Greetings,

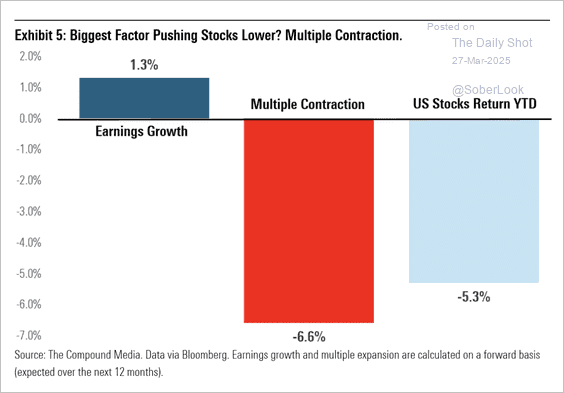

Equities: Multiple contraction has been the main source of the market’s recent weakness.

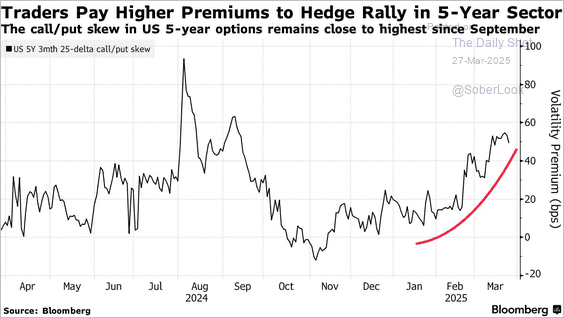

Rates: The sharp rise in 5-year call/put skew reflects surging demand for upside exposure as traders hedge against a Fed pivot amid tariff-driven uncertainty. This growing premium underscores the market’s conviction that intermediate Treasuries offer the best risk-reward profile in a volatile macro environment.

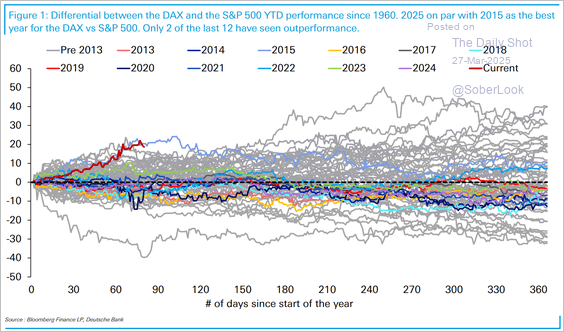

The Eurozone: Germany’s DAX has sharply outperformed the S&P 500 this year, on par with its 2015 record.

Asia-Pacific: The 10-year JGB yield hit the highest level since the GFC.

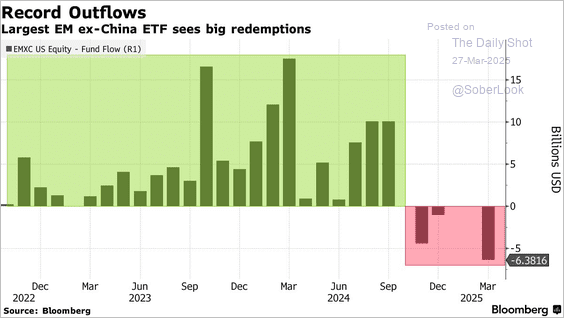

Emerging Markets: EM-ex-China funds experienced significant outflows this month.

Global Developments: The market is no longer pricing any risk premium on the dollar.

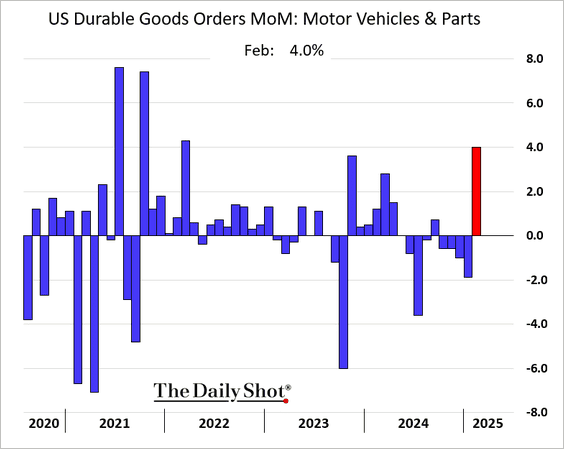

The United States: Vehicle and parts orders increased sharply.

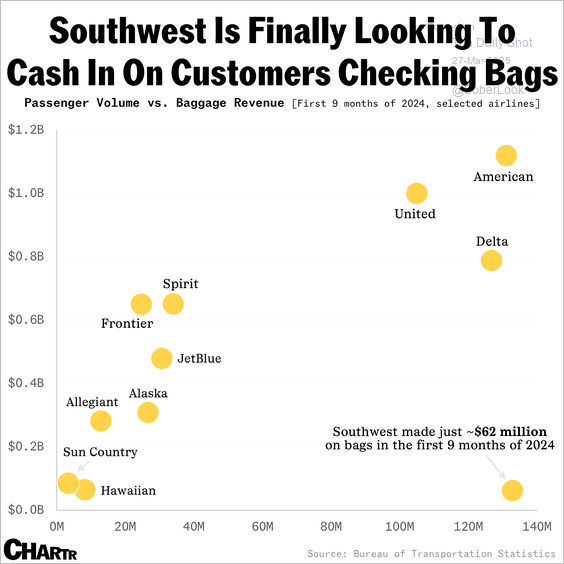

Food for Thought: Baggage fee revenue across major US airlines:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily Shot Brief