Greetings,

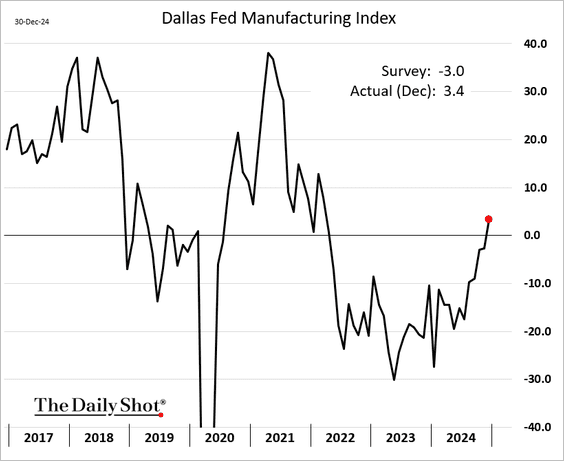

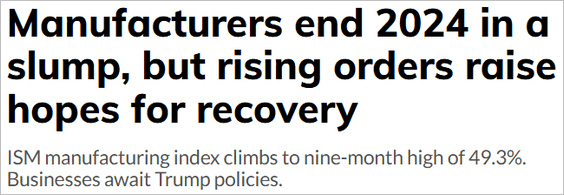

The United States: According to the ISM PMI report, the US manufacturing downturn eased in December as demand strengthened

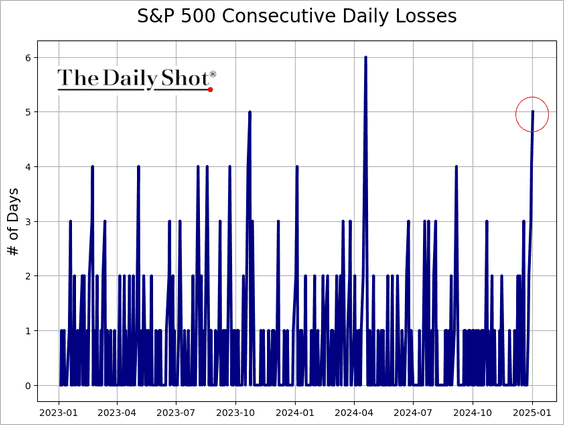

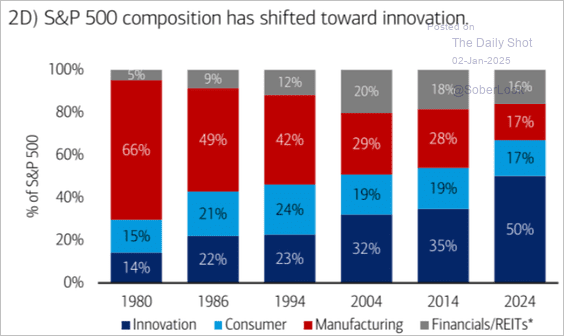

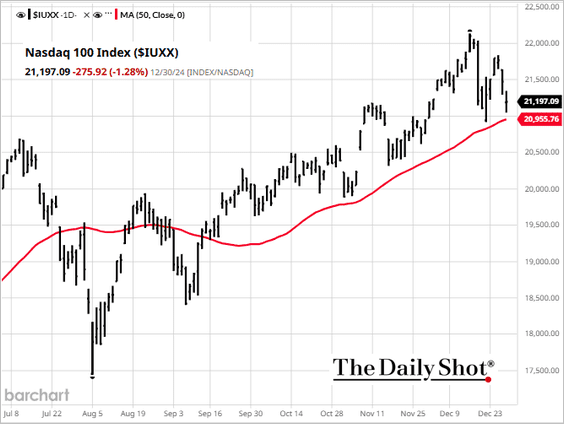

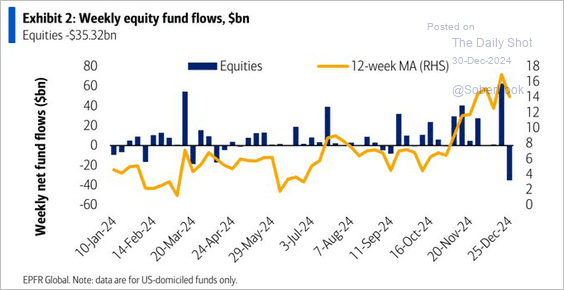

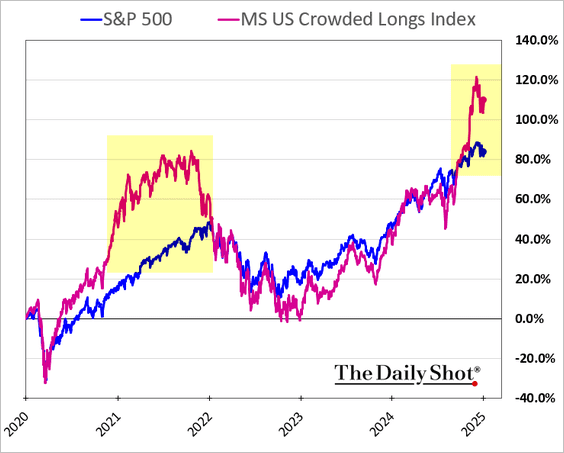

Equities: Crowded longs are outperforming again.

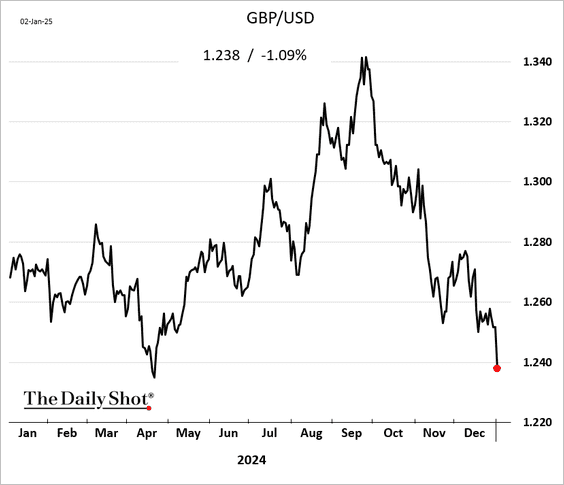

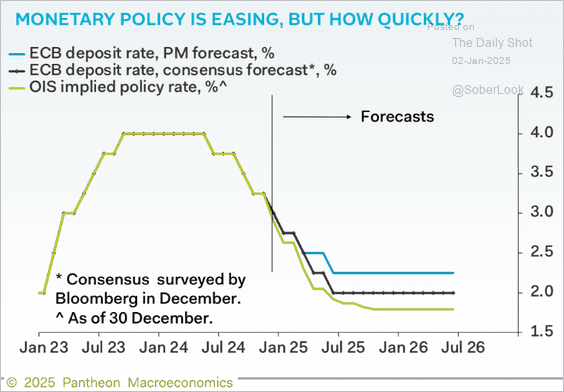

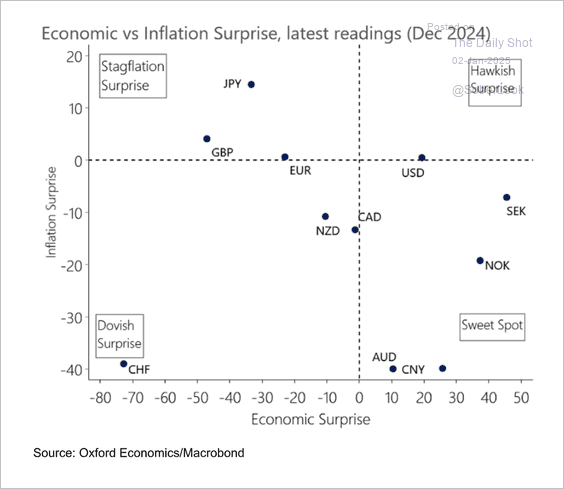

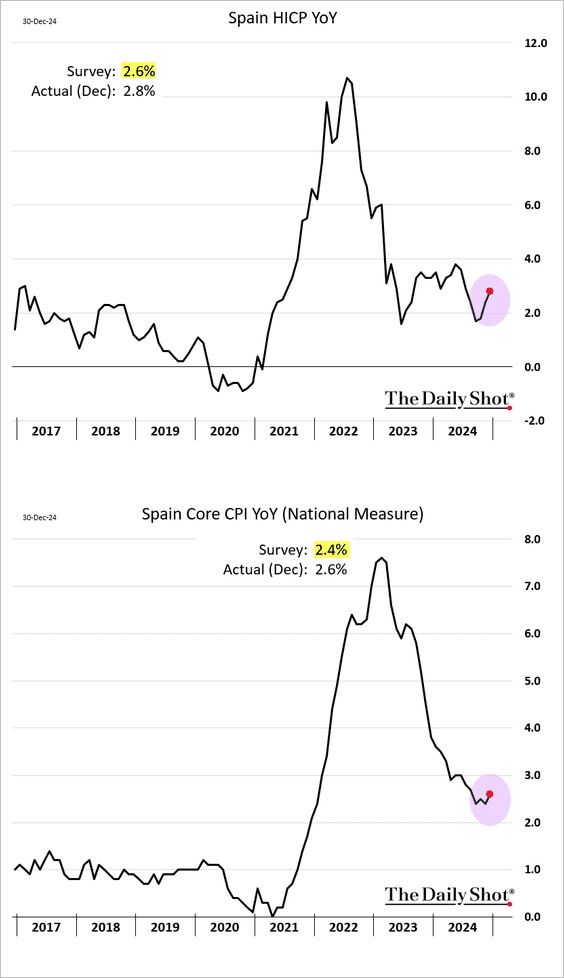

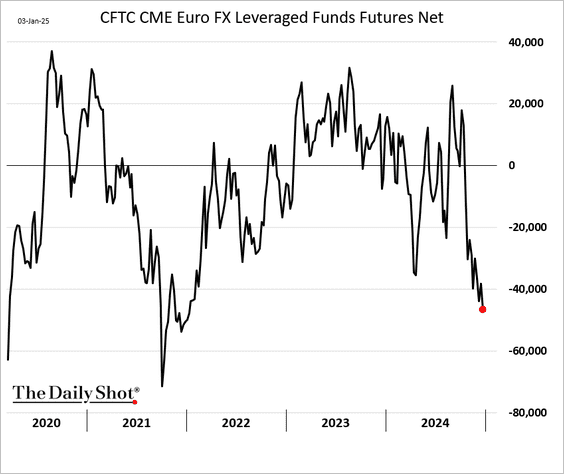

The Eurozone: Hedge funds are increasingly bearish on the euro.

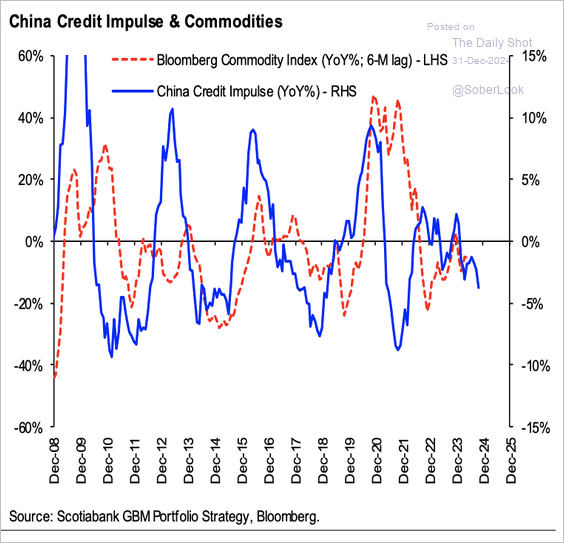

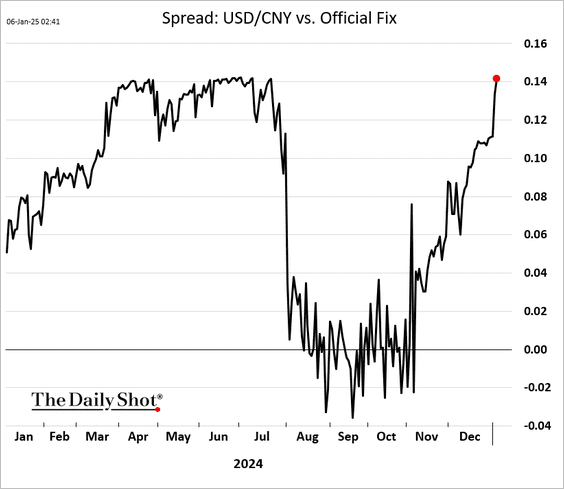

China: The renminbi weakened beyond 7.3 to the dollar as Beijing increasingly signals its intent to curb the currency’s decline.

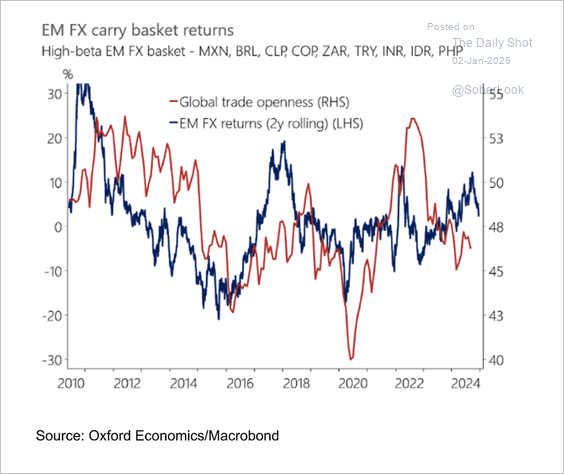

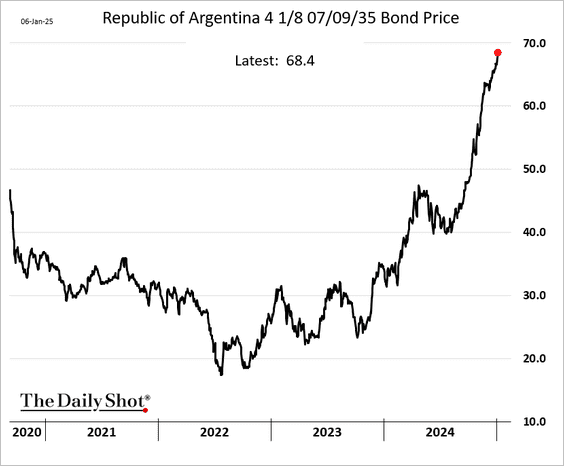

Emerging Markets: Argentina’s USD-denominated bonds continue to see a rebound as Milei secures bank financing.

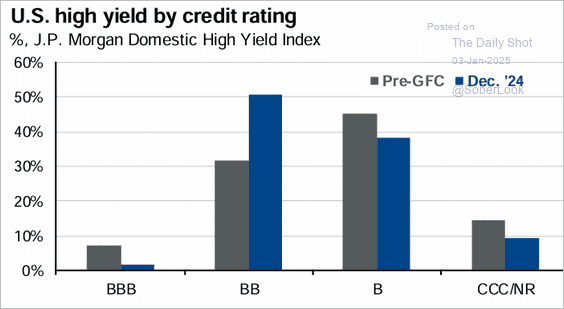

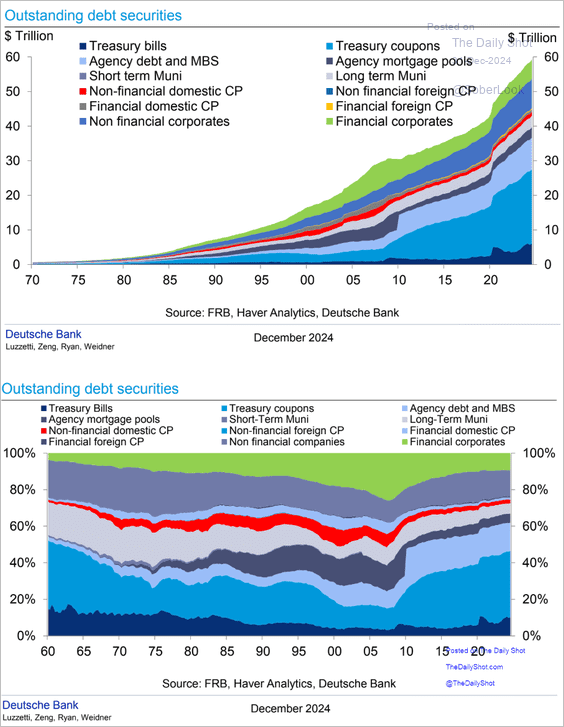

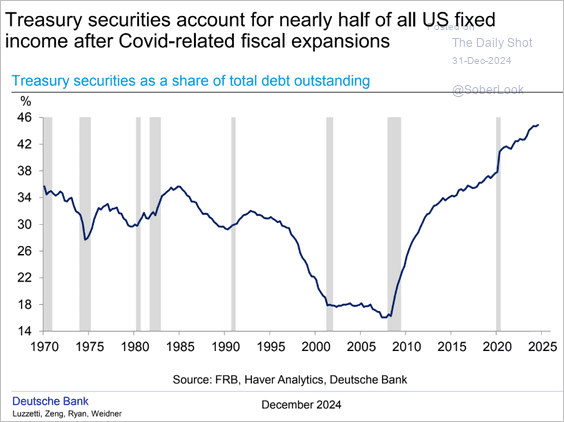

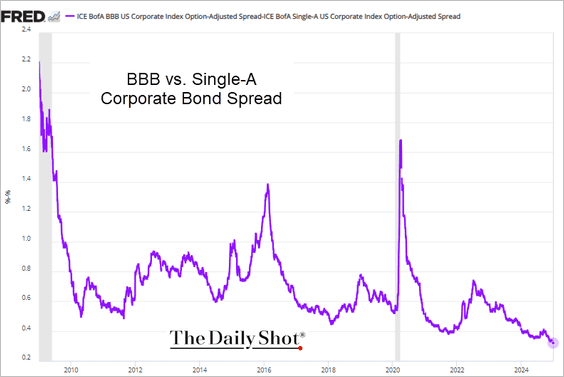

Credit: US corporate BBB/single-A spread hit a multi-year low, indicating higher risk appetite.

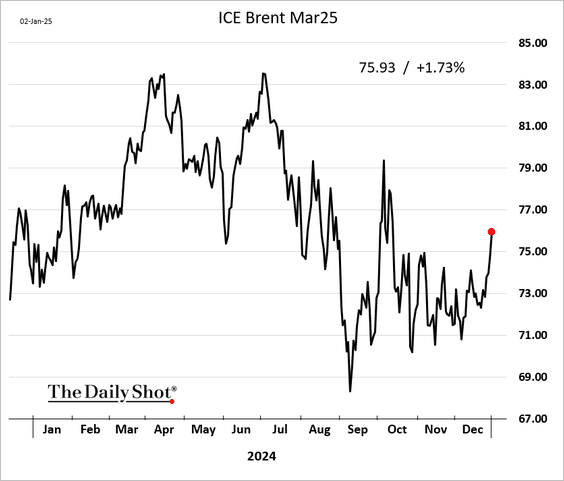

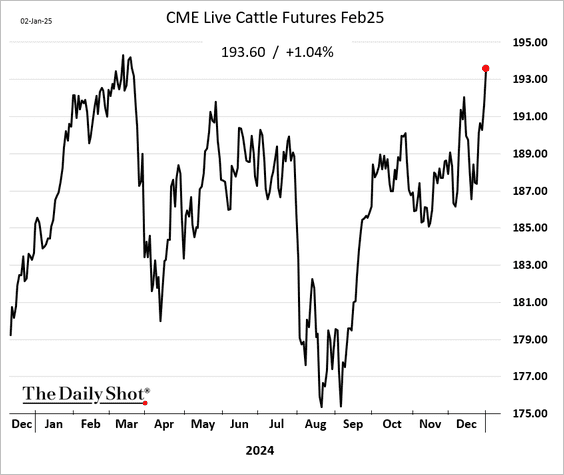

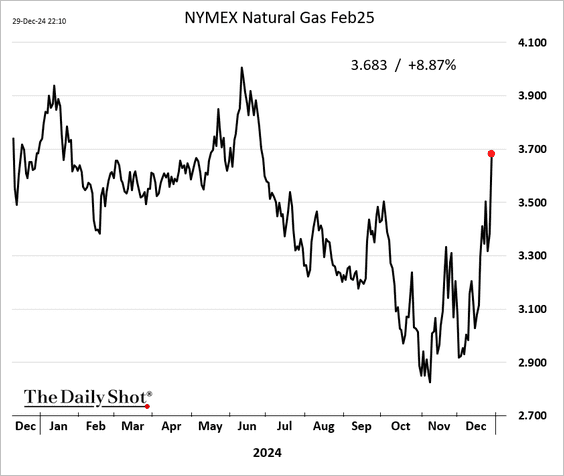

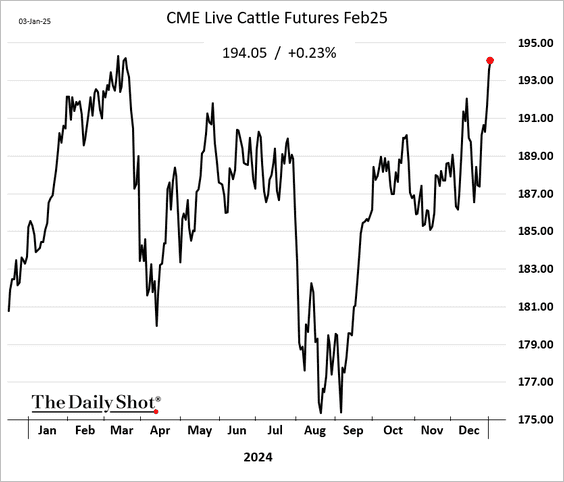

Commodities: Cattle futures continue to rally.

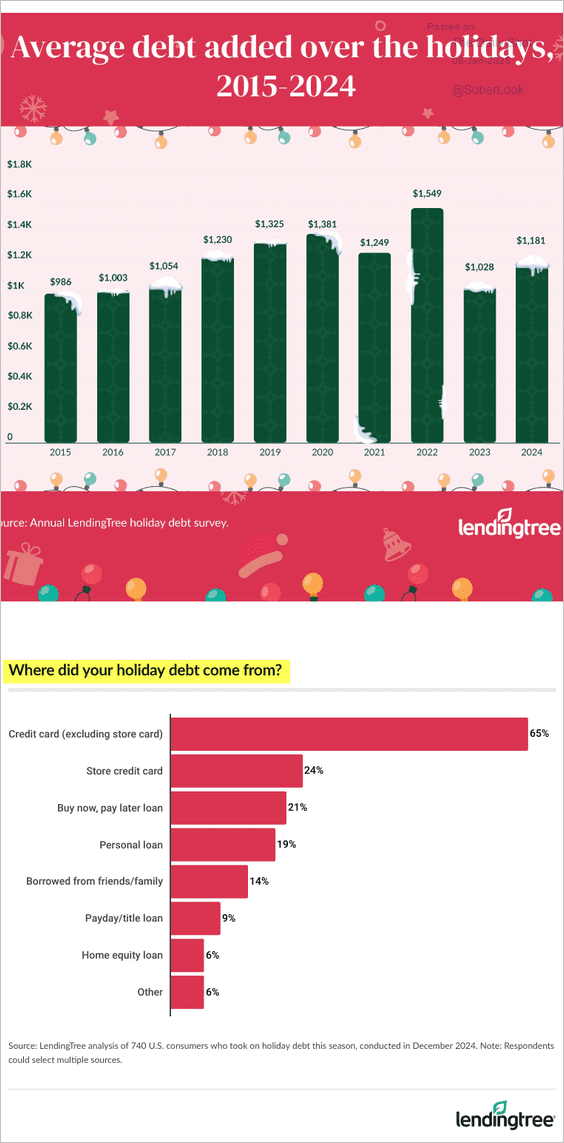

Food for Thought: Holiday debt trends:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily Shot Brief