Greetings,

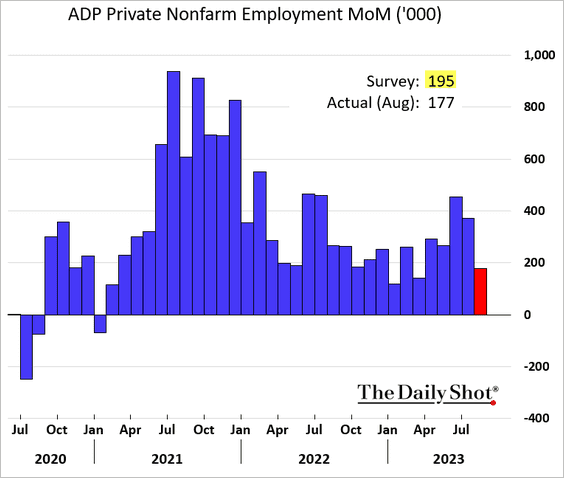

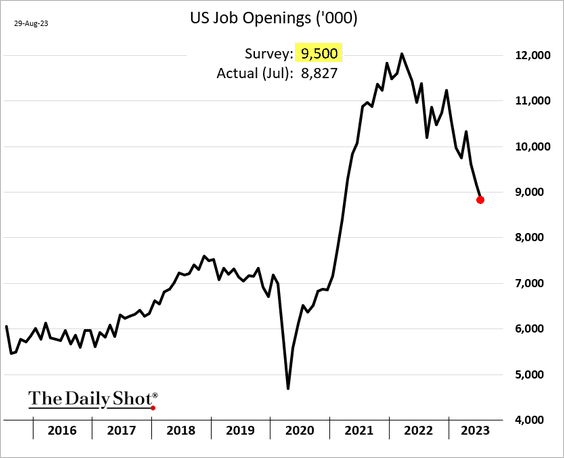

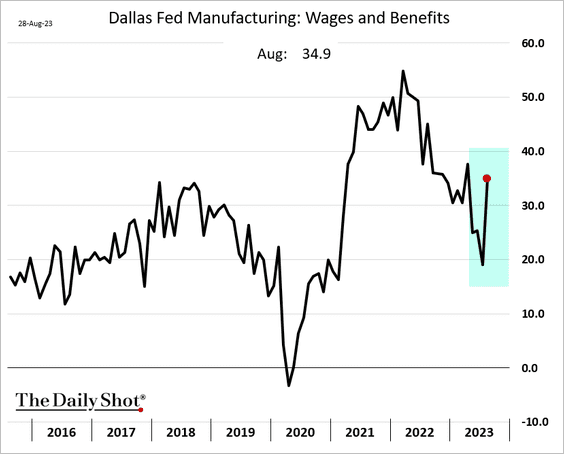

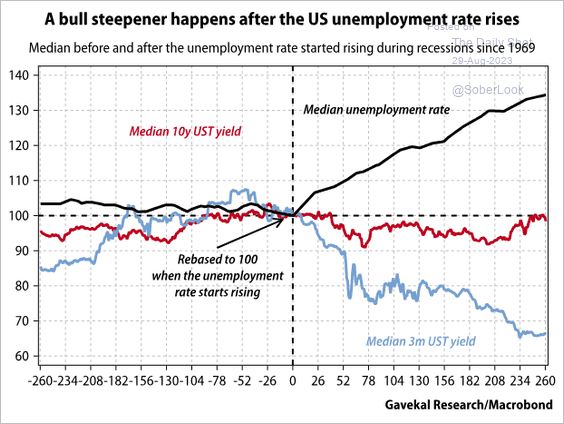

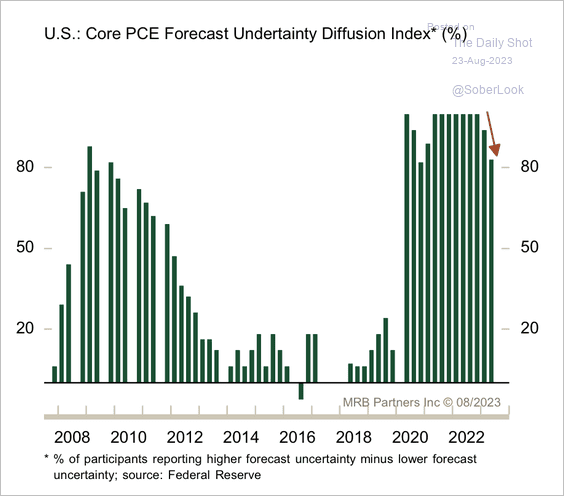

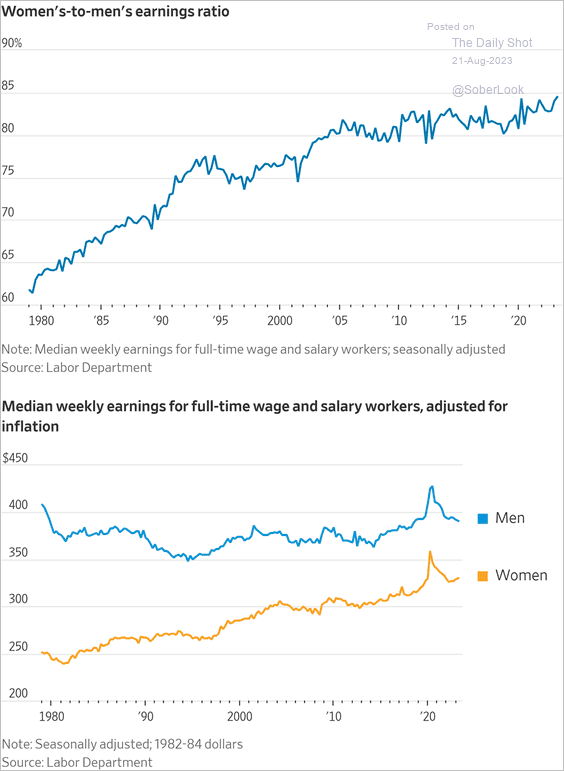

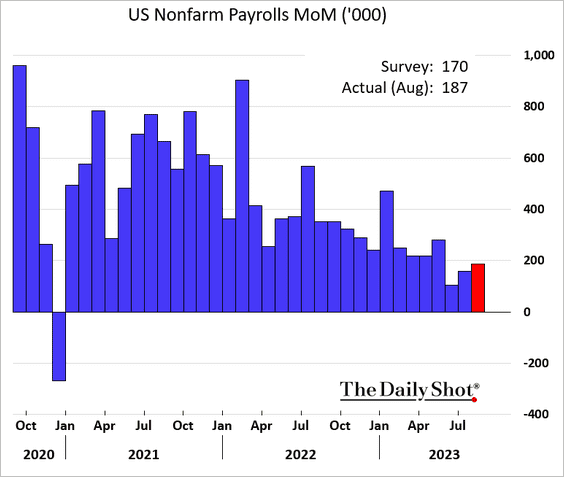

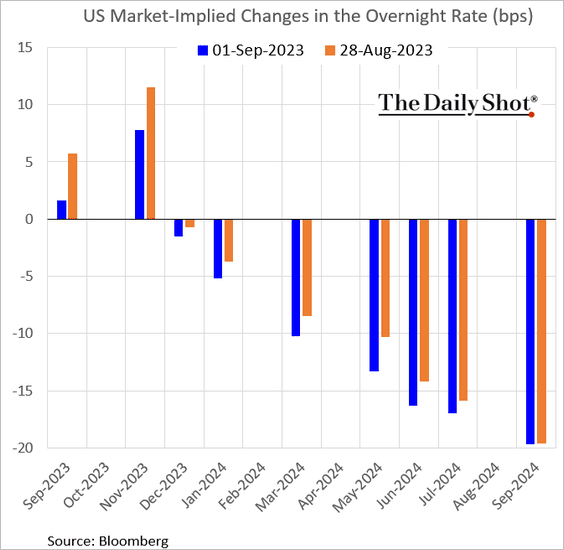

The United States: Hiring remained robust in August, but the labor market continues to soften.

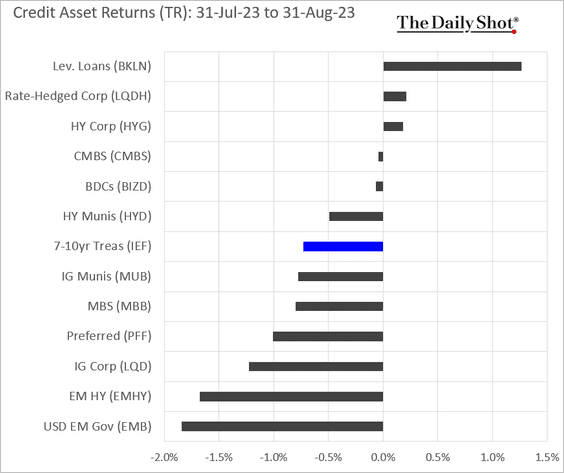

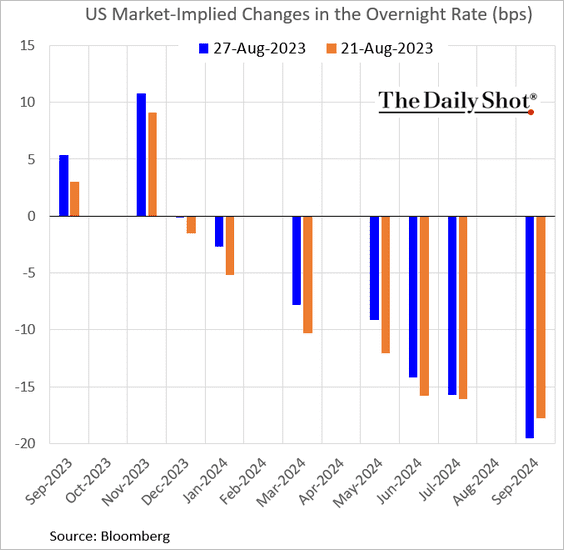

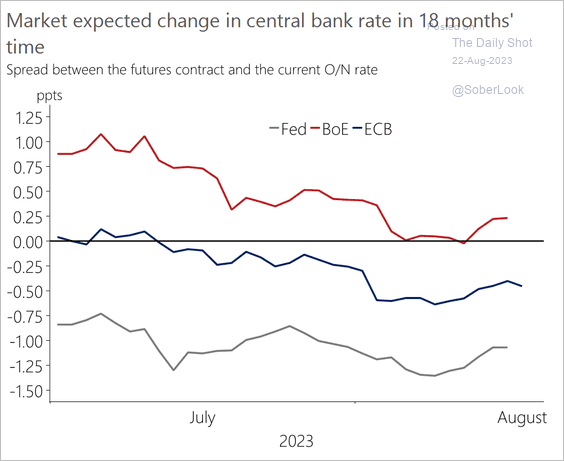

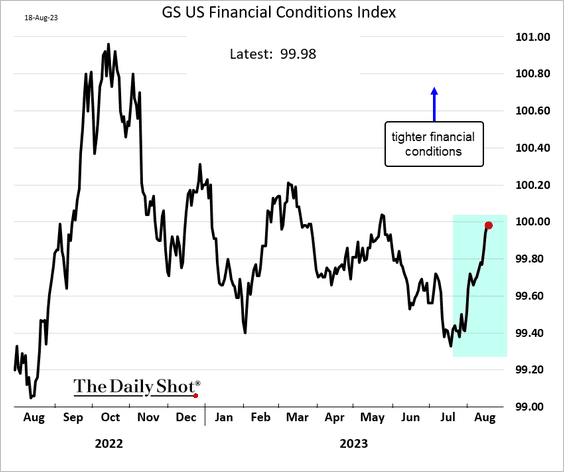

The jobs report reinforces the view that the Fed is likely done with rate hikes.

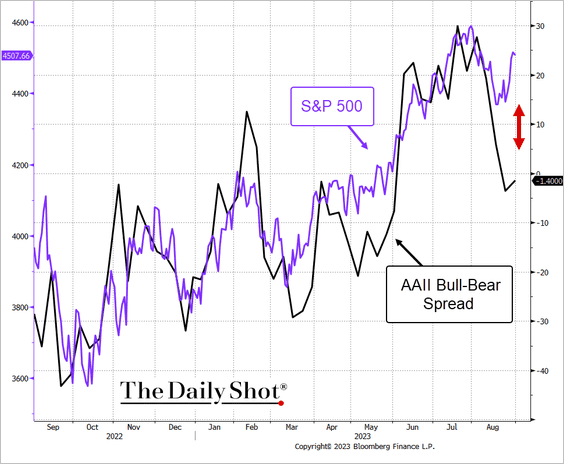

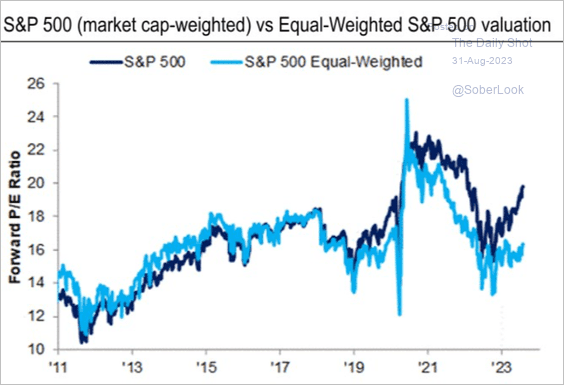

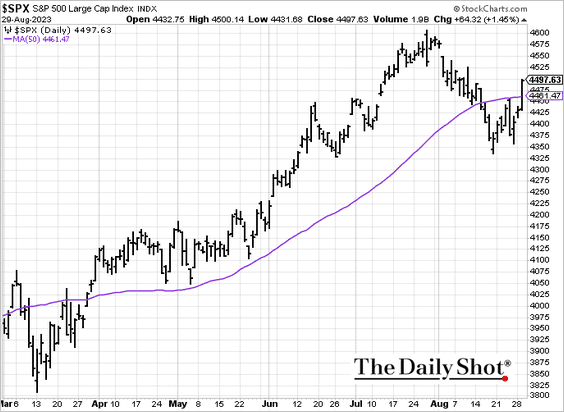

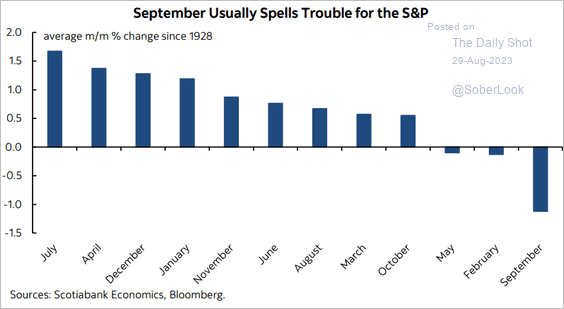

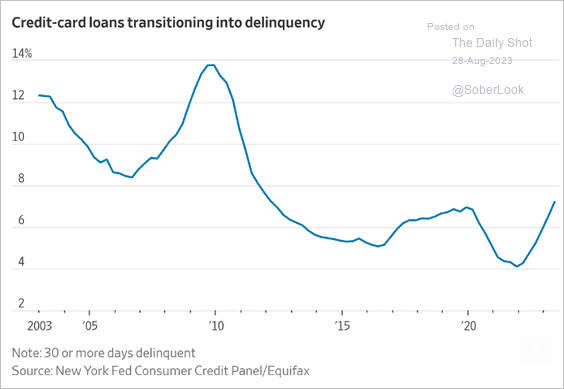

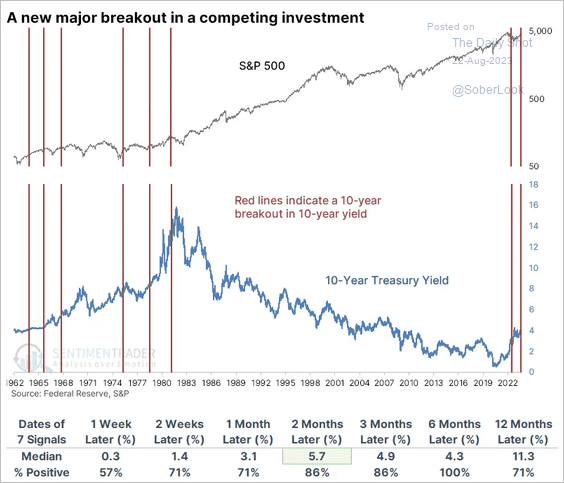

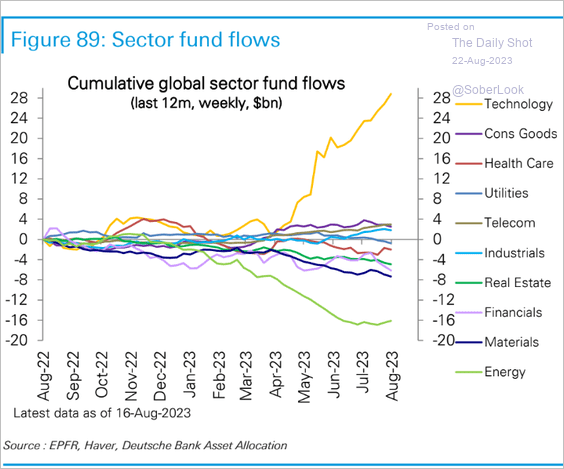

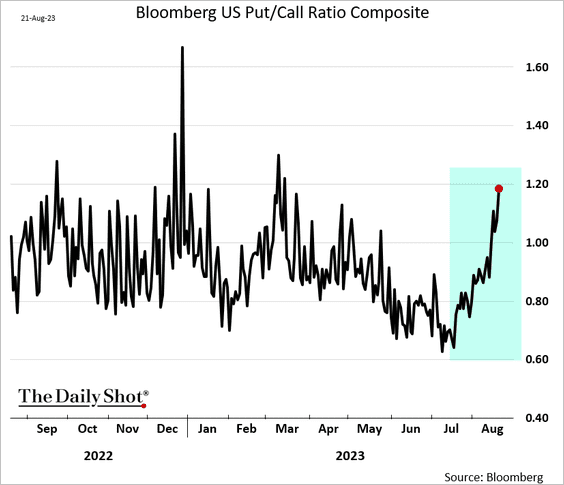

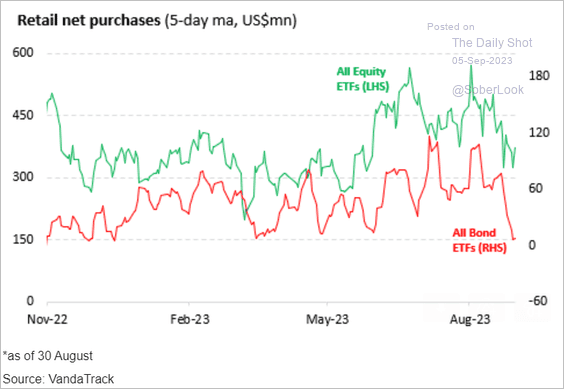

Equities: Softer retail ETF demand was more about fixed income than equities.

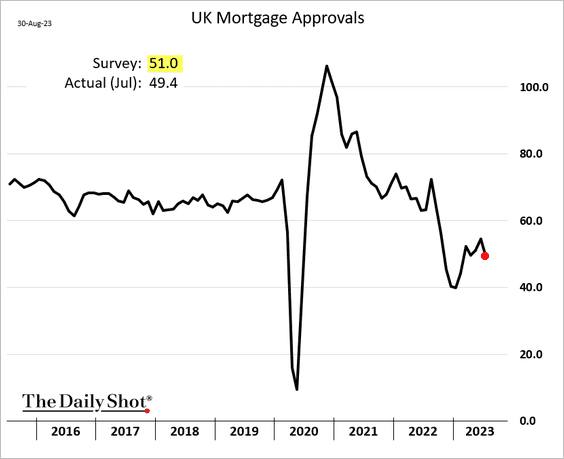

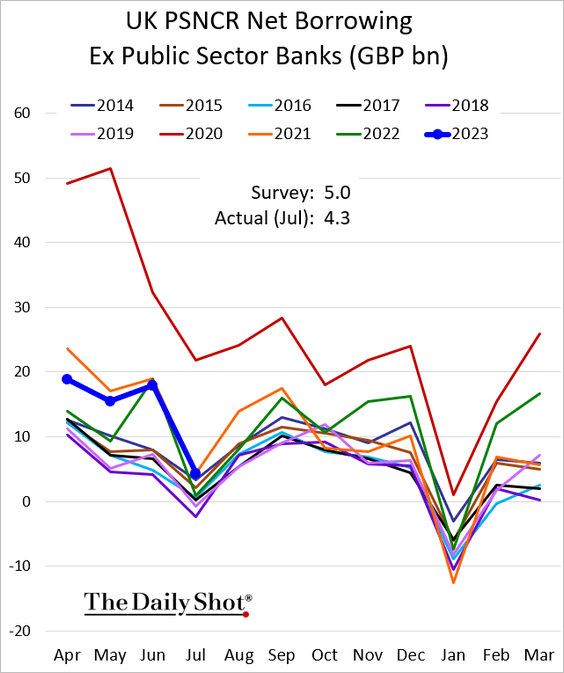

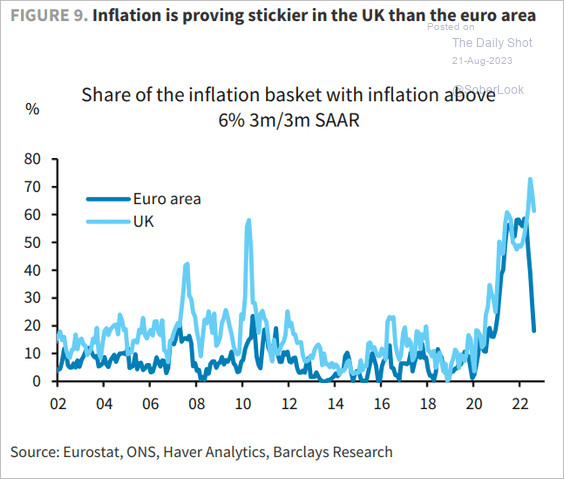

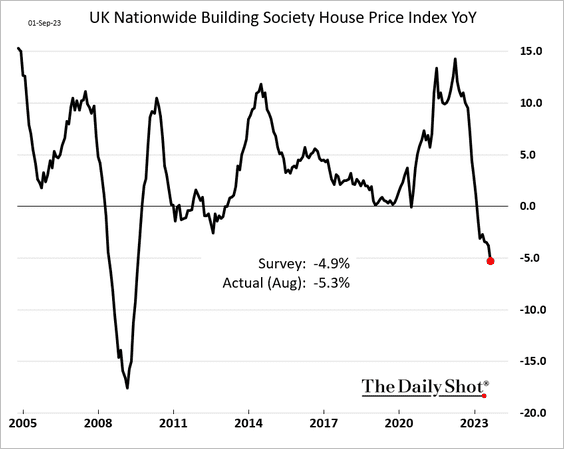

The United Kingdom: Home price declines haven’t been this severe since the GFC.

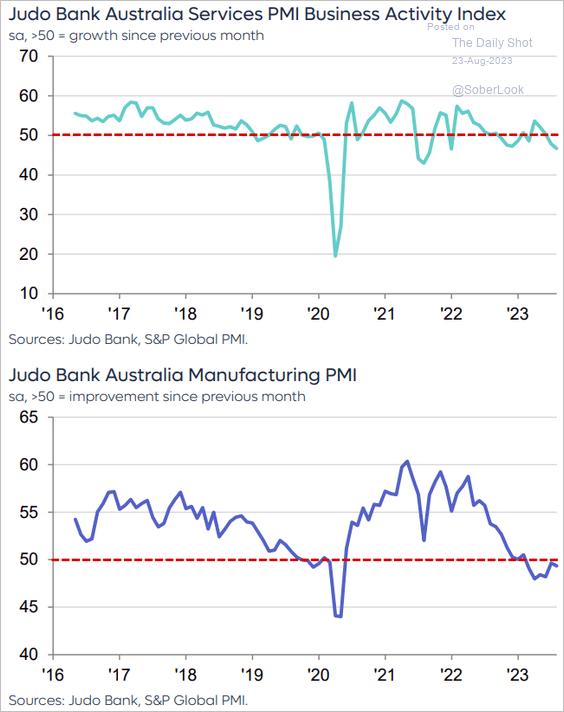

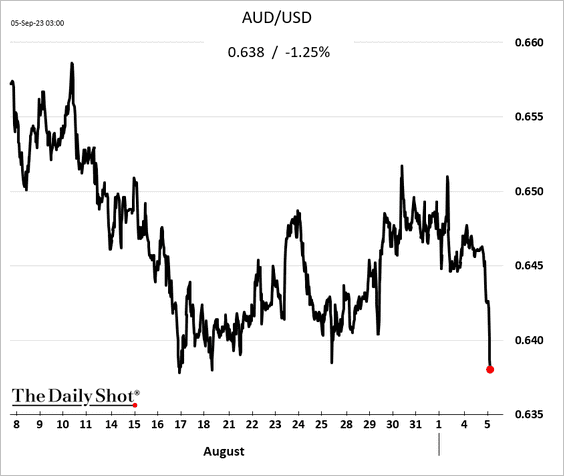

Asia-Pacific: The Aussie dollar is sharply lower after the RBA left rates unchanged again.

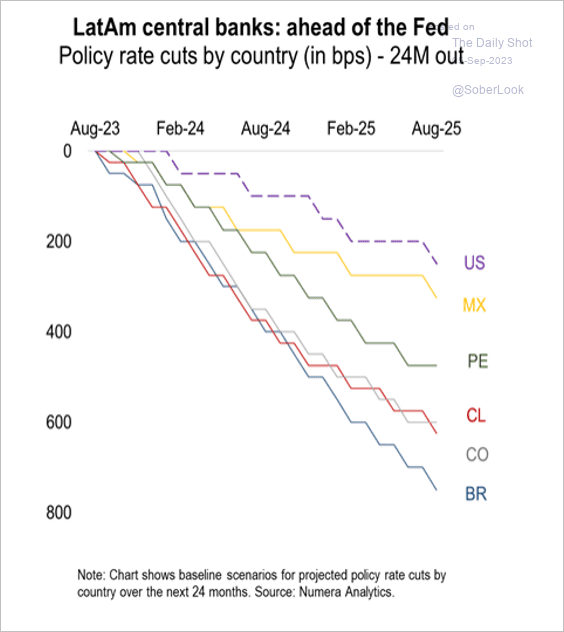

Emerging Markets: Here is a look at LatAm policy rate forecasts.

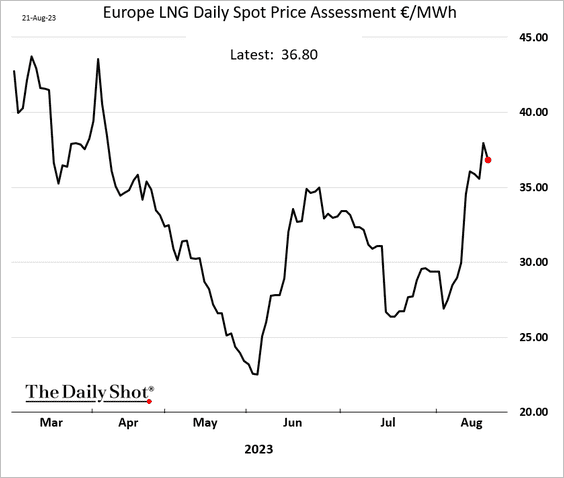

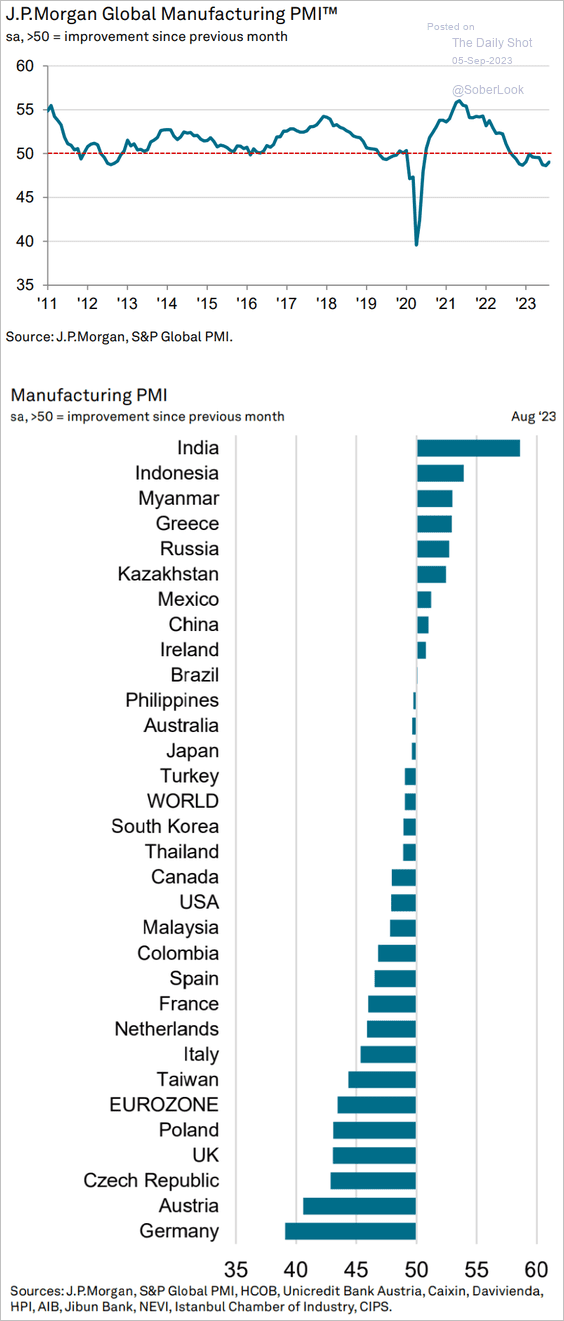

Global Developments: Global factory activity remains in contraction mode.

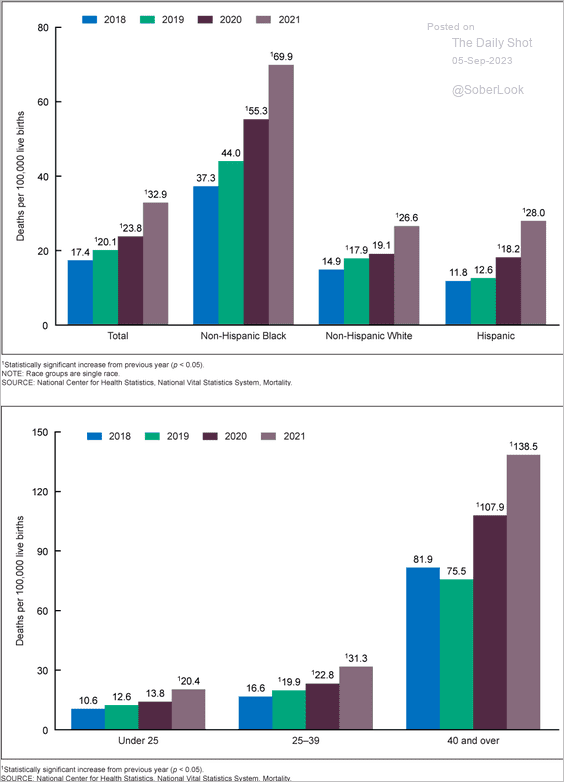

Food for Thought: Here are US maternal mortality rates:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily ShotAverage hourly wages for US teens: Brief