Greetings,

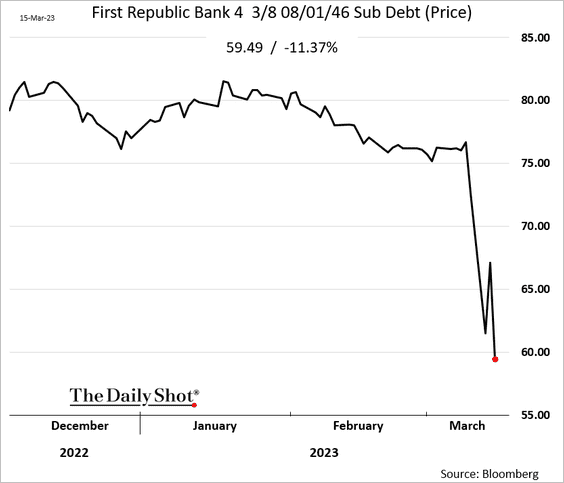

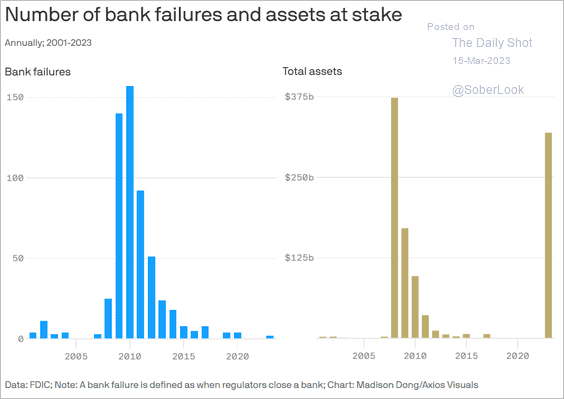

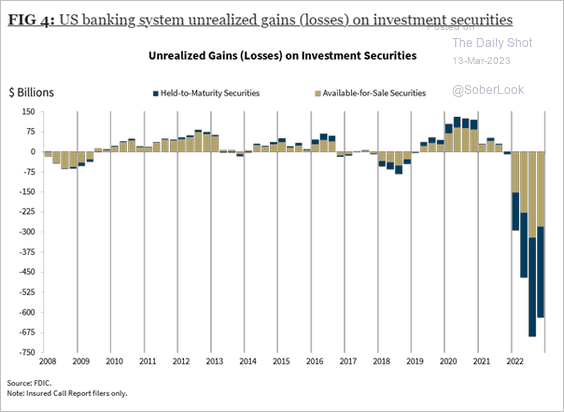

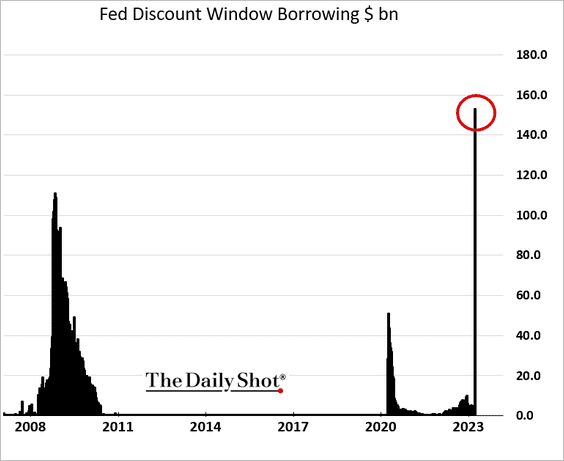

The United States: Banks have borrowed $165 billion from the Fed over the past week:

– $152.85 billion via the discount window and …

– $11.9 billion via the Fed’s new emergency facility (Bank Term Funding Program). And there is more to come …

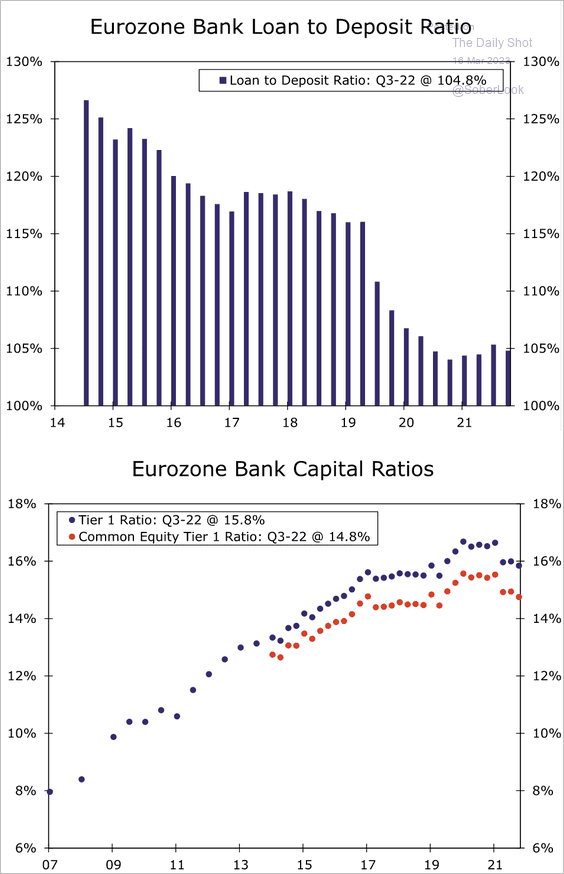

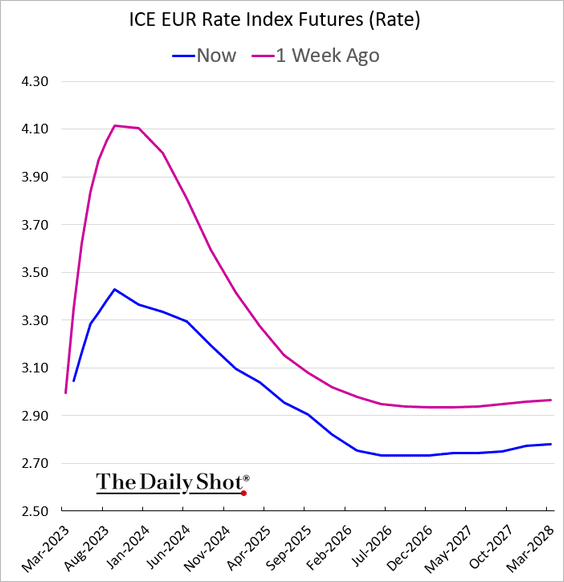

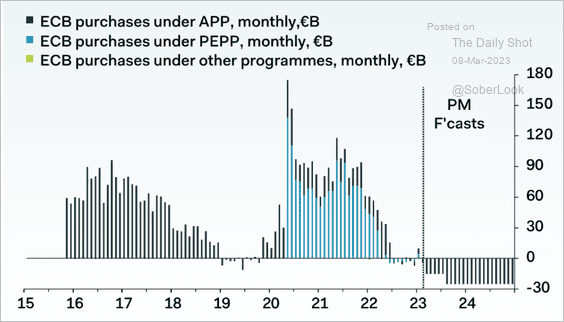

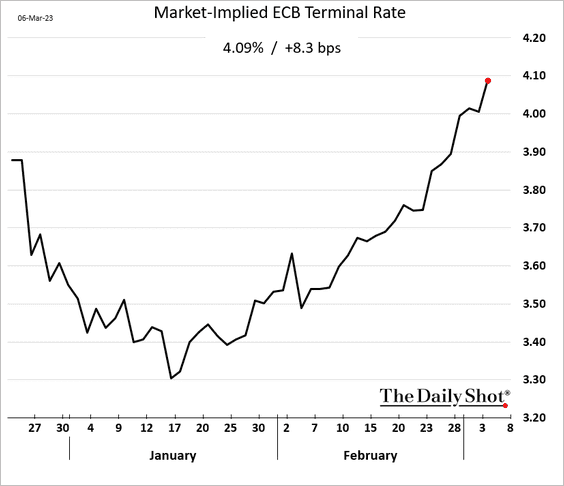

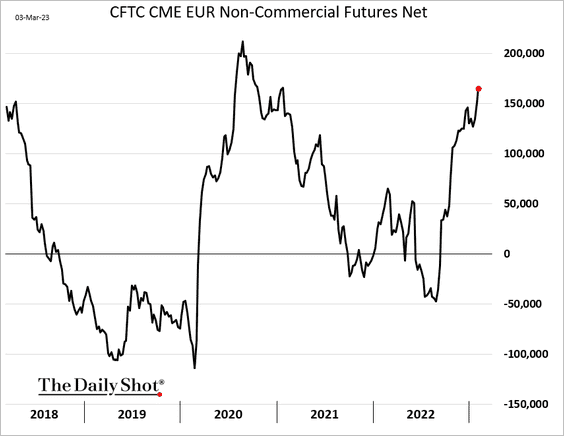

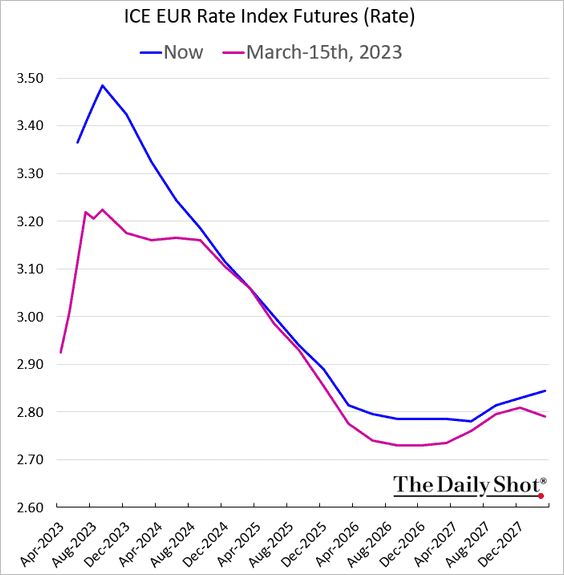

The Eurozone: The central bank’s hawkish action shifted rate trajectory expectations sharply higher.

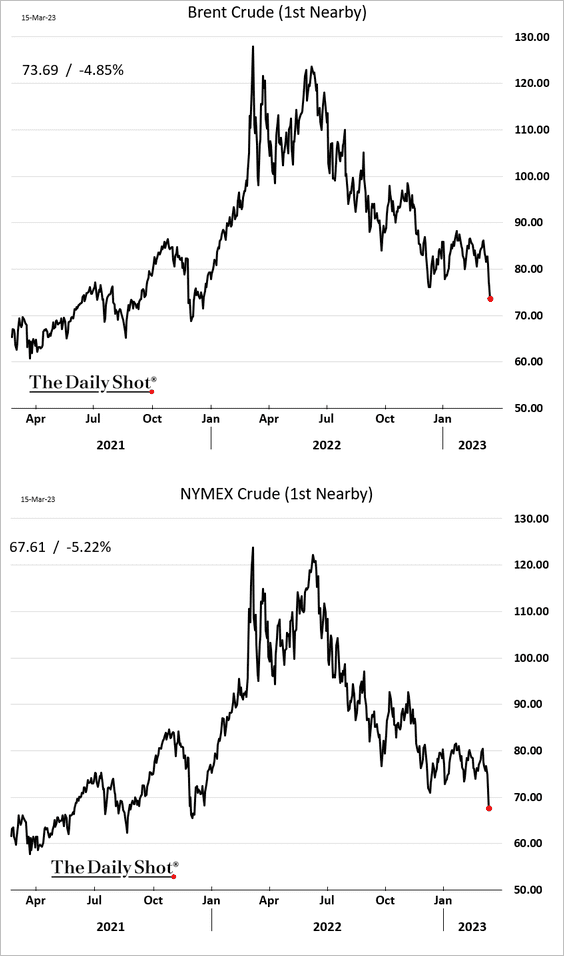

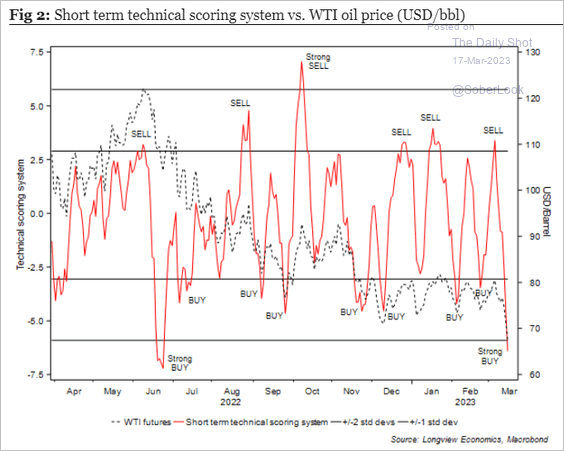

Energy: Crude oil appears to be oversold.

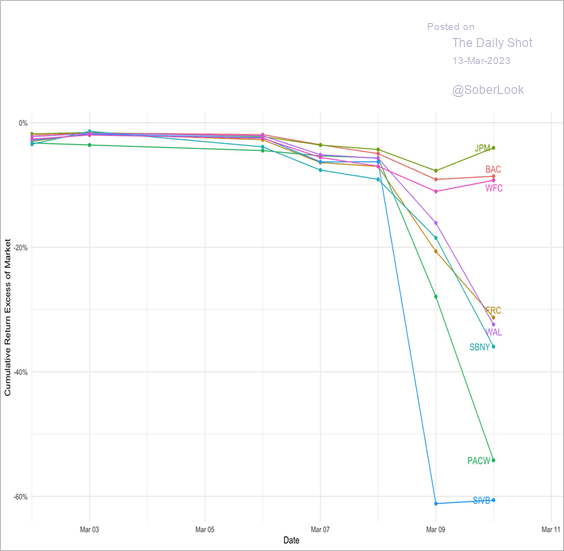

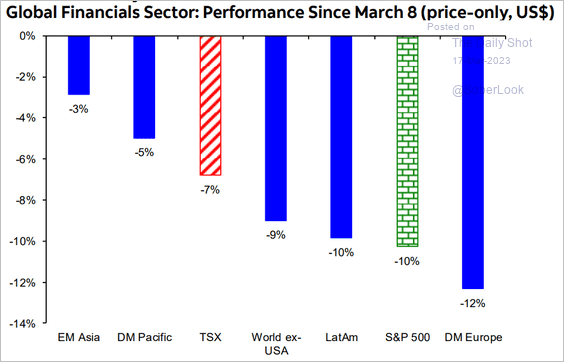

Equities: This chart shows financial sector performance globally since March 8th.

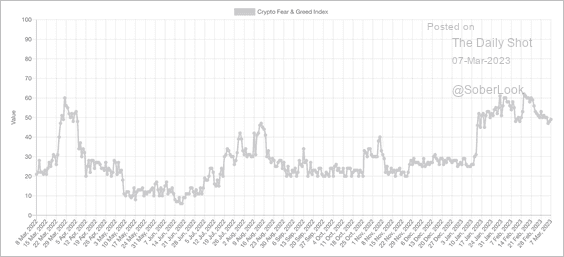

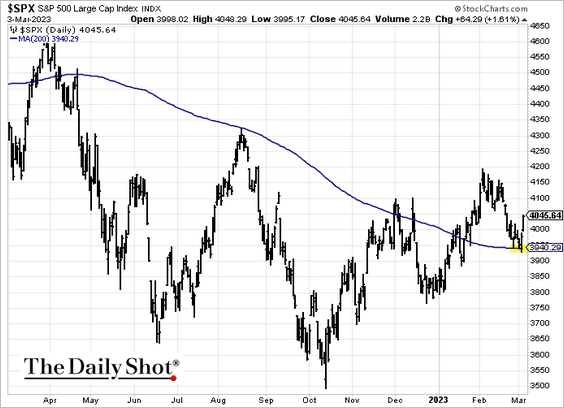

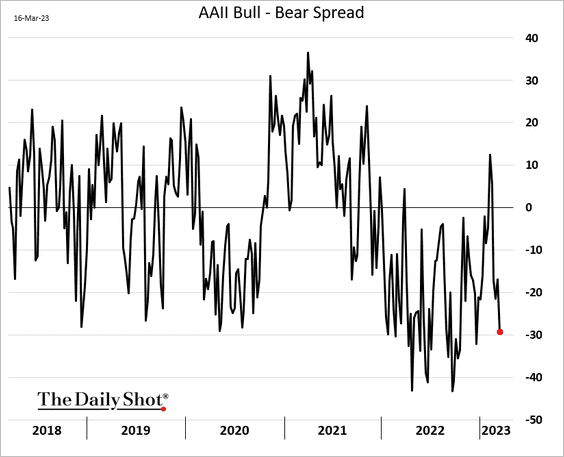

Investor sentiment has been moving deeper into bear-market territory.

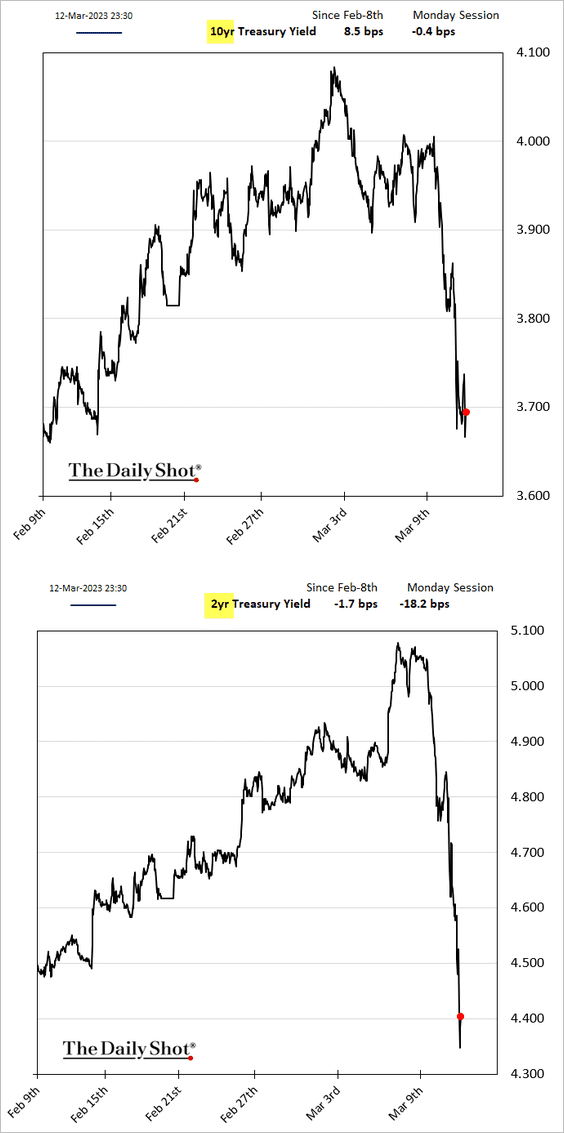

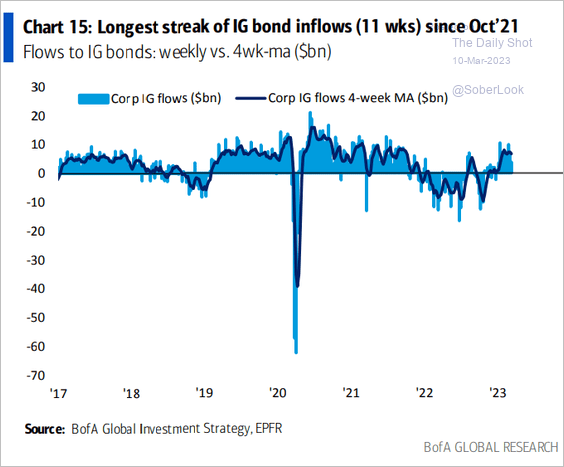

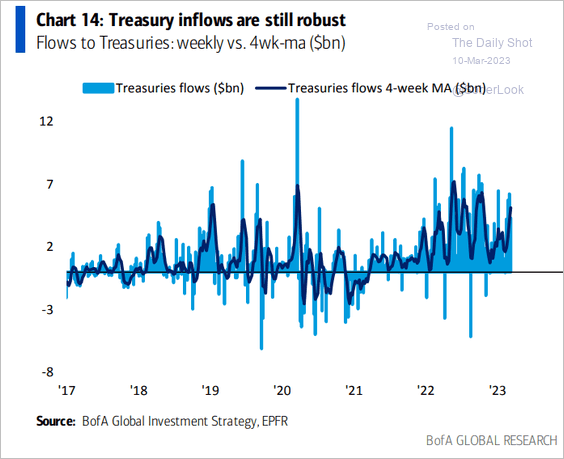

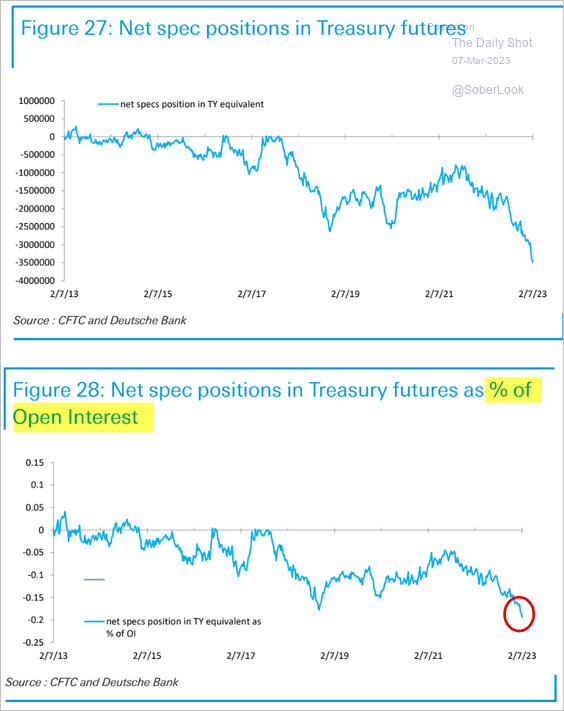

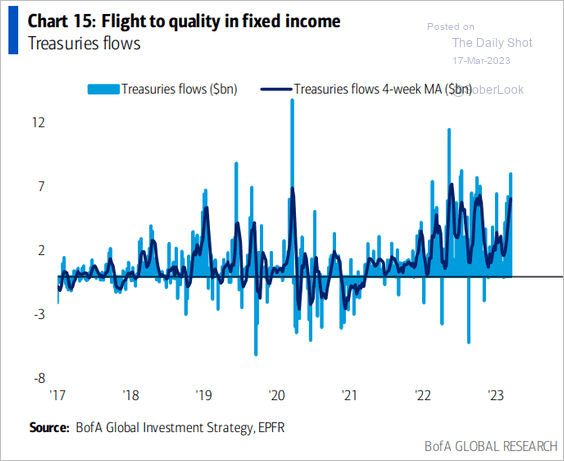

Rates: Inflows into Treasury funds remain elevated.

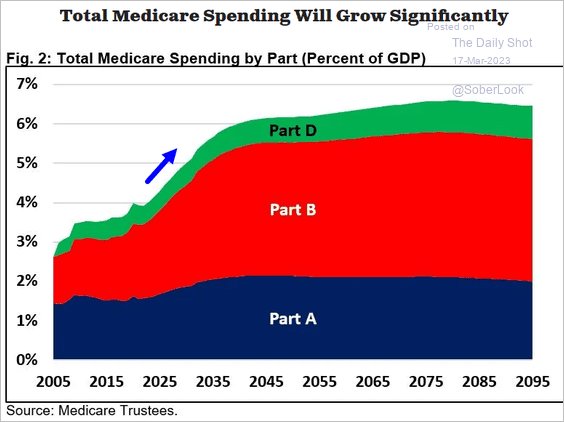

Food for Thought: Projections for Medicare spending:

Edited by Josh Oldmixon

Contact the Daily Shot Editor: Brief@DailyShotResearch.com