Greetings,

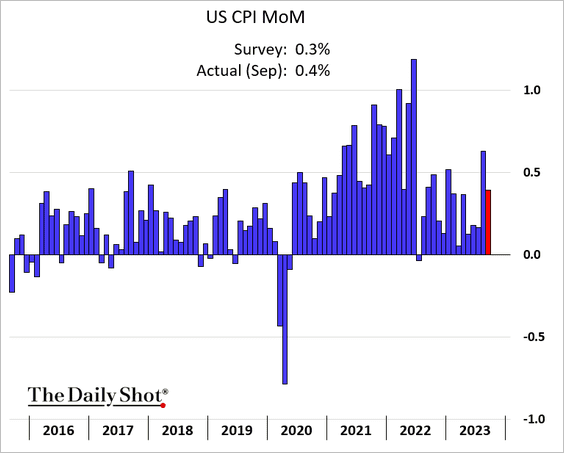

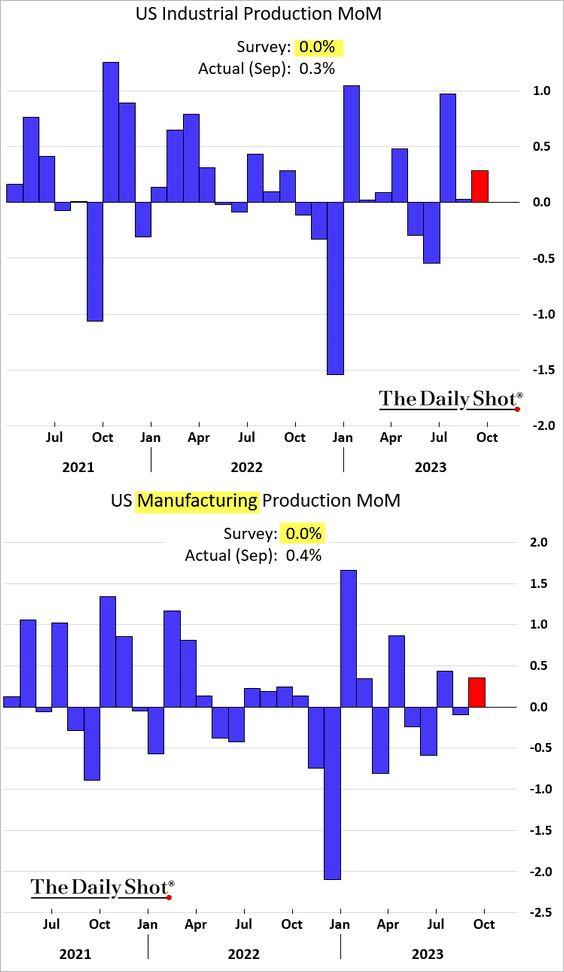

The United States: Industrial production also surprised to the upside, with robust gains in manufacturing output.

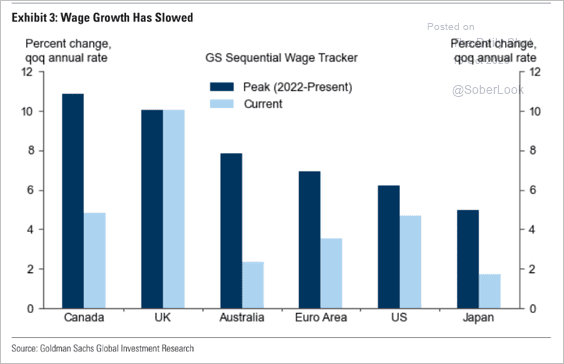

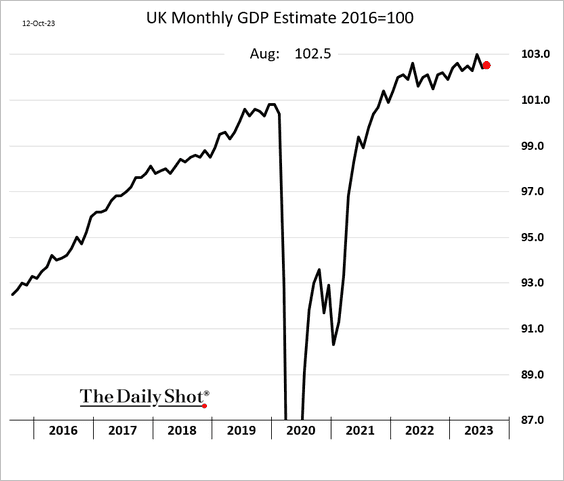

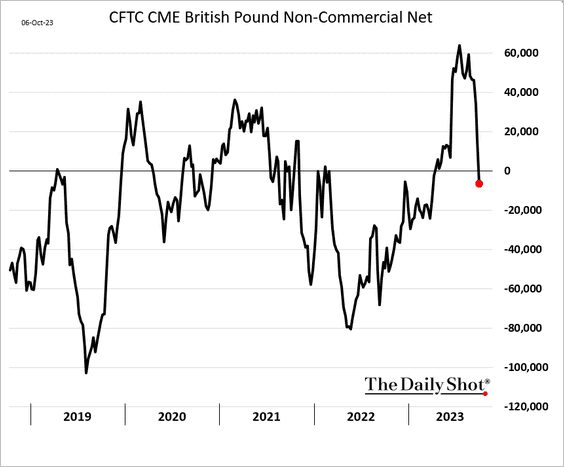

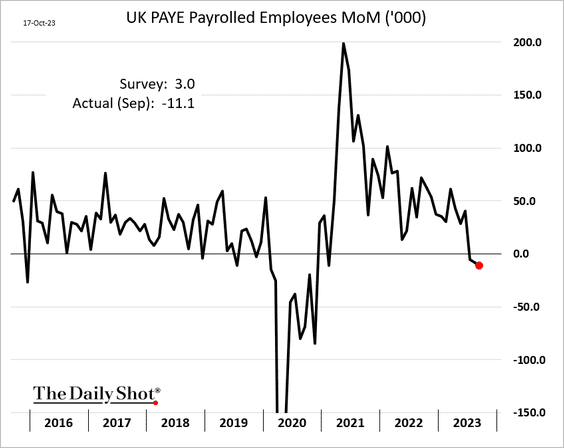

The United Kingdom: The payrolls estimate declined again, pointing to a softening labor market.

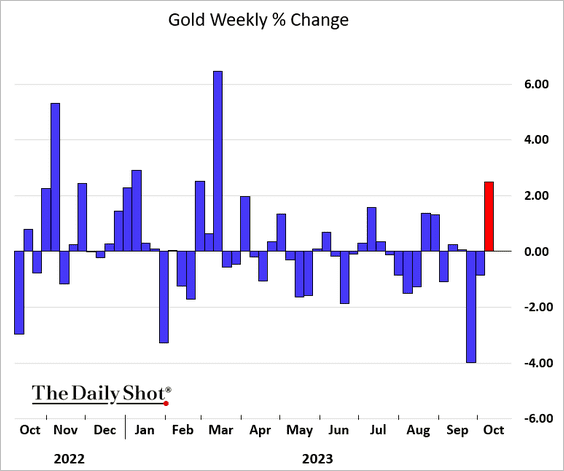

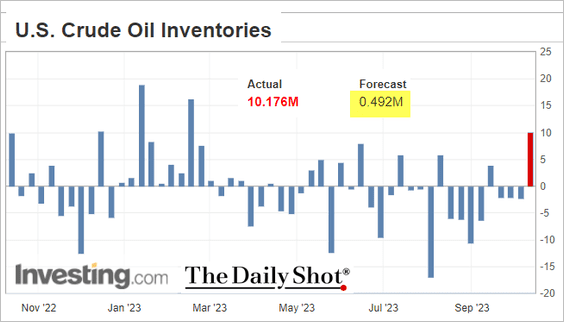

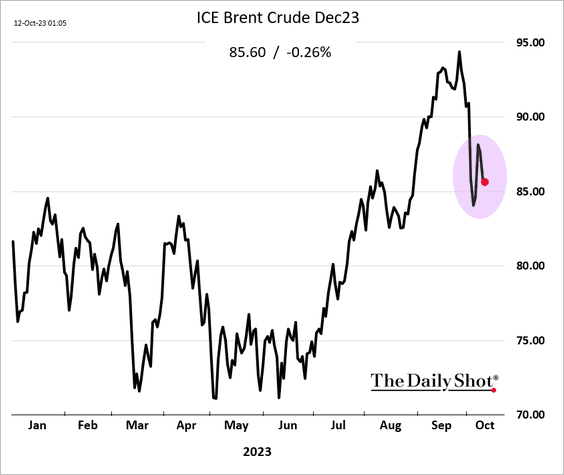

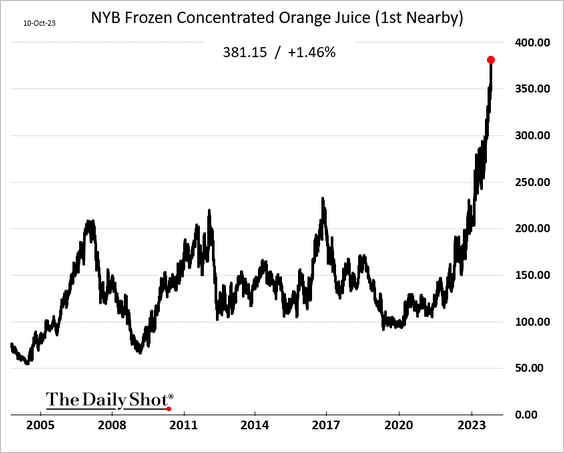

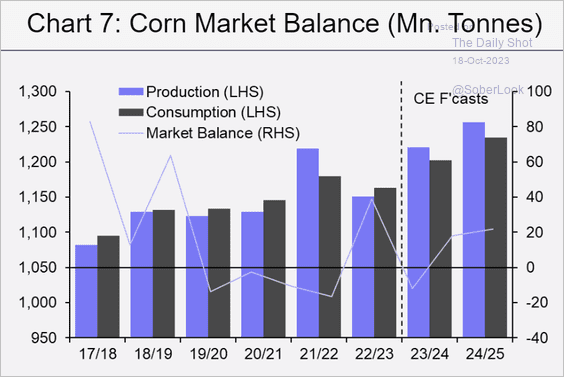

Commodities: The global corn market is expected to be in surplus next year, according to Capital Economics.

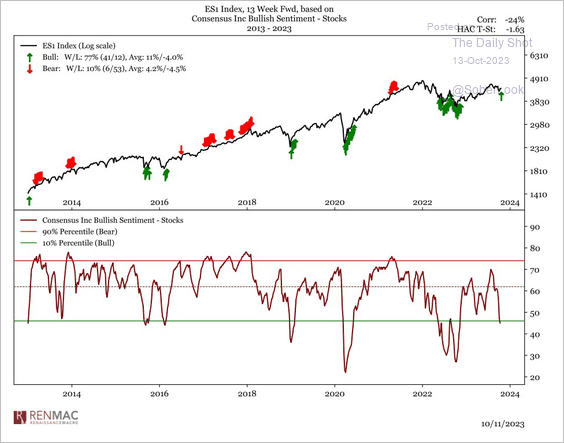

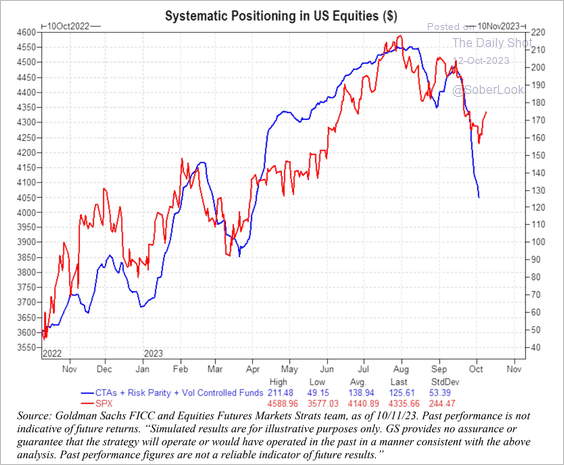

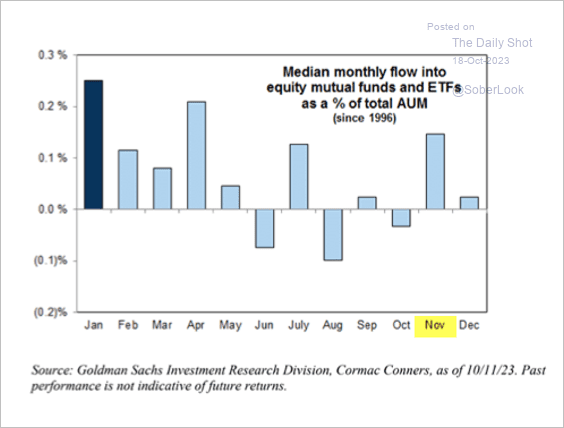

Equities: November is typically a strong month for inflows into equity ETFs and mutual funds.

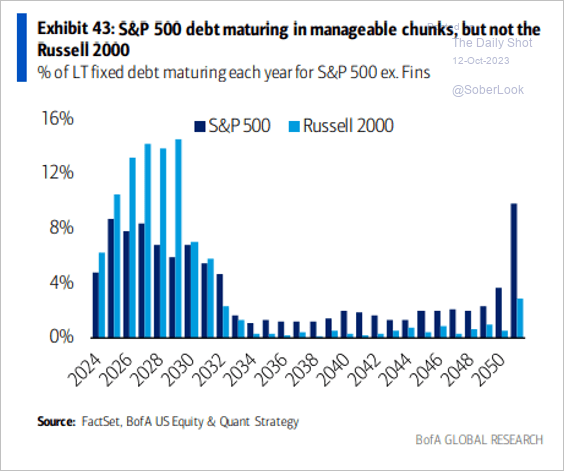

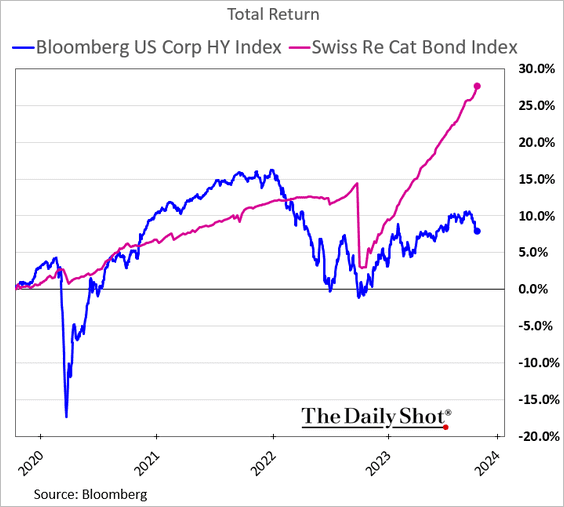

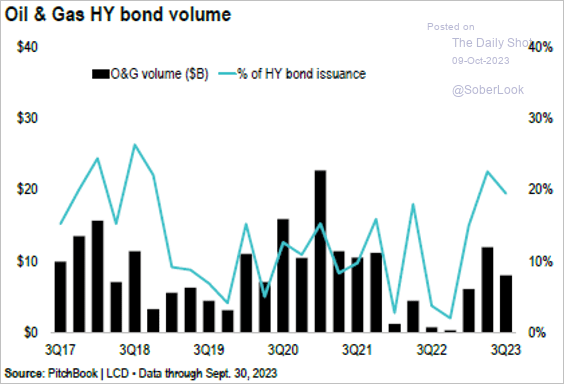

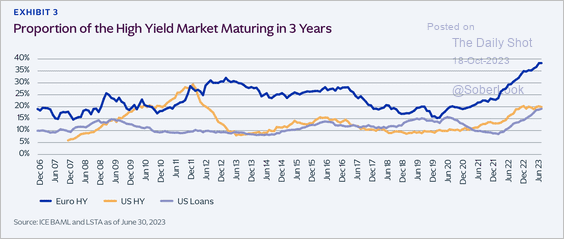

Credit: The European high-yield market has a greater share of debt maturing in three years relative to the US.

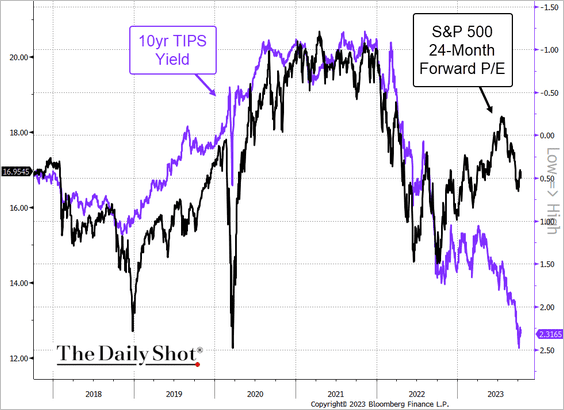

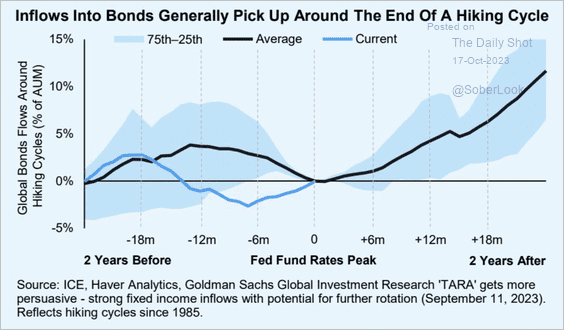

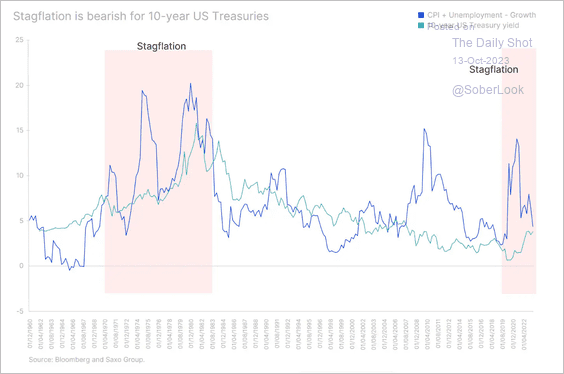

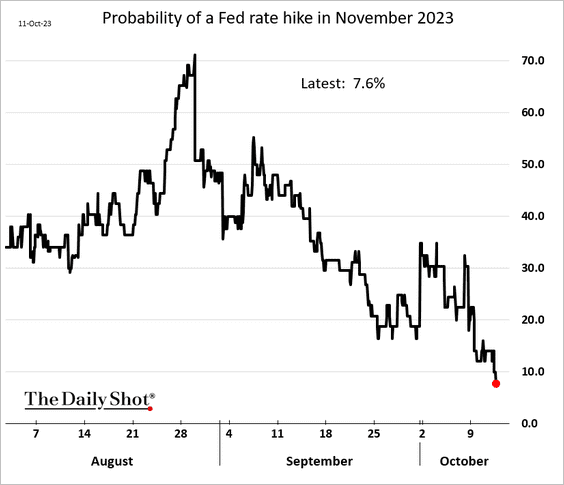

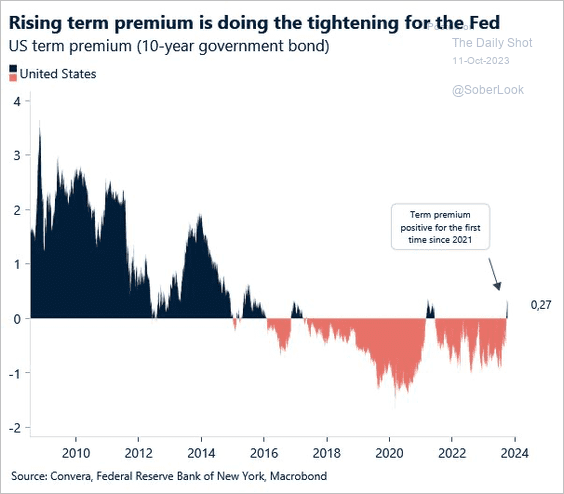

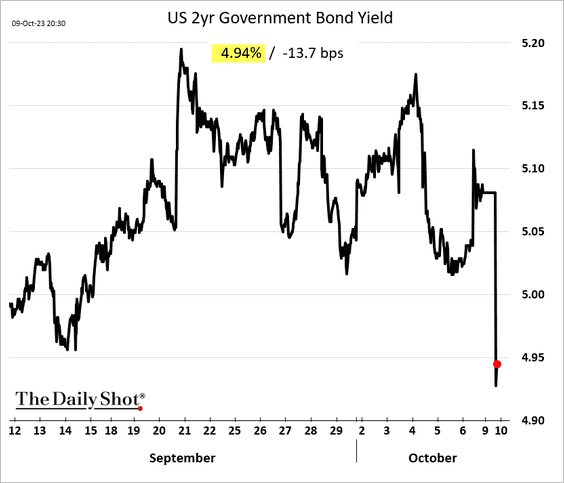

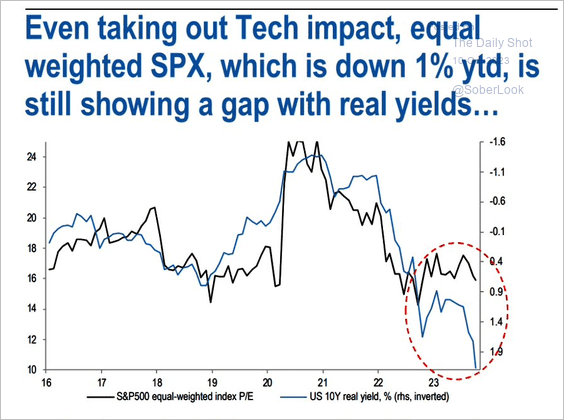

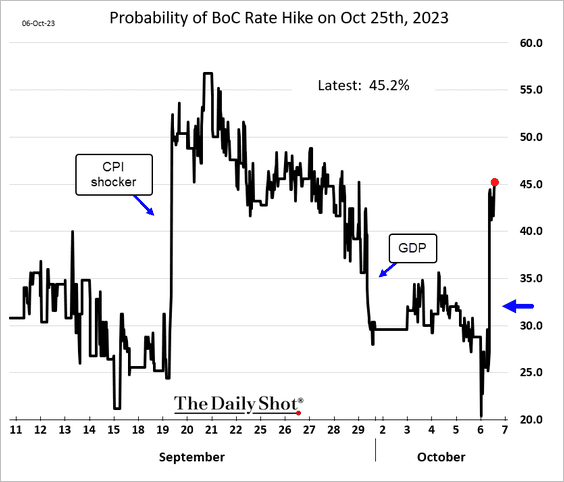

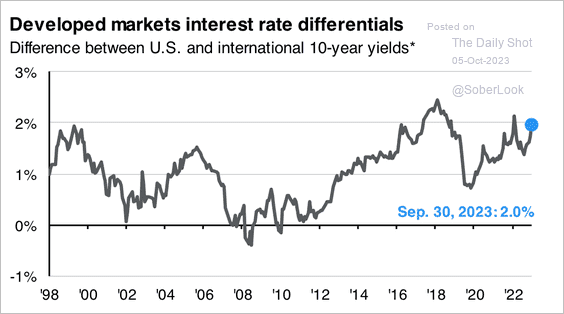

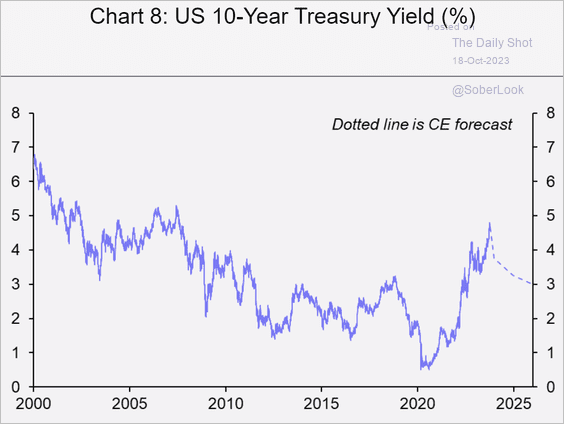

Rates: According to Capital Economics, Treasury yields are peaking.

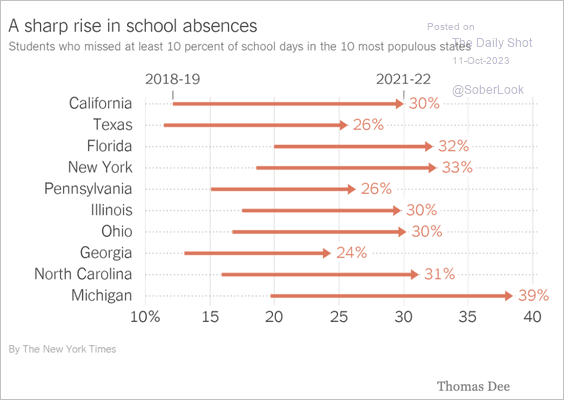

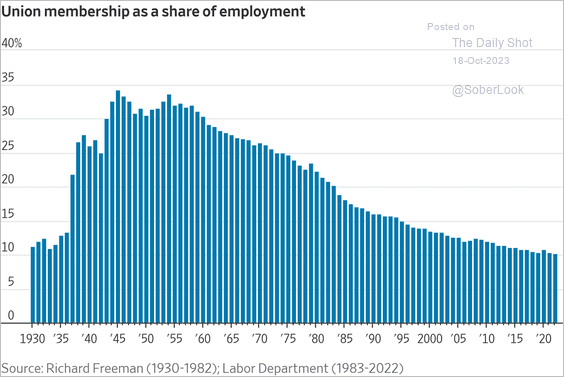

Food for Thought: Union membership as a share of employment in the US:

Edited by Josh Oldmixon

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily ShotAverage hourly wages for US teens: Brief