Greetings,

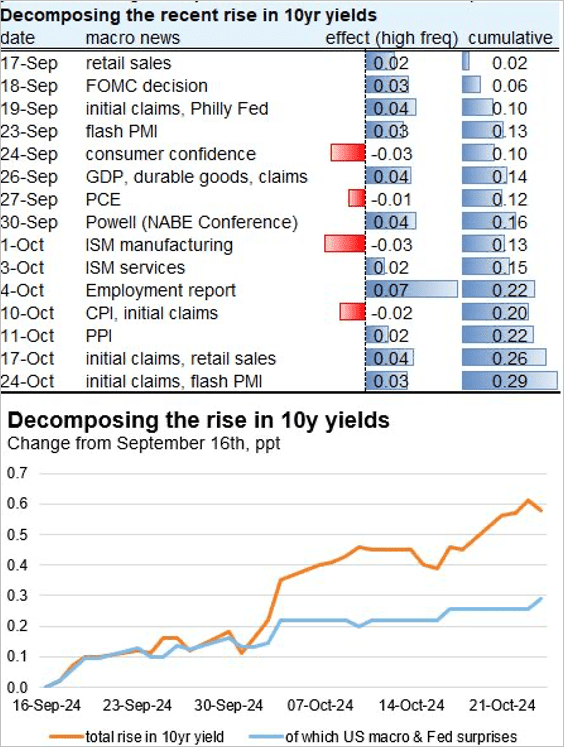

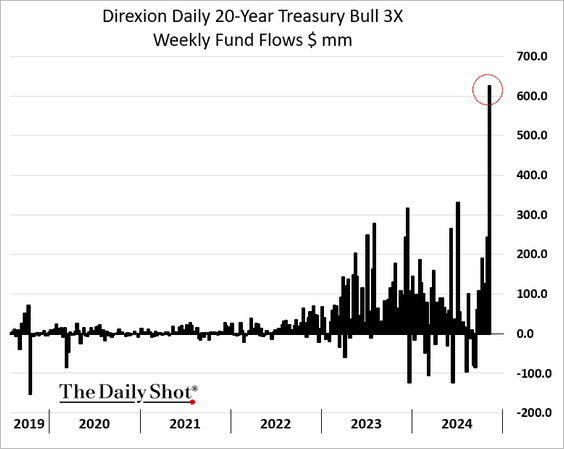

Rates: The 3x leveraged long-term Treasury ETF is experiencing massive inflows, indicating that some investors believe Treasury yields are peaking.

Credit: High-yield bond spreads are the tightest they’ve been since before the GFC.

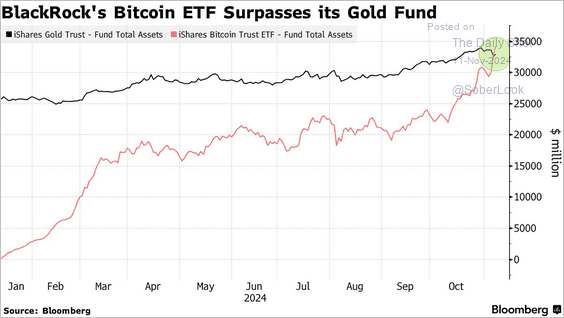

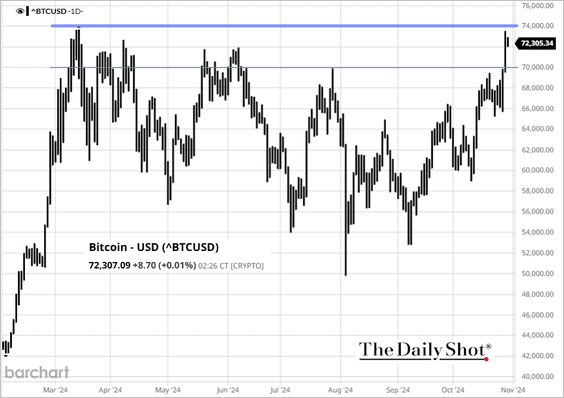

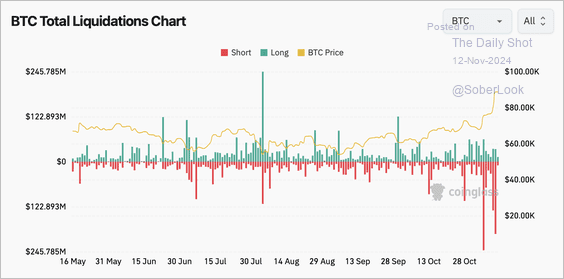

Cryptocurrency: Short liquidations continued to spike after BTC/USD accelerated past $80K.

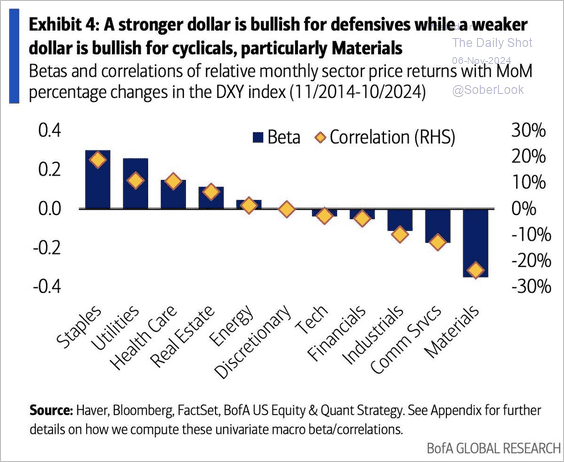

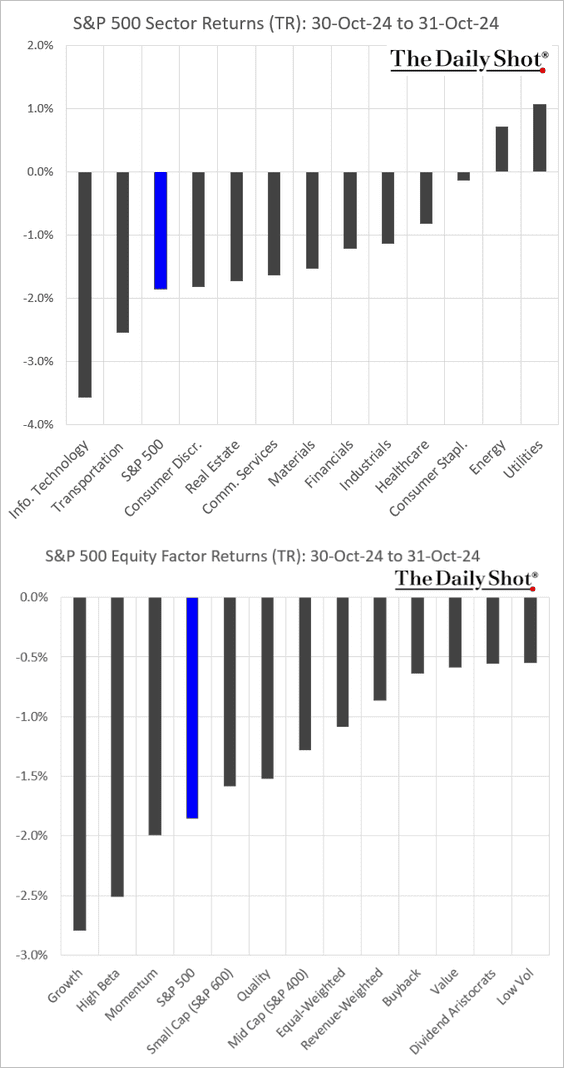

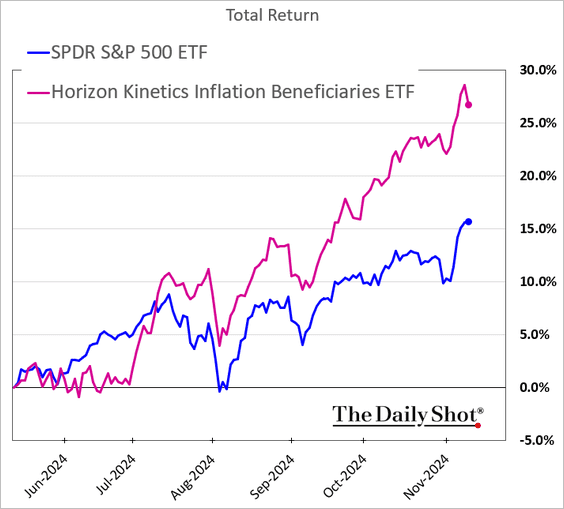

The United States: Stocks that tend to benefit from higher inflation have been outperforming.

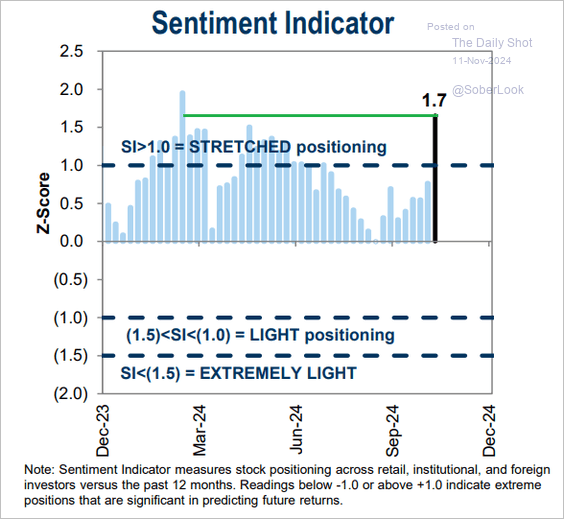

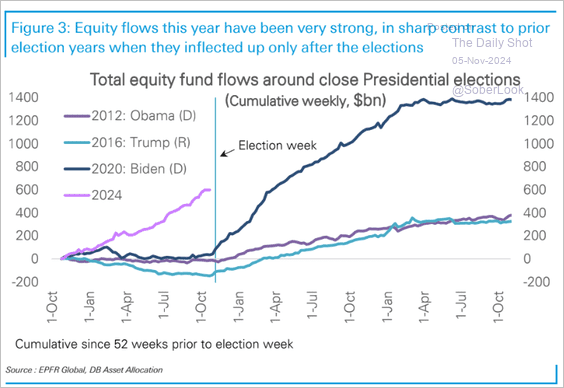

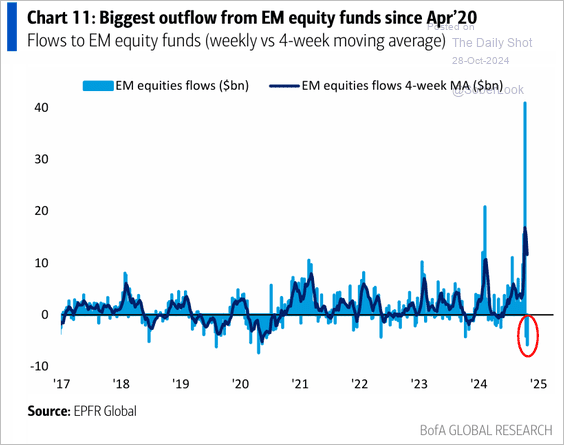

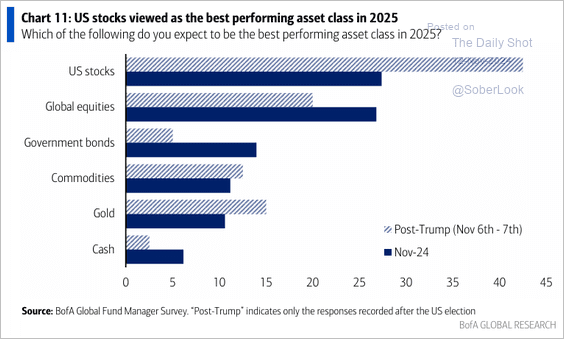

Equities: Global investors remain enthusiastic about US equities.

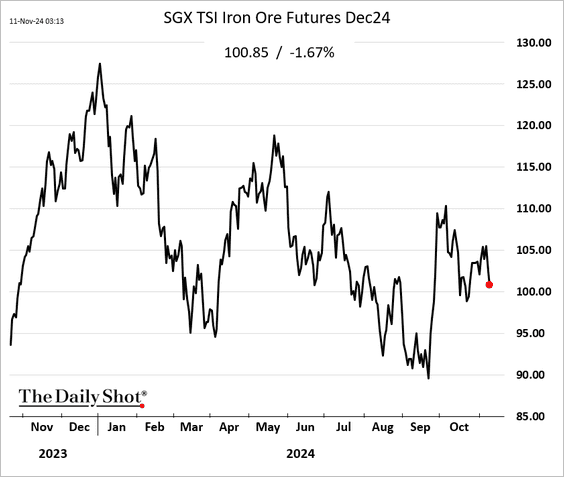

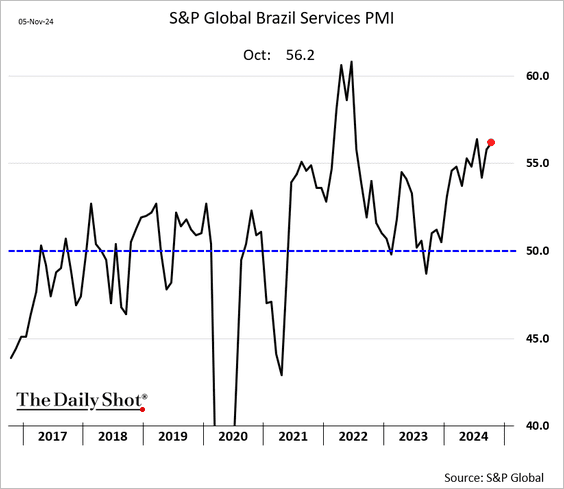

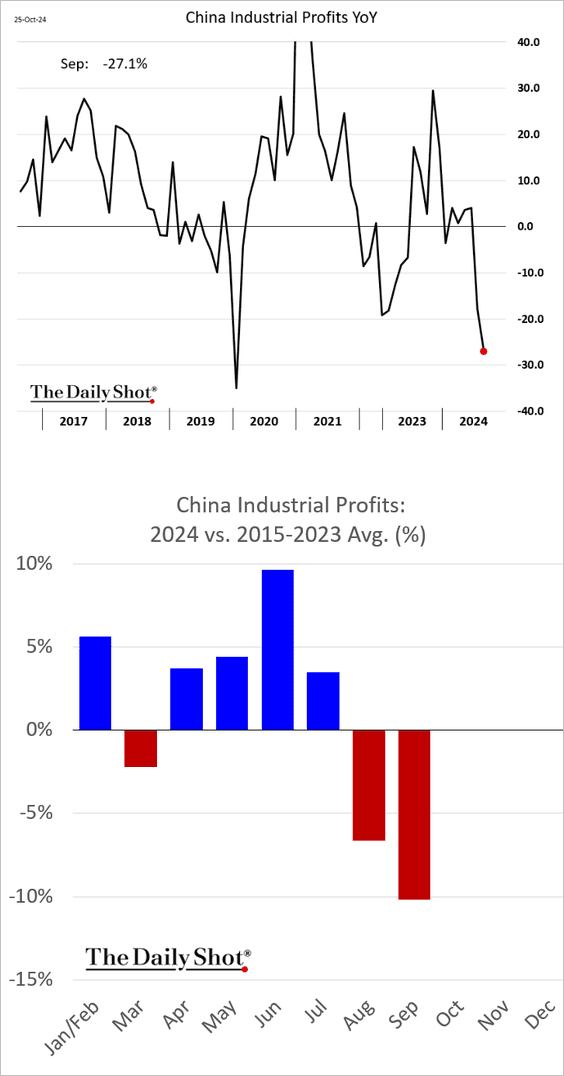

China: Economic momentum is starting to improve.

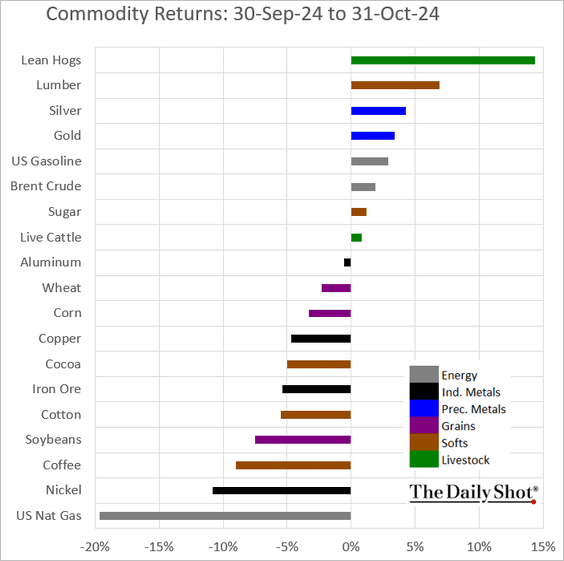

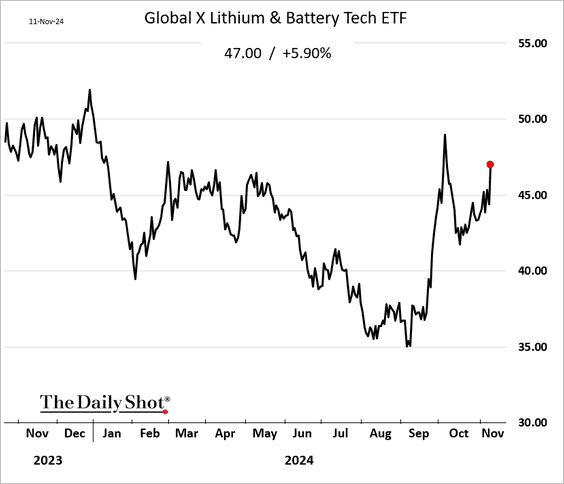

Commodities: Lithium miners are cutting production, sending prices higher.

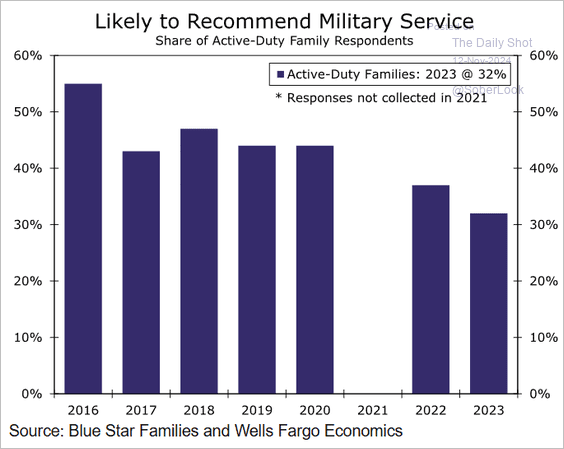

Food for Thought: The US military is grappling with mounting recruitment challenges.

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily Shot Brief