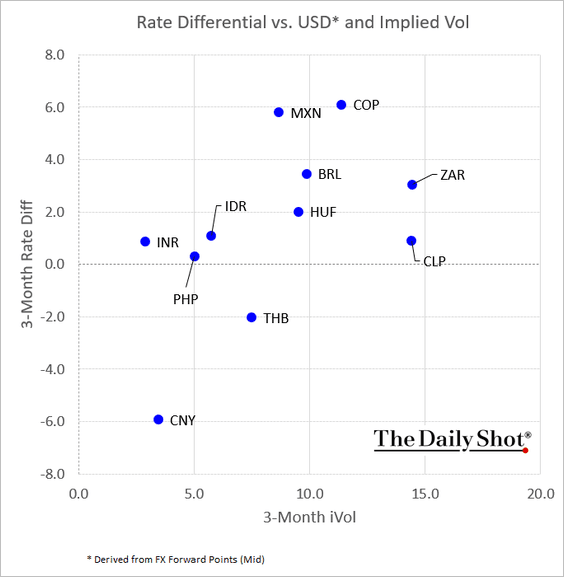

Emerging Markets: This chart shows the rate differentials (vs. USD) and implied volatility for select EM currencies.

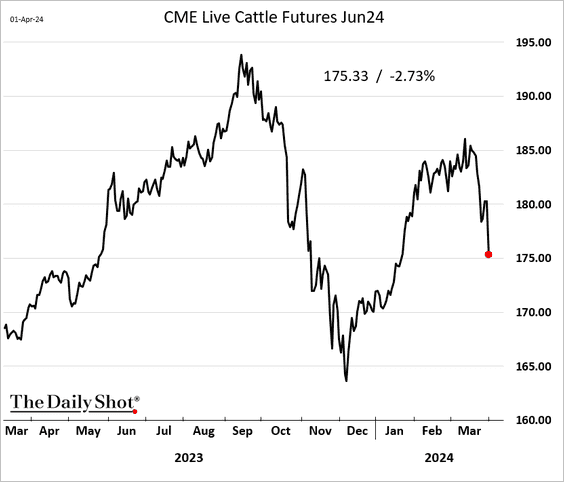

Commodities: Chicago cattle futures are selling off.

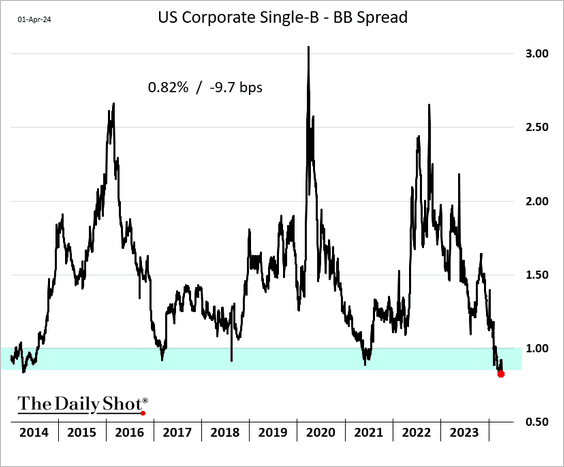

Credit: The single-B – BB corporate spreads continue to tighten, singling increased risk appetite.

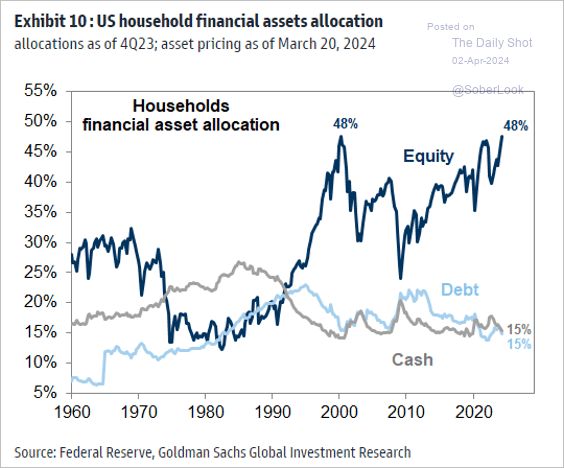

Food for Thought: US households’ financial asset allocation:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com