Greetings,

The United States: Initial jobless claims show no signs of increasing layoffs, suggesting companies are in a holding pattern-hiring less but not resorting to layoffs either.

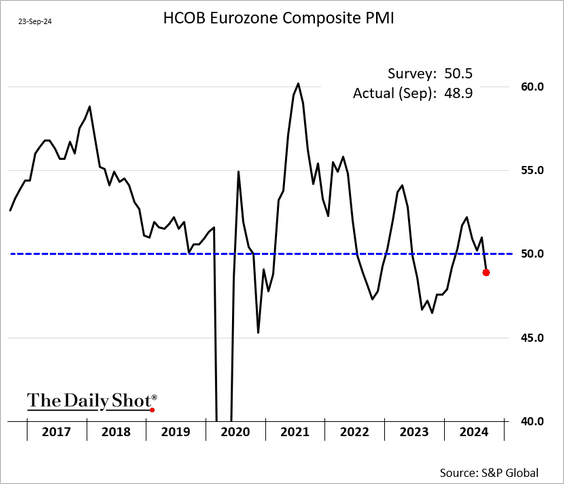

The Eurozone: The Spain/France 10-year yield spread turned negative for the first time since 2007 (2 charts).

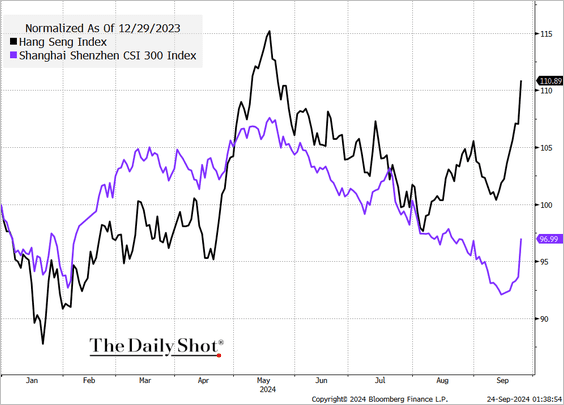

China: Stocks continue to surge.

Cryptocurrency: Traditional assets have experienced higher-than-usual volatility compared to Bitcoin over the past year.

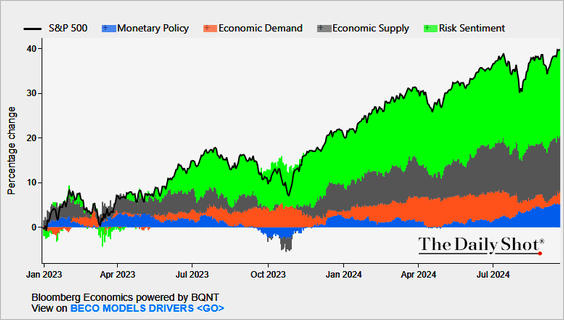

Equities: The S&P 500 hit its 42nd record high of 2024 and is now up almost 34% year-over-year.

Rates: Treasury funds are seeing outflows.

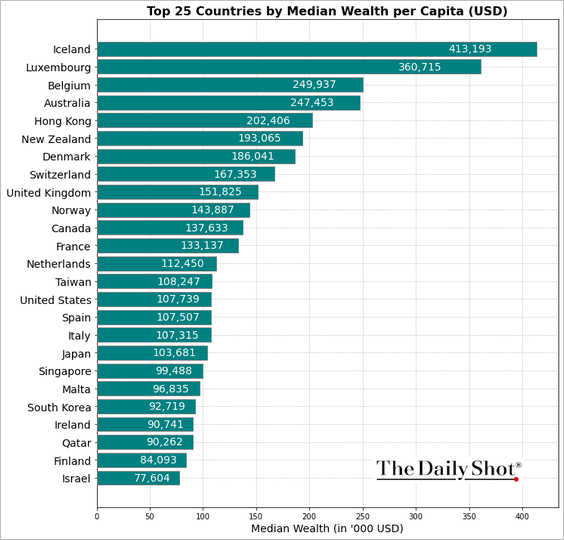

Food for Thought: Countries with the highest median wealth per capita:

Edited by Josh Oldmixon

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily Shot Brief