Greetings,

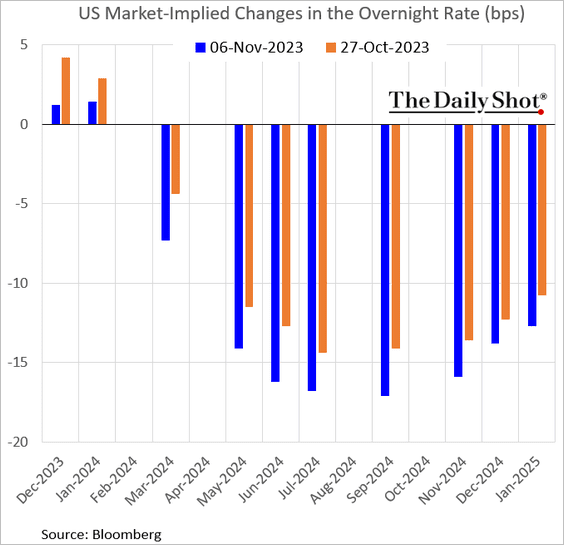

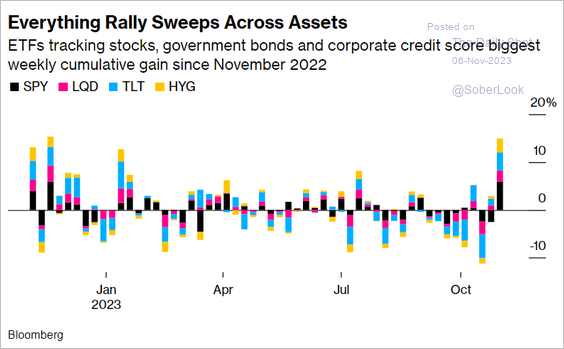

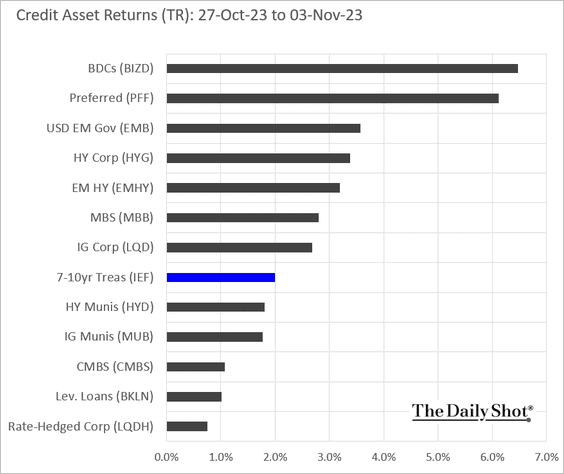

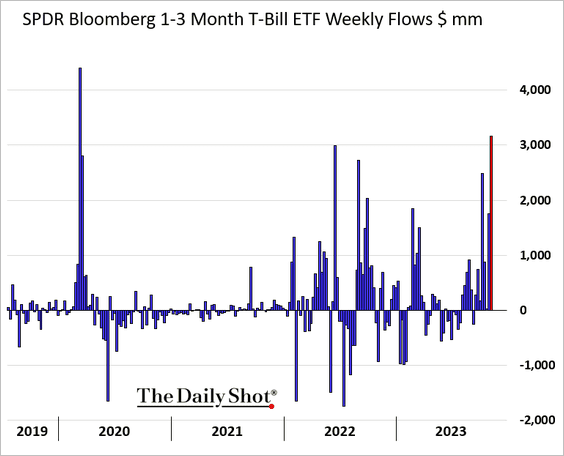

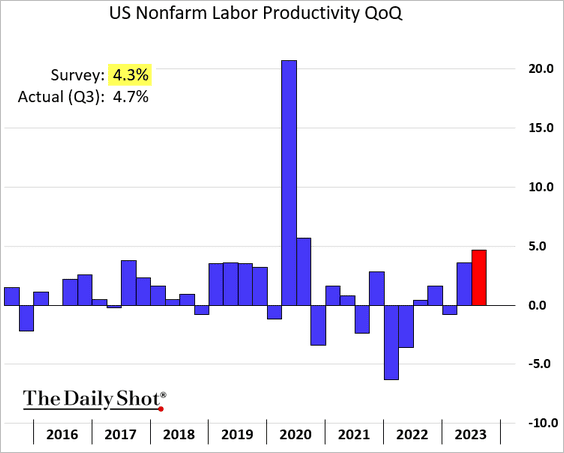

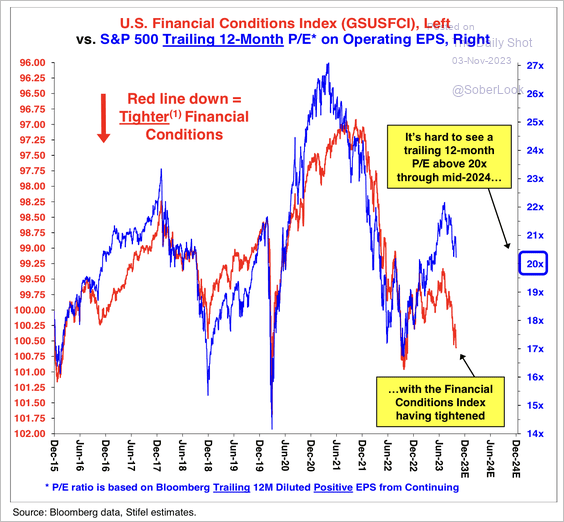

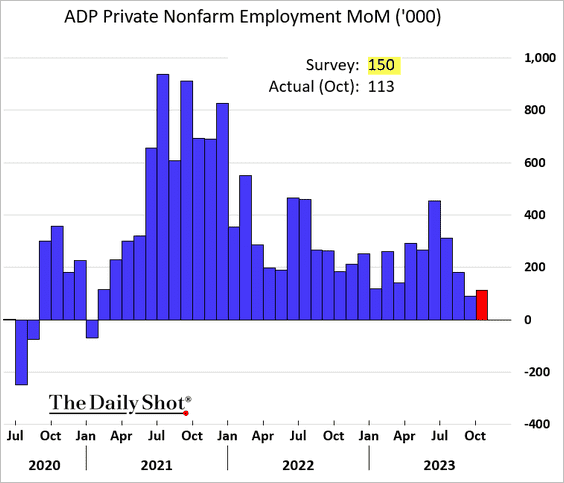

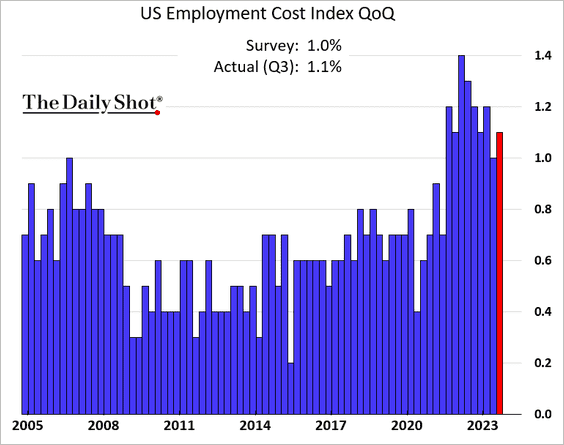

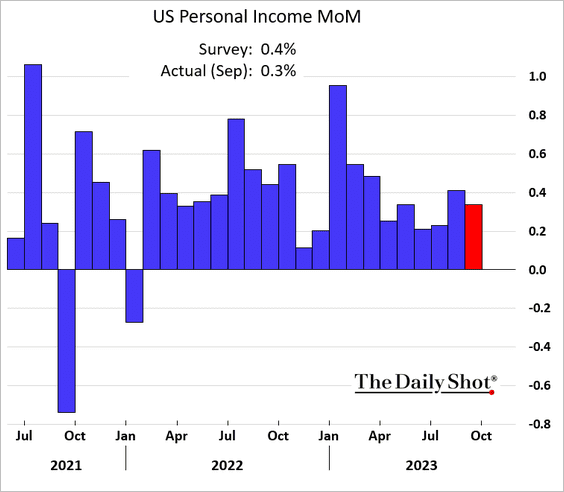

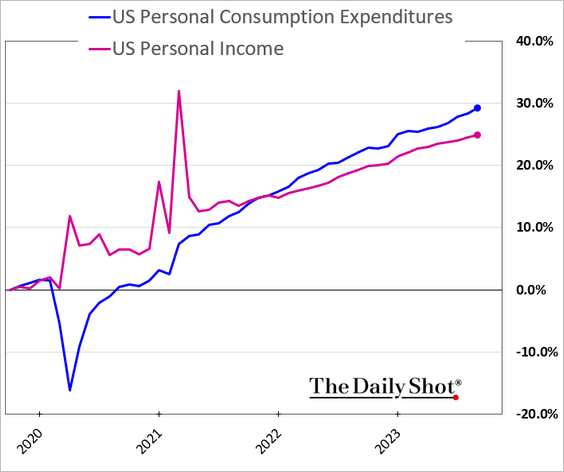

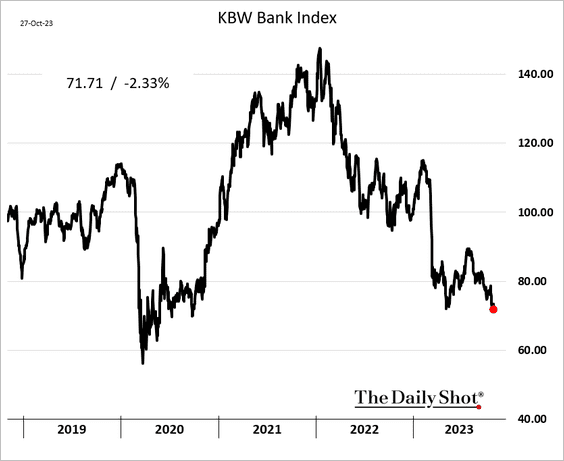

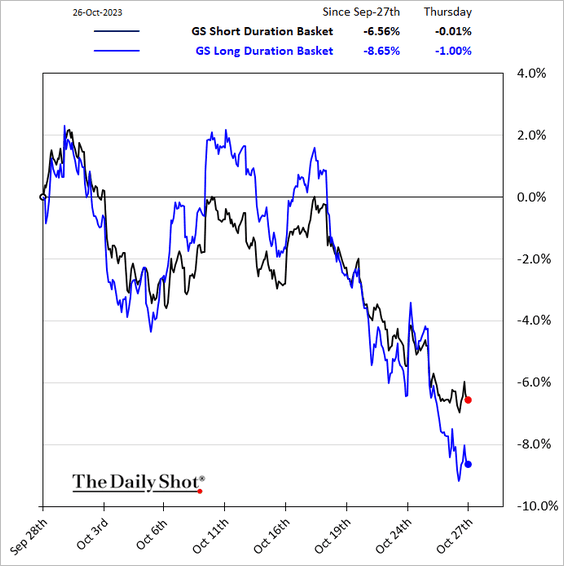

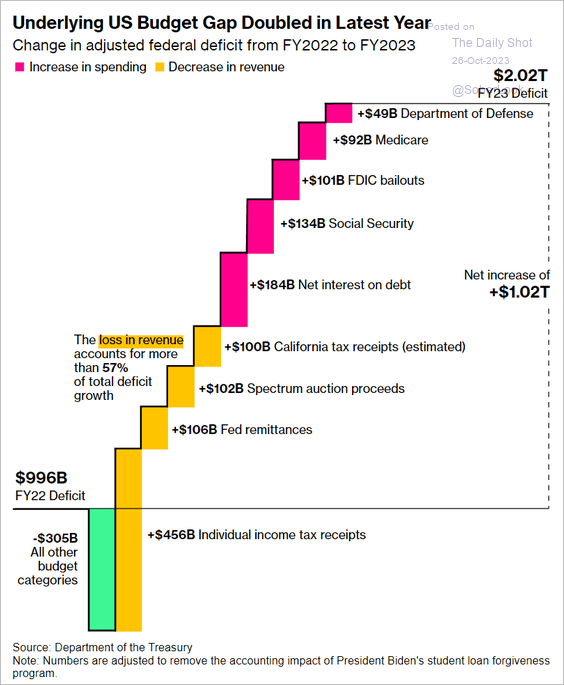

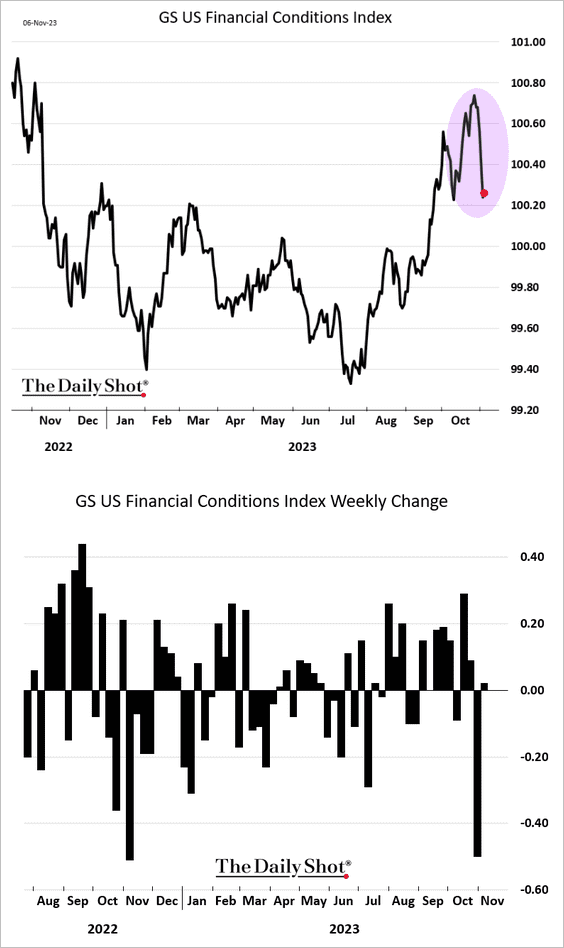

The United States: US financial conditions eased sharply over the past few days.

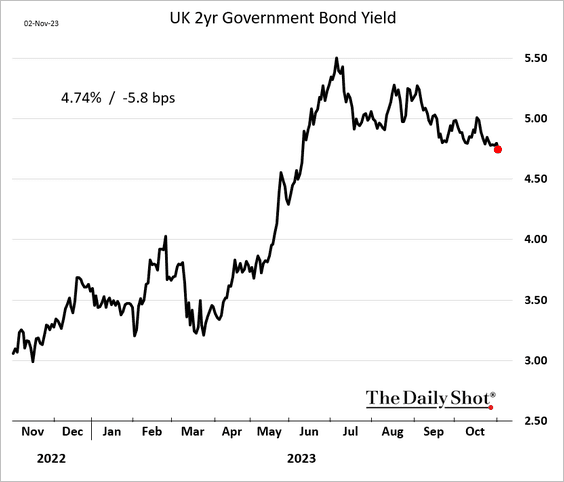

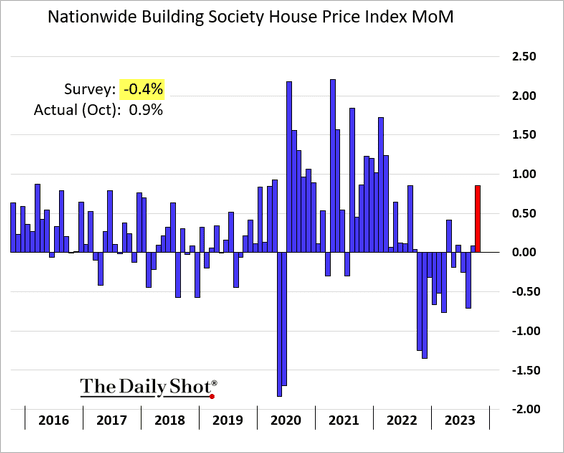

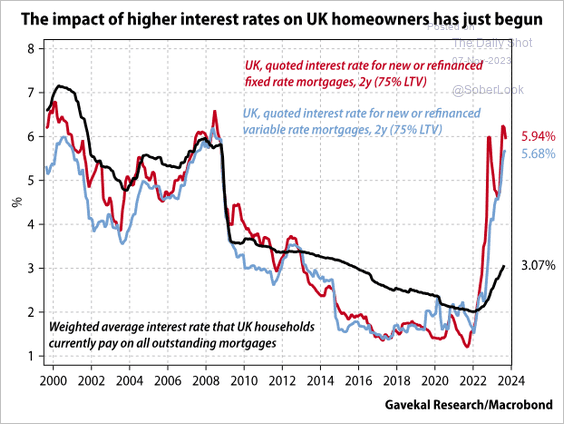

The United Kingdom: Homeowners are facing a refinancing shock.

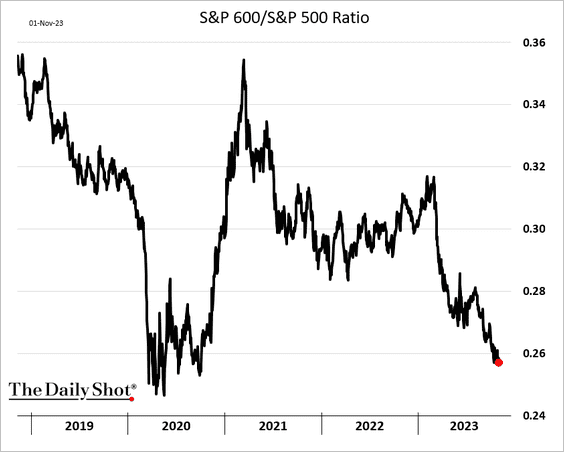

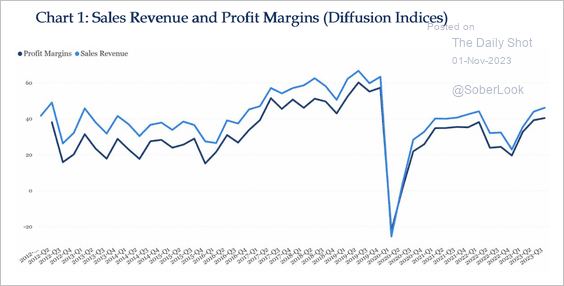

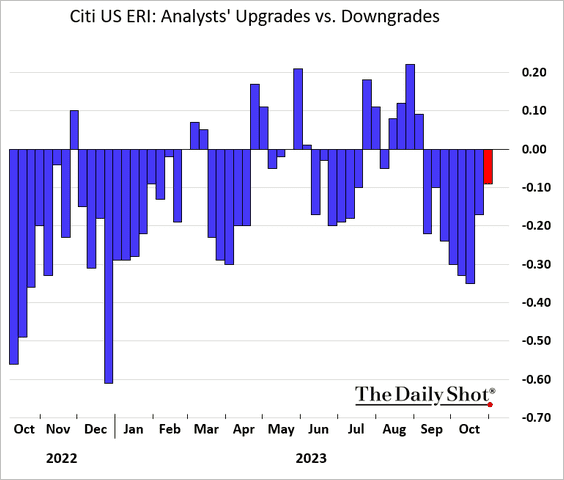

Equities: Earnings downgrades have exceeded upgrades for eight weeks in a row.

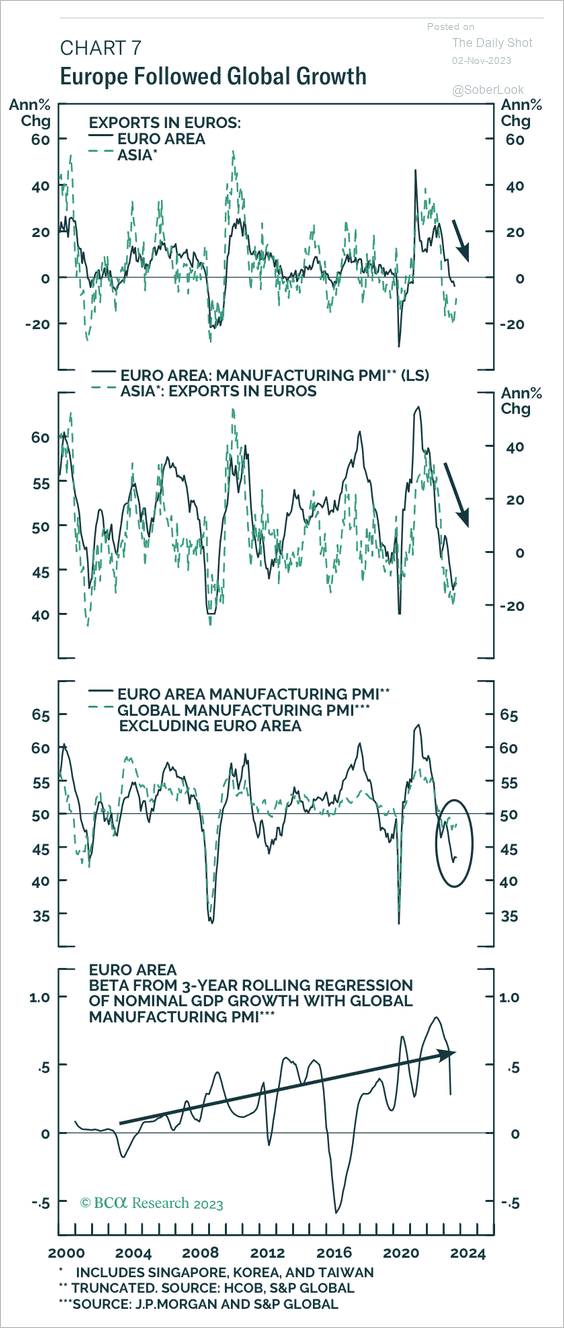

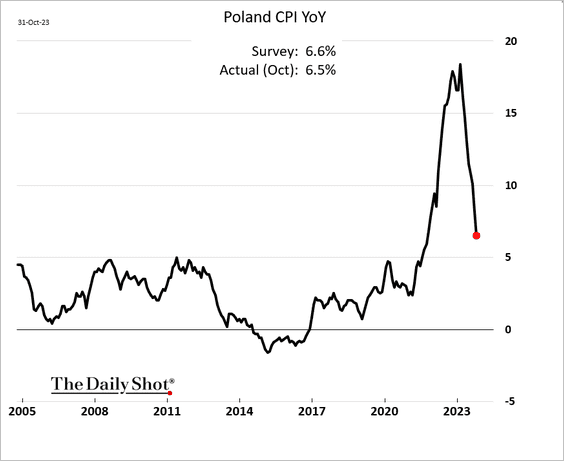

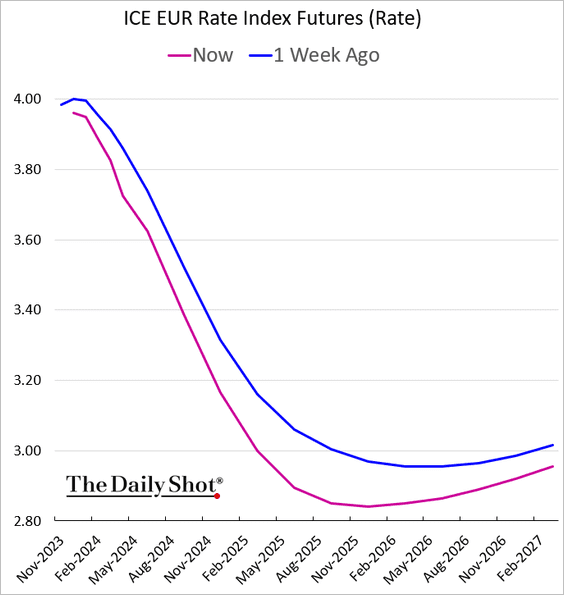

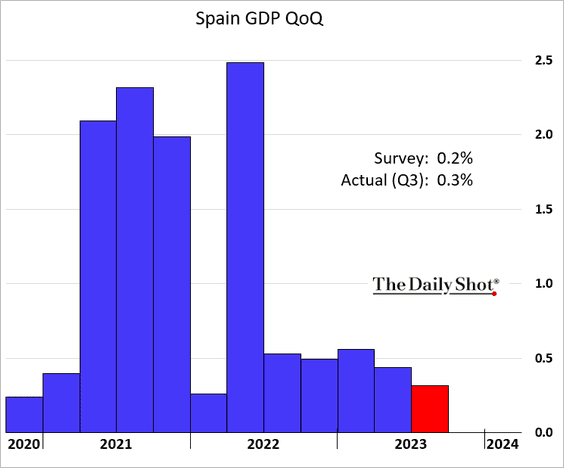

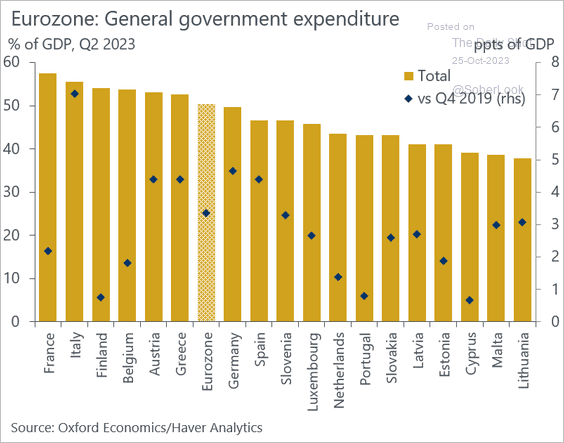

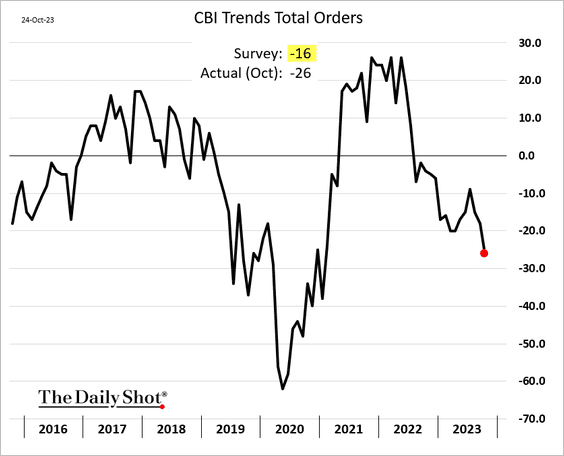

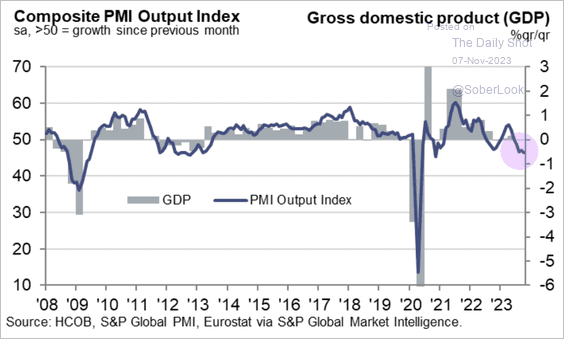

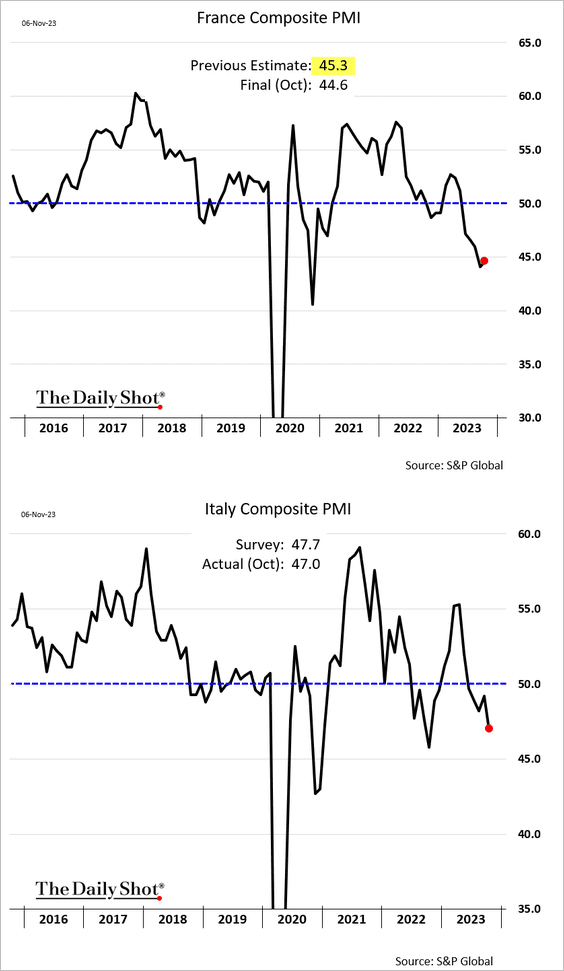

The Eurozone: Euro-area October PMI reports have been awful.

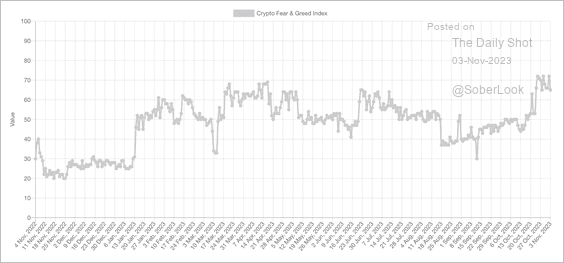

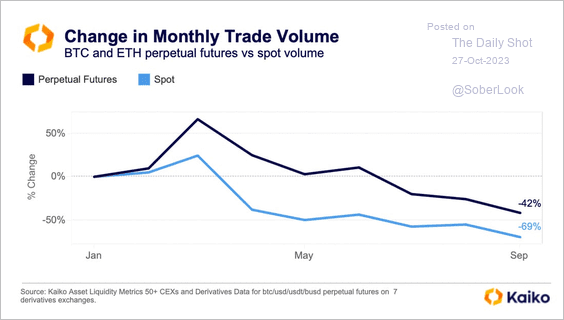

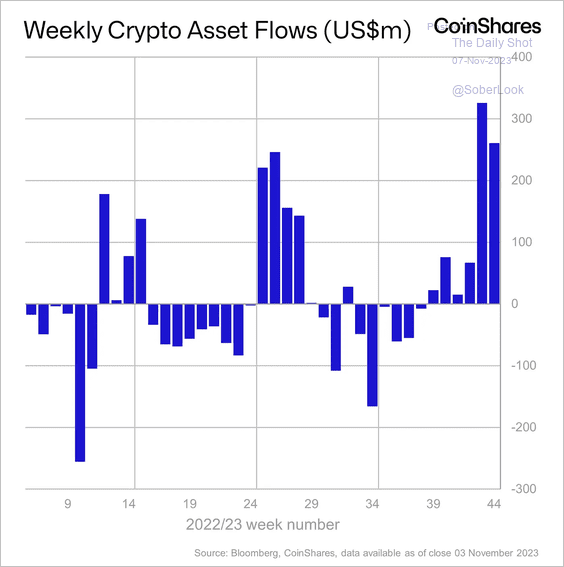

Cryptocurrency: Crypto funds saw the sixth consecutive week of inflows.

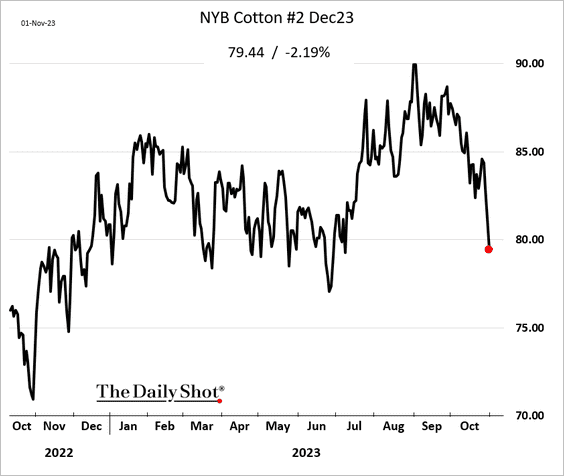

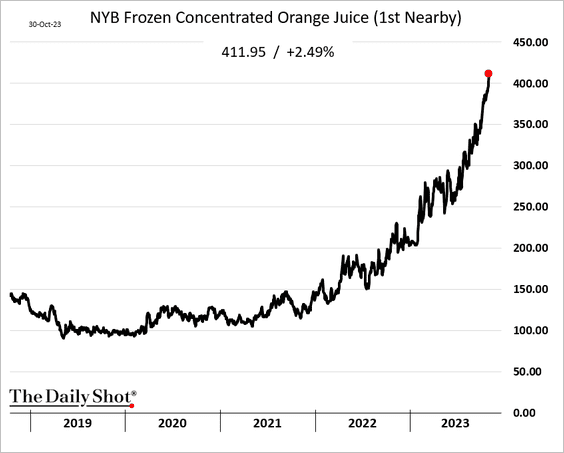

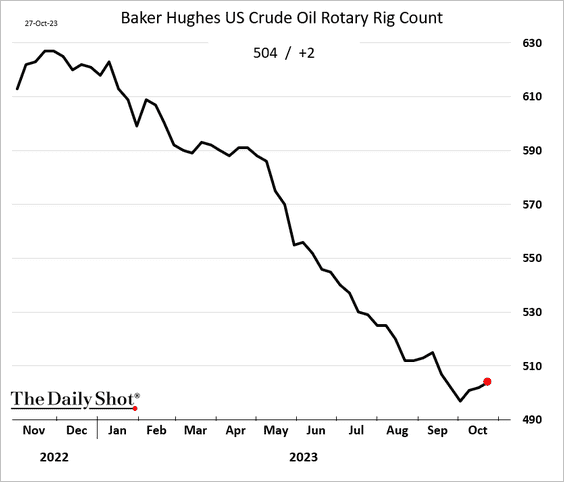

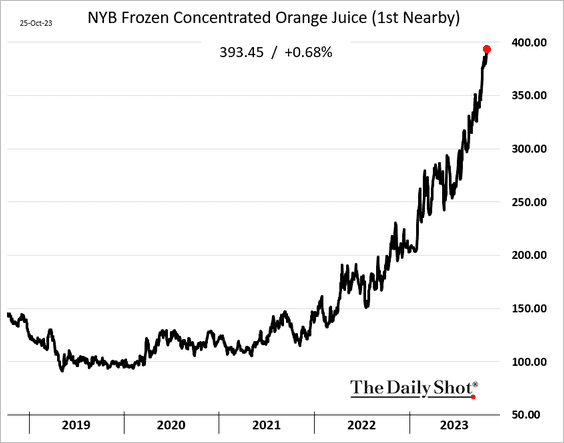

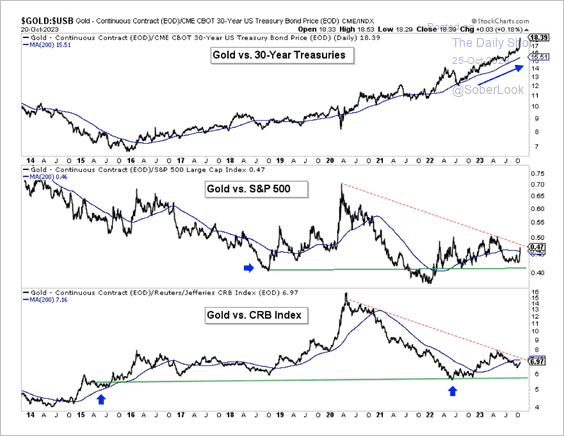

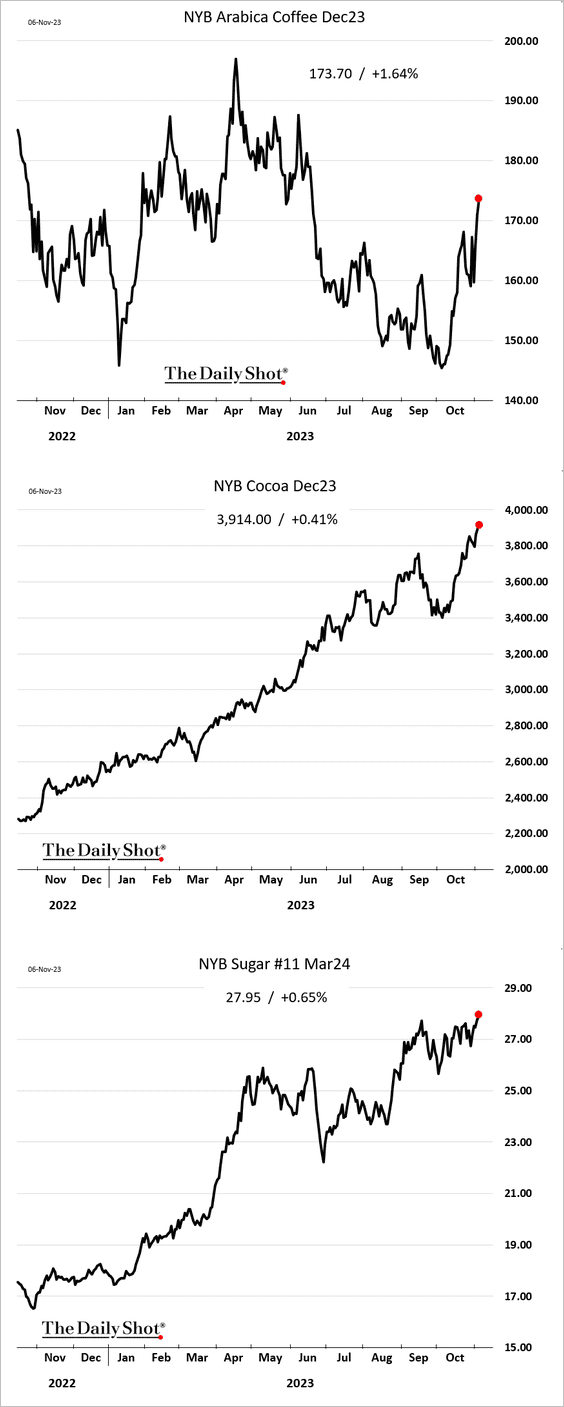

Commodities: Coffee, cocoa, and sugar continue to surge.

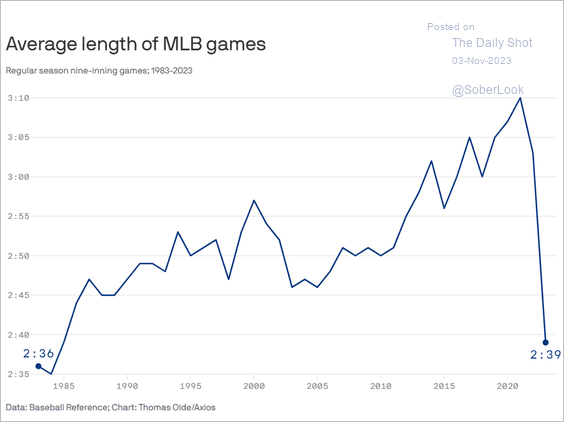

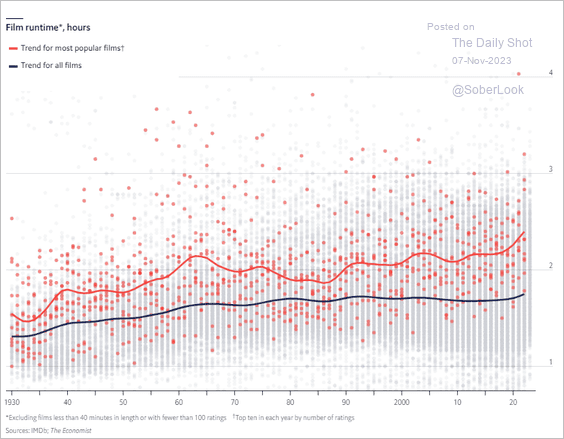

Food for Thought: Movies are becoming longer:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily ShotAverage hourly wages for US teens: Brief