Greetings,

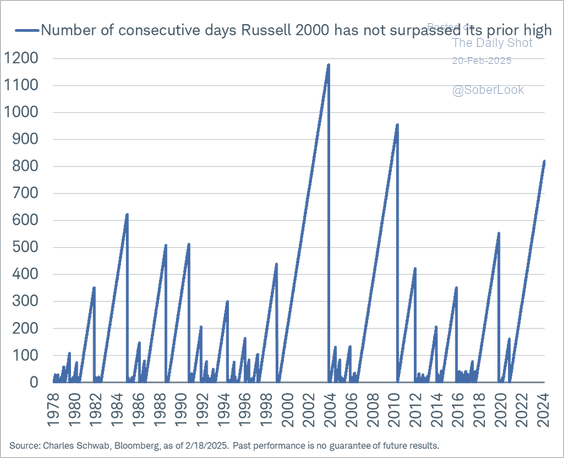

Equities: Here is the number of days the Russell 2000 has remained below its previous high.

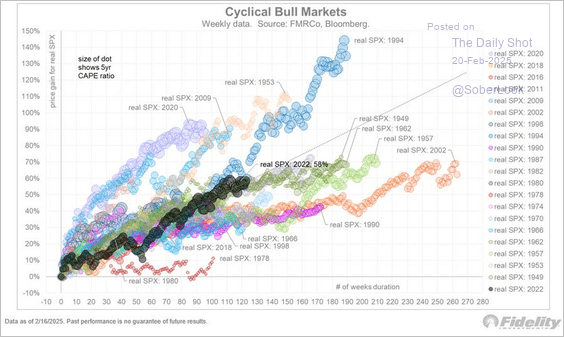

This chart shows the S&P 500’s historical cyclical bull market durations and returns, suggesting the current bull market is still near its median age.

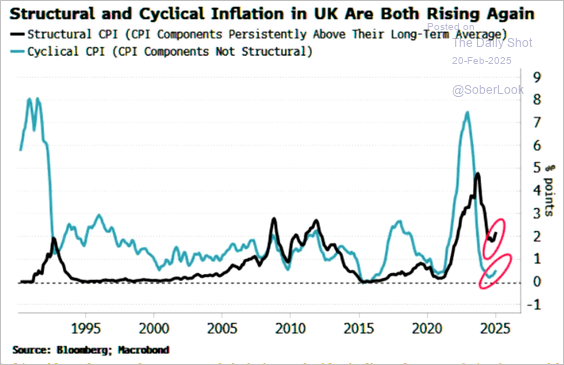

The United Kingdom: Both cyclical and structural components of UK CPI accelerated.

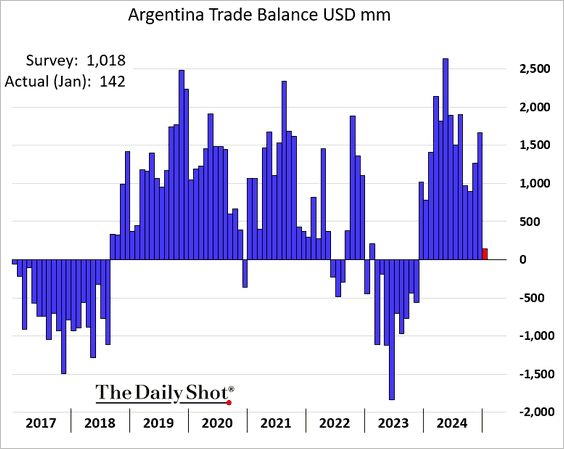

Emerging Markets: Argentina’s trade surplus nearly vanished last month.

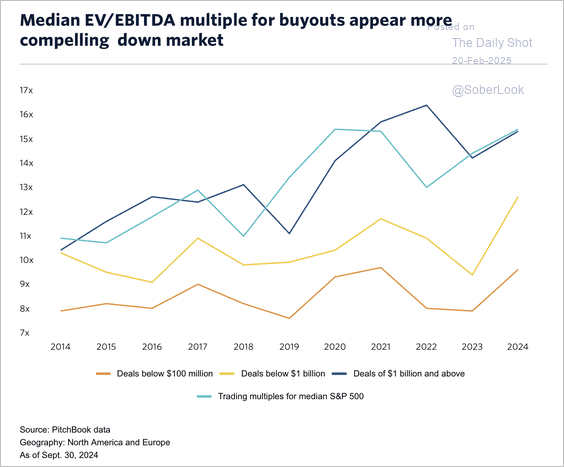

Alternatives: The median valuation multiples for large PE deals are inching closer to the S&P 500’s median trading multiple. Middle market valuations are also improving from their low levels.

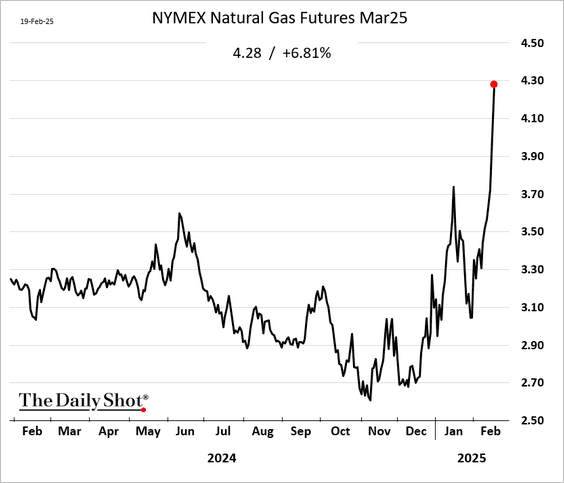

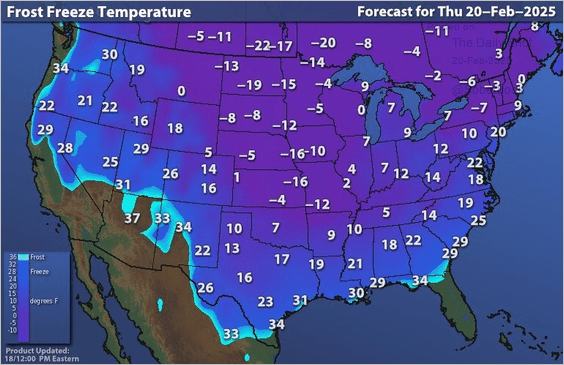

Energy: US natural gas futures climbed further on Wednesday.

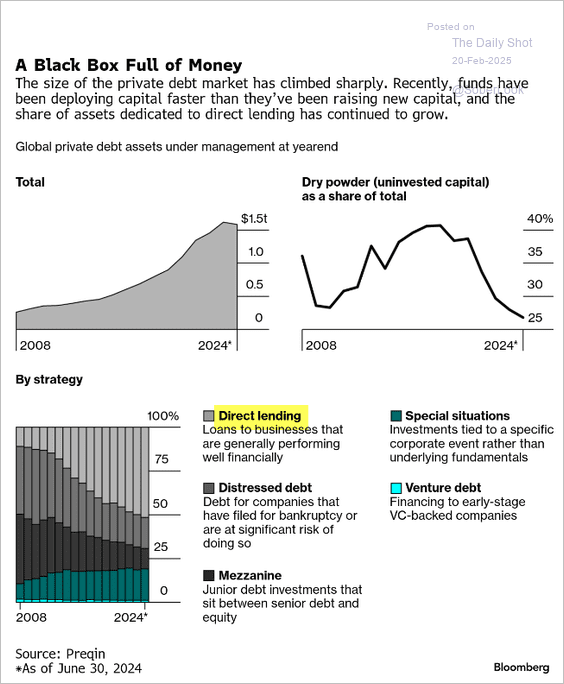

Credit: Private debt assets under management have surged, but funds have been deploying capital faster than they are raising it, leading to a decline in dry powder. Direct lending now accounts for a growing share of the market.

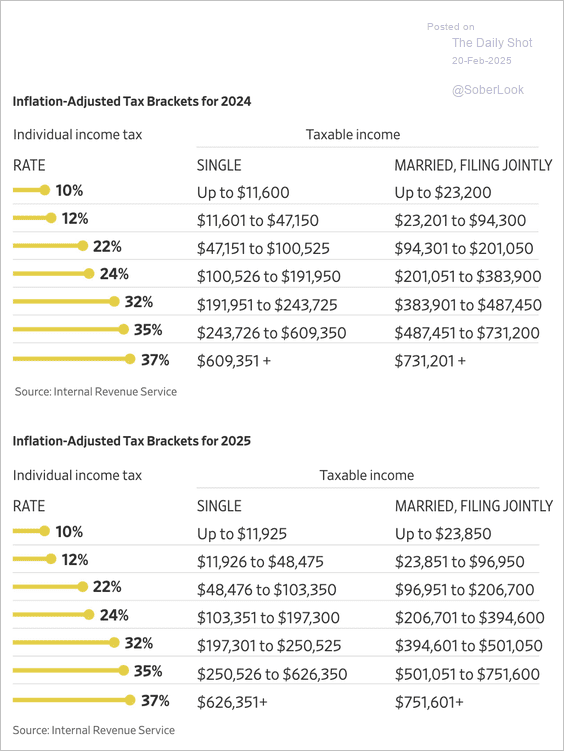

Food for Thought: US inflation-adjusted tax brackets for 2024 and 2025:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com

Subscribe to the Daily Shot Brief