Greetings,

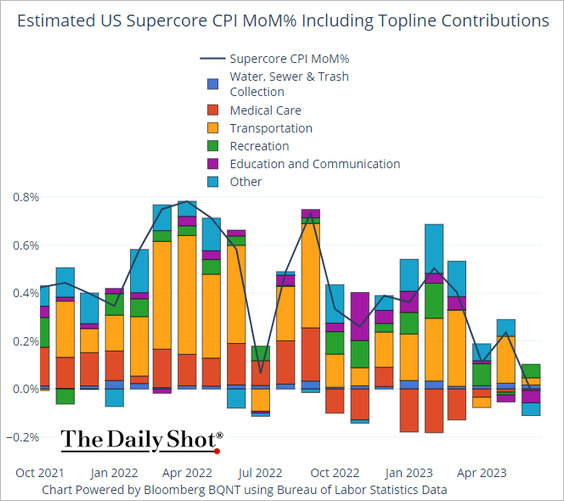

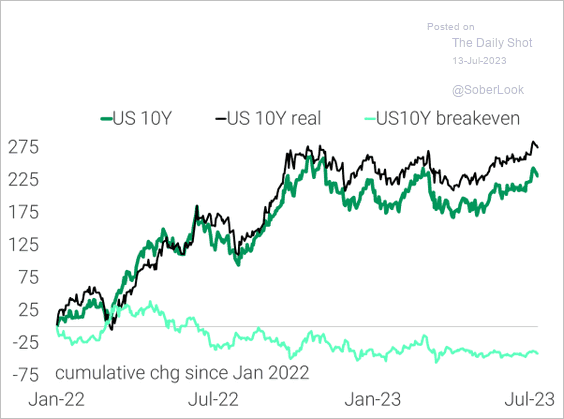

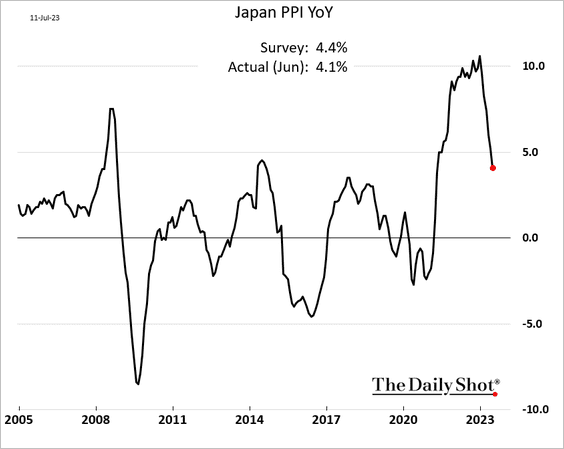

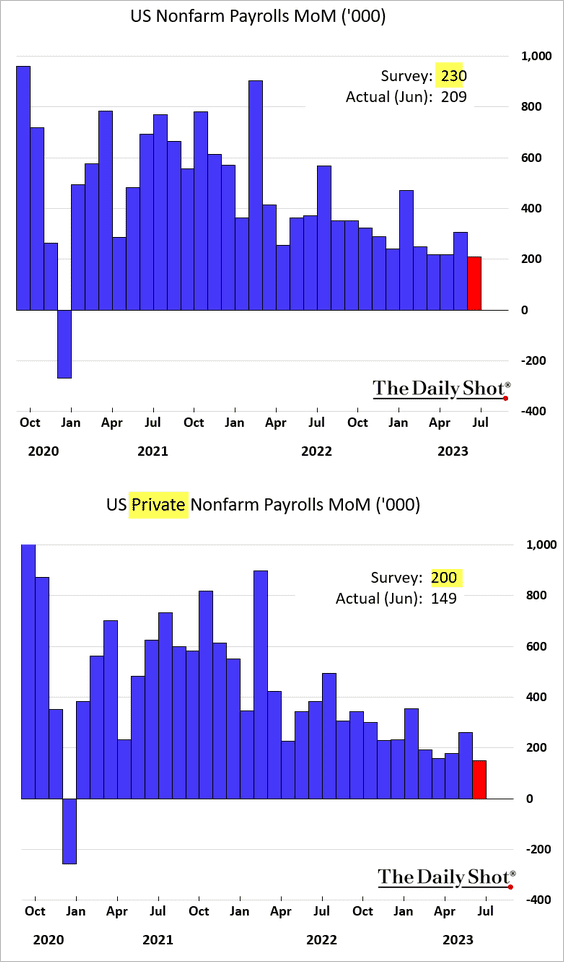

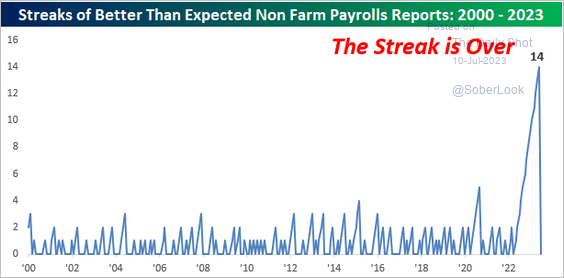

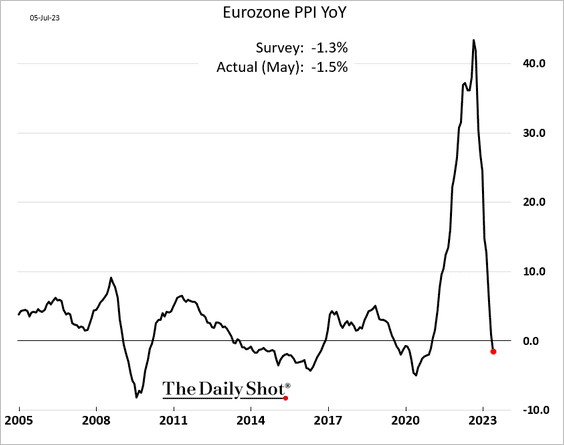

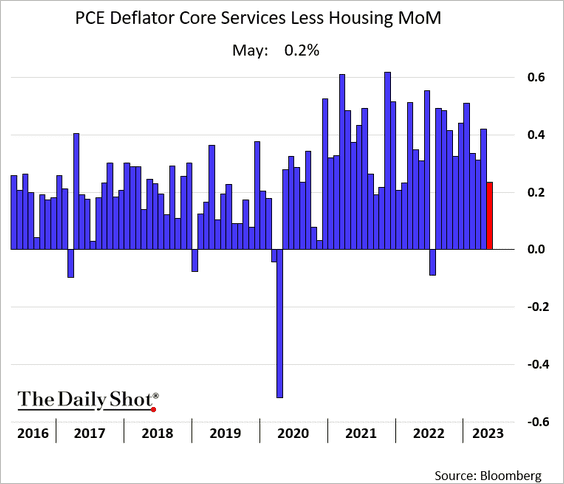

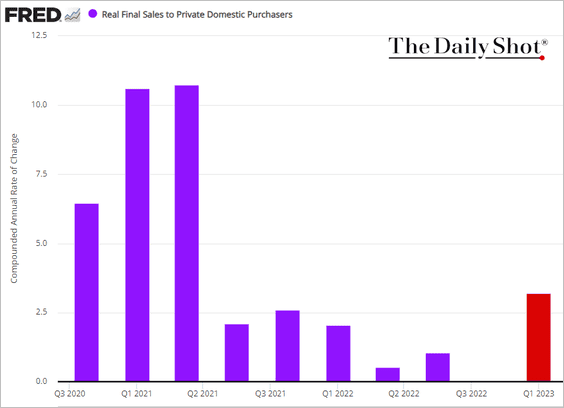

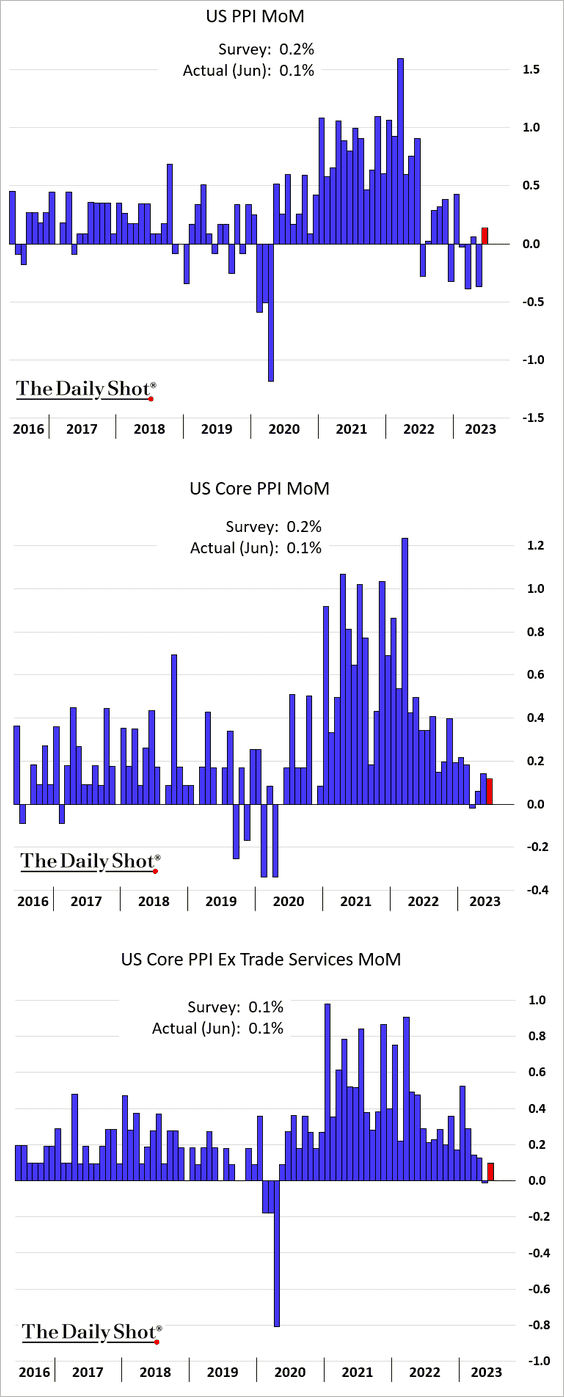

The United States: The PPI report provided further evidence of easing inflationary pressures, with the June headline and core figures coming in below forecasts.

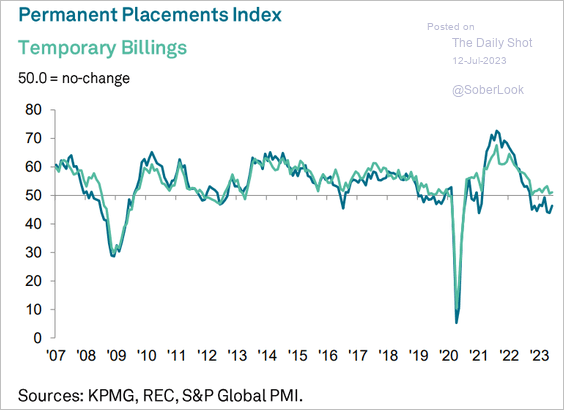

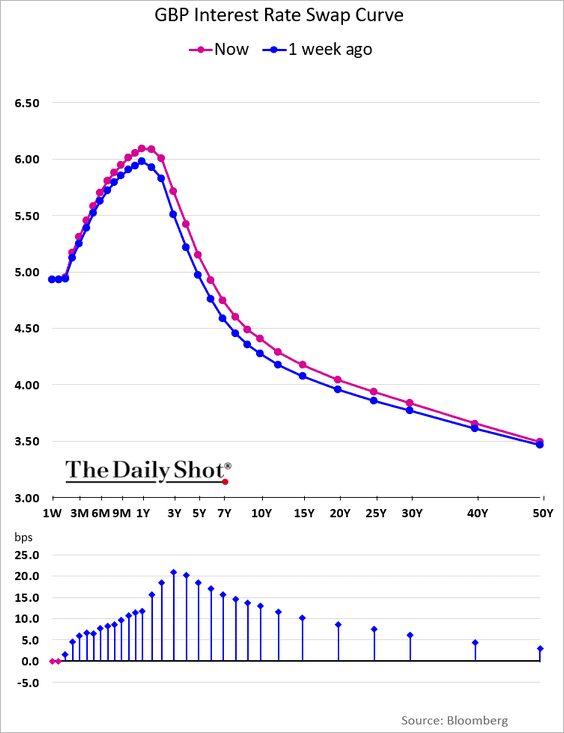

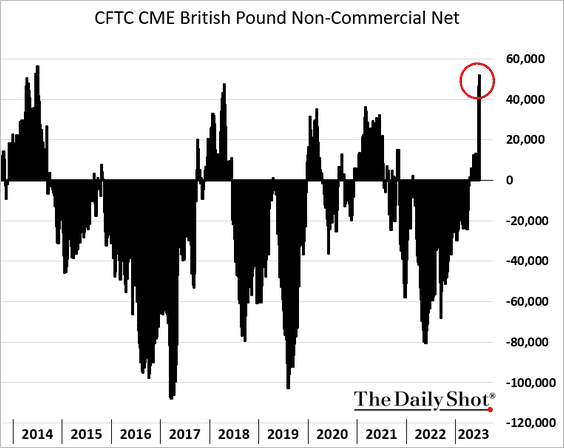

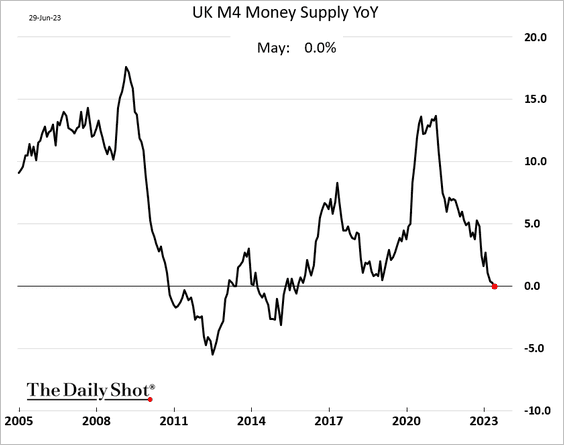

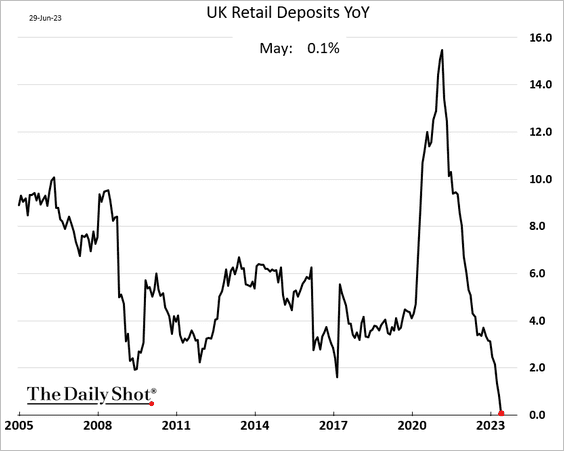

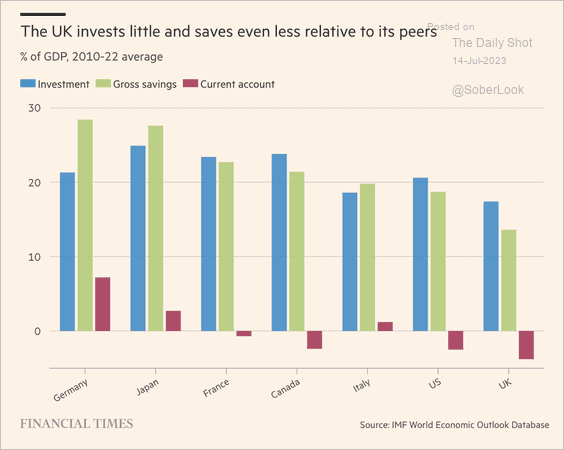

The United Kingdom: UK investment and savings have lagged other advanced economies.

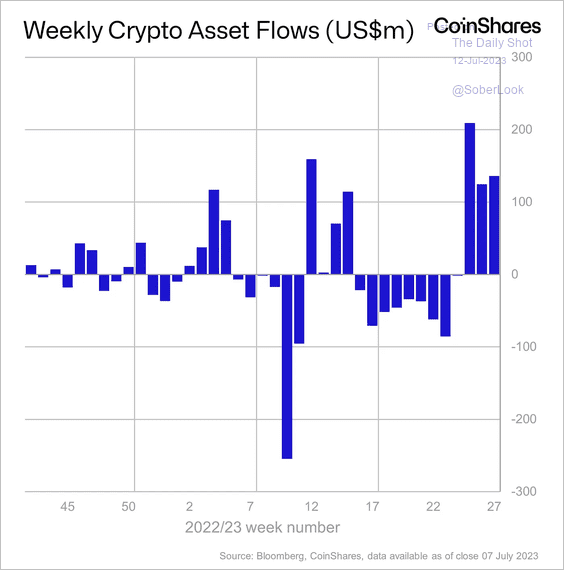

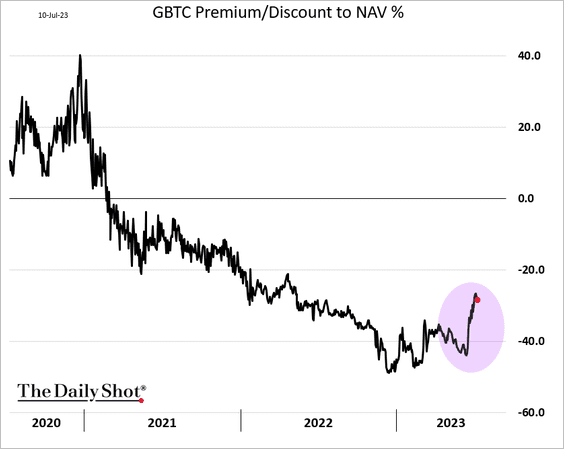

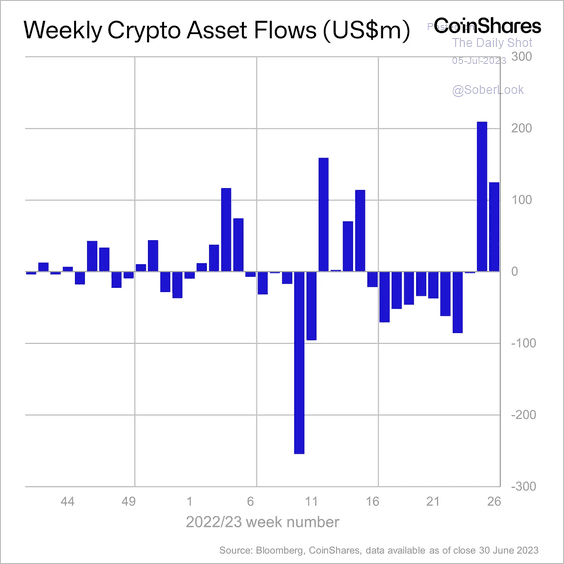

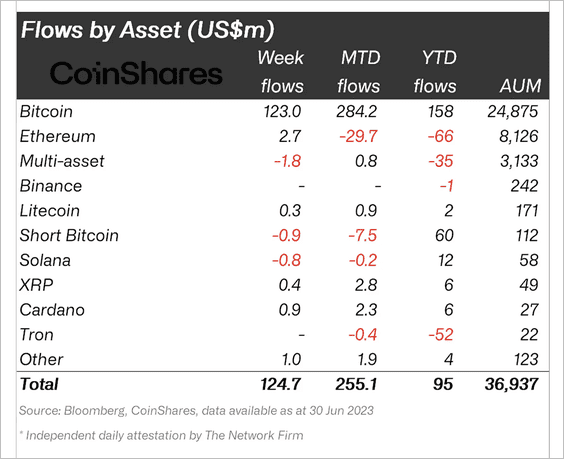

Cryptocurrency: On Thursday, the SEC charged Celsius and its founder/former CEO with violating securities laws.

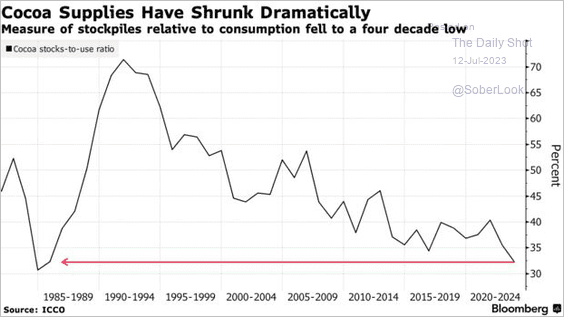

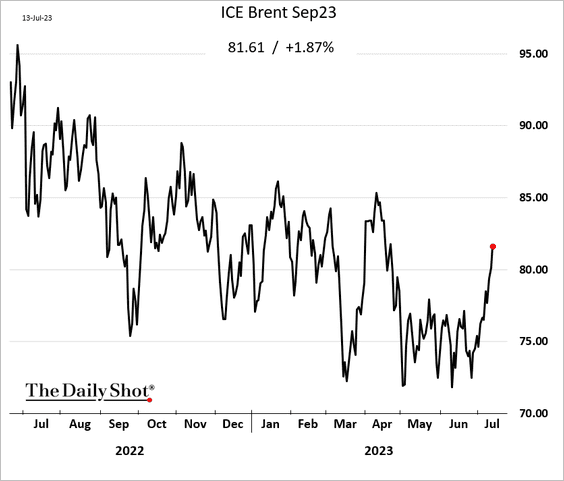

Energy: Crude oil prices continue to surge.

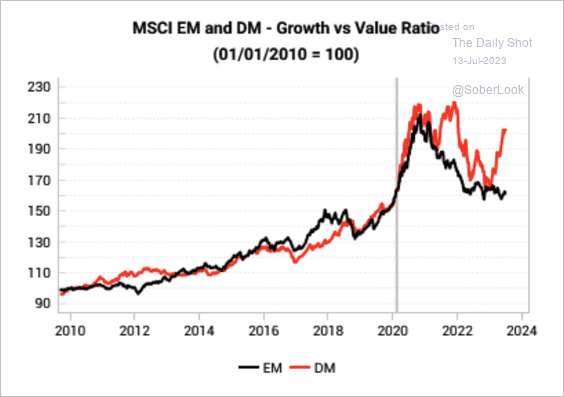

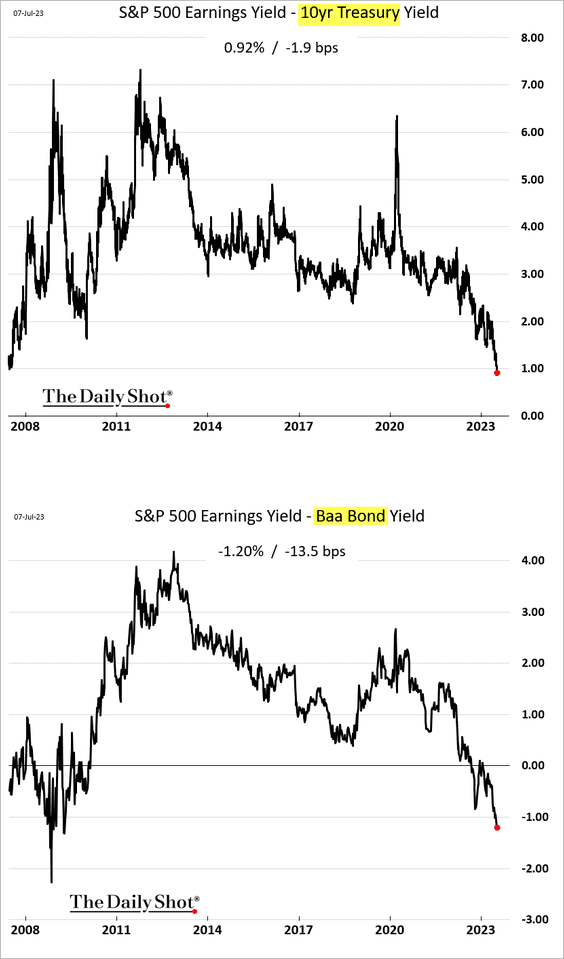

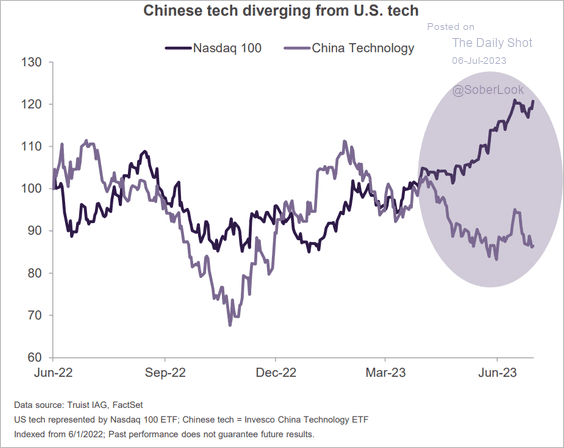

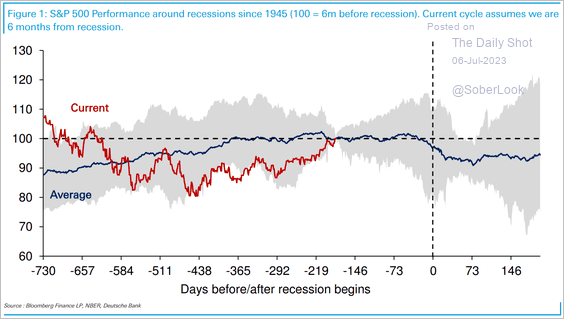

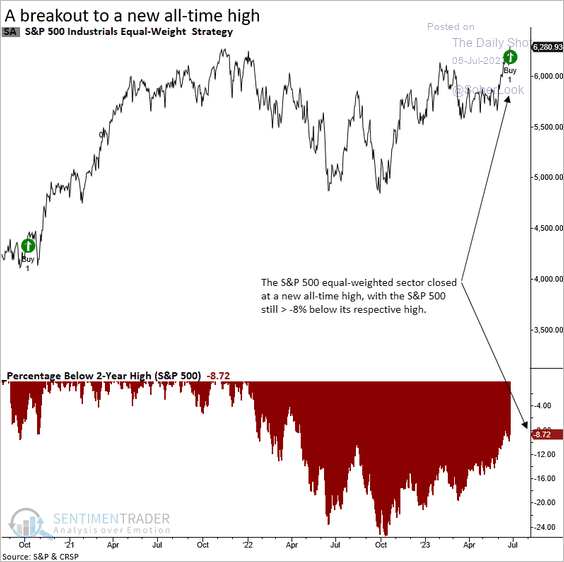

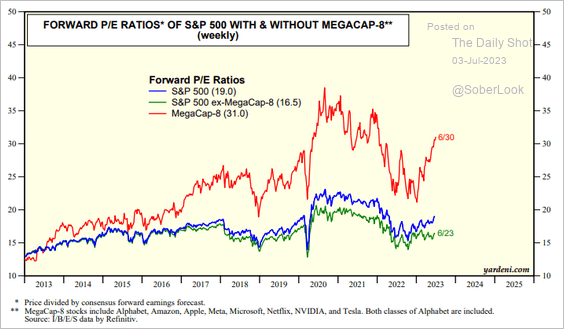

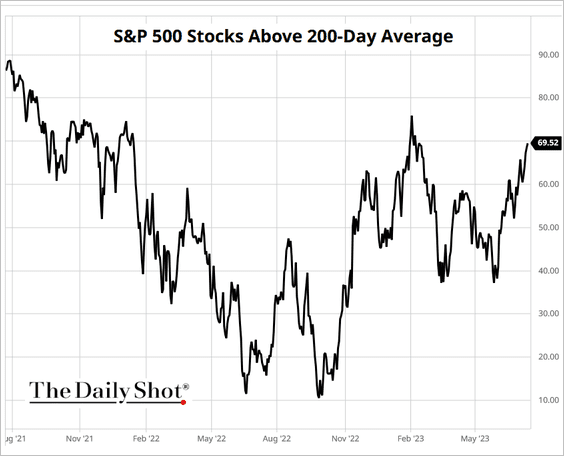

Equities: This chart shows the percentage of S&P 500 stocks that are above their 200-day moving average.

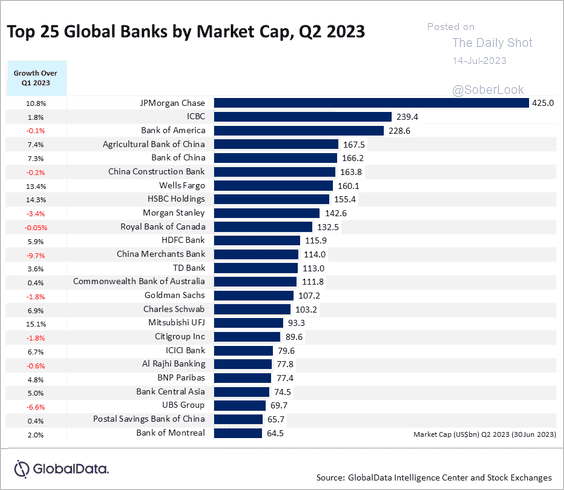

Food for Thought: Top 25 global banks by market cap:

Edited by Josh Oldmixon

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily ShotAverage hourly wages for US teens: Brief