Greetings,

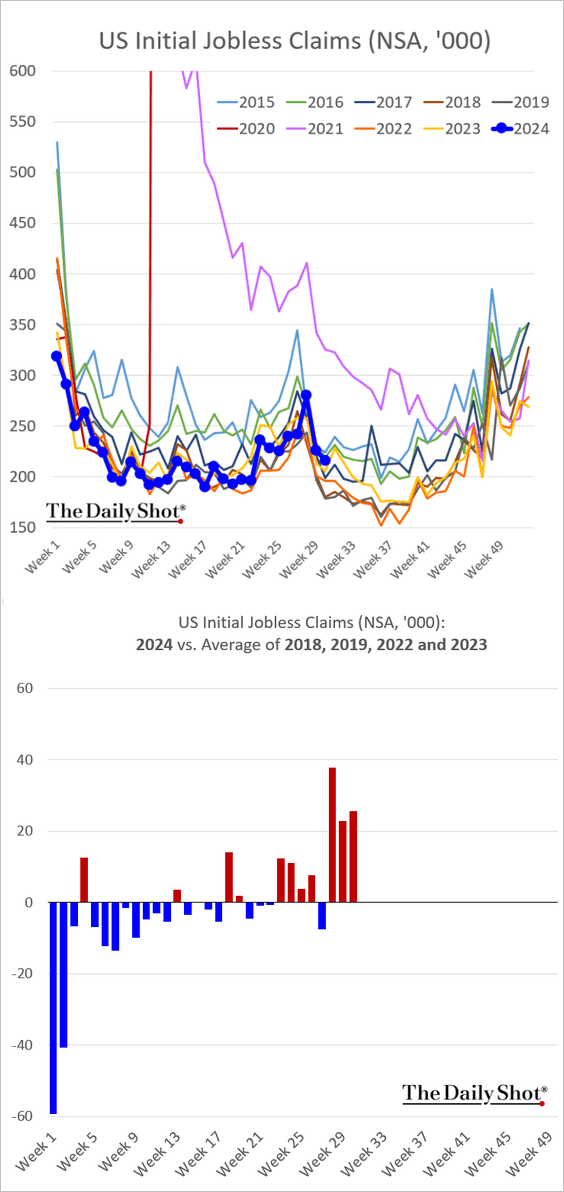

The United States: This chart shows the probability of a recession as implied by various market indicators.

China: Bond yields jumped as Beijing cracks down on debt purchases by banks.

Emerging Markets: India’s industrial production growth slowed, surprising to the downside.

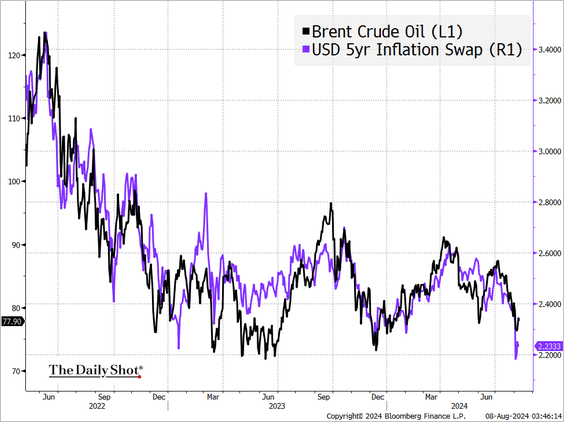

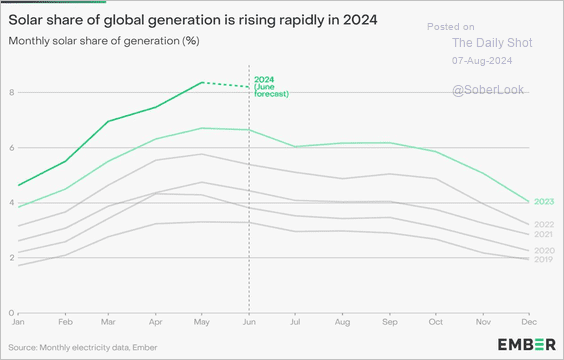

Energy: Brent crude jumped above $80/bbl due to geopolitical uncertainty but encountered resistance at the 200-day moving average.

Equities: The Fed is increasingly discussed on earnings calls.

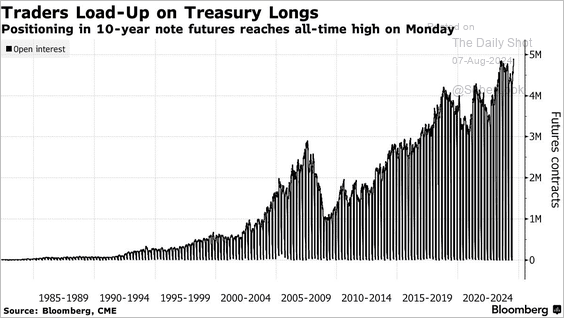

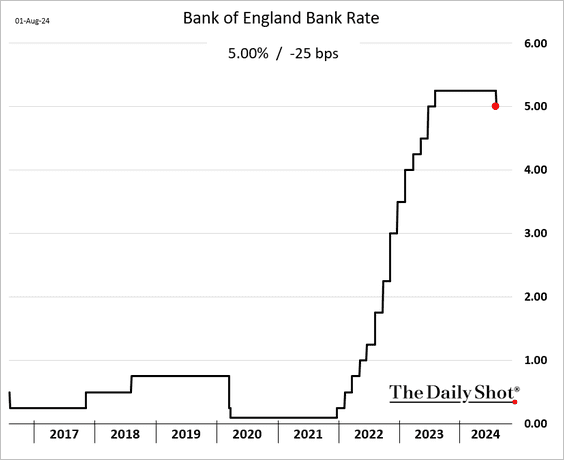

Rates: Fund managers expect short-term rates and bond yields to decline in the months ahead.

Food for Thought: Delaware is the preferred domicile for S&P 500 companies.

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily Shot Brief