Greetings,

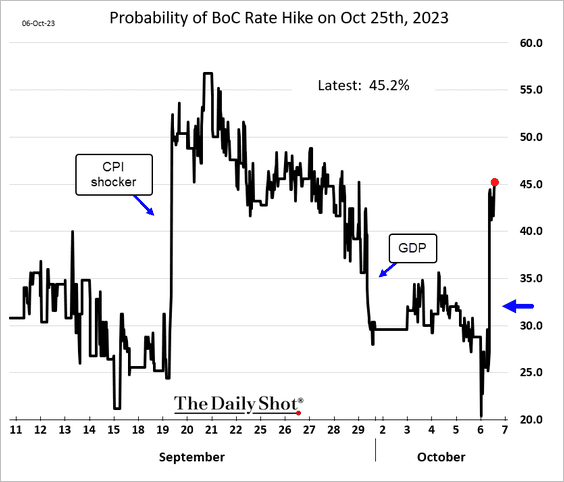

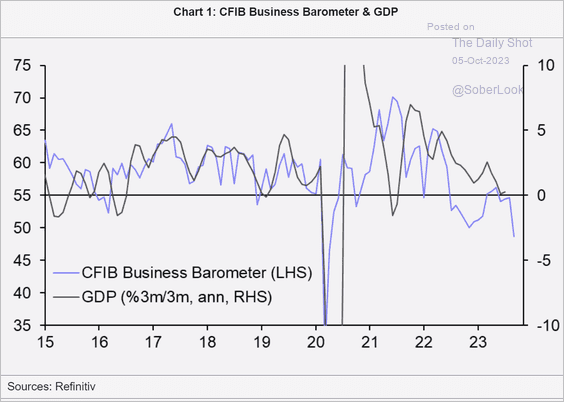

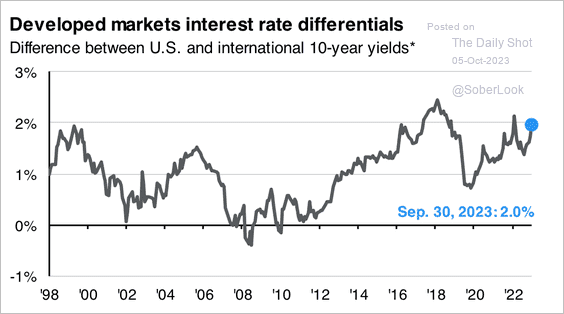

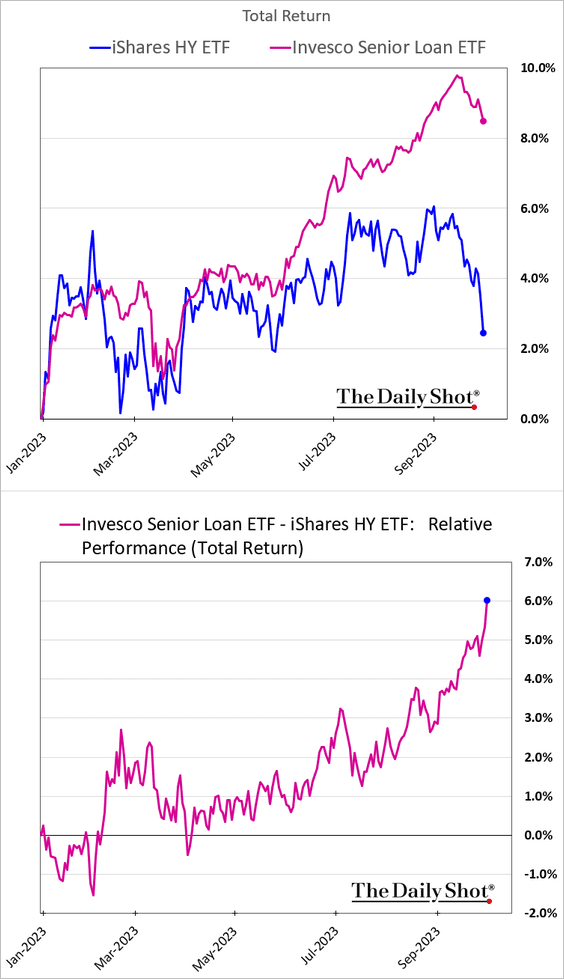

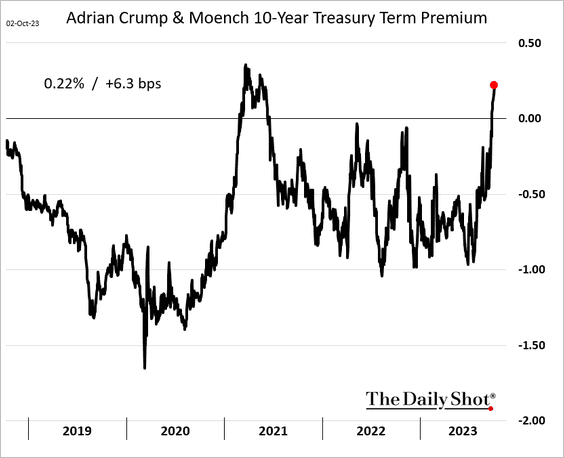

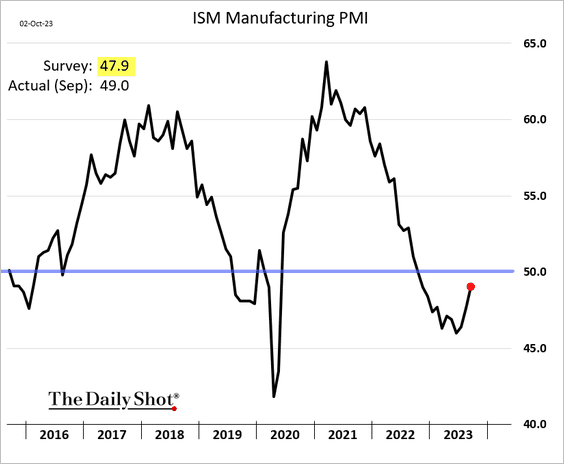

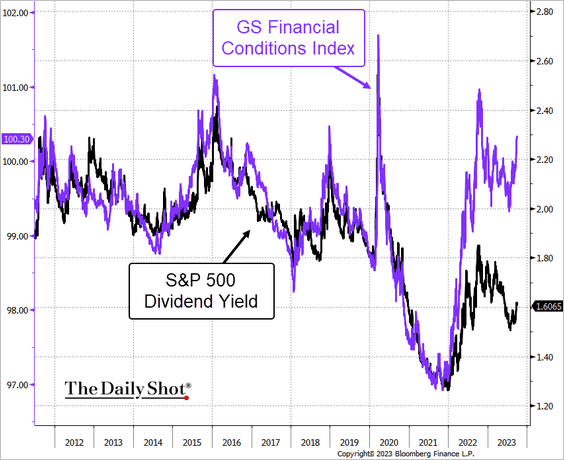

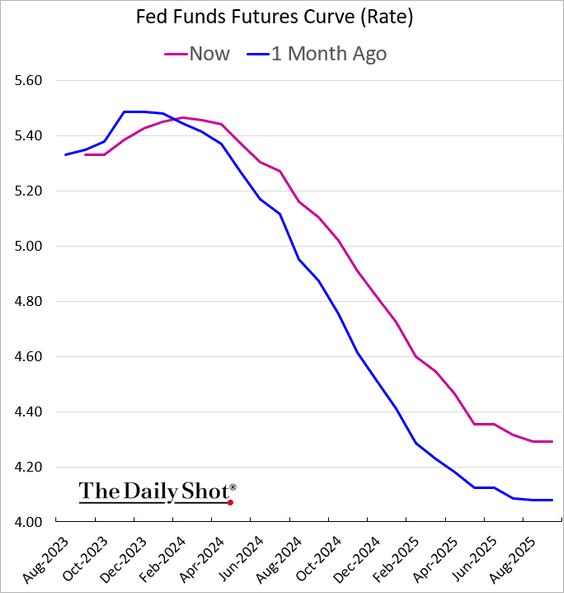

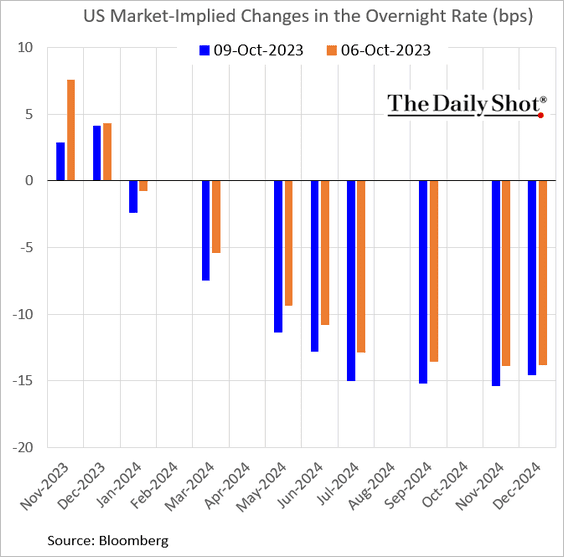

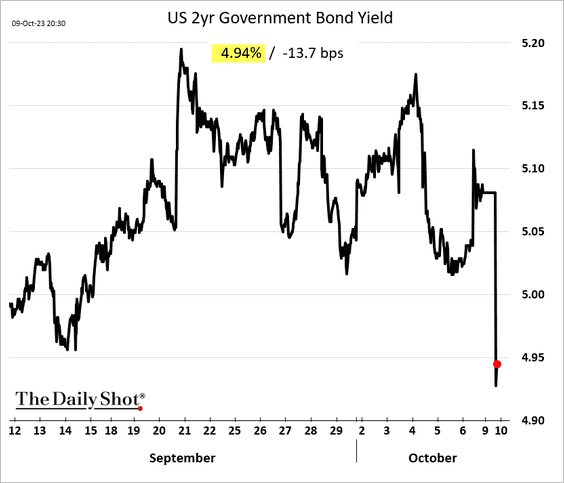

The United States: The probability of a rate hike in November declined as Fed officials’ concern grew about rising Treasury yields and tightening financial conditions.

Treasury yields dropped sharply, with the 2-year rate dipping below 5%.

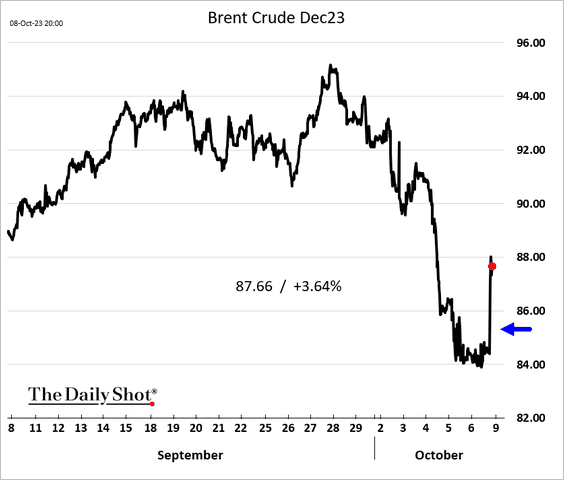

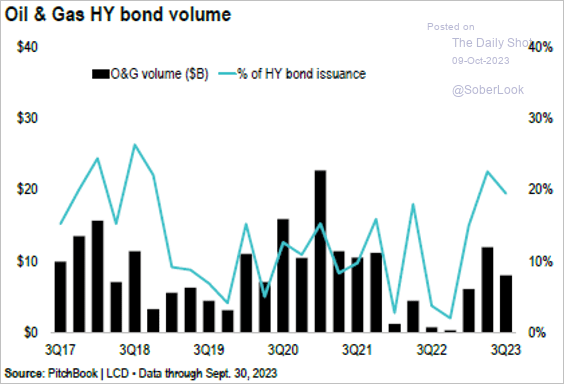

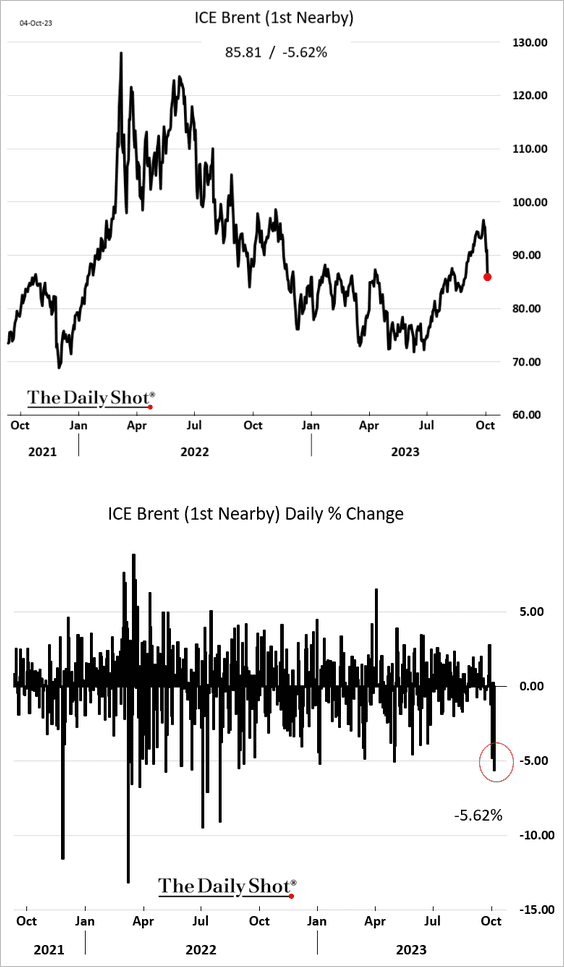

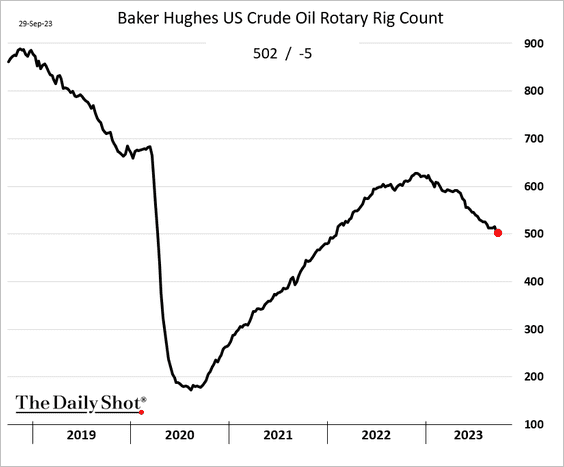

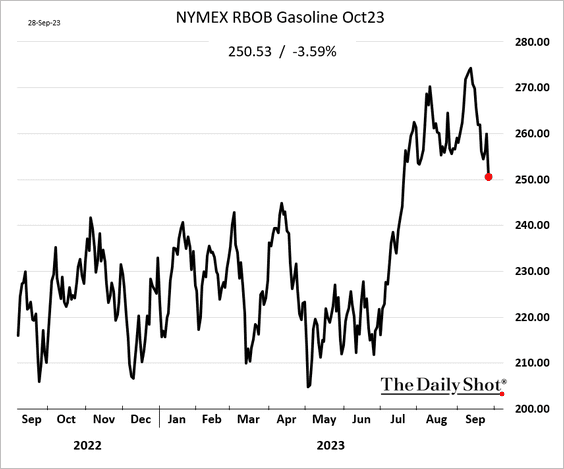

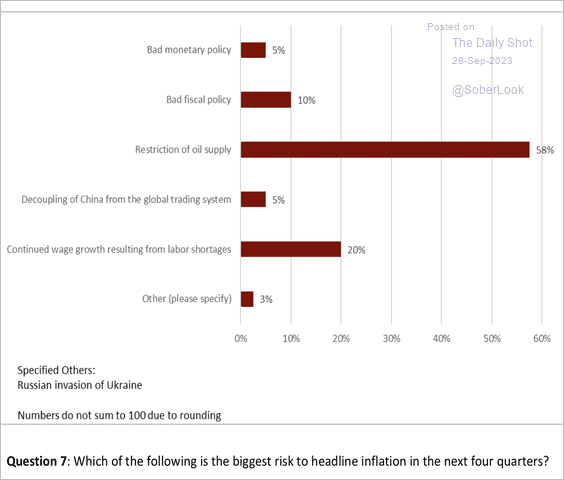

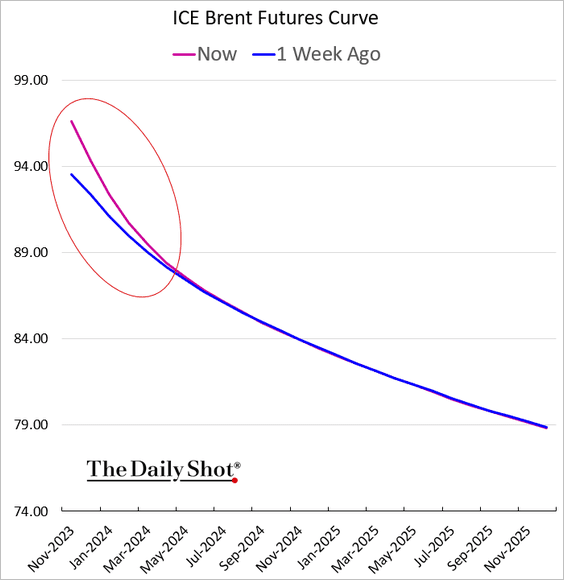

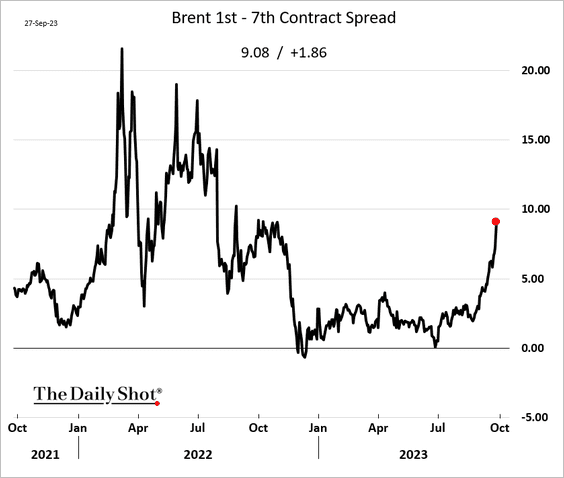

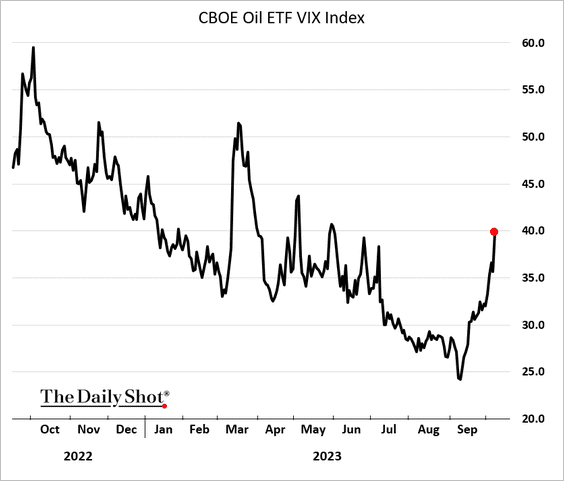

Energy: Oil implied volatility continues to rise.

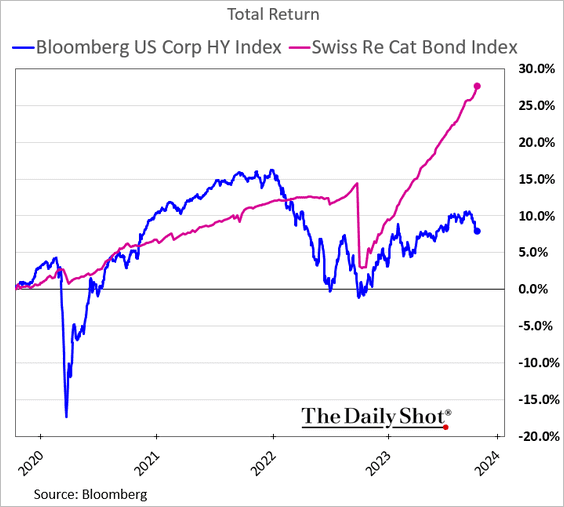

Credit: Cat bonds have been outperforming.

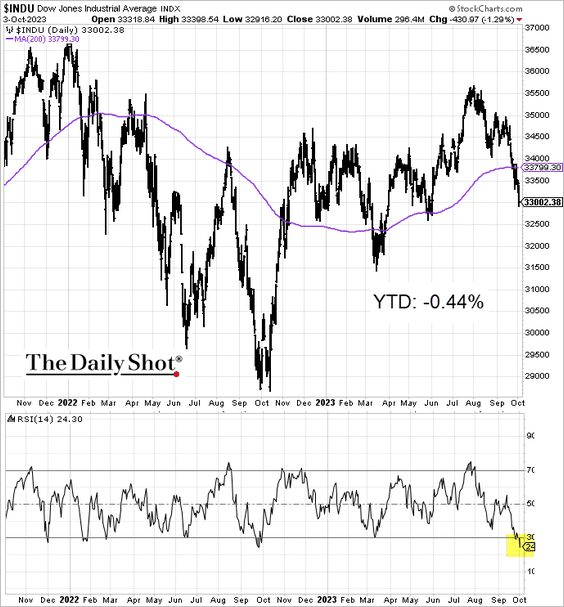

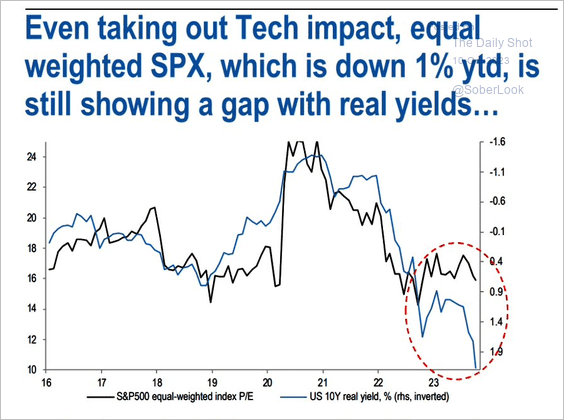

Equities: The disparity between valuations and real yields extends beyond the tech-heavy S&P 500. Here is the equal-weighted index:

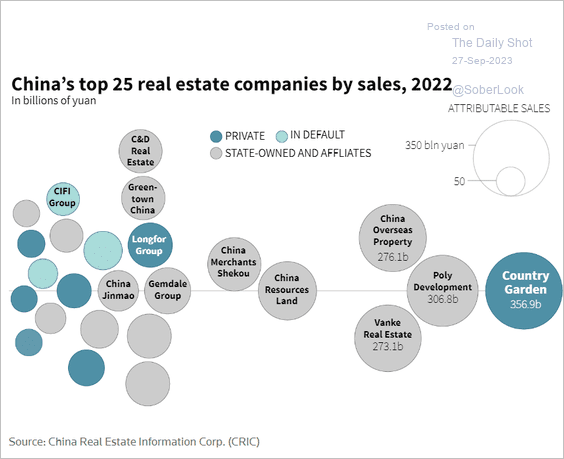

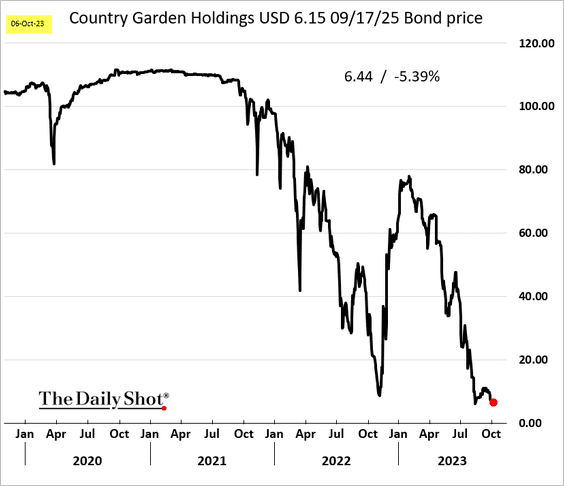

China: After the Evergrande fiasco, markets viewed Country Garden as a relatively safe bet. That bet didn’t end well.

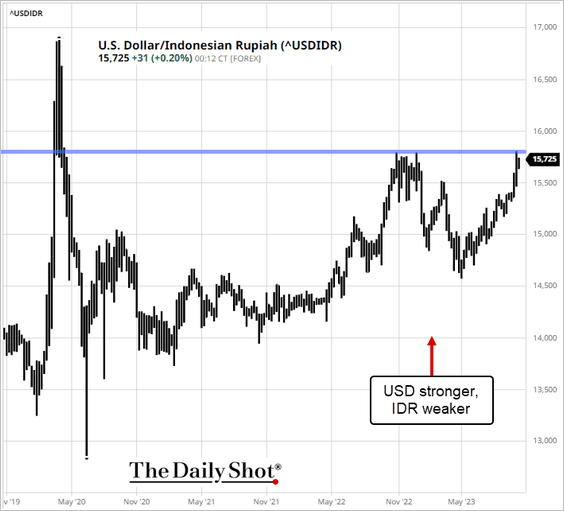

Emerging Markets: USD/IDR is at resistance as the Indonesian rupiah weakens.

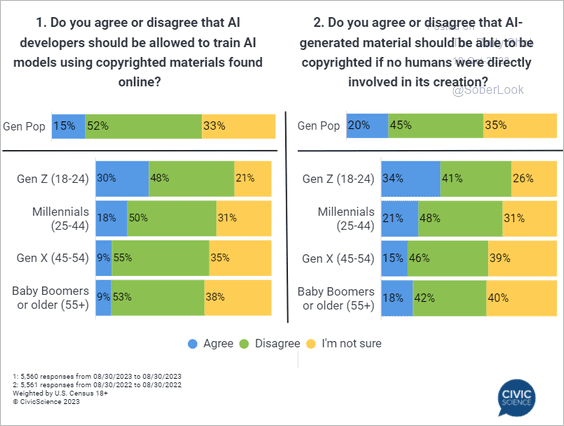

Food for Thought: AI and intellectual property:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily ShotAverage hourly wages for US teens: Brief